Every company or business, that aims to achieve its set out goals and objectives, has to constructively analyze its strengths and weaknesses. There are many parts and sub-parts that need obvious attention. Among such parts is the revenue stream or profits of the company. Very little can be achieved without funds. Revenue analysis is not an easy task. It determines many factors such as the costs of products or production and which areas of the company needs an increase in revenue. To that end, here’s what you need to know about revenue analysis

What Is Revenue Analysis And How Does It Work?

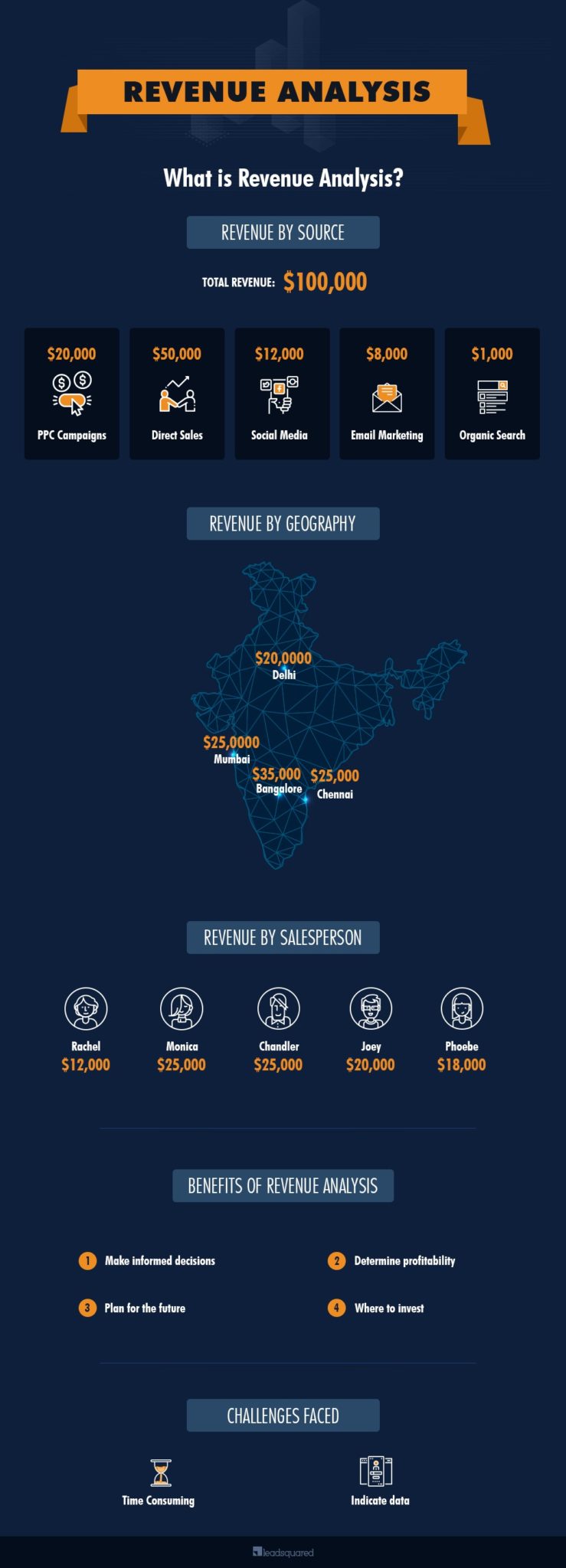

We know revenue can refer to income, sales or turnover, monetary units or just plain money. From here, we get the idea of what revenue analysis means. It’s a deliberate, detailed and well-researched report that indicates revenue for all activities in a company. This can range from sales (products and services), costs, income, and other variables. Revenue analysis is important for business. With it, you can ensure your plans and strategies do not deviate from your goal.

Revenues are derived from the ordinary course of business. All costs or sales and finances involved in the operation of the going concern are documented. Keep in mind that assets sold do not form part of this. Costs of production of goods and services for sale are subtracted from the revenue. As a result, the gross margin is discovered and divided by the general revenue. An upshot on the gross margin often indicates that the business is moving well and profitable. This breakdown of every conceivable cost helps you know and understand performances. All sectors of the business are evaluated against past or previous records. A decision regarding the way forward is then made. Whether it’s an increase in revenue or a cut to the deadwood.

Benefits And Importance Of Revenue Analysis

Helps You Make Informed Decisions

All that recording, research, and documentation can only be vital to your business. For every decision you make, you’d want it to be from a position of strength. From revenue analysis, you get to learn and understand the workings of your business. Also, you weigh each preceding financial and production year against the next. It puts you in a favorable condition planning for the future.

It’s normal for some products to outstrip others in sales and demand. It’s not uncommon for a business to consolidate on areas that yield more profits for the business. From such analysis, you gain insight on how to improve areas where your products and services have failed or are deficient in. Part of the informed decisions is whether to increase your firm’s revenue. It’s all about getting the best results with minimal expenditure.

Helps To Determine Profitability

Profitability is a great sign your business is thriving and on the right track. Revenue analysis brings this fact into sharp focus. When all the expenses associated with production and income from sales are calculated, you get an idea of how economically viable your business is. Profitability may not be an overall indication of growth but its absolutely vital. The main aim is for your business to make a profit and not doing so makes it an effort in futility. No company can survive for long without profit.

Helps You Plan For The Future

If you’re in business for the long-term, (who isn’t?) then you need to make sound plans and projections for the future. Revenue analysis is key to this. While it’s difficult to get an exact value for the future, an analysis of your revenue and performance of your products and services gives you an idea of what to expect.

From revenue analysis, details of projections for your business begin to emerge. You get to plan your staff strength, review of costs on products (increase or reduction). In other words, you’re trying to predict how the market will unfold in the future. An increase in revenue will continue over the course of the years. If a product is doing badly you can re-strategize or rebrand to give it another shot. More investment may be needed for this but it shouldn’t be a problem if your business has great profitability.

How And Where To Invest

All records from revenue analysis help you know where and how to invest. It’s a fact that there are aspects of businesses to discontinue. But the important part is where to plow your profit into. You can’t maintain the status quo for long. It’s indicative of good growth when your revenue analysis points you towards areas to invest in. The area must not be novel to you or your business. It may be an existing part of your business like a great selling product.

The investment may come in the form of an increase to key areas. Such as target marketing ads to increase traffic to your business. Also, improving products and services delivery and investing in the expertise of staff.

Challenges Associated With Revenue Analysis

It Takes An Awful Amount Of Time

It’s rather difficult to pinpoint exact challenges that could arise from revenue analysis. However chief among them is the amount of time it takes to break things down. Especially if the company is a huge giant. Even startups need a detailed evaluation.

Using good tools like LeadSquared could alleviate some stress. Some revenue analysis takes as much as 5-8 months to finalize. It’s common knowledge that many companies hand out such tasks to external specialist firms to handle.

Estimates May Be Inaccurate

Estimates are a vital part of the business and how you want to grow. But sometimes the figures tell half the story. Present concerns and future projections will get affected by such information. As much as possible, you want to avoid this challenge because it could affect revenue. Sometimes data gets misrepresented or falsified. Systems used may also be outdated. This leaves your business with a setback to fix in order to derive adequate numbers. The best analytics tools alongside experts can correct this challenge.

To conclude, revenue analysis goes a long way to determine how successful your enterprise will be. It’s a routine that ensures that you cover all financial and revenue-based angles.