“Mayank, make your holidays great with ABC. Get XXXX instant pre-approved funds into your bank account in just 3 seconds.”

I received this message before starting this article, and it is the perfect example of what marketing in financial services looks like today.

I inquired about their product a long time ago and have received these messages weekly in my SMS box since. As annoying as they are, if I were to consider a loan product, they would be the first ones I reach out to and question.

Why is that? Because they are constantly visible to me on a very personalized level.

In the last two decades, marketing in the financial services industry has evolved significantly. From occasional 15-second TV ads, flyers, and radio commercials to smartphone notifications, the strategies/channels have become more targeted, personalized, and real-time.

For instance, many advanced salary providers may target you in the third week of the month because most of us run out of extra cash to spend. Similarly, many trading apps may target you at the beginning of the month, asking you to start a tax-free SIP.

It’s changed because customer preferences have shifted. Your customer wants the best, most personalized experience. They want to feel special, like they are the only customer you have, and you need to know how to make them feel that way.

So, in this article, we’ll discuss some strategies to ace your marketing performance, deliver excellent customer experience, sell more products with LeadSquared marketing tools, and stay ahead in the game.

Why is Marketing in Financial Services Important?

To compete with the suppliers and match the demand. Here’s an example that’s relevant for all financial organizations globally —Today, India has 9000+ NBFCs, 1800+ banks, and 50+ insurance companies/carriers. In 2023, India will become the most populous, with more than 1.4 billion people.

As your target base grows, so will the competition! Rising disposable incomes, improving internet/smartphone penetration, and increasing financial awareness will ultimately result in a higher demand for financial products. And financial organizations are battling to capture this growing market share.

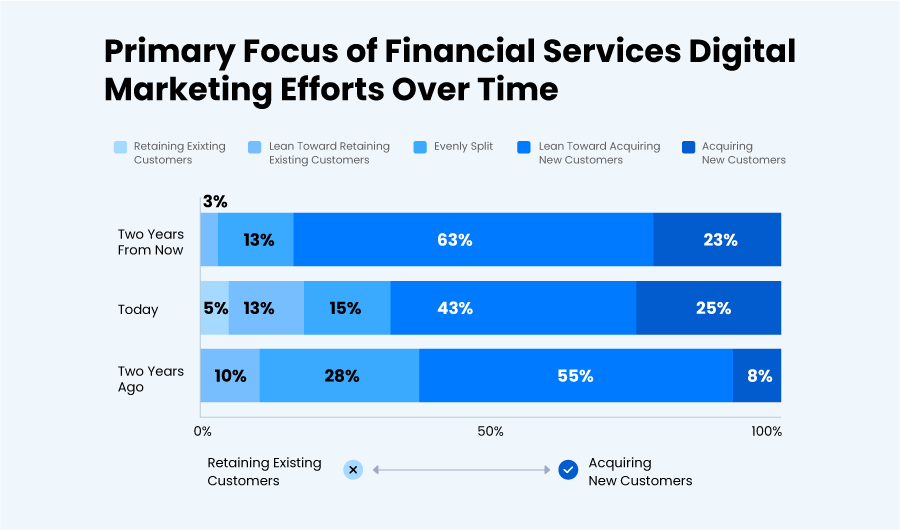

According to Gartner, nearly 86% of all financial organizations globally focus their marketing efforts on acquiring new customers.

A solid marketing presence is critical to reach your target audience, convey your value proposition, pushing the individual into your sales funnel, and then through the funnel as a successful conversion.

So, let’s jump to a few strategies to help you build this solid marketing presence and grow efficiently.

8 Building Blocks to Create an Effective Financial Marketing Strategy

1. Optimize Your Website and Make it a Lead Generation Hub

Quick question – What has been your first action while searching for any financial product in the last two years?

Talking to your relatives and family members about availing it.

What is the second action?

Searching for it online!

Websites are hubs of information. They are at the center of most marketing strategies today. According to one traffic analysis, direct traffic (traffic that directly comes to your website) contributes to at least 22% of average monthly searches for a brand. So, if you do not have a website, start making one now. WordPress, for instance, is a great tool to begin with.

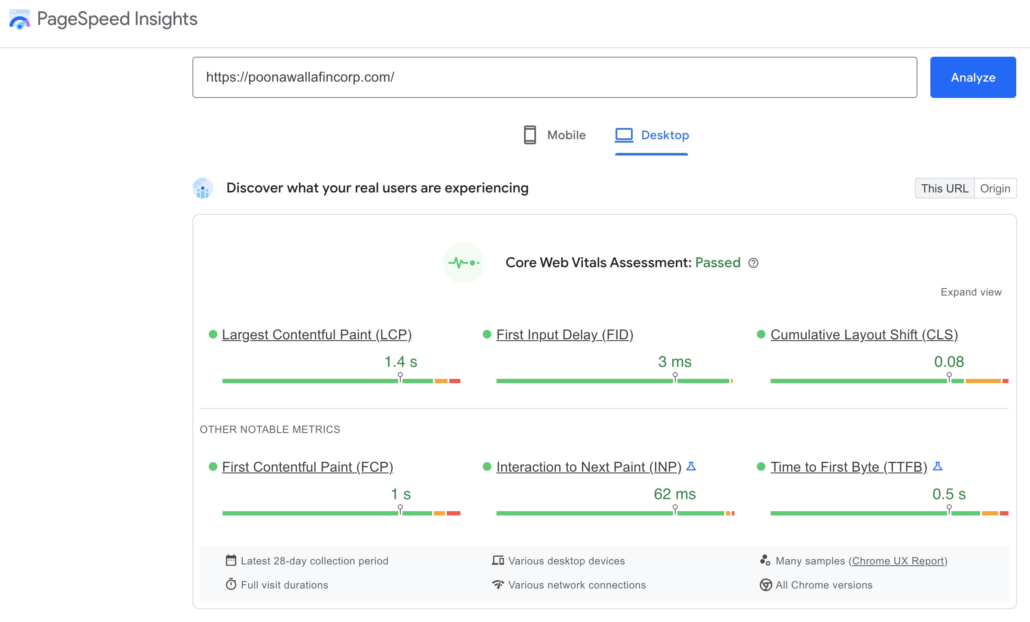

Having a website is essential. But having a great website is even more critical. Customers today value seamless experience above all. And sub-par website performance can ruin it.

The same research also shows that at least 60% of all searches are from mobiles today. Hence, you must optimize your website surfing experience across both desktop and mobile devices.

Tools like Google PageSpeed Insights can help identify the heavier elements within the website and optimize them. You can also leverage PageSpeed Insights to improve the performance of your website.

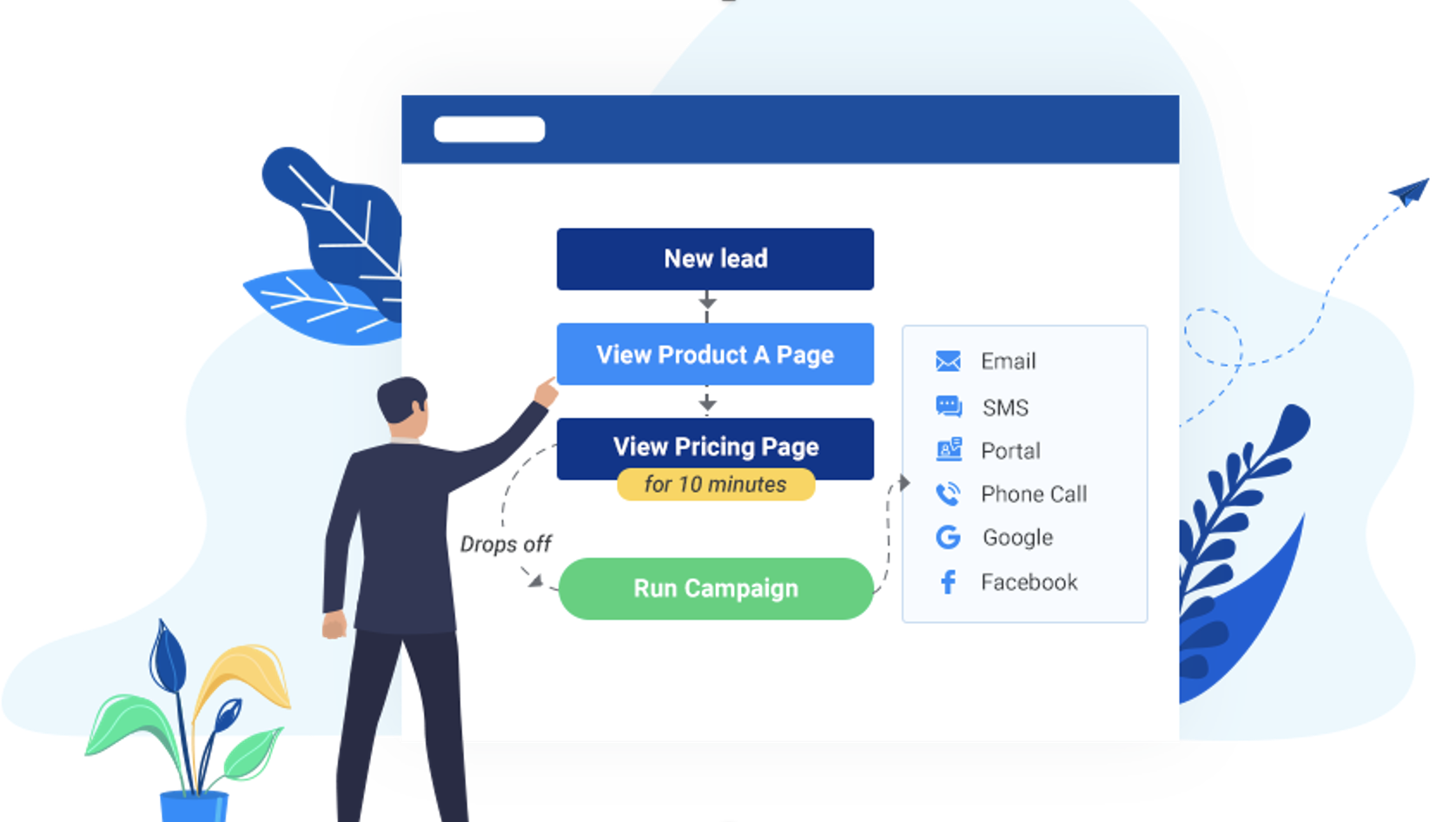

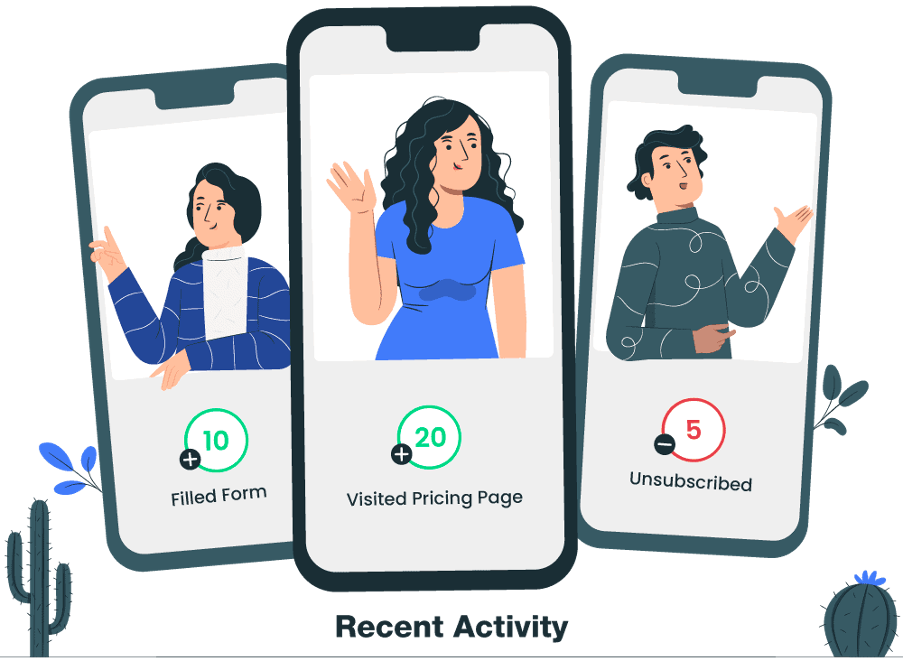

You can also integrate your website with a marketing automation tool like LeadSquared. Consequently, you can track lead activities like page visits, email opens, unsubscribes, form fills, and much more.

Many marketing automation platforms use this data to generate appropriate engagement scores and determine intent, allowing your sales and marketing teams to pursue hot leads and nurture the cold ones for better conversion.

2. Design and Deploy Landing Pages for Maximum Sales Conversions

Landing pages are another great way to capture new inquiries and there are many objectives that landing pages serve.

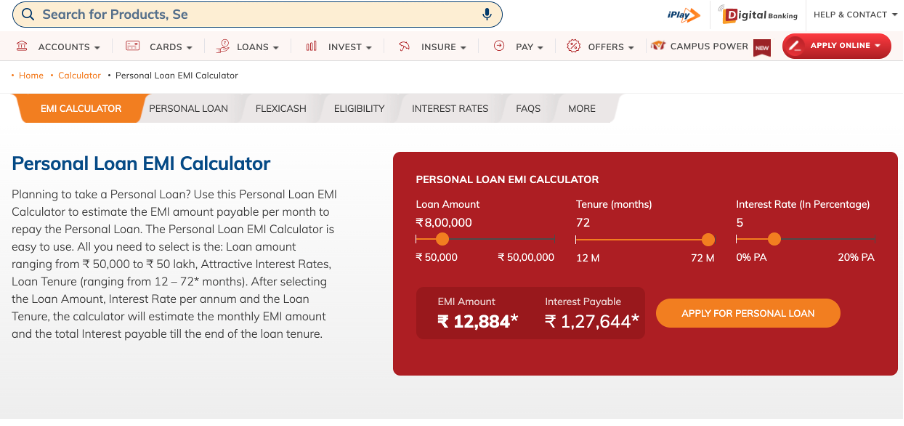

You can create product-related landing pages to inform the customers and capture their leads directly from the same page. Landing pages that help customers calculate their liabilities in exchange for securing your products are another great way to capture inquiries.

Similarly, insurance businesses can use landing pages to book a consultation with insurance agents or request a call back. Landing pages can initiate the onboarding process for insurance agents as well.

If designed well, landing page conversion rates can reach up to 80% – meaning you can capture details of four out of every five people that hit your landing page.

LeadSquared marketing automation allows you to design highly responsive landing pages in just a few clicks. You can also choose from hundreds of high-quality internal templates.

Another benefit of using LeadSquared landing page creator is the effortless drag and drop feature that allows to add new elements into you landing page (like text boxes, forms, images, videos, etc.) without the hassle of any coding. Zero coding can save your marketing teams hours in time!

With LeadSquared, you can also attach a lead score to every form fill and notify your sales team to reach out to these hot inquiries almost instantly.

3. Install Chat Widgets for Better Engagement

So, now the customer is on your website. What next?

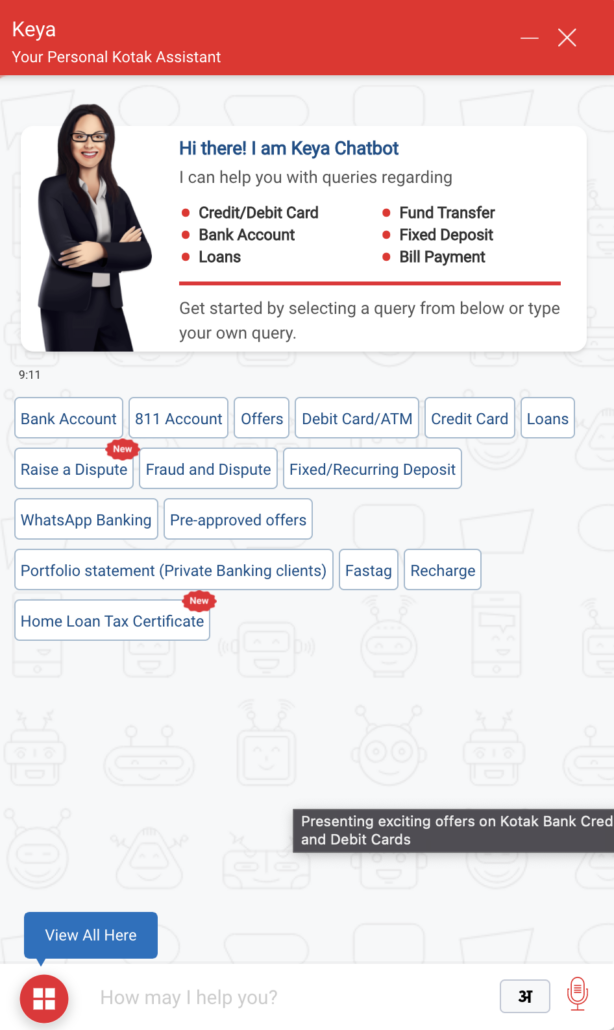

It is essential to engage this customer and capture their details. Chat widgets are a great way to do that. They give you many upsides like:

- Expedite time to response

- 24×7 availability

- Data collection during the first interaction

- Better waiting experience

- Reduce the cost of lead acquisition

- Omnichannel engagement

- Both app and web integration

- Responds to FAQs, saving agent bandwidth

- Multi-lingual response

- Voice-enabled at times

With the advent of AI, these intuitive conversational solutions are becoming a highly effective medium to convert cold leads into MQLs and funnel them into your CRM.

Chat widgets are also great for post-sales processes like customer service. Most customers want a quick self-serviced resolution to their problems. Pre-programmed chat widgets are an affordable and straightforward way to solve this problem. They can:

- Collect problem statements

- Generate a ticket

- Keep the history of the discussion intact

- Provide possible solutions to the customer

- Direct the customer to the appropriate agent for complex issues

LiveChat, Olark, Yellow.ai, Ori, Zopim, etc., are some examples of great chat widgets you can deploy for your business. There’s another benefit for you if you are a LeadSquared CRM user. There’s another benefit for you if you are a LeadSquared CRM user.

LeadSquared CRM offers you out-of-the-box integrations with many third-party platforms like these chat widgets, and these integrations can bring down your go-to-market time by up to 80%. That’s one of the fastest in the market!

4. Use Search Engine Optimization Practices to Rank Better

SEO is one of the most effective and low-cost ways to generate business. It is the practice of optimizing your website’s technical configuration, content relevance, and link popularity to rank better in a given search.

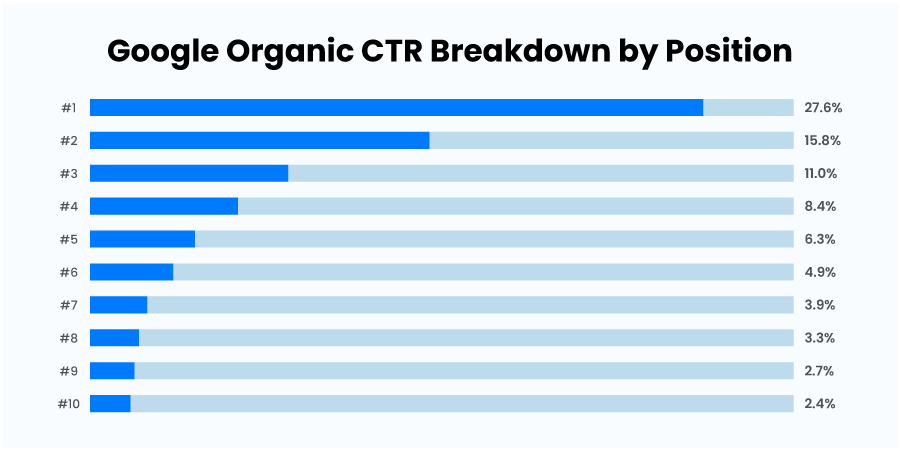

The higher you rank in a Google search (for instance - more than 83% of the online search market resides with Google), the higher your click-through rate (CTR) will be. According to SEM Rush, the top three links in a google search get more than 50% of all clicks for a particular keyword.

You can optimize your page rank in many ways. Here are three ways to get started:

- Choosing the right keyword: You can reach more customers by incorporating keywords with higher search volume and lower keyword difficulty (less competition). To identify the right keyword, you can checkout tools like Ahrefs, Google Keyword Manager, SEMRush, and more. Additionally, incorporating Google Trends API can provide real-time insights into the popularity and seasonality of keywords, helping you stay ahead of trends and optimize your content strategy accordingly.

- On-page optimization: Optimize your website for the targeted keywords. Use the keywords in the page titles, headings, and body content, to improve the website’s ranking in search results. For instance, if you are a financial planning and management FinTech and your chosen keyword is ‘financial planning‘, using the keyword frequently in your web content can help you rank for . Embedding FAQs related to financial planning can also increase your visibility.

- Off-page optimization: Off-page optimization, as the name suggests, includes activities that are done off the website to improve its ranking and visibility. These activities could include:

- Getting high quality links from trustworthy and relevant financial services websites. Examples include Forbes, Economic Times, Bloomberg, etc.

- Enhancing social media presence on platforms that include your audience.

- Creating and distributing high quality educational content to make your audience more aware about your benefits.

- Capturing online reviews on third party websites/aggregators.

- Getting brand mentions in press releases and prestigious blogs.

On average, organic traffic (unpaid searches and listings) can constitute up to 17% of total web traffic. Hence, it is essential to develop your organic channel through SEO.

5. Set Up Performance Marketing Initiatives

Platforms like Facebook, Instagram, Google, Twitter, etc., are excellent for highly targeted marketing ad campaigns.

Basis user search history and current search results, you can identify an audience with shared attributes and target them with highly personalized content.

On average, performance marketing can contribute up to 21% of web traffic.

There are many advantages to using developing a performance marketing strategy:

- Flexibility to turn these ads on and off per your choice.

- Specify ad groups- based on product, search, geography, device, etc., factors.

- Schedule these ads in advance for special times in the year – for instance, for personal and consumer durable loans during festivals like Diwali.

- Contributes to both brand awareness or lead generation.

- Retarget lost customers and drop-offs during the lifecycle journey, thus reducing cost per lead and increasing chances of conversion.

According to ET, digital ad spending in India will grow to USD 21 billion by 2028, adding to more online competition in the financial services industry. You need to leverage this channel and become more visible.

There are several ways that you can use PPC for marketing:

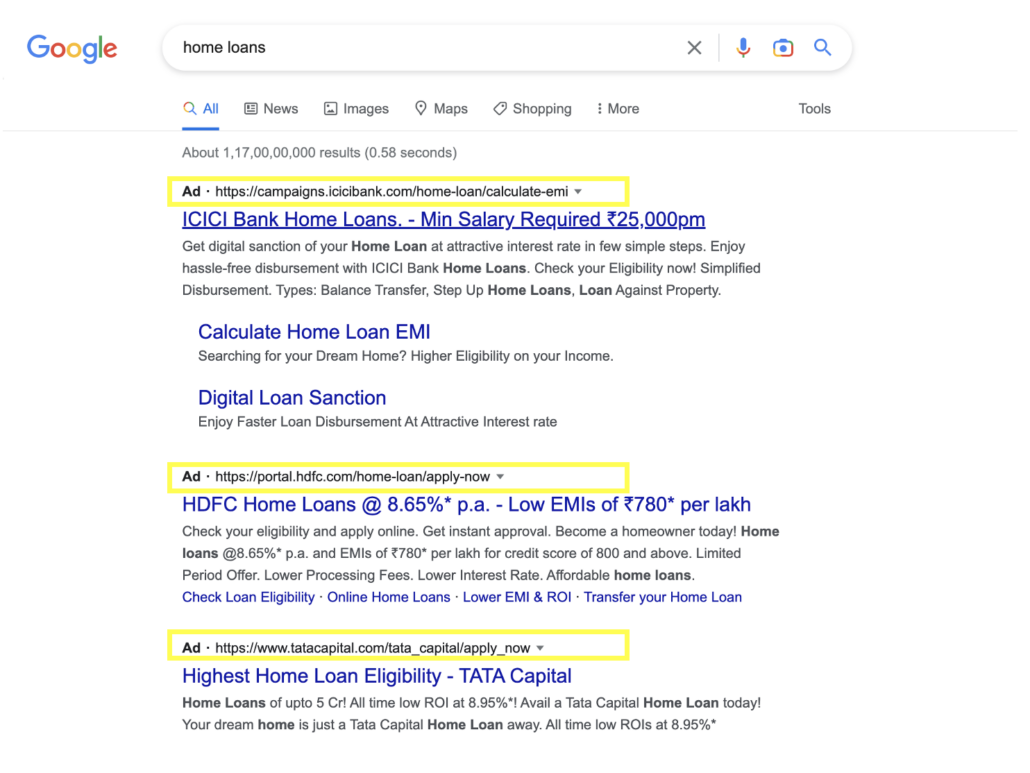

- Google Ads: Create and run PPC campaigns on Google Ads by bidding on specific keywords. When a user searches for one of the targeted keywords, the ad may appear at the top or bottom of the search results page. The image you saw earlier showcases google ads running on the keyword ‘Home loans’.

- Social media advertising: Many social media platforms, such as Facebook, Instagram, and LinkedIn, offer PPC advertising options. You can create ads and target specific audiences based on factors such as location, age, interests, and behaviors.

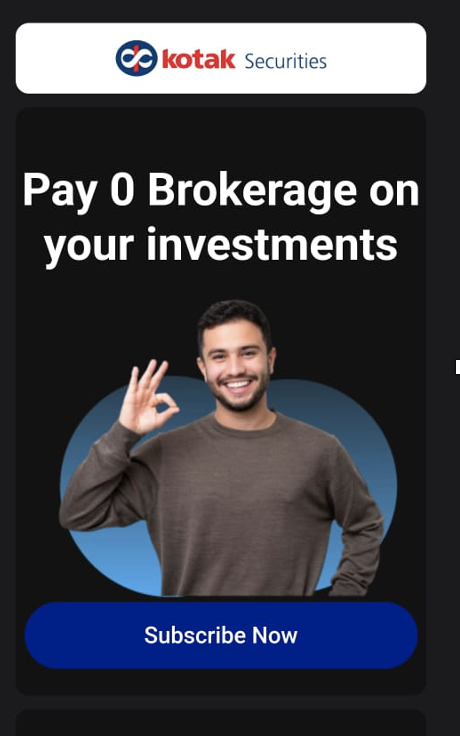

- Display advertising: Another type of PPC campaigns use advertisement to be displayed on websites and apps related to financial services to reach your potential audience. These ads may appear as banners or interstitial ads and can be targeted to specific audiences based on factors such as demographics and interests.

- Aggregators and listing websites: There are many third-party platforms like Policy Bazaar, Bank Bazaar, and Paisa Bazaar that offer audiences a unique experience of comparing financial products from different providers. As a business, you can enlist your products/services on these websites and promote them for better visibility to new leads.

[Also read: Top 10 B2C Lead Generation Strategies for a few more tips on generating quality leads.]

6. Leverage Email, Mobile, and SMS Marketing to Personalize Outreach

These are three powerful channels for marketing in financial services.

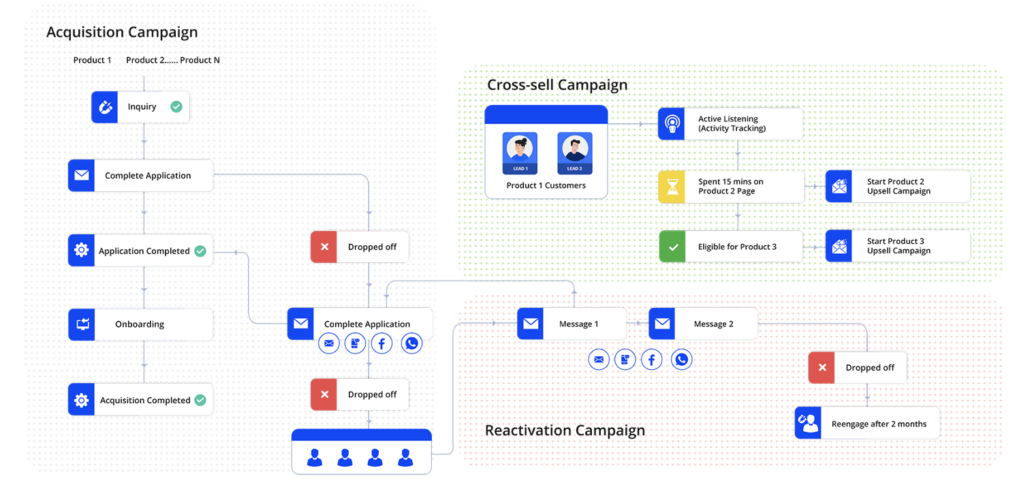

Many organizations use these channels for new lead acquisition and increase cross/up-selling of products. The reason is that they allow engagement through highly personalized messages.

A great example of this would be Kotak Securities or Groww. Both these investment apps leverage all three channels simultaneously to keep you informed of new trends in the market, investment opportunities, and the status of your holdings. As a result, you end up constantly engaged with their apps, and the personalization improves brand awareness, consequently, increasing trust in the brand.

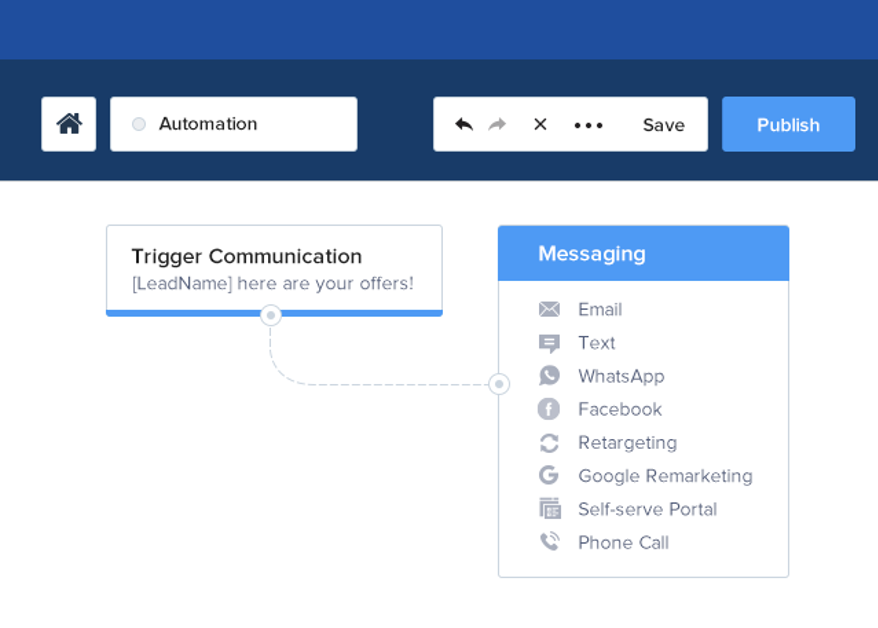

You can leverage these channels using marketing automation tools like LeadSquared. Here’s how simple it is:

- Use the intelligent lead scoring engine to segment all your leads into different buckets basis attributes like hot, cold, product, region, language, channel, etc.

- Set up personalized messaging in email/sms campaign builder.

- Leverage automation workflows tuned to conditions like – If hot, then run offer campaign A. If cold, then reactivate via campaign B.

- Press ‘send’ to engage hundreds of leads in a single click.

The advantage of using LeadSquared is that you can set these campaigns to run dynamically. As soon as a lead matches your criteria, the campaign will start running on that particular lead.

7. Don’t Forget WhatsApp Marketing

WhatsApp took the financial services landscape by storm a few years ago. Today, due to the more than 90% open rate for its messages, WhatsApp is used across most enterprise businesses to communicate with customers.

Pre-programmed workflows allow teams to capture responses, collect documents, send offers, initiate payments, and resolve conflicts—basically end-to-end acquisition, onboarding, and servicing in a single application.

A seamless WhatsApp integration with your CRM solution (like LeadSquared) can enable your sales and marketing teams to perform all these functions seamlessly and generate more ROI.

8. Influencer and Webinar Marketing are Great For Brand Awareness

Using influencers to market your product is another excellent way to make noise and inform your target audience about your financial service.

Cred is one payments brand that has consistently aced this strategy. Influencer marketing can be an expensive endeavor to undertake, and tracking their ROI takes work.

Instead, nurturing through webinars and roundtables on contemporary topics is a great strategy to leverage influencers and increase brand awareness.

You can collaborate with influential speakers in the industry on topics like benefits of tax-free financial investments or the importance of life insurance policy.

This exercise improves brand awareness, helps with nurturing of existing leads, and increases new lead acquisition.

You can set up landing pages to capture new leads and promote the session via different channels like WhatsApp, SMS, Email, push notifications, mobile app, YouTube, etc. A marketing automation platform can help you promote effectively on all these channels using a single dashboard.

This helps you become visible on multiple channels at the same time. (Note: The success of the webinar can depend on many factors like the topic, number of speakers, target audience characteristics, quality of promotions, and more.)

Conclusions

Leaders in the financial industry are already perfecting these areas to attract more customers, and so you must take on the competition by doing the same. Start by improving your website and enhancing your self-serve experience. Then move to the other areas but remember to hit them all.

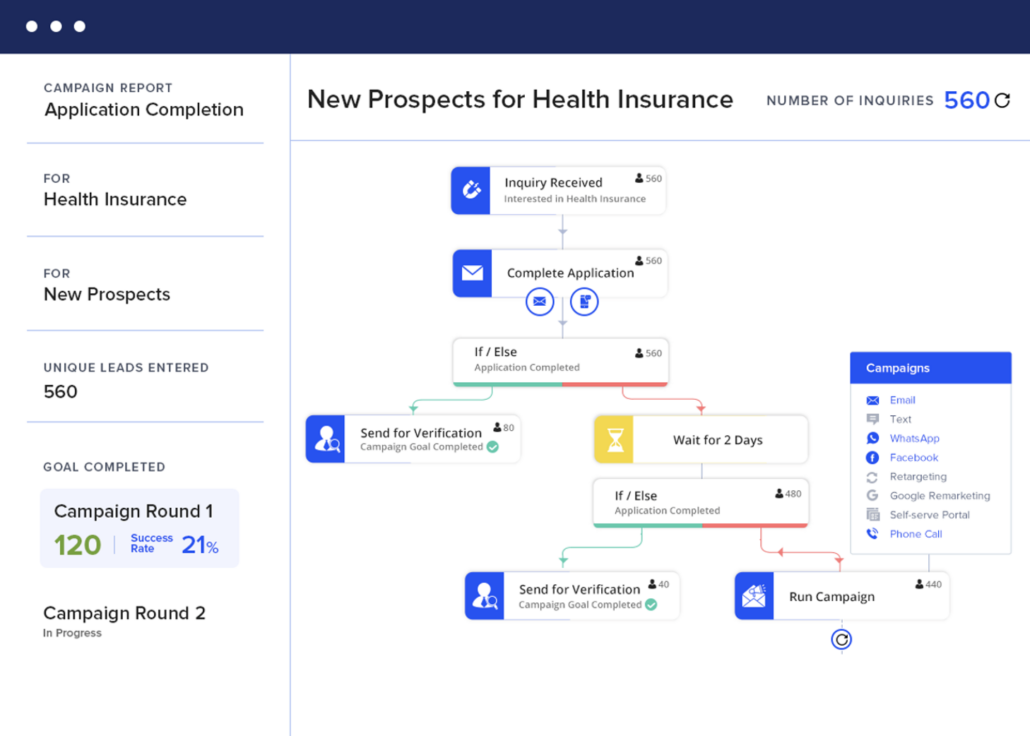

Also, with marketing automation tools, you can achieve granular segmentation, personalization, and timely engagement with all your prospective leads, getting the right message to them. Additionally, these platforms give you highly detailed reports and analysis of channel performance, engagement rates, drop-offs, campaign performance, etc. Here is an example of what a health insurance campaign report may look like:

If you want to leverage easy-to-use automation workflows and create an excellent onboarding and engagement process, check out the LeadSquared marketing automation solution today!