Powering India’s Most Trusted Lenders

Smarter lending

starts here: with one

AI-powered system.

From application to repayment, manage the complete

lending lifecycle with speed and compliance.

Accelerate growth with intelligent

lending modules

Reduce TAT, boost team productivity, and deliver better

customer experiences.

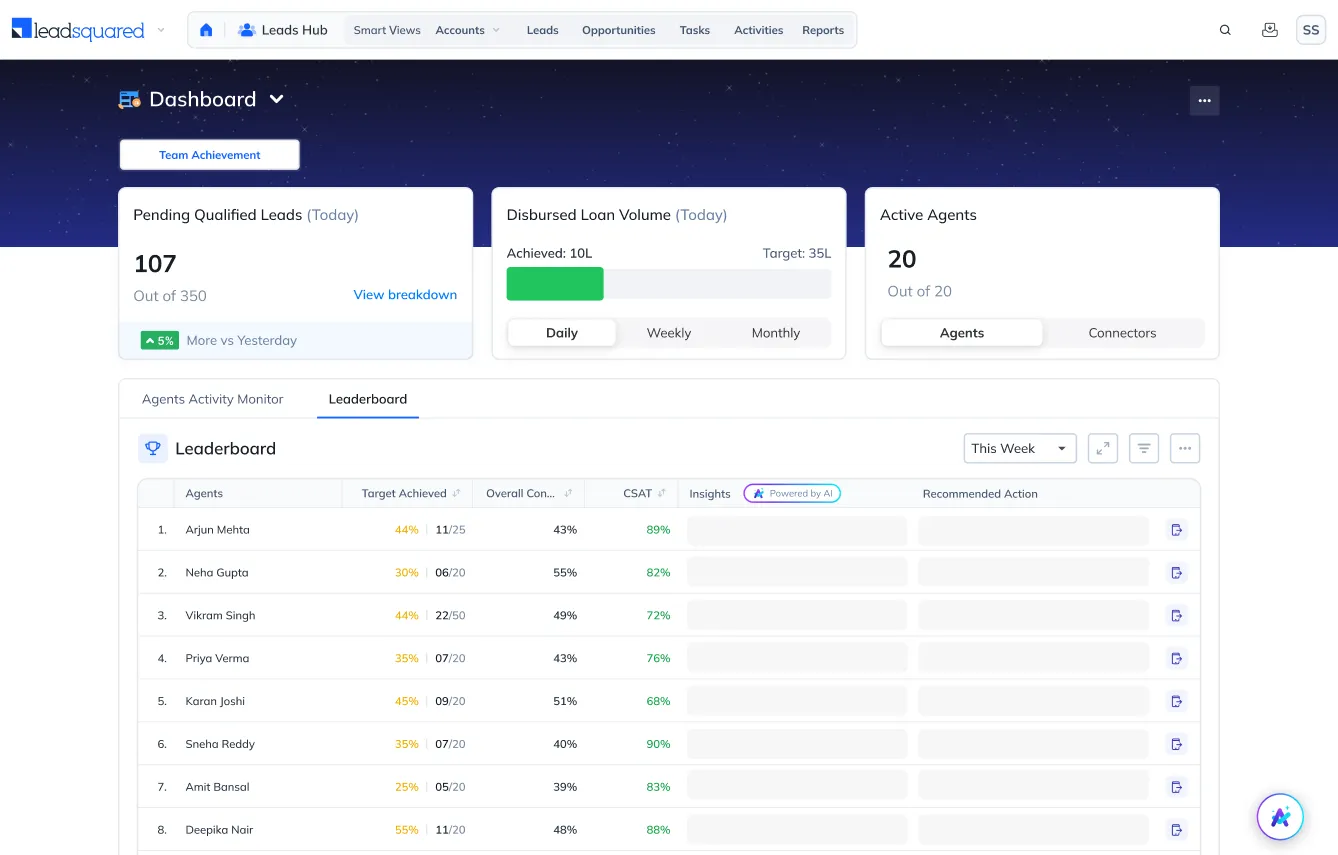

Sell smarter with AI. Predict conversions, flag risks early, and drive higher productivity across your teams.

Fewer drop-offs. Faster conversions. Explore

Cut turnaround time (TAT) across the entire lending lifecycle. Automate verifications, speed up approvals, and disburse loans faster than ever.

Shorter cycles. Quicker disbursements. Explore

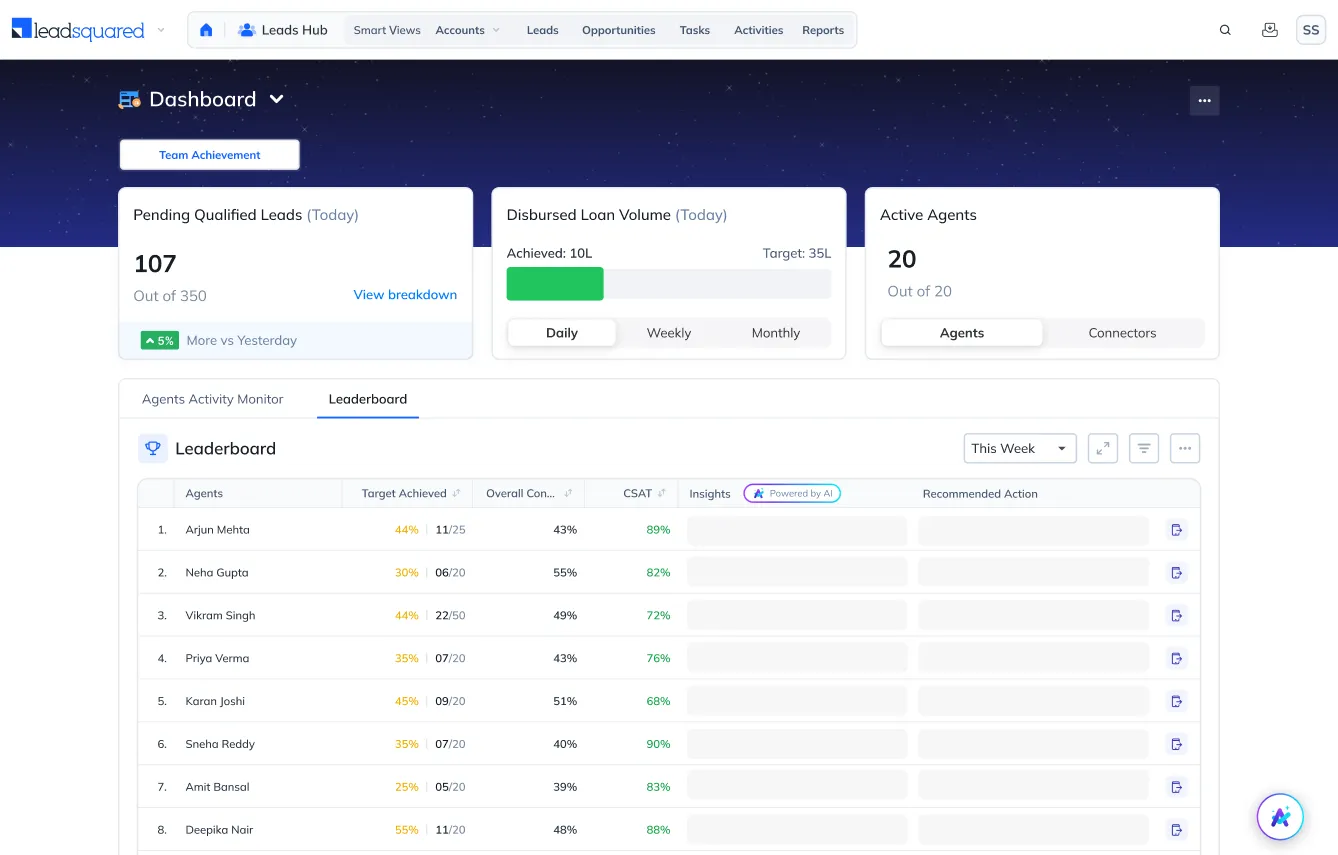

Empower agents with mobile tools to maximize productivity. Ensure managers stay in control with real-time visibility into every activity.

High productivity. Higher accountability. Explore

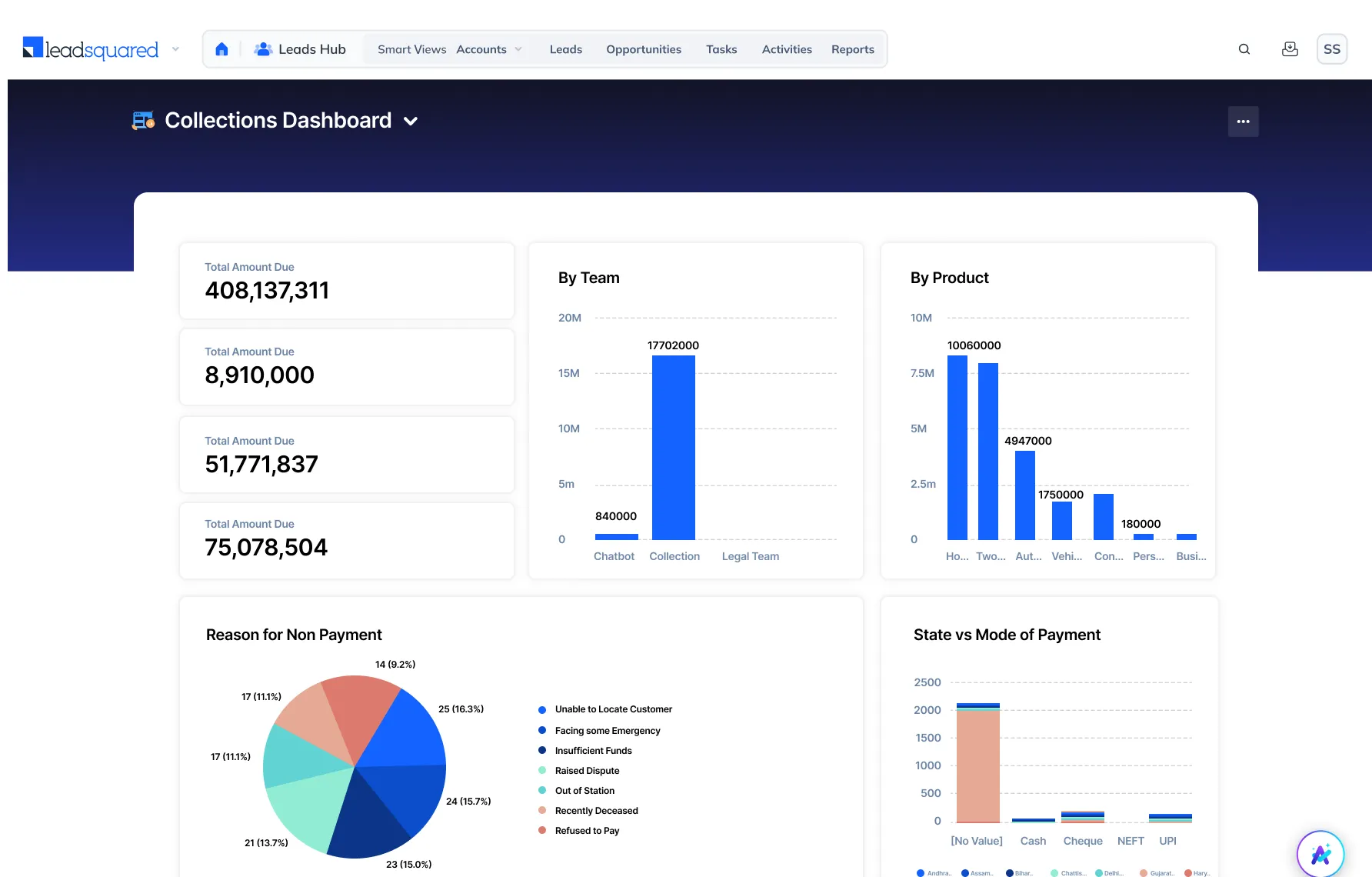

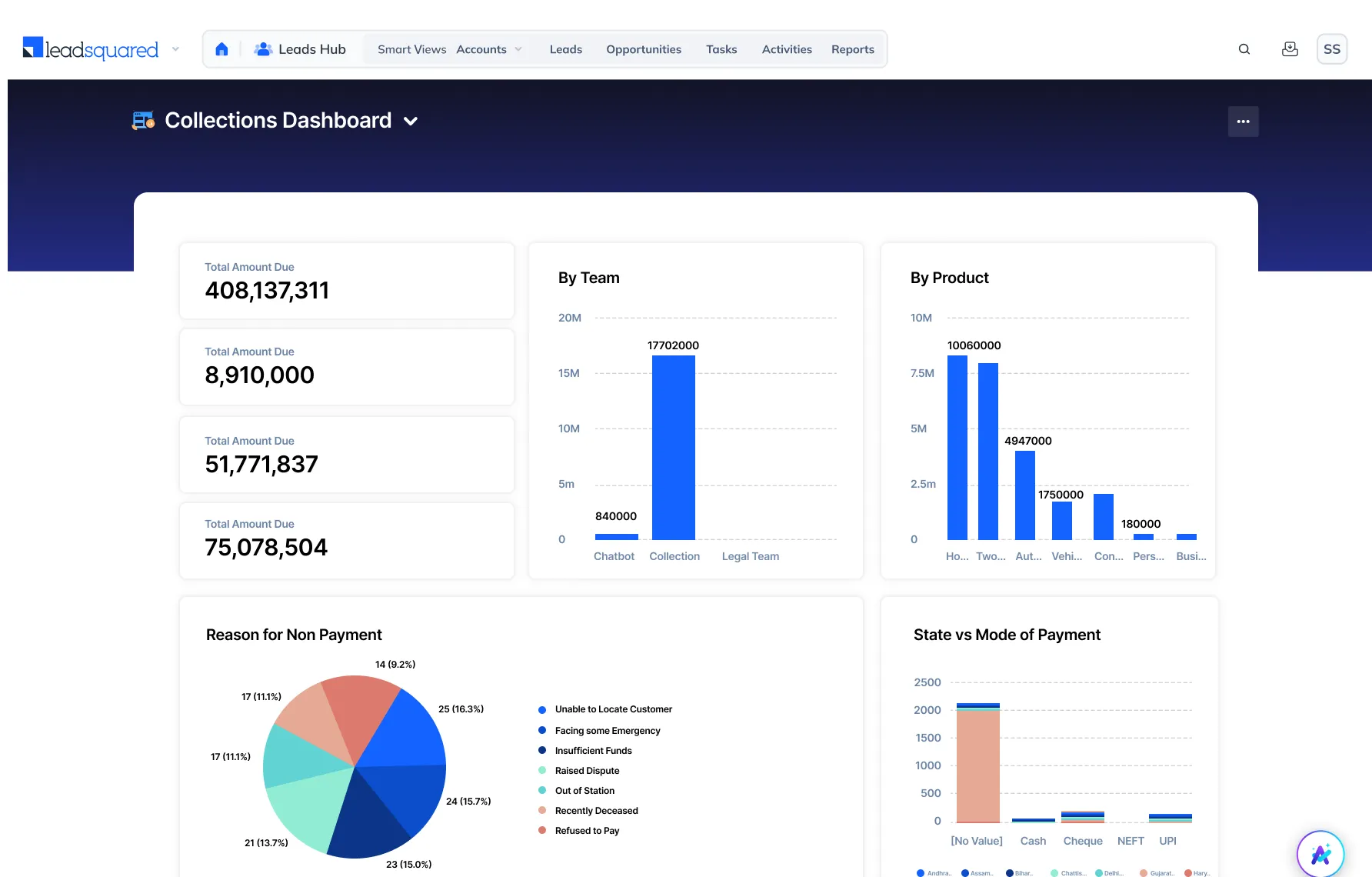

Predict risk, segment customers, and handle both soft and hard collections smoothly. Boost recovery rates through smarter tracking, proactive follow-ups, and predictive debt management.

Better recovery. Lower defaults. Explore

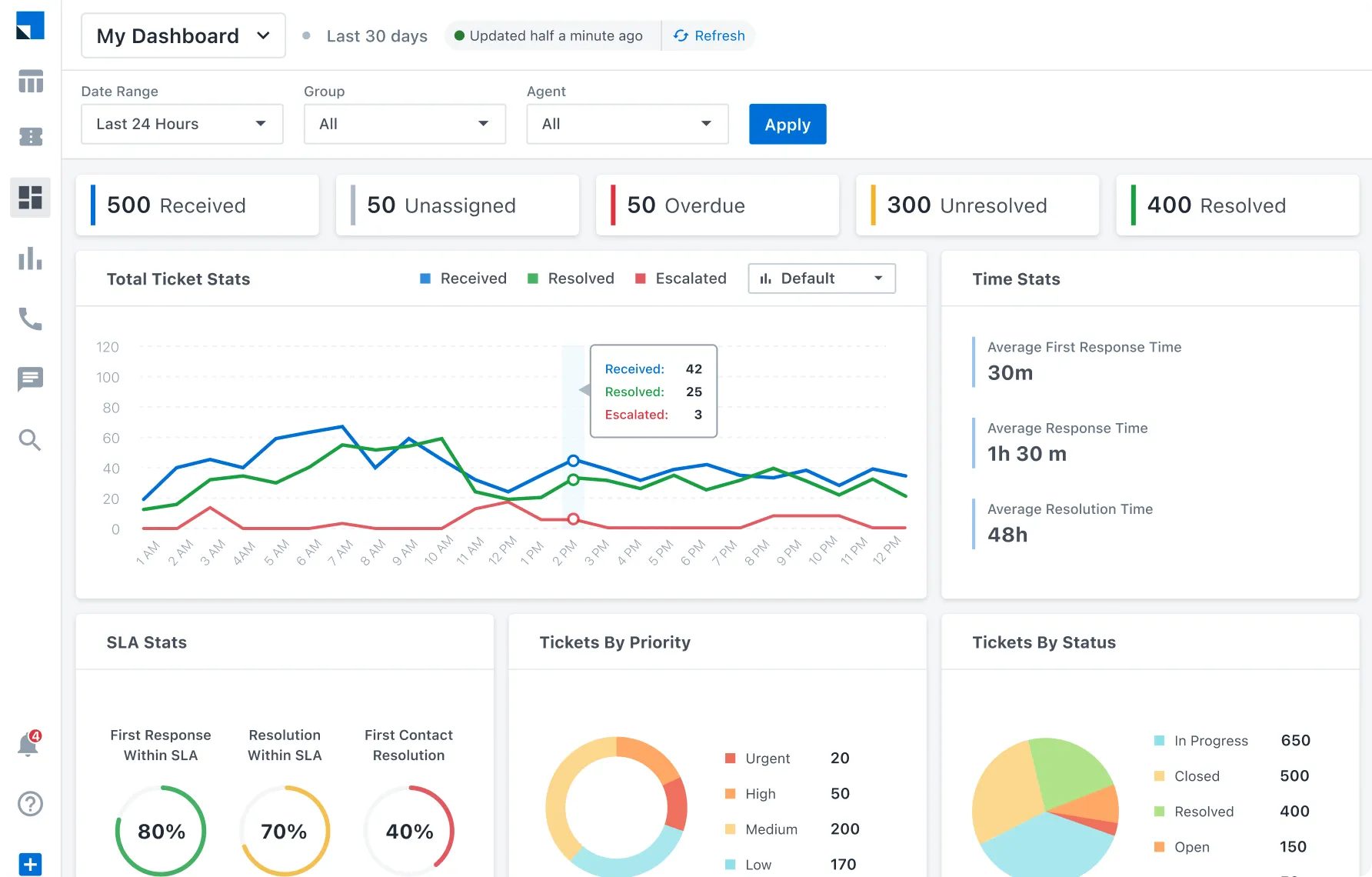

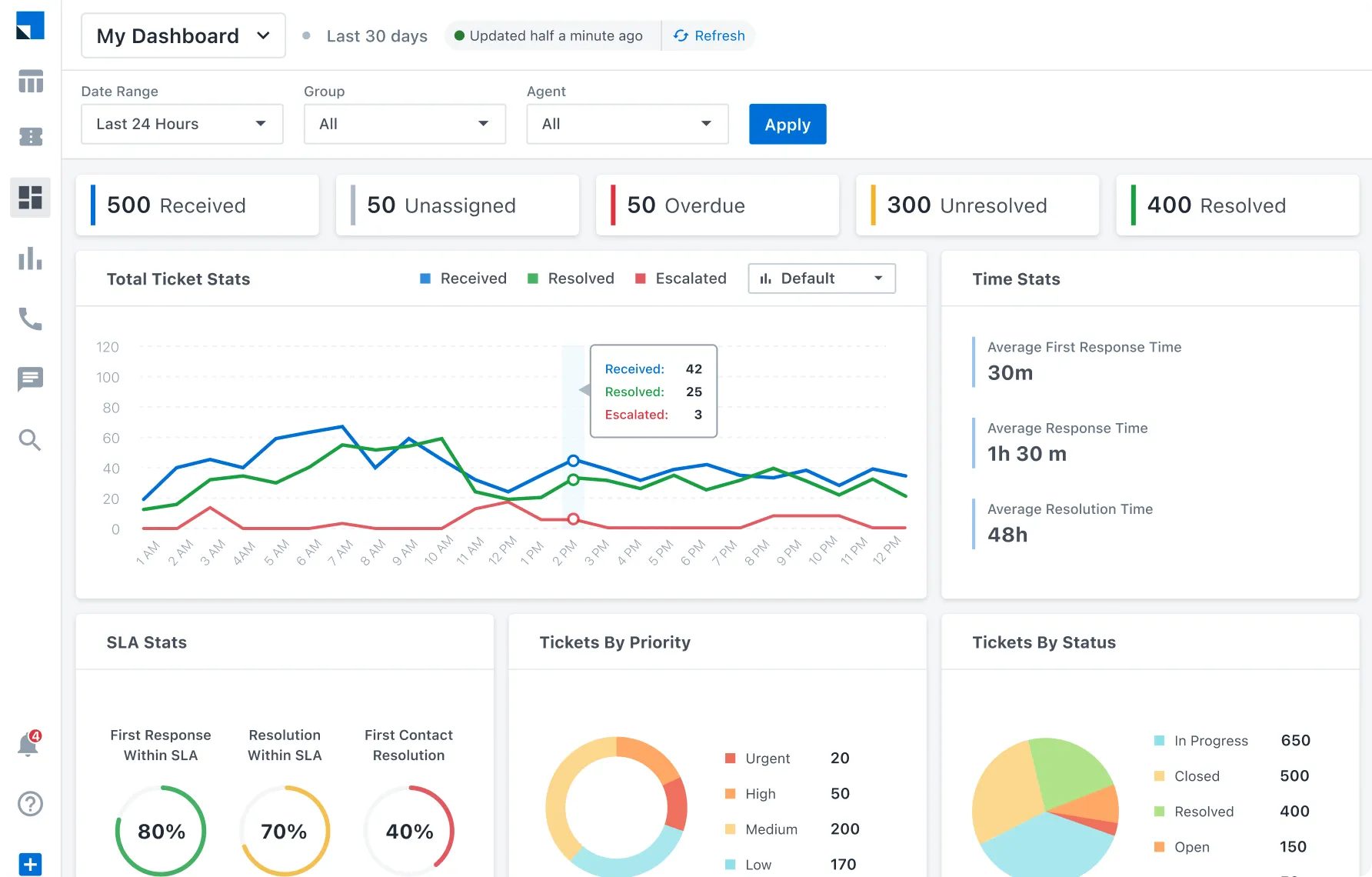

Turn service into a growth driver: resolve issues faster, stay compliant, and build lasting relationships.

Stronger loyalty. Quicker resolutions. Explore

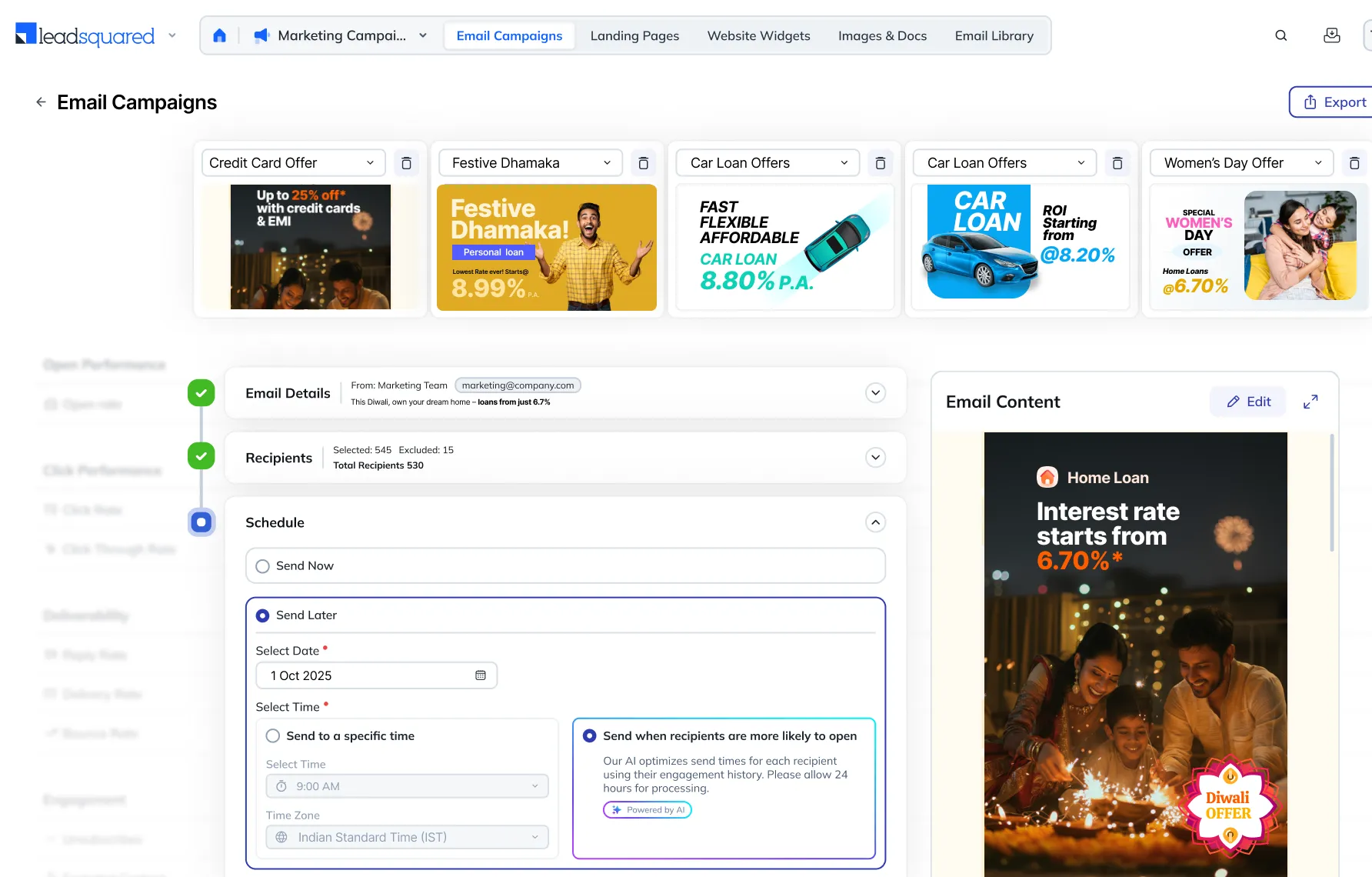

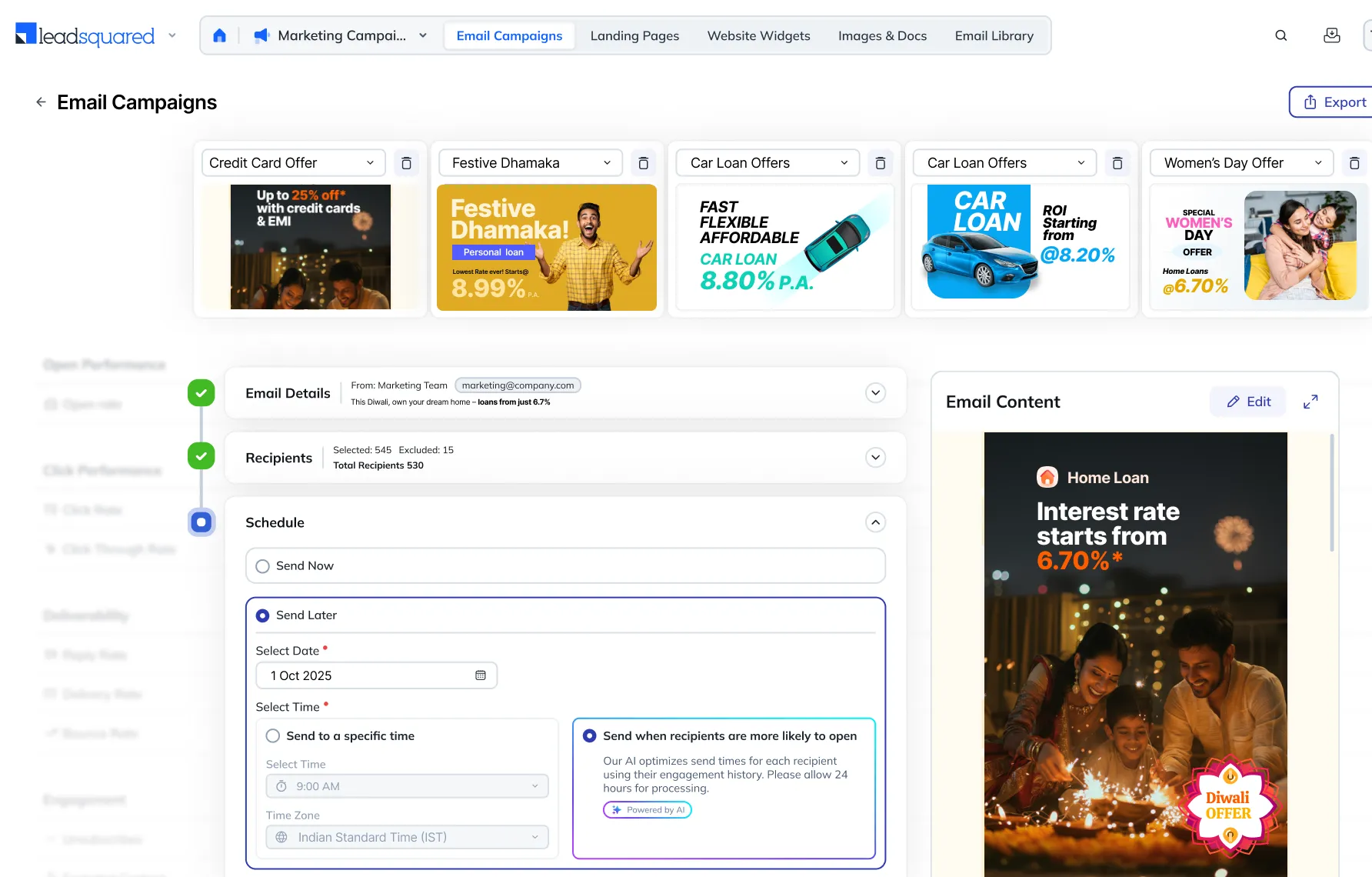

Acquire, nurture, and retain customers with hyper-personalized marketing. Maximize ROI with smarter cross-sell and upsell campaigns.

Lower CAC. Higher lifetime value. Explore

The unfair advantage for

new-age lenders

Lean workflows, stronger outcomes. At every step of your lending journey.

Scale

Grow loan book &

application volume

seamlessly.

Speed

Cut decision cycles;

speed up approvals

dramatically.

Efficiency

Scale outcomes – not complexity, nor the size of your teams.

Impact

Faster approvals. Happier borrowers. A better check-to-cheque experience.

Loan products we power

Support multiple loan products on one platform—without adding

complexity to your operations.

Housing Loans

Personal Loans

Education Loans

Vehicle Loans

Gold Loans

SME & Business Loans

Microfinance

BNPL & Digital Lending

Seamless Integrations. One connected ecosystem.

LOS, LMS, credit bureaus, payment gateways, KYC providers, and everything else you need.

Regulations change — your readiness shouldn’t.

- Robust disaster recovery and business continuity.

- RBI & DPDP compliant consent management.

- Automated compliance checks across all modules.

- Bank grade encryption & regulatory compliance.

- Customer data privacy.

- Built-in audit trails.

Success stories, straight from

our customers

Strategies, tools, and

insights to scale

17 Tips to Become a Successful Debt Collection Agent

How to Find Loan Leads in India [Download Checklist]

Lending Cloud – Frequently Asked Questions

What is LeadSquared’s Lending Cloud Solution?

LeadSquared’s Lending Cloud is a highly configurable, end-to-end solution built on a secure, low-code platform designed to power the entire customer lifecycle for lending institutions. The platform is an integrated suite of five core products that streamline processes from initial enquiry to final collections:

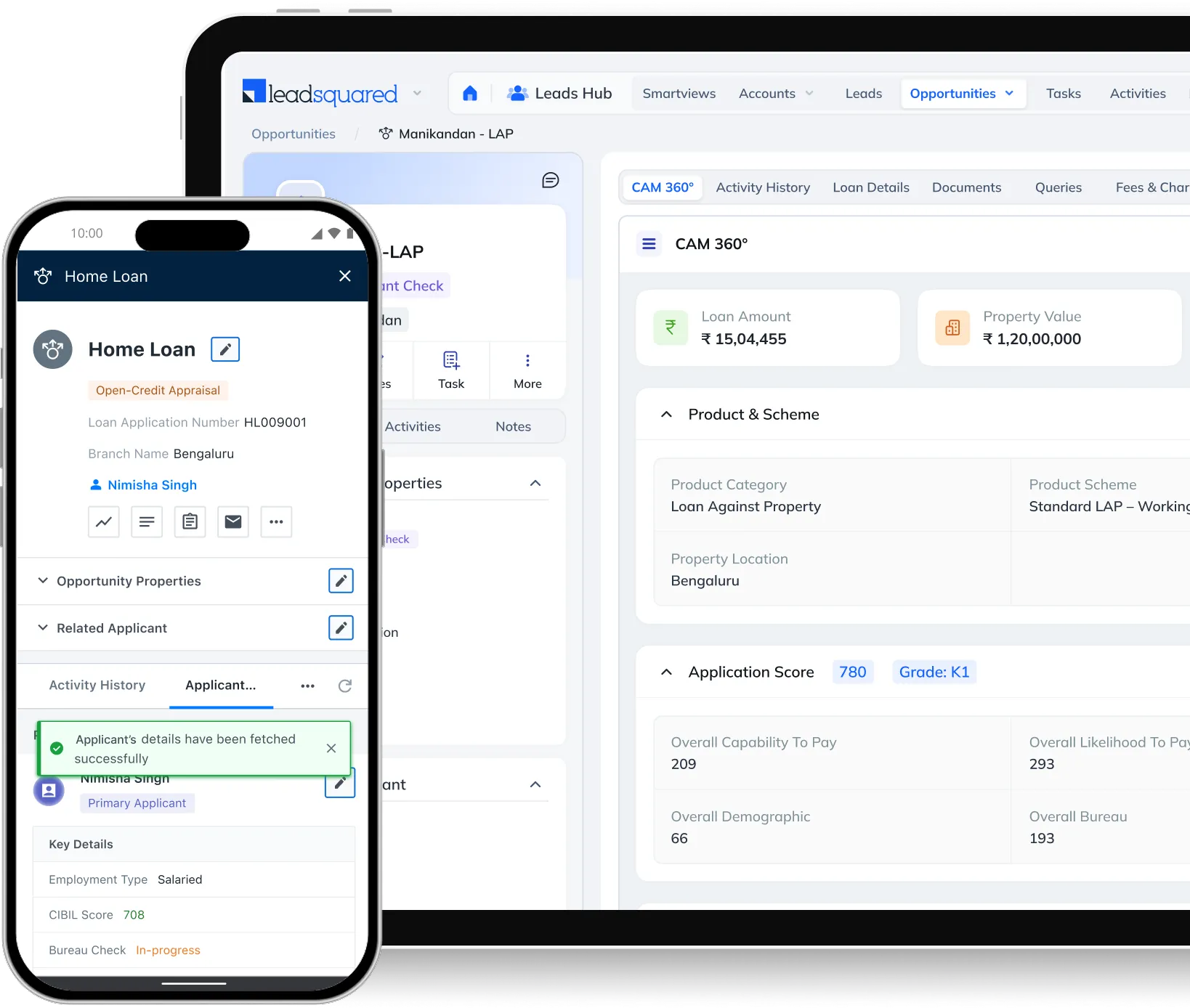

- Lending CRM: Enables multi-channel lead sourcing, distribution, and engagement for frictionless customer journeys.

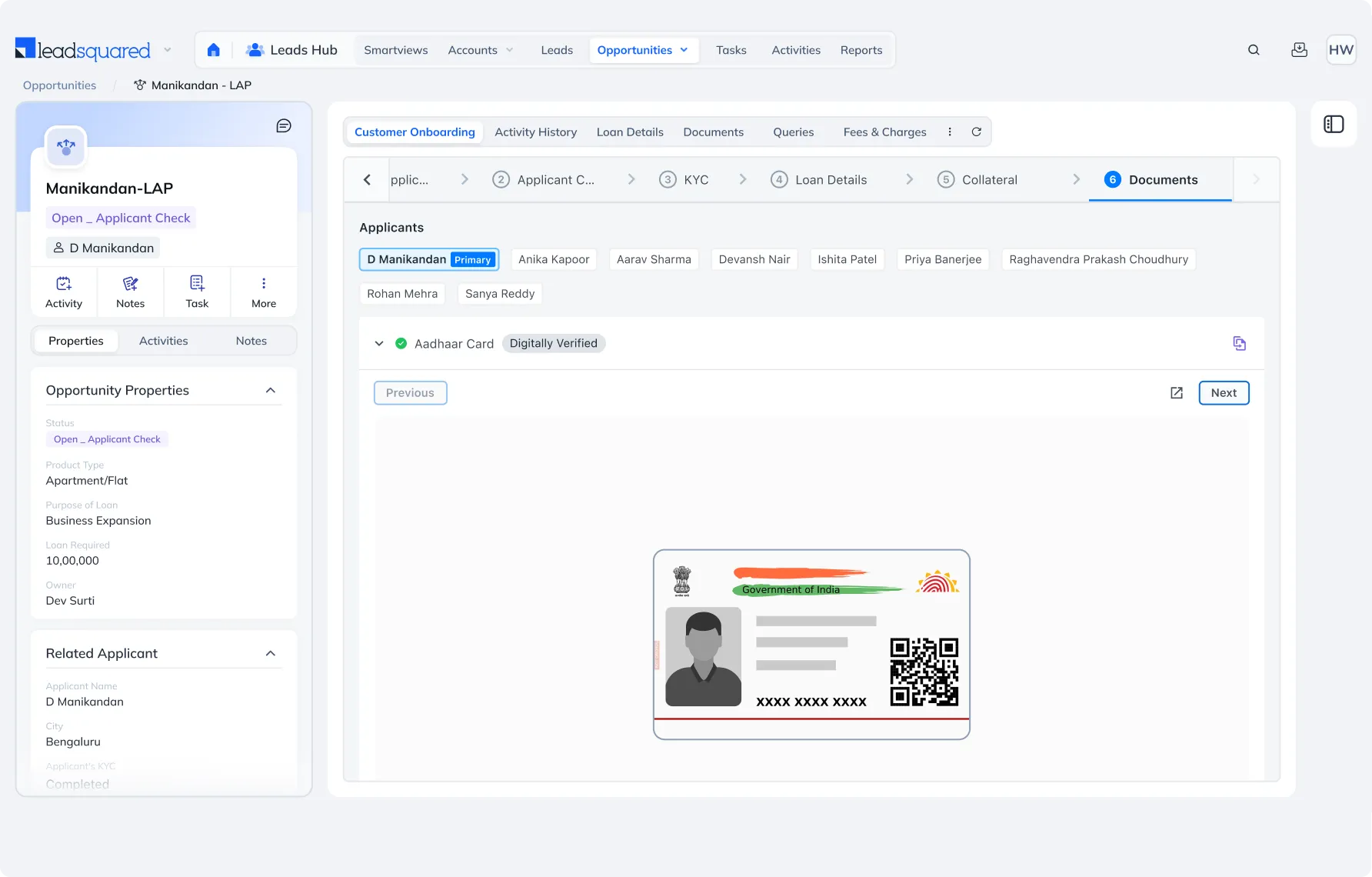

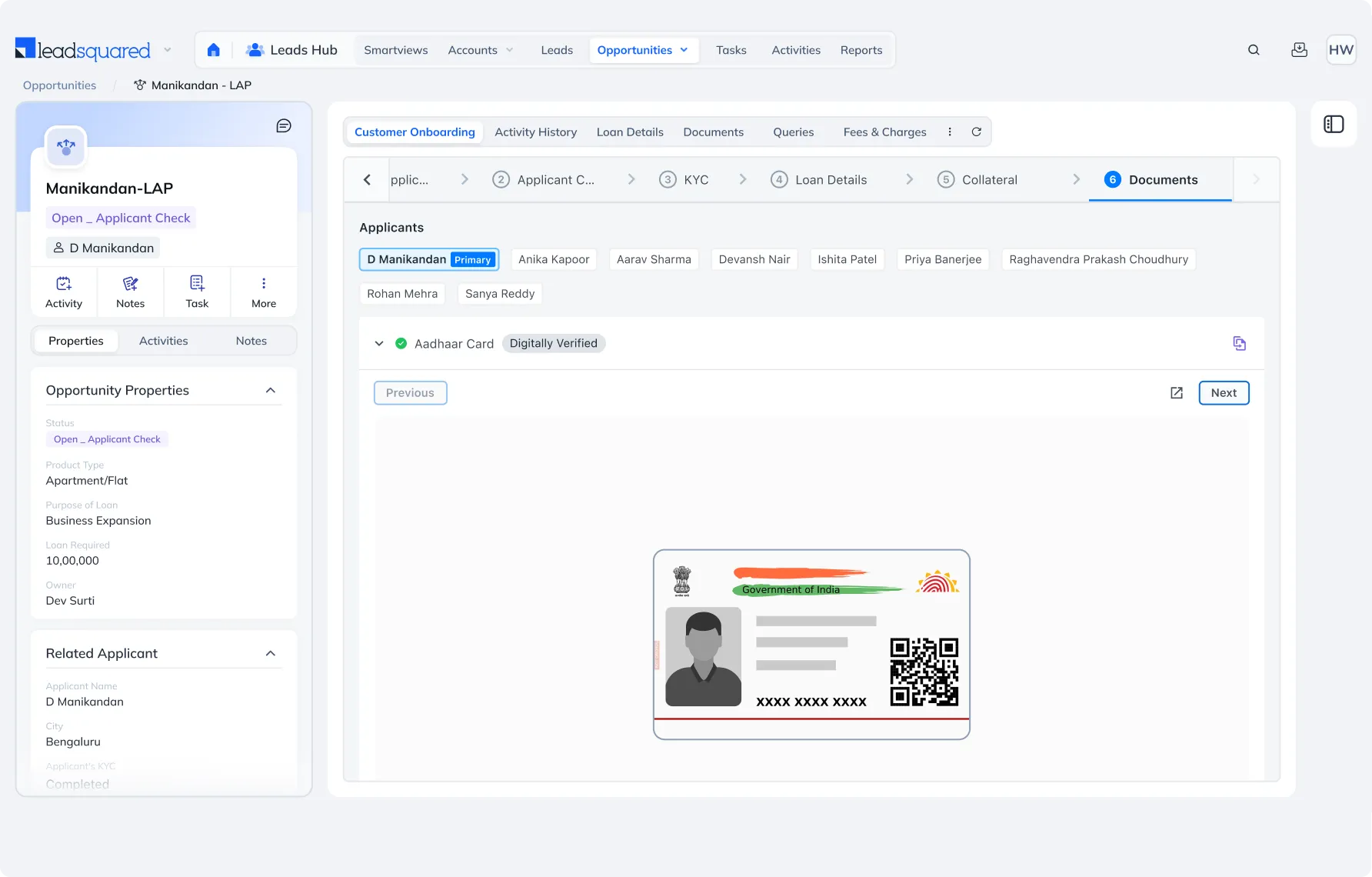

- Loan Origination System (LOS): Allows you to create and manage self-serve loan application journeys, conduct pre-screening checks, and automate back-end credit assessments.

- Field Force Automation: Provides a mobile solution to plan, automate, and track field agents in real-time with remote CRM access.

- Collection CRM: Empowers teams to efficiently track and follow up with customers, using predictive insights for faster collections.

- Service CRM: Streamlines customer support with AI-powered ticket management, from creation to resolution.

What types of financial institutions do you work with?

LeadSquared serves over 200 clients in the Banking, Financial Services, and Insurance (BFSI) sector. Our platform is versatile enough to support a wide array of institutions and their specific needs. Our clients include major banks, housing finance companies (HFCs), Non-Banking Financial Companies (NBFCs), wealth management firms, and modern fintechs. The Lending Cloud is designed to handle various loan products, including Home Loans, Personal Loans, Vehicle Loans, Business Loans, Loan Against Property, and Microfinance.

What key business objectives does your platform help lenders achieve?

Our platform is designed to help lenders achieve three primary objectives: scale, speed, and cost-efficiency. We focus on delivering value in four key areas:

- Accelerate Revenue Growth: By scaling customer acquisition and personalizing journeys, our platform helps you grow your loan book.

- Reduce Cost & Improve Efficiency: We digitise field operations and streamline processes to improve operational efficiency and lower the total cost of ownership (TCO). Poonawalla Fincorp, using our platform, reduced their cost per application by 72%.

- Ensure Compliance: Our solution helps you embed governance and adapt to changing regulations, such as those from the RBI. This includes features like RBI-compliant consent capture and configurable document designers for items like the Key Facts Statement.

- Facilitate Digital Transformation: We enable AI-driven decisions and seamless transitions, helping you modernise your operations. One of our clients reduced their two-wheeler loan processing time from 30 minutes to just 5 minutes.

What is “digital lending software,” and how is it different from traditional loan systems?

Digital lending software is an integrated, end-to-end system that automates the entire lending lifecycle: from lead capture and onboarding to underwriting, disbursal, servicing, and collections. Unlike traditional, siloed systems, it enables real-time workflows, decision automation, seamless integrations with external systems (KYC, credit bureaus, banking, payments), and provides better visibility, speed, and compliance across the board.

What are the benefits of using digital lending solutions for small and medium enterprise (SME) lending?

Digital lending platforms offer small and medium enterprises (SMEs) a game-changing advantage. Lenders can:

- Accelerate application and approval processes, allowing SMEs to secure funds quickly.

- Eliminate manual paperwork through tools like OCR and integrated data capture, reducing errors and time spent on repetitive tasks.

- Leverage automated credit assessments and real-time data fetching for stronger risk management and faster underwriting.

- Enable multi-channel onboarding—whether through web, mobile, or in-person—making it easier for SMEs to start and complete applications.

- Utilize robust audit trails and compliance features to meet regulatory standards while maintaining a seamless customer experience.

With these benefits, lenders can not only scale their SME loan portfolios faster, but also deliver the efficiency and transparency today’s businesses expect.

What is the difference between retail lending and commercial lending?

At a fundamental level, retail lending and commercial lending cater to different audiences—think individuals versus businesses—and this creates some important distinctions in products, processes, and risk profiles.

Retail lending: Retail lending (also known as consumer lending) is designed for individuals looking to fund personal aspirations: buying a home, a car, or pursuing higher education, for example. These products tend to be standardized and templated (like home loans, auto loans, or personal loans), with processes that are highly automated and eligibility checks that rely on straightforward individual income and credit scores. Retail loans are generally smaller in size but occur in higher volumes. Since these assessments are simpler, you get faster turnaround times and less documentation.

Commercial Lending: Commercial lending (also called corporate lending), on the other hand, is geared toward business entities needing capital for things like expansion, new projects, or trade finance. These loans are typically tailor-made to suit intricate business requirements—think term loans, working capital financing, or project finance. The exposure here is much larger (but at lower volumes), and evaluation involves deep-diving into company financials, promoter background, cash flow projections, group exposures, and sometimes even a full industry analysis. Due to the greater risk and complexity, multiple stakeholders are often involved in approval and documentation is significantly more exhaustive. Full automation is rare due to ongoing third-party evaluations.

Can your platform integrate with our existing systems?

Yes, system integration is a core strength of our platform. We offer an ‘Integration Cloud’ and have extensive experience connecting with the diverse systems used in the financial services industry. Our Loan Origination System alone has over 70 ready integrations for services like KYC, credit bureau checks, and fraud detection. We frequently integrate with:

- Core Banking and Loan Management Systems (LMS)

- Third-party dialer and telephony systems

- Marketing automation platforms

- Other CRMs like Salesforce if needed

- Payment gateways

Our platform uses a robust framework of APIs and webhooks to ensure seamless data flow.

How does your platform ensure data security and regulatory compliance?

We provide enterprise-grade, bank-grade security and are compliant with global standards such as ISO 27001, GDPR, SOC 2 Type II. Our platform is 100% cloud-based and hosted on AWS, which is protected by services like AWS WAF. For our clients in India, we provide data hosting in India at multiple locations.

Specific security and compliance features include:

- Regulatory Compliance: Features like RBI-compliant consent management and data masking for DPDP Act compliance are built-in.

- Access Control: We offer Multi-Factor Authentication (MFA), SSO authentication, permission templates, and detailed audit logs.

- Data Protection: Data is encrypted in transit (TLS 1.2) and at rest (AES 256).

- Vulnerability Testing: We conduct third-party VAPT (Vulnerability Assessment and Penetration Testing) every six months to ensure the system remains secure.

- Flexible Deployment: We offer flexible AWS deployment options, including shared and dedicated models, to meet strict regulatory requirements.

What are the key capabilities of LeadSquared’s lending solution?

LeadSquared’s lending solution simplifies the loan journey with digital onboarding, automated KYC, and no-code workflows. It supports smart underwriting, bureau integrations, and decision automation to speed up approvals. Field teams get mobile tools for data capture and task management, while compliance is ensured with audit trails and consent handling. With built-in analytics and integrations, lenders can launch products faster, reduce risk, and deliver a smoother borrower experience.

Do you provide a CRM solution for banks, NBFCs, and fintechs?

Yes. Our solution includes a Lending CRM module built for financial institutions (banks, NBFCs, fintechs). It supports multi-channel lead sourcing, lead distribution, engagement tracking, predictive scoring, and funnel management. It’s designed to be tightly integrated with loan origination and servicing modules, so your sales and credit teams stay synchronized.

How do digital solutions support commercial real estate (CRE) lending and deal management?

Digital CRE lending platforms simplify and accelerate the complex world of commercial real estate financing by automating processes, improving visibility, and ensuring compliance.

- End-to-End Deal Tracking: Manage leads, loan applications, documents, and deal stages in one platform for full visibility and faster closures.

- Automated Workflows & Compliance: No-code workflows streamline underwriting, due diligence, and approvals while ensuring seamless KYC, credit checks, and RBI-compliant processes.

- Centralized Collaboration: All teams—from origination to operations—access real-time data, documents, and query management in a single dashboard.

- Reporting & Auditing: Generate audit trails and regulatory reports instantly to meet RBI and DPDP requirements.

Faster Disbursal: OCR-based document verification and integrated risk checks enable faster approvals and disbursals.

In short, digital lending platforms help CRE lenders close more deals, faster, with greater accuracy, transparency, and governance.

Powering traditional and

digital lenders alike

From banks to fintechs to NBFCs – scale

lending with confidence.

Ready to build a faster, smarter

lending engine?

Digitize every step: from origination to disbursal, to cut costs,

speed up approvals, and stay compliant at scale.