Retail Banking Crm. Transform the Way You Sell

Digitize you complete customer acquisition, onboarding, sales, collections and upsell/cross-sell operations

Digitize you complete customer acquisition, onboarding, sales, collections and upsell/cross-sell operations

Right from customer acquisition, onboarding, engagement, upsell/cross-sell and guided sales actions

Increase digital acquisition rates with a top-notch experience for your prospects.

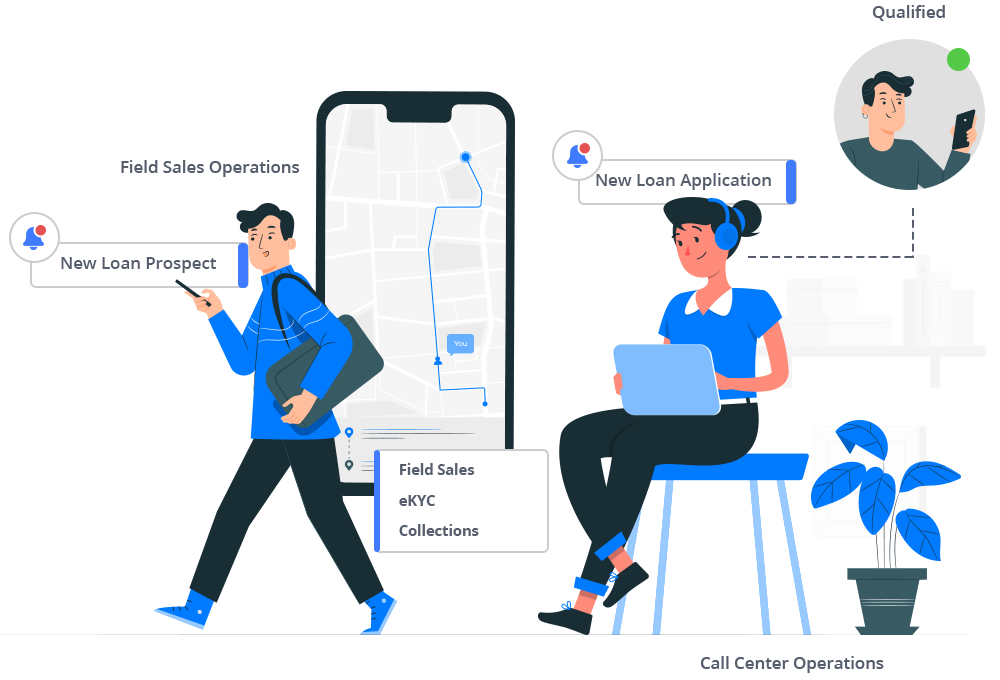

Improve the efficiency & conversions of your call centers with intelligent lead routing

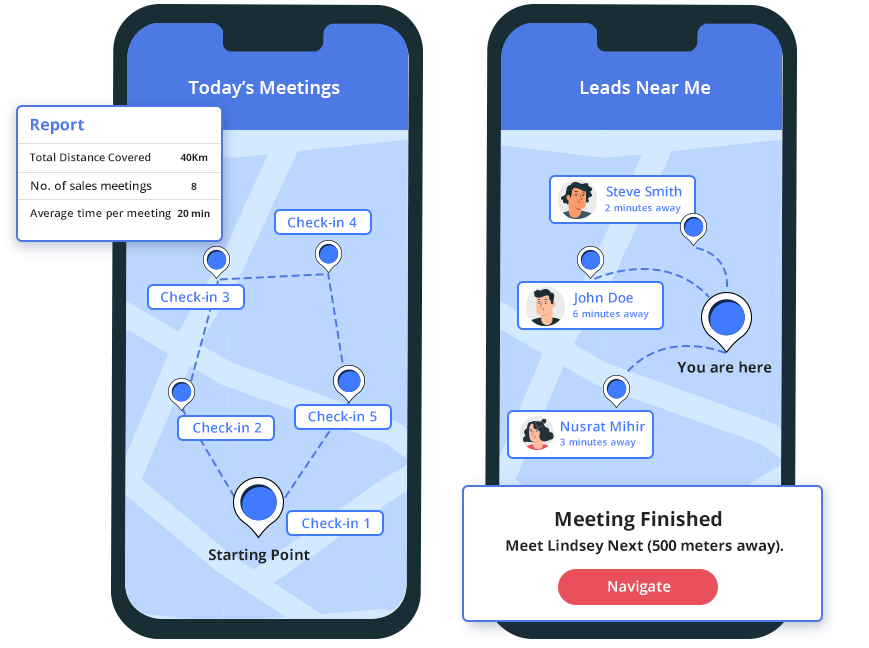

Empower your field sales teams with a mobile app built for banking sales.

Onboard customers faster with eKYC and video KYC add-ons for LeadSquared.

Allow your operations teams to define and modify sales workflows on the go.

Identify the right collection strategies, and enable faster collections.

Acquire, onboard, engage and retain

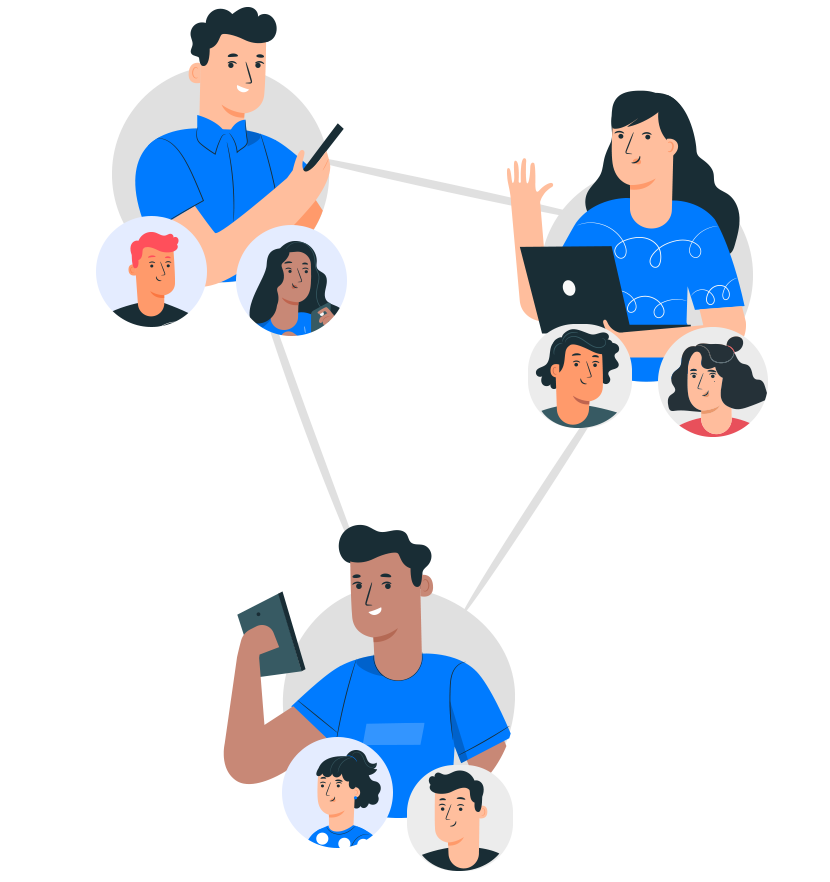

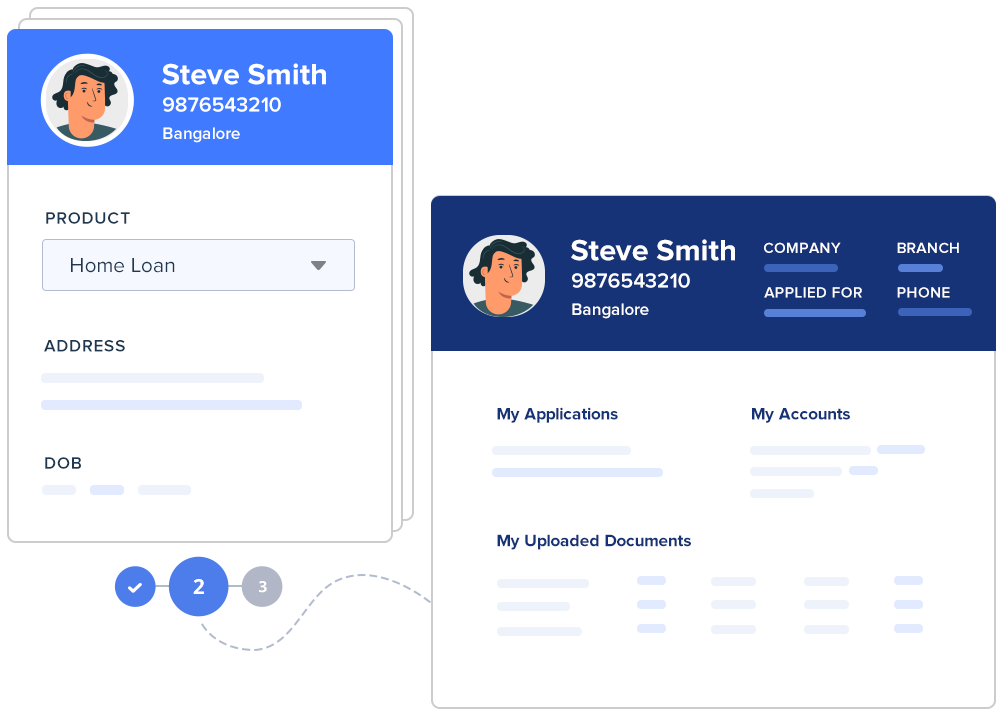

Ensure a smooth application experience for your banking prospects. Captures inquiries and applications with LeadSquared’s self-serve, mobile-friendly application interface (forms and portals) or integrate your own. Applications can be resumed anytime, thereby enhancing prospect experience, and saving your agents’ time.

Ensure faster and efficient customer onboarding. LeadSquared add-ons like eKYC verification solution and Video KYC helps banks eliminate lengthy verification processes, reduce costs & fight fraud. Help your onboarding agents (both on and off the field), KYC reviewers, and verification teams stay on the same page.

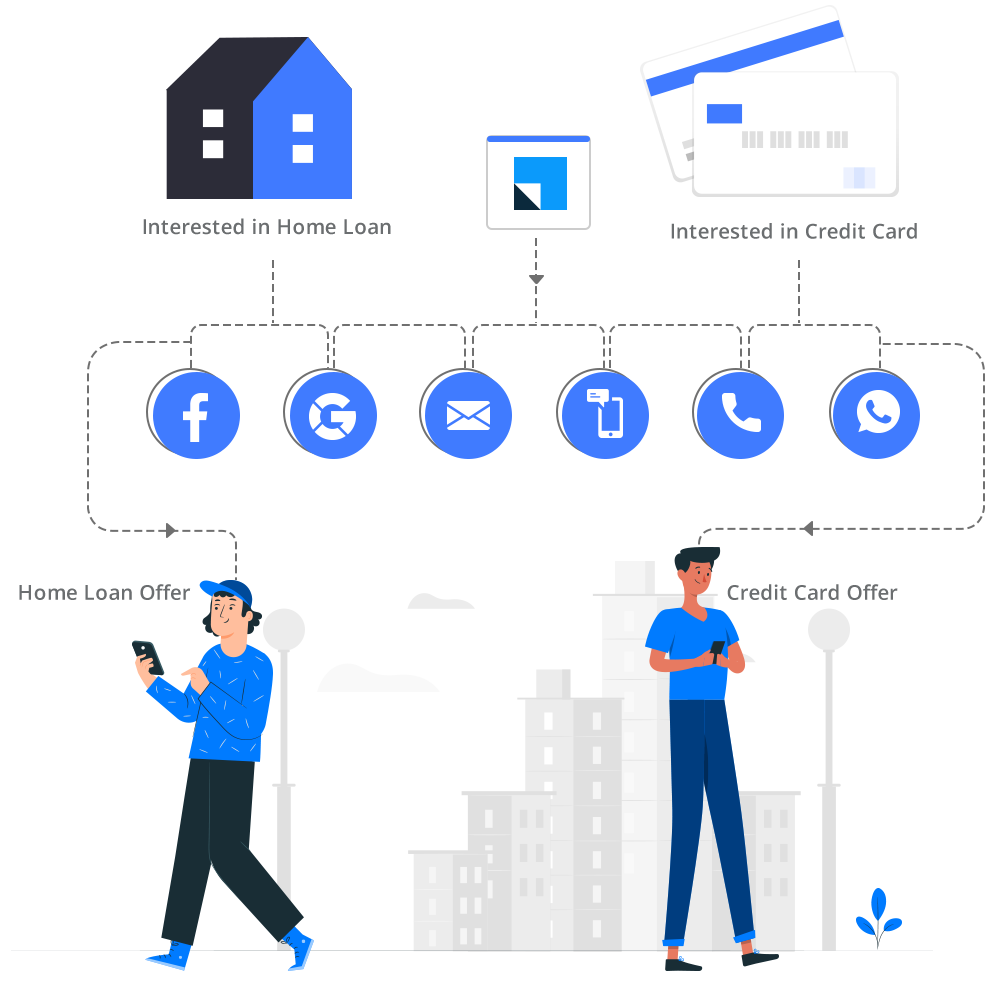

Run highly relevant campaigns to engage your prospects until they become customers and beyond. For instance, if a customer applied for a credit card, and has been unresponsive since you can send him offers and benefits around different credit cards via email, text messages, and remarketing campaigns. You can send transactional messages via WhatsApp as well.

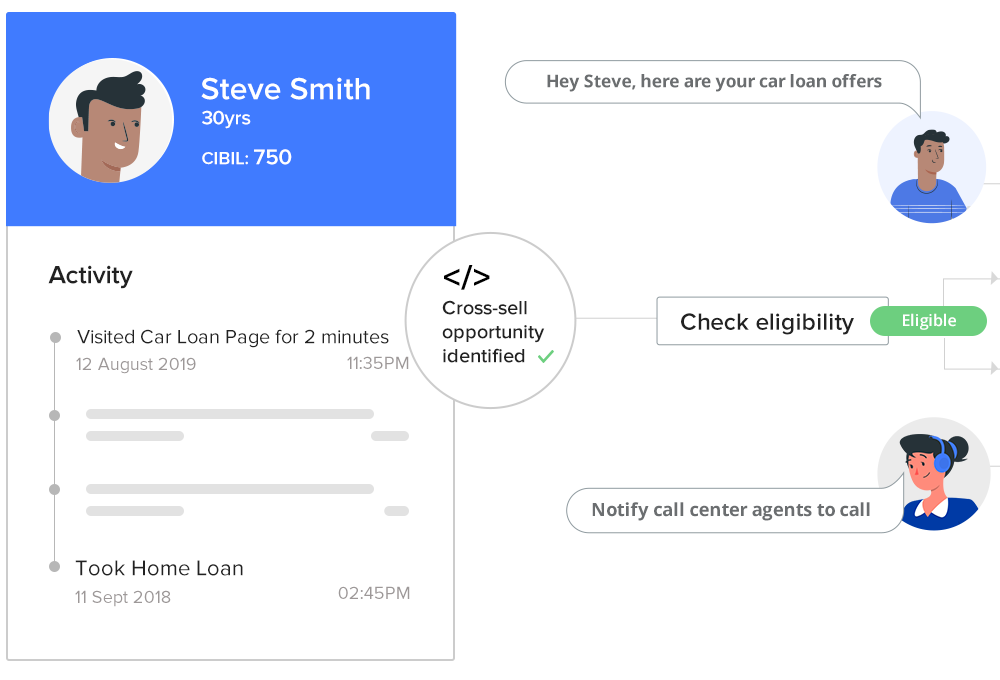

Provide all your sales teams – digital, call center, or field sales teams (relationship managers, verifications, collections, etc.) comprehensive details about their customers and prospects. They’ll always know the existing products, credit history, and cross-sell opportunities, to build better relationships and sell more.

Increase Customer Lifetime Value and retention rates by identifying and acting upon cross-sell opportunities. For example, a home loan customer with an excellent credit repayment history who visits the car loan page on your website can be offered a pre-approved vehicle loan.

Provide all your feet-on-street teams (relationship managers, verifications, collections etc.) comprehensive details about their customers and prospects. They’ll always know the existing products, credit history and cross-sell opportunities, to make build better relationships and sales.

Empower your teams to track and follow-up with defaulters efficiently, predict debt recovery, and enable faster collections. Complete borrower management, categorization, case prioritization, recovery prediction, and detailed borrower, team & collections analysis.

Customer profiles, agent performance, funnels and everything else

LeadSquared helps us manage our lending partnerships with banks & NBFCs, and our internal processes across the lending lifecycle (sales, credit, verification & operations) to disburse loans 30% faster than before. Our DSAs are 55% more efficient than before, and all their work is trackable.

The only banking CRM you need for sales and prospect engagement

(+1) 732-385-3546 (US)

080-47359453 (India Sales)

080-46801265 (India Support)

62-87750-350-446 (ID)