The lending process, in general, involves a lengthy and sophisticated underwriting process. The lender needs to verify whether the borrower can repay the loan within the given timeframe. However, this process can often disqualify people in dire need of money.

In contrast, microlending allows people to get loans without lengthy checks.

What is Microlending?

Microlending is lending small amounts of money to individuals or small business owners who can’t get traditional bank financing. These loans are usually smaller in amount from a few hundred to several thousand dollars and are meant to help entrepreneurs and small business owners achieve their goals.

Here’s an example.

Say, a small store owner lost a part of his business because of a storm and needs some cash to get the repairs done. They do not have access to loan services provided by their bank. The cost for repairs could be something like $500.

So, the business owner signs up with the local organization that will find them the right lender. The organization will match the lender and borrower and lay out the terms of the microloan. If they agree, the lender pays the organization that forwards the amount to the local business owner.

Once the business owner gets his store up and running, he can then pay back the lender according to the agreed terms.

Often, instead of local organizations, traditional financial institutions can provide microloans directly.

How Does Microlending Work?

Microlending grew in developing countries like India and Bangladesh, where small rural banks were established to fund local businesses. Often, these banks provide funds to local women to encourage them to start their own businesses.

In the US, the concept of microloans grew with the onset of the recession and inflation. With the increased tightening of the credit market, the need for smaller loans also increased.

Microloan lenders are organizations that lend out small amounts of money, typically in the range of $5,000 to $50,000.

Recently, microlending has increased with the introduction of P2P lending platforms. These platforms match lenders and borrowers based on their unique requirements and help process the loans. While microlending seems like small business loans, the users using it and what they aim to achieve differ from loans offered by financial institutions.

For instance, microlending focuses on the development of the borrower.

While microloans can be used for personal purposes, most lenders give out microloans as investments. The aim is to help entrepreneurs from rural and poverty-stricken areas gain access to financial products. Investors can help these people start or expand their businesses and share the profits accordingly.

The microlender process

Modern microlending takes place over online platforms. Here, investors can search for a borrower in need. The investor can be an individual, a non-profit organization, or even a large commercial bank.

- An investor looks for ideas that they can invest in.

- The investor can lend out money, sometimes as low as $25 using wire transfers, PayPal, or even credit cards.

- The online platform aggregates funds from different investors and forwards them to the borrowers.

Over time, the borrower pays back the loan with interest. Sometimes, the loans can be without interest as well.

How much can one borrow via microlending and what are the interest rates?

“Micro” is a relative term. According to the U.S. Small Business Administration (SBA), anything below $50,000 is a microloan. The average microloan value in the US is $13,000. Some microlenders may require a specific minimum credit score, while others may not, illustrating the diversity in eligibility requirements across different lending options.

However, in other parts of the world, microloans can go as low as $25. In India, the value of microloans ranges from Rs.20,000 to Rs.30,000.

You’ll be surprised to know that loans in the range of Rs.30,000 to Rs.40,000 rose by 56% between Q3 FY18 and Q3 FY19. This has been accelerated with the introduction of formal and semi-formal microfinance institutions.

How Not to Use Microloans

Remember, businesses can’t use microloans to pay off or restructure existing debts. Businesses cannot use a microloan to purchase real estate either.

So, if a business finds itself in a situation where it needs to manage outstanding debts or consolidate debts, it should look at other financing options, like personal loans, which may be more flexible in these situations.

However, be aware that using a personal loan for business purposes won’t help you establish business credit and you’ll be personally liable for the debt you take on.

Also, as mentioned earlier, microloans can’t be used to buy real estate. This restriction is to highlight the purpose of microloans which is to support smaller business needs like buying inventory, operational expenses, or investing in essential equipment. By following these guidelines, businesses can ensure they are using microloans correctly and looking at other types of financing for more complex needs like debt restructuring or real estate purchases.

So it’s important for businesses to understand these limitations if they want to use microloans as part of their funding strategy; as it will help them match their funding to their needs and goals. Businesses should review their financial situation and consult with financial advisors to determine what funding is best for them.

Earlier, we mentioned that microlending has increased with the introduction of P2P lending platforms. While the two schemes share some common aspects, they differ in many ways. Let’s look at it.

Difference between microlending and P2P lending

Peer-to-peer lending or P2P lending is an offshoot of microlending. Microloans can be granted by individuals to other individuals and businesses. P2P does the same but through an intermediate platform. Traditional business loans often have stricter eligibility criteria, particularly regarding credit scores and annual revenue, making it more challenging for startups and businesses with poor credit to qualify compared to microloans.

| Microlending | P2P lending | |

| Definition | Microlending, also known as microcredit, is a process of granting small loans to business owners that do not have access to financial products. | In P2P lending, borrowers can request a loan from another individual without the need for any intermediary financial institutions. |

| Security | Microfinance institutions that serve marginalized, insecure communities face risks to their staff, clients, and assets. Similarly, consumers can become a victim of ghost loan frauds, where companies create false loan agreements, collect cash disbursements from banks and never give them to the intended customer. | The P2P lending platform acts as a security measure, ensuring that the money is delivered to the right person and is repaid on time. These platforms provide multiple fund transfer tools and come with alternative credit checking tools, allowing lenders to verify if the borrower can repay the loan or not. |

| Loan management | Most microloans are unstructured. | It allows lenders to manage their loans in a more structured manner. |

| Profitability | More profitable. | Less profitable. P2P lending platforms charge an operational cost. Often, lenders incur this cost. But to make up for this cost, lenders generally increase the interest on the loans. Since multiple lenders use the same platform, they tend to keep the interest rates competitive, which are often below 10%. Therefore, borrowers must pay a higher interest rate, while lenders make less profit from the loans. |

Nonetheless, microlending has been a boon for small business owners, especially in tier two and tier three cities.

In the next section, we’ll look at the advantages of microlending.

The Advantages of Microlending

Access to credit enables entrepreneurs and small businesses to improve their earnings and quality of life. While microlending can be a great investment option for lenders, it can also give borrowers access to the credit they truly need. The key advantages include:

1. Accessibility

Microlenders have less stringent requirements than traditional banks so borrowers with limited credit history can get funded.

Through microloans, investors can help local or global businesses. The funds are managed through a centralized platform, simplifying cross-border transactions.

For small business owners, microloans are a great way to access credit without having any credit history or a bad credit score. Often the businesses must pay a high-interest rate because of the associated risks, but reliable borrowers are rewarded accordingly.

Some microlenders are taking a step further to help small businesses. An example of this is New York-based Grameen America.

Grameen America focuses on providing female entrepreneurs small loans along with financial training. Grameen America does not require proof of business income to access funding, making their lending program accessible to women entrepreneurs who may not have traditional financial documentation. They enable women living below the poverty line to learn about savings, loans, and credit building. They also report the repayments to Experian with a simple goal: to enable their clients to build up a better credit score and get qualified for more loans.

Repayment history in Grameen America

The credit rating of borrowers is imputed using data (including whether or not the borrower owns a home), a credit check or background check, and repayment history if the borrower has participated in microloans in the past.

Every six months, depending on their repayment history and support from their Grameen America location, they may have the opportunity to receive larger loans.

2. Faster loan disbursal

Microloans can be processed within minutes. Since there is no sophisticated underwriting process involved, it is possible to disburse loans faster. In case of emergencies, microloans are a suitable option.

For example, Capital Float, a Bengaluru-based microfinance company, offers collateral-free loans from ₹3 lac to 1 crore to Indian e-commerce merchants and startups. Loans get disbursed within 3 days.

However, borrowers may need to provide a personal guarantee, meaning they would be liable for repaying the loan if their business defaults.

3. Growth

Microloans can be a lifeline for small businesses to grow, hire more staff and develop new products and services. By supporting these businesses, microloans help drive local economies. These small amounts of cash can have a big impact so entrepreneurs can chase their dreams and contribute to their community’s growth and vitality.

Microloans also often reach those who can’t get traditional finance, so more people can participate in and benefit from economic development.

4. Powered by latest technologies

With the increasing adoption of fintech, microloans are becoming much more accessible. Lenders can create a diverse investment portfolio by giving small loans to multiple businesses.

Managing loans are also easy as it happens through a single managed platform. By making timely payments on microloans, businesses can establish and enhance their credit scores, making it easier for them to secure future funding.

Online P2P lending platforms also make cross-border lending easy.

5. Helps reduce poverty for small businesses

Another advantage of microlending is that it helps reduce poverty. This advantage is perceived more at a social level than at the individual level.

Mohammad Yunus, a Bangladeshi economist, started the process of giving out small loans via a rural microfinance institution in Bangladesh. In developing countries such as Pakistan, microfinancing has helped reduce poverty. However, when a borrower defaults, recovery for lenders may be minimal, emphasizing the importance of diversifying investments across multiple loans to mitigate the impact of potential defaults.

In the next section, we’ll discuss how new-age lending platforms like CRM software can improve the microlending processes.

Challenges

While microlending has many benefits, it’s not without it’s challenges and pitfalls. One of the biggest is that some borrowers may struggle to pay back their loans especially if interest rates are high. These high rates can put a huge financial burden on entrepreneurs who are already juggling the complexity of starting or growing a business. Debt stress can be overwhelming especially for those with limited cash flow or uncertain income streams.

Also, the varying quality of microlenders is another big challenge. Not all microlenders operate on the same principles of fairness and transparency. Some charge exorbitant fees or impose unfair terms that can trap borrowers in a debt cycle and make it hard for them to get out of their financial obligations. This can lead to a situation where individuals take out more loans to pay off existing debts and end up in financial trouble.

Moreover, some borrowers lack financial literacy. Many entrepreneurs don’t fully understand the terms of their loans and end up misunderstanding the repayment schedules, interest rates, and penalties for late payments. They might make decisions that worsen their financial situation without proper education and resources.

The Future of Microlending

Technology

As technology advances, microlending will change. Online platforms and mobile apps will make it easier for borrowers to access funds and for lenders to process applications quickly.

Sustainability

The future of microlending will be more about sustainability. Lenders will be looking to support businesses that are socially and environmentally responsible.

Global Reach

Micro lending is growing in many parts of the world, especially in areas where traditional banking is not available. This will uplift more communities and drive global economic growth.

How to Improve Microlending Processes

“Microfinance is a very manpower-intensive business. But, through digitization, if you’ve made your processes right—customer onboarding, customer geotagging, and digital payments—you’re less likely to get impacted by political and environmental disruptions.”

– Purvi Bhavsar, MD and Co-Founder, Pahal Financial Services

Faster loan disbursal at scale can give your micro-lending institution a competitive advantage. But for this, you’ll need to improve your underlying processes.

Just like any customer-facing business, microlending processes–from loan origination to collection–can be improved using CRM software.

Let’s see how.

1. Add flexibility to the lending process

Often borrowers have specific requirements. Having a one-size-fits-all policy shuts out people who need money. By making the lending and borrowing process more flexible, you support accessibility. Flexible interest rates and repayment policies, in turn, enable the borrower to pay back the loan.

For example, Kiva, a San Francisco-based non-profit organization, provides loans starting from $25. All loans up to $15,000 are without interest. Kiva uses the crowdfunding architecture to enable microfinancing. Kiva does not look at any credit scoring but has a list of criteria that the borrower must meet to get the loans. Choosing a suitable microlender based on competitive rates and personal business needs is crucial for borrowers, as microlenders support businesses that typically face barriers to traditional financing.

2. Finance wisely by considering credit history

With a CRM solution, you have data on who borrowed money from you before, who paid back, and who defaulted. This allows you to understand the persona of creditworthy borrowers. Thus, you get insights into the type of business you should invest in and ones that have high risks associated with them.

3. Automate underwriting

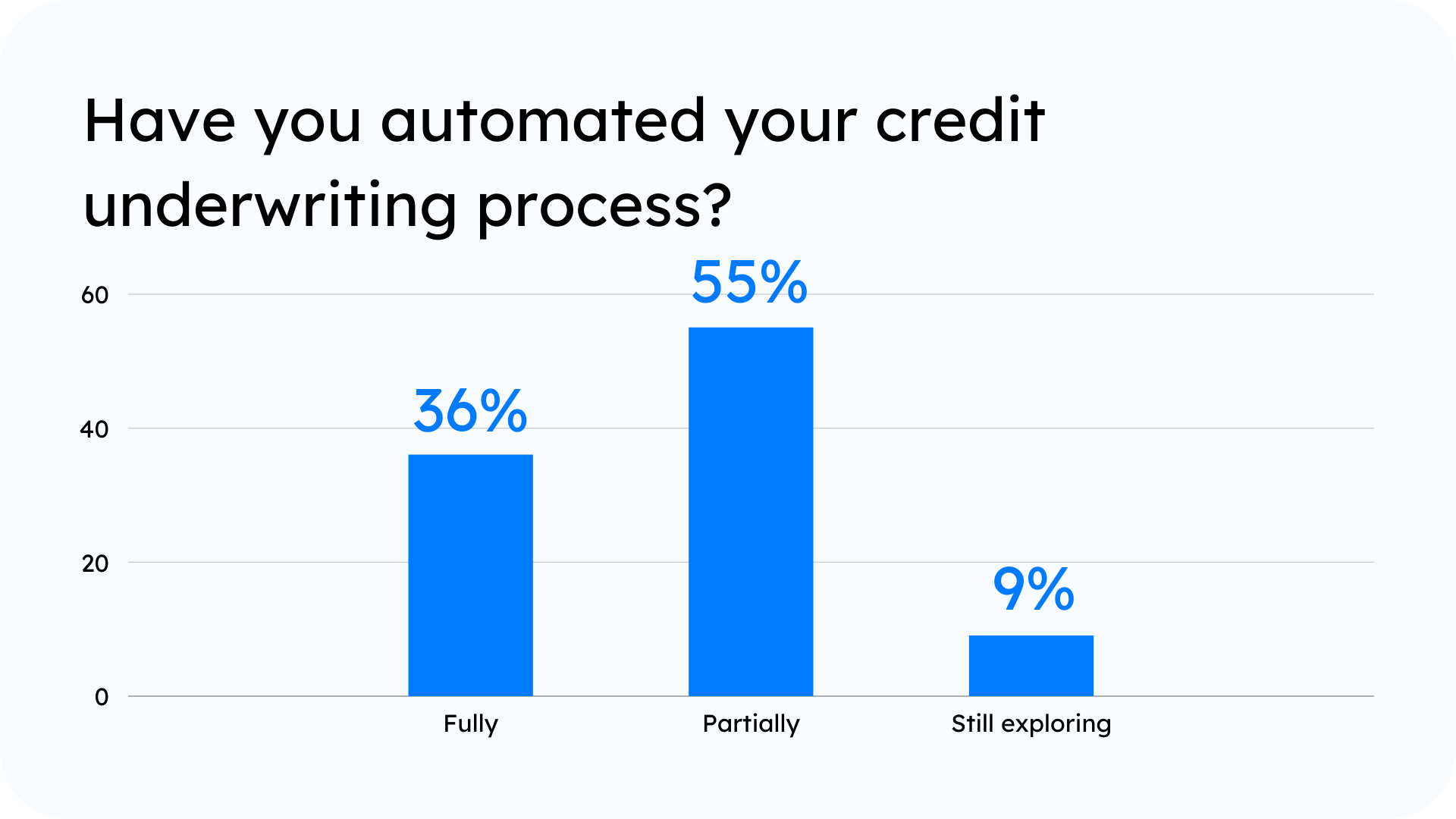

Depending on the complexity of your underwriting process, you can automate the whole or a part of it.

Recently, we asked professionals from the microfinance sector about the level of automation in their underwriting processes. 55% have partially automated, and 36% have fully automated their underwriting processes.

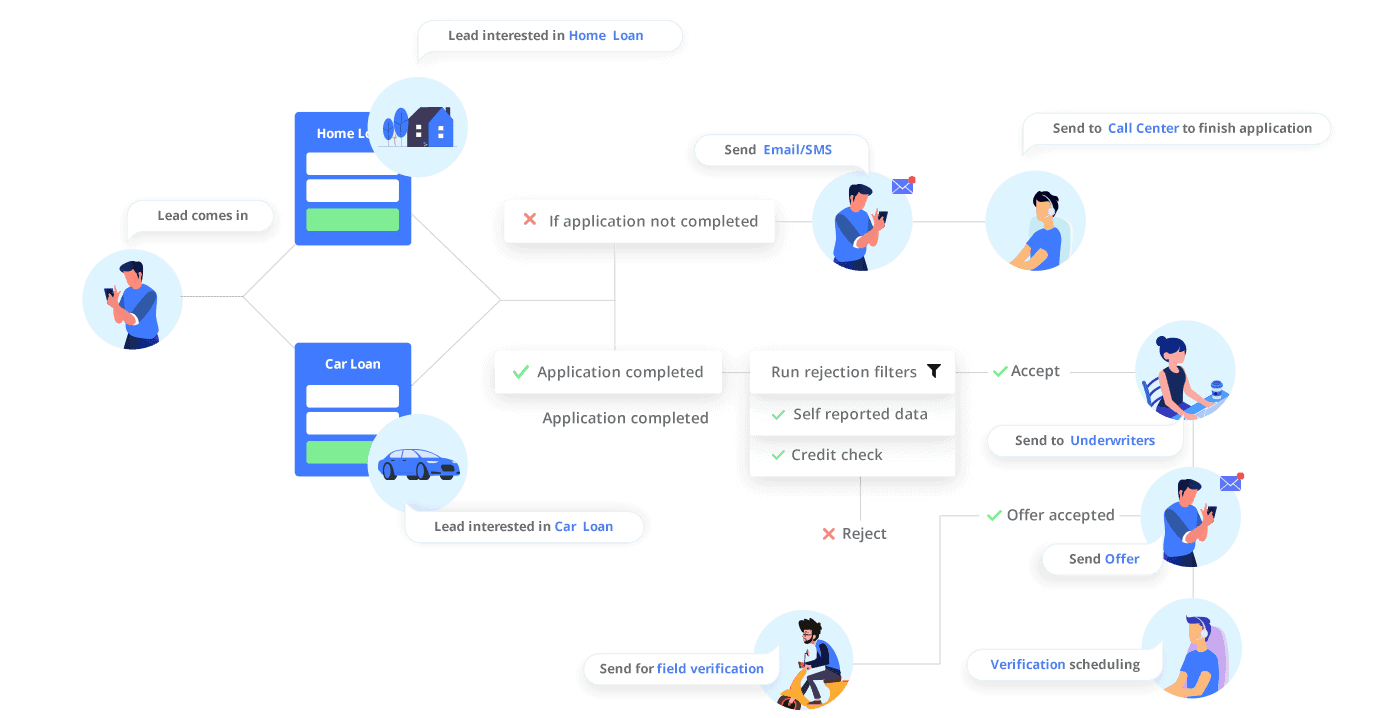

Lending CRM can help you automate your underwriting workflow and increase the speed of loan disbursal.

For instance, LeadSquared’s Lending CRM allows you to create automated workflows to run rejection filters, check credibility, and send the application to underwriters for final approval.

4. Personalize your offerings

Lending CRM helps you segment customers basis location, type of product interested in, etc. You can use this segmentation to send personalized communication.

For instance, in India, women entrepreneurs in Gujarat who want to get into dairy farming need Rs. 30,000 to get started. However, local financial institutions do not offer more than Rs. 10,000. This restriction forces them to seek credit elsewhere, often at a much higher interest rate.

By bucketing them based on their requirements, you can enable more businesses and get better returns on your investments. You can even bundle multiple financial products and offer guides, training, and other relevant resources to customer segments. It will ensure your clients perform their best at their businesses.

For example, CDC Small Business Finance, a San Diego-based SBA lender, offers loans for small businesses with 12 hours of complimentary advising for long-term success. It is helpful for companies that cannot get funding from banks or other financial institutions. Loans are offered at an interest rate of 8 to 10% for three to five years.

Moreover, using a CRM allows you to access and manage borrower information from multiple data points.

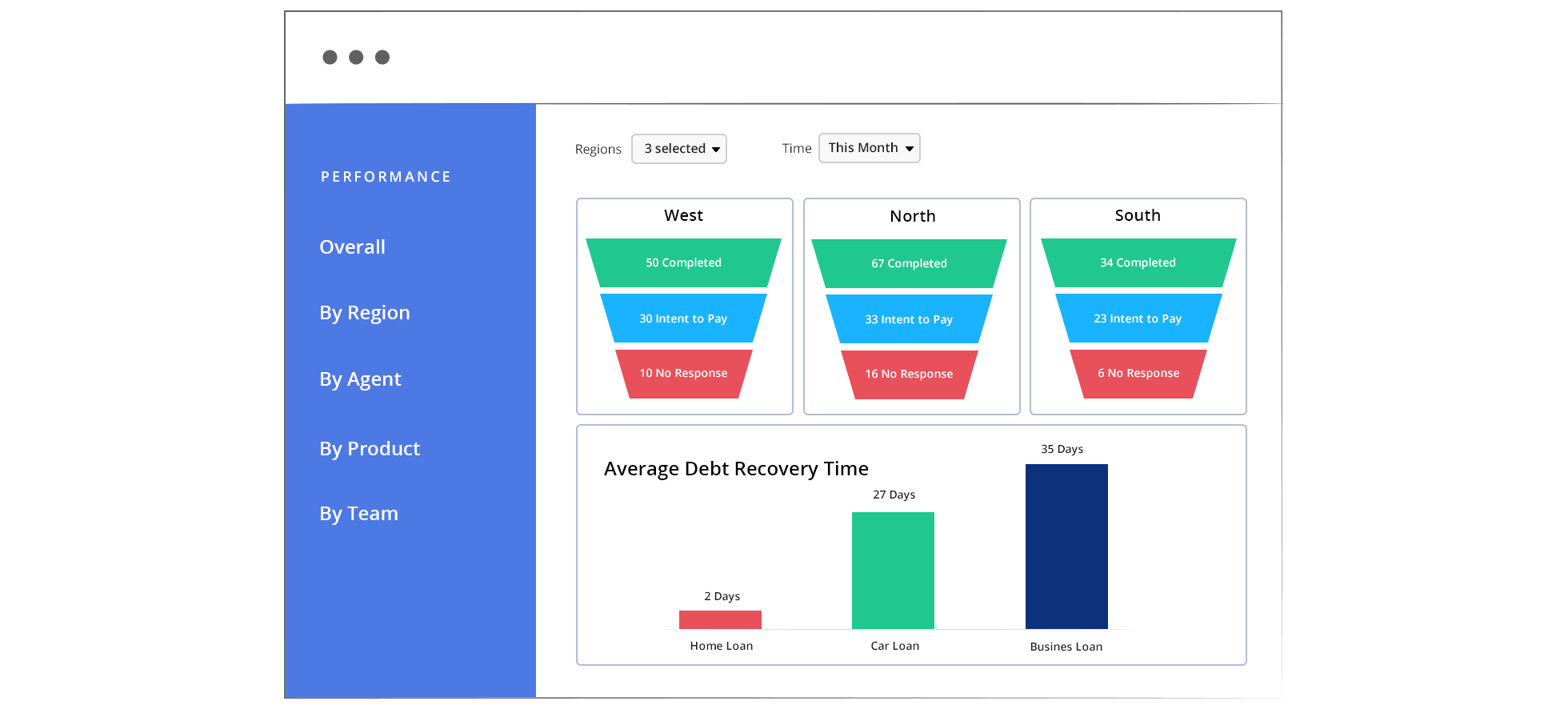

5. Get a holistic view of your investments

CRMs allow you to have a bird’s-eye view of your business. You can use the dashboard to understand your returns on different investments. You can see which borrower is paying back on time and who are defaulting. This info can help you change your lending strategy or adjust your repayment policies.

So, we have seen how simple tools like CRM can improve your lending processes. If you’re looking for one such solution, check out LeadSquared.

LeadSquared enables several lending and microfinance institutions like Capital Float, Lendingkart, InCred, Uni Cards, etc. to automate their lending processes. Book a demo to learn more about LeadSquared’s Lending CRM.