Your strategies for mortgage lead generation will get a boost if you understand the home-buyers behavior. Download the “Decoding the home buyer’s journey” e-book to make smart marketing moves at every stage of the buyer lifecycle.

Last week, Bob got a hefty raise. Now, he can afford a better living and own an apartment. Alongside finding the best property, he also started looking for mortgage options.

While searching for a mortgage online, he came across some 57 lenders across the United States. He is facing a tough time figuring out whether Navy Federal Credit Union is better or the Guild Mortgage, or other lenders.

He decided to read all mortgage company reviews. But at the same time, he felt that it would be better if he could talk to the mortgage lenders directly.

So, this is Bob’s side of the story.

On the other hand, lenders are also looking for leads like Bob to grow their business. Lenders resort to buying leads from agencies, but not all contacts are active leads. Out of several inquiries, only a few qualify as a lead. Mortgage companies will not know that Bob got a raise, but they can track that Bob is looking for a property.

Bob and the lenders are on the same side of the mortgage deal. Not only is Bob finding a mortgage, but lenders are also finding customers. To solve the equation, mortgage companies need to formulate a strategy to generate leads like Bob and at the same time help Bob find them.

Bob + Mortgage = Property sold!

In this article, we will discuss mortgage lead generation techniques to help you find qualified leads.

Find and Follow Your Leads

Wherever there is a crowd of people, there is a chance to sell a product. But the crowd may be of different groups of people with distinct interests. Therefore, you must choose your flock wisely.

For example, if you sell bread near a church, hardly anyone will buy from you. But, if you wait outside an office premise during lunchtime, you would be able to sell more loaves of bread.

The point is – you need to identify who wants your product and where such people are.

So how will you find people who need a mortgage? Let us resolve this for you.

1. Mortgage Lead Generation at the Source

Think about the home buyer journey.

When a buyer wants to purchase a property, he/she looks for properties for sale on the internet. The National Association of REALTORS® identifies that 44% of buyers look for properties online first.

The common places to search properties online include – Zillow, Realtor.com, Redfin, Century 21 Real Estate, Craigslist, HomeFinder, to name some.

At this moment, the mortgage might not be in the mind of the prospect, but he will eventually need it. Thus, you can start engaging with the prospects – right from the time they wish to “buy a property.”

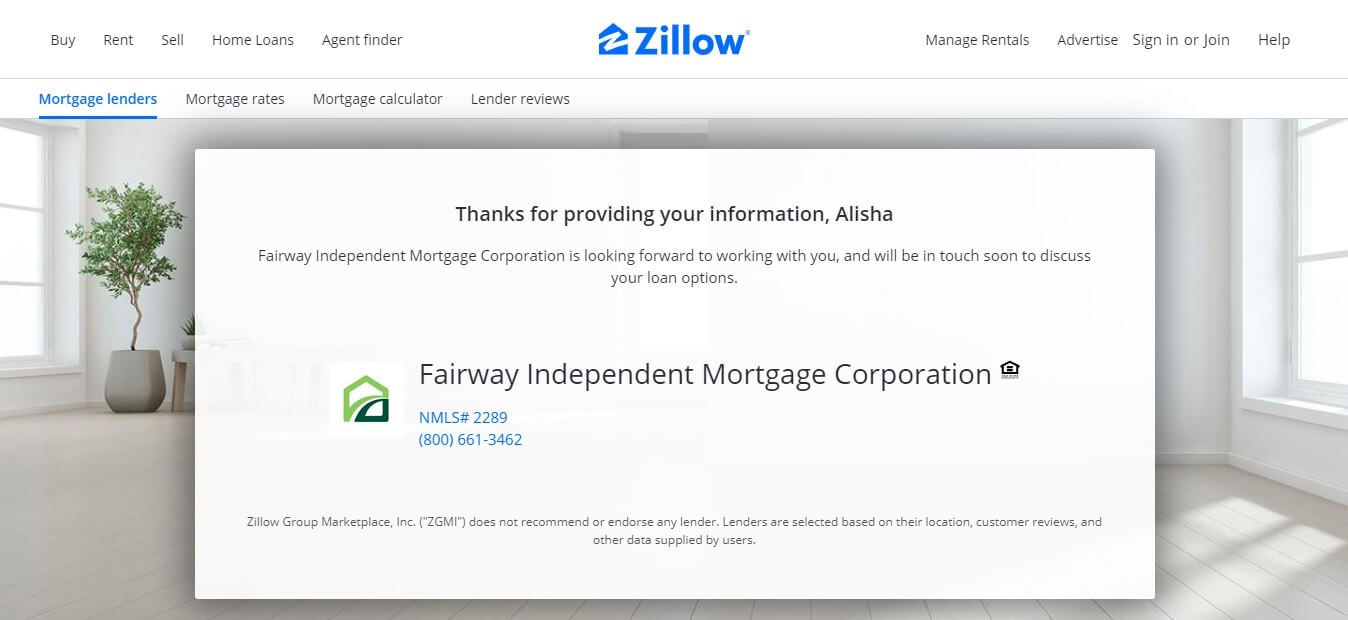

The simplest way to engage with prospects at this stage is through advertising on the property listing sites. If advertising is not an option, then you can partner with the real estate listing sites and get yourself listed. But do not miss this opportunity. For instance, while browsing properties in California, Bob found his dream house. But the price was more than his budget. It occurred to him to look for mortgage options. And voila, he was able to find you at the very initial stage of his home buying journey because you were listed there.

Download the Home Buyer’s Journey e-book.

2. Partner with Real-estate Builders

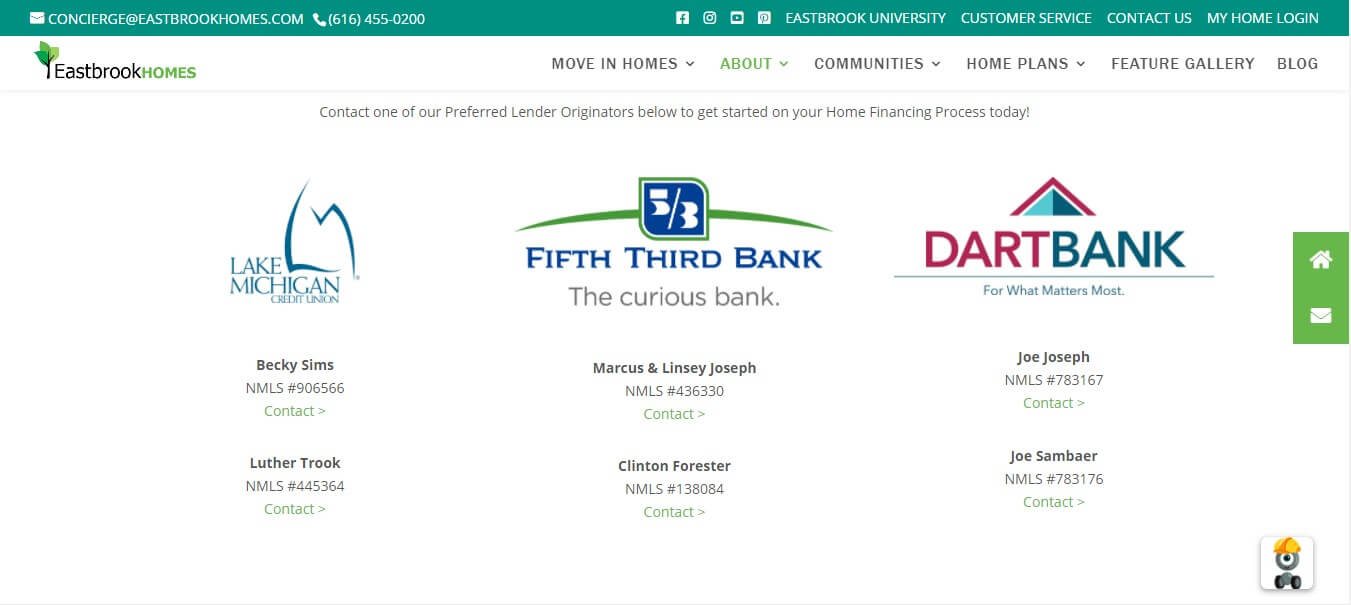

Last year, 31% of home buyers said that securing a mortgage is difficult (NAR survey). To address this, builders facilitated loan options on their websites. Either they recommend their subsidiary mortgage lender, or they partner with other lenders to simplify their buyer’s journey.

You can partner with real-estate builders to help a buyer find you as well as move a step further in your exclusive mortgage lead generation strategy. In the following image, Eastbrook Homes has listed its partner mortgage loan originators on its website.

Mortgage Lead Generation through Ads

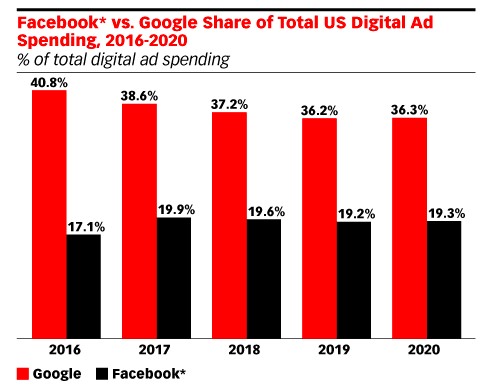

Considering Bob’s home buying journey – unless you advertise, Bob will not know that you exist and the fact that you can help him in buying his dream home. Therefore, you need to advertise on the platforms where Bob is mostly active. Advertisement is one of the most effective marketing strategies for immediate ROI. Digital platforms like Google and Facebook allow targeted advertisements so that your ads show up only to the relevant people. There are more channels for digital ads like LinkedIn, Bing Ads, etc. But, Google and Facebook hold the largest share of the US digital ad spend (Google:38.6% and Facebook: 19.9%).

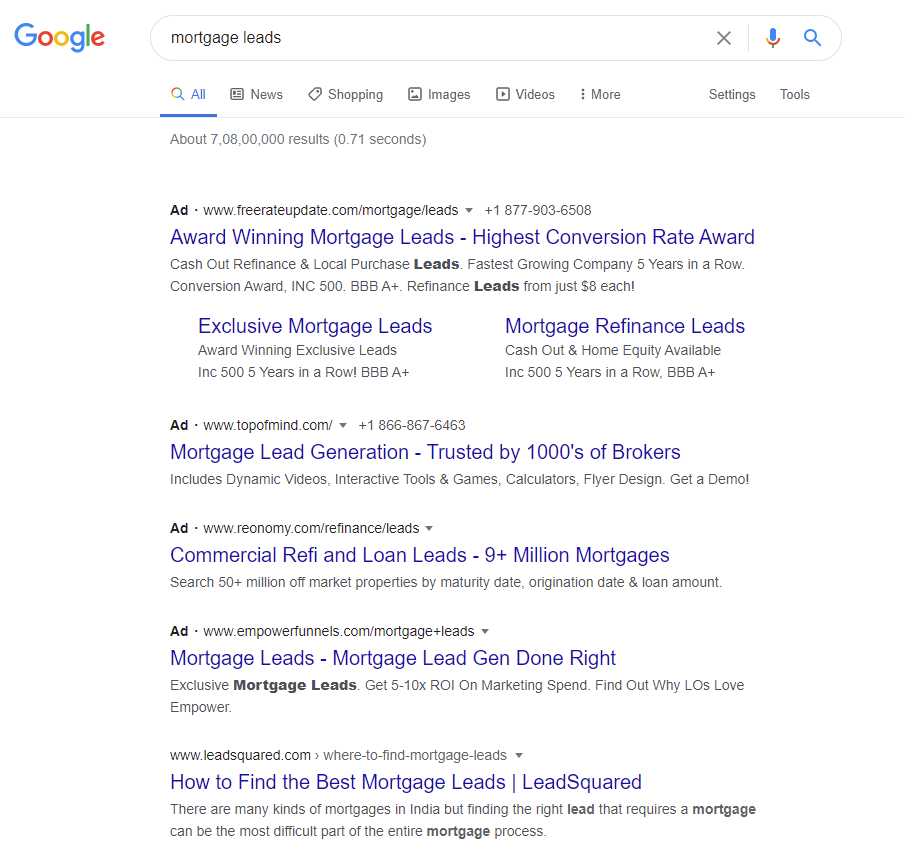

1. Google Ads

Google ads is the most popular digital advertising medium. You can target people based on their browsing history, location, age, gender, affinity, in-market preferences (what they are searching for), and more. The types of mortgage lead generation ad campaigns you can create on Google include:

- Search Ads: These ads appear on Google Search Engine whenever a prospect types in a relevant query. Search ads are only text-based.

- Display Ads: These ads appear on third-party websites. You can manually select the websites to show your ads or let Google do it for you. In the Display ads, you can use images and videos.

- YouTube Ads: These ads appear on YouTube – one of the most popular videos streaming channels. Google reports that YouTube advertisement is 84% more likely to receive viewer’s attention than TV ads.

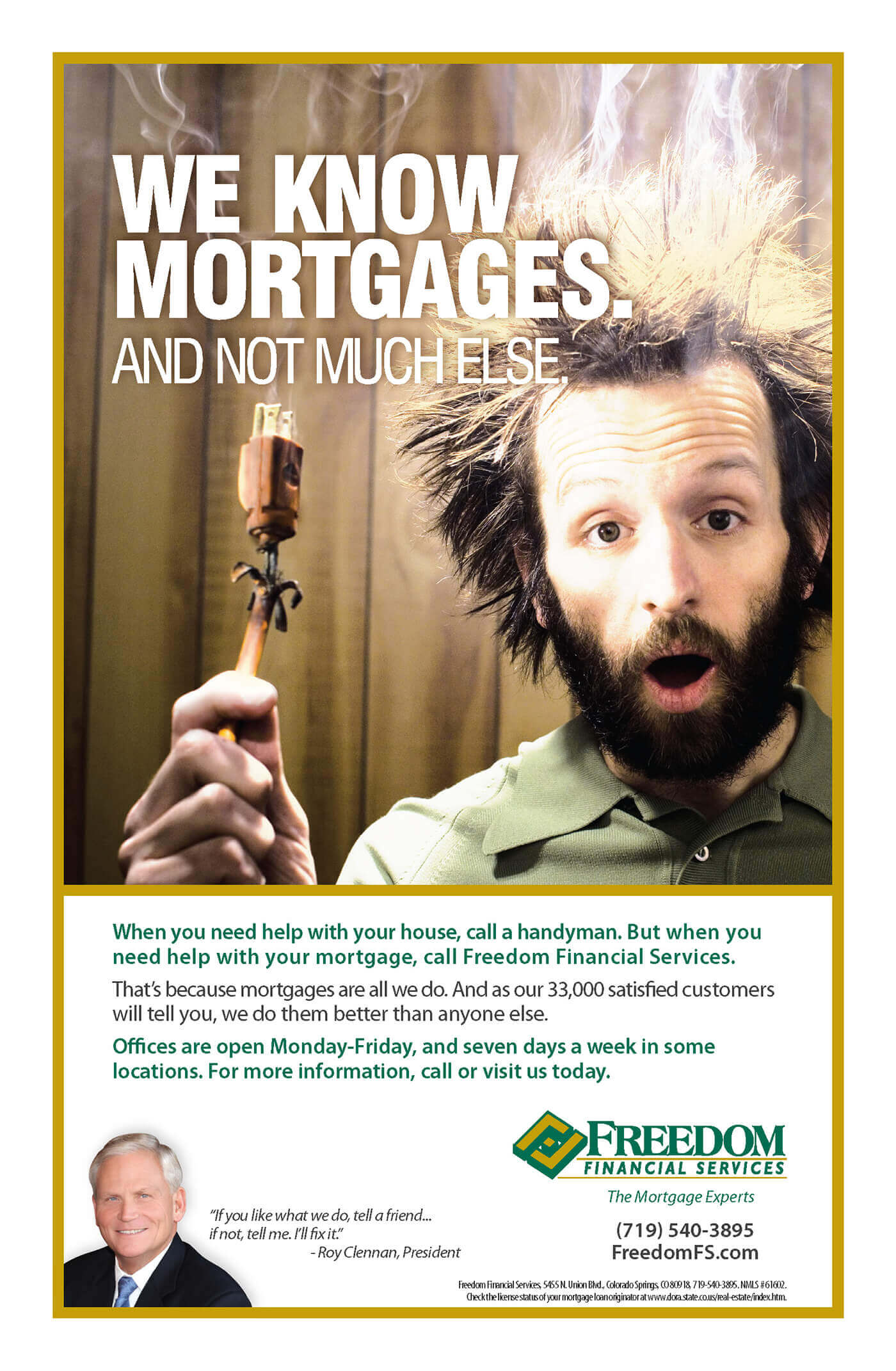

In the following gallery, you can see the best mortgage ads examples.

Also read:

- Google Ads basics

- 7 Benefits of Google Ads to grow your business online

- 10 PPC metrics you should monitor

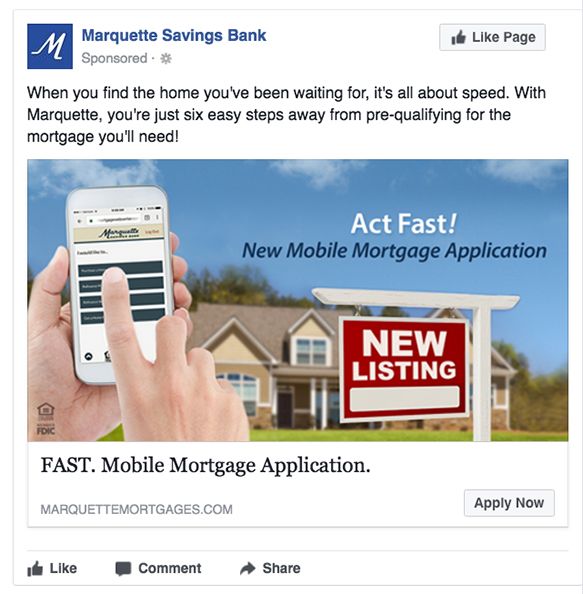

2. Facebook Ads

Facebook is the second most popular medium for digital advertising. You can target ads to people based on their interests, engagement history, job titles, location, age, gender, and more. In a recent HubSpot study, 64% of consumers say that watching a video on Facebook influenced their purchase decision.

Although Facebook provides a number of ad formats like text, image, video, etc. carousel ads are best for property and mortgage businesses. To start creating digital ads on Facebook, you can refer to the following guides:

- Facebook ad types for lead generation

- How to use Facebook ad formats and placements?

- Facebook remarketing guide

- The advertiser’s manual for Facebook leads ads

While we discuss digital ads, it does not mean that offline ads are dead. Digital advertising is, of course, the least expensive, but offline display ads at property sites, newspapers, open houses, etc. are also beneficial for lead generation.

3. Offline Mortgage Lead Generation

Let’s look at where Bob is in his pursuit to buy a house.

Bob has done a lot of research and has shortlisted a few properties. He has decided to attend an open house and visit some of the villas. After all, buying a home is a lifetime event, and he wants to make sure that he is making the best deal.

In one of the properties, he found a standee of a mortgage lender. What timing! Bob has almost finalized the property and was about to explore lenders in the area. To Bob, this ad seems relevant and develops a perception that the lender must have tie-ups with the builder and could offer the best rates.

Advertising at this stage is also crucial because the leads generated here are at the final stages of their buying journey. They have a higher chance of a conversion.

Pro tip: If you want to sync lead generation through online and offline channels and nurture them efficiently, you should try mortgage CRM.

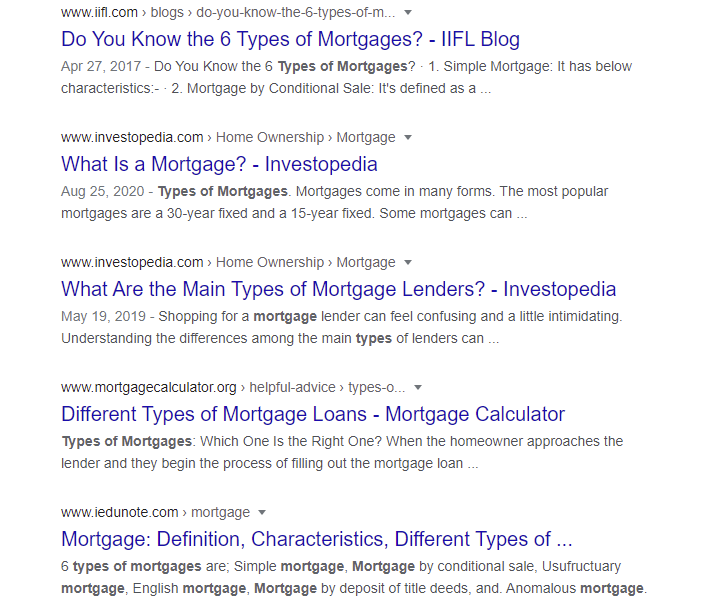

Mortgage Lead Generation through Content

While advertisements can give you immediate ROI, comprehensive content will help you educate borrowers and establish your brand authority. Even during the initial phases of the buying journey, prospects will look for information like “types of mortgage,”“banks near Mammoth Lakes,”“mortgage best practices,” or “property buying guide,”to name some. If you help buyers with information relevant to their interests and your business, it will create an impression in their minds. Moreover, if the prospects find your content informative (through your website, blog posts, endorsements, etc.), they will certainly trust you.

You can leverage the following forms of content for lead generation:

- Explain your offerings: Give detailed and updated information about your offerings on your website.

- Publish articles on news/information websites: To establish brand authority, publish articles like “Top 10 mortgage lenders in the USA” in PR and News sites.

- List open houses on events sites: It will help you reach out to the audience who are interested in similar events.

- Informative blog posts: Give your content better visibility through search engine optimization. You can create your own blog or, you can also use blog publishing platforms like Medium, Substack, etc.

Apart from the above techniques, there is another way to generate qualified mortgage leads. You can list your offerings on your website and make them searchable. Embedding plugins like mortgage payment calculators, google maps, direct phone calls, chatbots, etc. can also help in engaging with the prospects. You can also track these activities in mortgage CRM and filter leads accordingly.

Pro tip: Make sure your call to action is always visible to the prospect. Whether it’s a discount offer or a “call now” button, ensure that people can see it before leaving your website.

Closing remarks

Now that you are well-versed with mortgage lead generation techniques, it’s time to think about how you will nurture them. In my opinion, you should try CRM (Customer Relationship Management) software to organize leads from all sources into a single place and follow up with them. Many companies offer a free trial on their CRM to ensure it fits your requirement. One of the best CRMs for lead management and nurturing is LeadSquared CRM custom-built for the mortgage industry.

Related articles:

- Where to find the best mortgage leads?

- Mortgage CRM that Loan Officers can trust

- What is a lead?

- Difference between lead, contact, and opportunity

Mortgage Leads FAQs

You can generate mortgage leads through advertisements (print and digital), open houses, listings on real estate/property sites, content marketing, and Search Engine Optimization.

When somebody applies for a loan mortgage, the loan officer draws your information from national credit bureaus. These bureaus prompt competing lenders about the fact that you are shopping for a mortgage. Leads acquired through this process are known as mortgage trigger leads.

In the mortgage industry, a lead generation process is an act of finding prospects who are interested in buying real estate and looking for financing options. It involves marketing and sales activities to find qualified leads through both – offline and online channels.

You can find commercial mortgage leads through digital marketing, content marketing, and by searching public mortgage records.