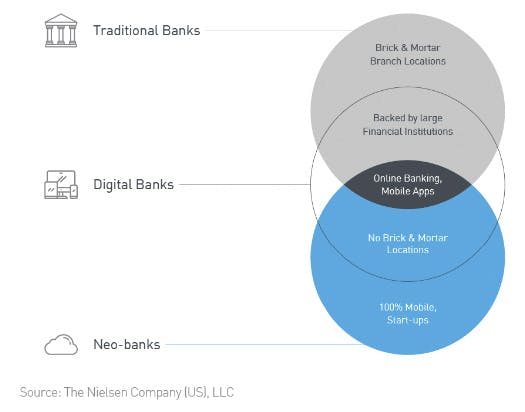

Neobanks are financial institutions that exist only online. Neobanks often offer minimal functionalities when compared to traditional banks. The minimalist approach of neobanks allows customers to enjoy the basic functionalities without the excess frills at lesser fees. Neobanks also provide better interest rates than traditional banks because of this approach.

There are 10 neobanks in India, and globally, there are over 250 live neobanks.

The neobanks in India raised USD 90 million in 2019. However, Indian neobanks are taking a less aggressive approach and are positioning their offering close to traditional banks. It is because RBI has not yet permitted banks that solely exist digitally. Therefore, most of them are now working in partnership with banks. In contrast, globally, neobanks are growing fast and are expected to generate 394.6 billion USD by 2026.

The USP

Neobanks provide banking services to the newer generation of tech-savvy consumers who are comfortable with digital payments. These customers often have a busy lifestyle and do not have the time to visit the branch to perform simple banking tasks. Neobanks allow users to manage their money via their smartphone app or their website.

By operating without physical bank branches and switching to the cloud, neobanks have drastically cut down on operational costs and provide banking services to more consumers. They are different from other financial institutions in many ways, such as:

- Neobanks are digital-only banks that provide technology-driven alternatives to services like current accounts, loans, credit cards, or trade finance.

- They also differ from credit unions in terms of customer base and operating principles.

- These are not chartered with the state or any government regulatory body as banks and are built from the ground up to provide better mobile and online experience.

- In many regions, they partner with traditional banks to insure customer deposits.

However, there are other features that make neobanks more appealing to the younger crowd. For instance, Coconut, a fast-growing neobank based in the UK, focuses on serving freelancers. They have specific features that allow easy accounting, invoicing, and tax management. Freelancers can directly use Coconut to generate invoices and ask for a payment from the app itself.

This type of deep specialization separates neobanks from traditional financial services. In fact, 31% of SMEs want value-added services like these from their banking partners – thus opening new partnership opportunities for neobanks.

Source: PwC

Neobank vs. traditional bank

In recent years, we have seen a massive change in the finance industry. Consumers started using digital payments more than ever. For instance, in India itself, over two thousand fintech players have begun their operations. People are now moving away from traditional banking systems and cash payments. Rising fintech in India has enabled platforms like Google Pay, PhonePe, Paytm, Samsung Pay, WhatsApp Pay, and more to thrive. This growth shows that neobanks have a massive potential user base. Traditional banks do not have the flexibility that these new-age digital banks provide. For example, Neat from Hong Kong provides a fully digital, AI-assisted onboarding, including a fully digital KYC process.

The following are the differences between a neobank and a traditional bank:

- Service platform: Traditional banks have a physical establishment, while neobanks operate entirely online.

- Client relation: Traditional banks have long-term client relations – often in-person and barely change with time. In neobanks, the client relations are short, virtual, and can easily change over time.

- Fee structure: Traditional banks have higher fees than neobanks. Since neobanks do not have to maintain physical branches and often offer a smaller set of services, their charges are also lower.

- Licensing: Traditional banks have full banking licenses. Neobanks may have such permits, but most newer banks have no or partial licenses. Therefore, they operate by partnering with traditional banks.

- Accessibility: Neobanks offer faster onboarding since their processes are entirely digitized. Traditional banks still depend on paperwork, which means they are often slower. One can access a neobank with any internet-connected device. In the case of a bank, customers may need to visit the bank branch for KYC and other transaction-related matters.

Source: The Nielsen Company (US), LLC

How does a neobank work?

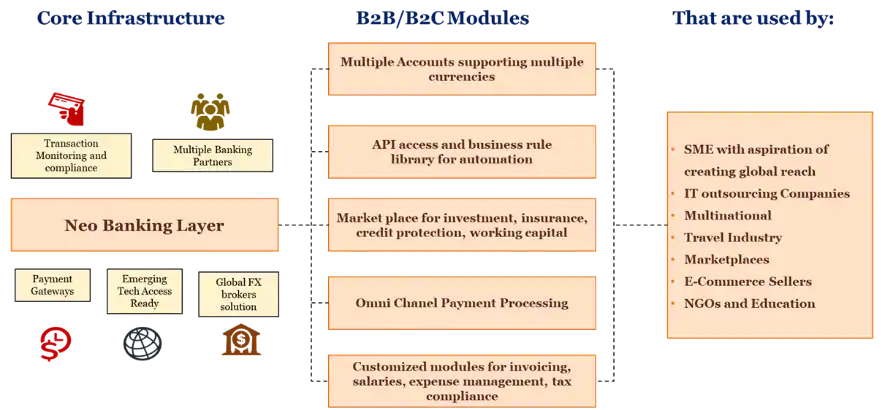

Neobanks work on the “Banking as a Service” model. Presently the neobank landscape is a combination of three entities:

- A non-licensed fintech that partners with a traditional bank. The fintech uses a wrapper around the products and services of the partner bank. The wrapper uses the branding of the fintech, along with their additional services.

- Traditional banks that have launched their digital-only initiative as neobanks.

- Licensed neobanks with digital banking licenses. It is possible only in countries that allow such stand-alone digital entities to exist.

While some neobanks have their license, most of them do not. That is why they have a bank as a partner. The bank provides them with a platform enabling core banking services. Often, these banks rely on legacy systems and have outdated digital infrastructures and services. Neobanks build a layer of digital products and services working on the top of the legacy systems. This layer makes banking services much more accessible, flexible, and scalable. Customers can access this layer using the app provided by the neobanks.

[Also read: latest digital banking trends]

What are the wins, and where do neobanks fall short?

The neobanks are still in their infancy. At this point, we do not know how the landscape will change. A lot of that depends on future government regulations. However, from what we have seen, the future of digital banking will also depend customer perceptions and experiences.

Convenience

One of the most important advantages is the ease to get started with a neobank. It is as easy as downloading the app and signing up for the service. The bank can use AI-assisted tools for online verification. Often, they use data from the partner banks for verification. These new-age digital banks have simplified customer onboarding to a great extent.

Since neobanks are completely app-based, they have leveraged payments using smartwatches and wearables. Many of them are already compatible with Google Pay, Samsung Pay, Garmin Pay, Apple Pay, and more.

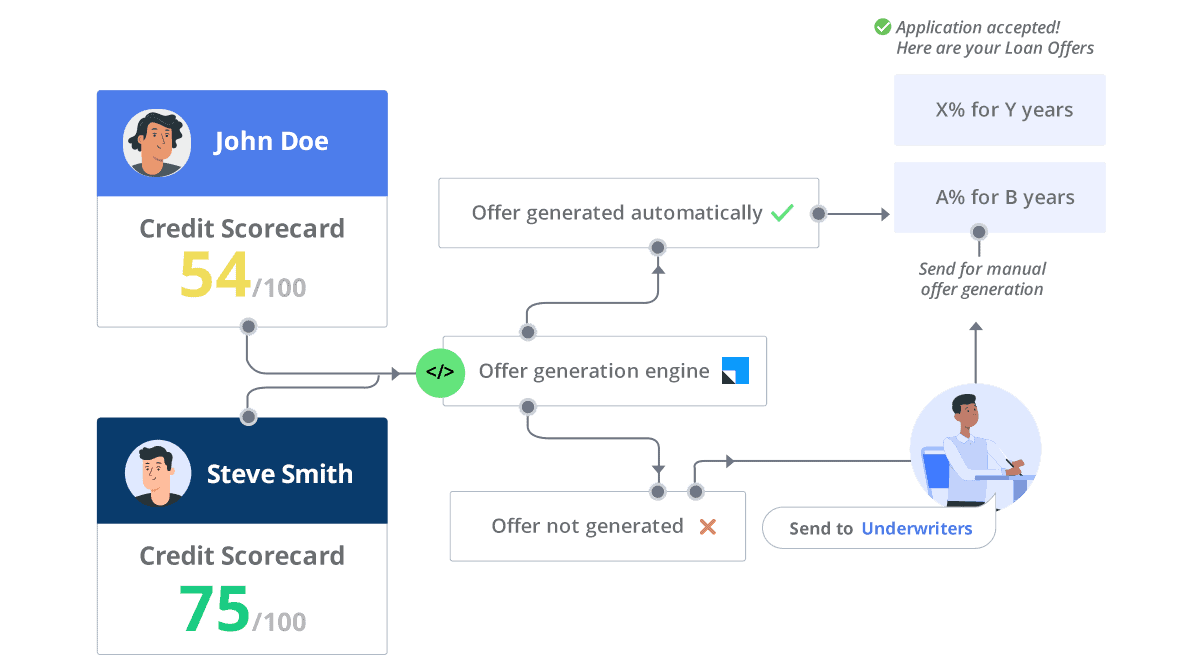

Quick loan processing

Setting up the account on a neobank is as simple as signing up on any website. Neobanks that provide loans do so with little or no paperwork. The rigid structure that is present in traditional banks is not there in neobanks. They can verify your credit score from numerous data sources and qualify you for a loan. You can see the amount and the interest rate within minutes.

Low costs

Often, banks charge you for debit card services, ATM services, text message alerts, and more. In neobanks, products are inexpensive, and there are often no monthly fees associated with opening an account.

Easy international payments

Debit cards from traditional banks have restrictions on international payments. For most banks, we must upgrade the debit card or request the bank to enable international payments. Also, getting an international debit card from a traditional bank can be quite a hassle. However, you do not have to worry about that when you have an account with a neobank. You can easily make transactions when you are abroad or use a debit card to purchase things in a different currency when shopping online. Also, a lot of neobanks have no international purchase fees. They allow you to hold an account with multiple currencies.

Excellent user experience

Neobanks replace glitchy internet banking websites with modern apps. These apps are fluid, clean, and responsive. Also, these FinTech apps provide familiar internet user experiences to their customers – making it extremely easy to bank with them.

Neobanks allow you to make instant transactions. Moreover, you can see all your account and transaction-related details on your app. Some banks take it a step further and show you how you are spending money. You can even set up savings goals that will allow you to manage your finances better. The user can also personalize the app according to their needs, which is not entirely possible with traditional banking apps.

Requires technical skills (not meant for non-tech-savvy users)

The app-only service also makes it one of the cons of Neobanks. To access their services, customers have to have a smartphone and a stable internet connection. Also, it often alienates older people who are not familiar with the technology. Furthermore, it becomes difficult to use in the internet deserts.

Less regulated than traditional banks

As neobanks are still not considered as banks, you do not have a legal or well-defined process to follow if you encounter any issues. Issues can be technical errors, where your amount gets debited in a transaction, but the other party does not receive the payment. There can also be frauds – resolution of which might not be easy.

No physical branches

The general customer perception is to visit a bank branch for complex transactions. People still want to ask in-person questions, get financial assurance, which is, so far, difficult at neobanks.

Watch the webinar on Digitizing Banking:

The path to growth and profitability

Along with fast-paced customer acquisition, neobanks are devising strategies towards profitability as well. In fact, larger neobanks are now focusing on enhancing underlying unit economics. It may even involve revising their fee structure. For example, Monzo recently launched a premium account for its customers at £15 per month.

The following are the key factors that can lead to profitability.

Revising unit economics:

Unit economics consists of two components: customer acquisition cost and CLV (customer lifetime value, i.e., the revenue generated over the lifetime of the customer).

In the past, customer acquisition was not an issue for them as people dissatisfied with their banking services were open to trying neobanks. Now that banks are also digitizing their operations, neobanks must strengthen their customer acquisition and retention strategies. A simple solution is to invest in technology such as opportunity management CRM.

Influencing customers to use neobanks as their primary bank accounts:

The bitter truth is most customers are not using neobanks as their primary bank account. Such accounts are valuable for banks because they are likely to generate higher payment volumes and more transactions. Moreover, customers deposit more funds in their primary bank accounts. Therefore, neobanks must focus on building trust and influencing customers to use their services more often.

One way to go about it is to broaden the scope of their apps and features to make their offerings appealing enough to replace banking apps. And then a well-crafted fintech marketing strategy illustrating those offerings can go a long way.

Redefining fee structure:

At the core, neobanks have to be operationally efficient to provide better services to customers at lower prices. However, as of date, the average neobank loses $11 per user. Thus, there is a need to think of sustainable business models tying with customer acquisition & retention strategies.

Freemium pricing strategies, multitiered subscriptions, and targeting niche demographics are the strategies that leading neobanks across the world are employing to drive profits.

Final thoughts

The wave of digitization is here to stay. In a post-pandemic world, traditional banks are expected to invest more in enabling technologies. AI, IoT, and solutions for customer-facing operations (e.g., CRM software) will be on the rise. The financial service sector will look forward to virtual call centers, online account opening procedures, loan automation, and automated/chat-based customer support. Neobanks, with their tech-expertise, have an opportunity to function as a digital front-end to the core banking solutions.

If you are looking for a digital solution to streamline and automate your banking process, check out LeadSquared Banking CRM.

Further reading: