What’s one word that you feel has increased in importance over the past few years?

My answer to this question is the word “subscribe.”

Don’t we see ads about subscribing to channels, services, and products now more than ever?

We do.

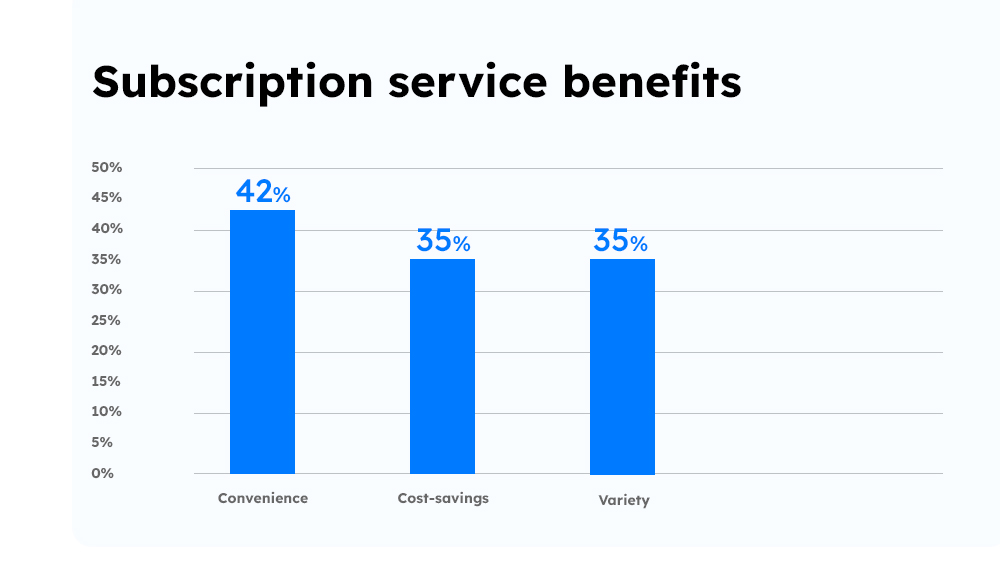

In fact, Subscription Economy Index (SEI) released by Zuora found that 78% of international adults currently have subscription services. And if you ask why—convenience, cost savings, and variety are the reasons.

Businesses that provide their services on a subscription basis are also increasing. For example, in the United States alone, there are more than 15,000 SaaS companies.

But how do you measure the success of subscription-based business model?

Well, it’s through MRR, or Monthly Recurring Revenue.

Let’s learn more about MRR.

Table of contents

What is MRR?

MRR is an acronym for monthly recurring revenue. It’s a standardized measure of a company’s consistent monthly income. We define MRR as the monthly recurring income for a subscription-based business model.

For example, imagine a customer subscribes to Spotify’s premium plan for a month. After the month, they can choose to extend or terminate the subscription. So, Spotify, ideally, should calculate MRR to gauge its revenue each month.

Note that MRR and revenue are not the same. Although, the bottom line for businesses is the same, there’s a significant difference between MRR and revenue. Let’s look at them.

| MRR | Revenue | |

| Definition | MRR is expected monthly earnings from buyers. | Revenue is a measure of your earnings after selling goods or services. |

| Goal | Track performance of your subscription business | Generate income statements and financial reporting for the company |

| Payments | Monthly; recurring for the subscription duration | One-time; based on the number of products sold |

| Examples of businesses | SaaS, entertainment, EdTech | e-commerce, retail |

As simple as that sounds, measuring MRR can be pretty challenging. Businesses make mistakes like including yearly estimated values in semi-annual subscriptions. And for that matter, excluding discounts and trial period.

To avoid such mistakes, let’s look at the precise formula to calculate MRR.

How to Calculate MRR

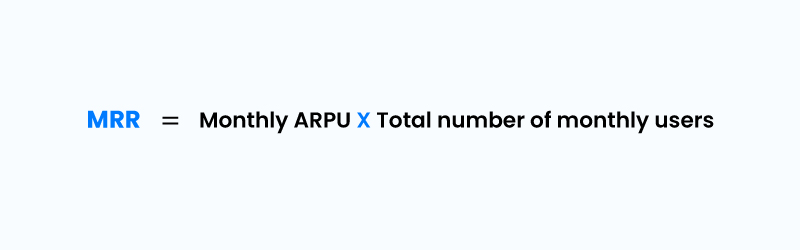

The precise formula to calculate MRR is:

MRR = Monthly ARPU X Total number of monthly users

Where, ARPU is the average revenue per user

Let me give you an example.

Imagine you have gained 300 subscribers in July, and the ARPU is $100. So, your MRR would be: 100*300 = $30,000.

Here’s an online MRR calculator. You can try it out yourself:

Online MRR Calculator

Enter Monthly ARPU ($):

Enter Total number of monthly users:

Your MRR is: $

To calculate ARPU, all you need to do is calculate the average subscription amount of the customers you acquired in a given month.

For example, let’s say you acquired 5 customers with the following MRR values.

Customer A = $10

Customer B = $20

Customer C = $30

Customer D = $40

Customer E = $50

So, your ARPU will be: $(10+20+20+10+20)/5 = $30

And the MRR will be: $30*5 = $150

Calculating MRR may look simple on the surface. But you might want to consider certain variables to make the MRR estimation as accurate as possible. Let’s look at the aspects that create discrepancies in MRR calculation.

5 Common Mistakes to Avoid while Calculating MRR

1) Overestimating your revenue

Businesses tend to include yearly or semi-annual subscriptions when someone subscribes. But this can cause major errors when calculating your monthly recurring revenue.

For example, you receive $1200 for a 12-month plan in June. The MRR should be $100 for June, not $1200. Before adding the entire value, divide it by the number of months to accurately calculate your MRR.

2) Considering one-time transaction

Imagine you’ve collaborated with another firm and collected a one-time payment of 100 dollars. This is excellent news; your bottom line will appreciate it, and your cash flow will benefit. This one-time transaction, however, should not be in your MRR. Singular purchases and payments aren’t considered “recurring.”

As a result, they don’t fit in the Monthly “Recurring” Revenue category. This is because you don’t anticipate receiving this income regularly. Including them in any MRR calculations will overstate your revenue forecasts and affect your payment model.

3) Including bookings and trials

A rookie mistake is to add your users on a trial period to your MRR calculations. Sure, most of us love to see someone subscribing to try your product. But, this does not make them recurring customers.

In general, we can’t add free-trial users to the MRR because they aren’t customers yet. And most of us can agree that there’s a solid chance they won’t convert either. So, it’s best to leave them out of your MRR numbers.

Similarly, if they convert, discount the duration of free-trial from the actual subscription duration.

Bookings, too, are a long-term commitment, similar to annual subscriptions. We can’t include the entire amount as there’s no guarantee of payment. The contracts will offer proof of agreeing to pay, but they don’t cover delinquencies.

4) Excluding Discounts and Offers

So far, we’ve covered some aspects we should not include when calculating MRR. In contrast, you must include discounted rates when calculating MRR. When users buy with a discount, including the full amount in MRR will inflate revenue.

For example, you offer a discount of $100 on a product that typically costs $350 per month. The MRR for that subscriber will be $250, not $350. You must subtract the discounted amount from the product’s original price.

5) Including delinquencies

On one side, forecasters overestimate their revenues by including ARR or one-time subscriptions. At the opposite end of this spectrum are forecasters who count in delinquencies.

Accuracy is of the utmost importance when calculating MRR. But, delinquencies should fall under a category of their own. Rather than subtracting delinquent fees, create a separate segment for it.

You must include subscription-related or recurring fees in your MRR. Transaction costs, like late charges, should be separated into their subcategory. Similarly, you must segment transaction fees and track them as an expense.

Once you put them in a separate category, you can calculate how much you earn later.

These are the common errors businesses tend to make when calculating MRR. But calculating MRR doesn’t end with knowing how to do it accurately. MRR differs depending on the plans you offer and the nature of the product.

We can typically calculate MRR using different formulas. The method will differ depending on which solution your company chooses. This brings us to the next section, where we’ll explore the different types of MRR.

Types of Monthly Recurring Revenue

MRR builds a link between the accounts and the users. As a result, their subscription behavior may be better understood. A rise in MRR shows that customer retention, plan renewals, or both have increased. On the other hand, downgrades and churn indicate a decrease in MRR.

So, you need to track the many factors that influence MRR separately. This is because we need to determine the particular reasons for its growth and decline.

Each type of MRR calculation provides unique insights into:

- Revenue

- Consumer behavior

- The health of your organization

Let’s get right into the different types of Monthly Recurring Revenue.

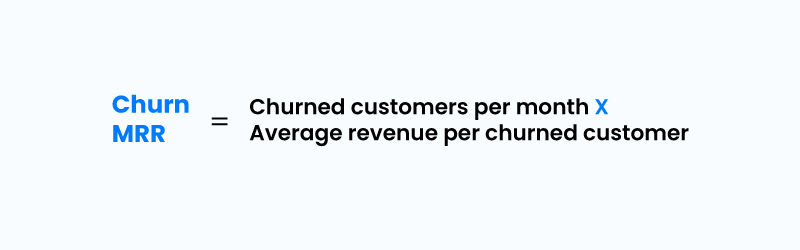

1) Churn MRR

The money your firm loses due to subscription cancels over a given month is Churn MRR. Churn puts your Monthly Recurring Revenue at risk by causing you to lose users and money. This generally takes place through cancellations and late fees.

If you track your churn Rate each month, your team will be able to:

- Produce a better product

- Sell it more efficiently

- Generate momentum through compounding growth

The accurate formula for Churn MRR is:

Churn MRR = Churned customers in one month x Revenue they usually generate.

For example, suppose you had five customers who paid $1000 each month. If three of them quit their subscriptions within the same month, your monthly churn MRR is $3,000.

2) Expansion MRR

Expansion MRR refers to the additional revenue generated by existing customers. Customers in the subscription sector produce more revenue when one of the following activities occur:

- Cross-sell: It refers to additional services or products your company offers with its core solution.

- Upsell: It happens when customers upgrade from a free to a paid plan. It could also refer to switching from a cheaper to a more expensive plan.

- Reactivating the older plan: When a customer decides to reactivate a canceled subscription.

- Add-ons: When a customer purchases add-ons, especially recurring ones.

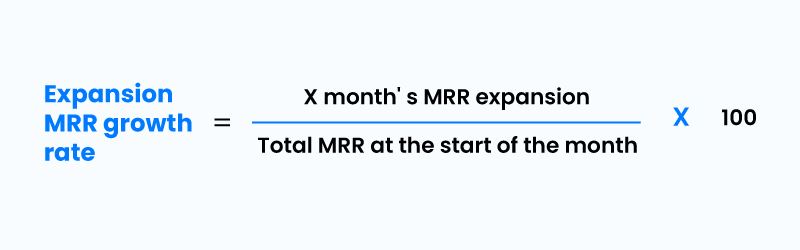

You can calculate the expansion MRR growth rate as follows:

Expansion MRR growth rate = X month’s MRR expansion / MRR total at the start of the month x 100

High Expansion MRR suggests that you were able to keep your clients by impressing and engaging them. This is beneficial to your bottom line because these sales to current clients have no Customer Acquisition Cost (CAC).

3) New MRR

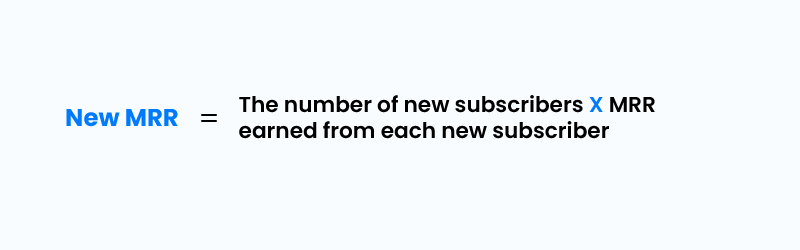

The sum of MRR earned from new clients is what we call new MRR. Monthly recurring revenue is the sum of regular revenue generated by your company every month. We need to find the MRR from new clients obtained during that month. You’ll need to know the following while calculating the new MRR:

- The total number of new clients gained for that month, and

- How much recurring revenue does each one of those clients produce every month?

The formula for New MRR is as follows:

New MRR = The number of new subscribers X MRR earned from each new subscriber.

If you get 7 new customers and your monthly plan is $100, New MRR will be $700.

It is also crucial to include customers who aren’t on a monthly subscription. In such situation, divide the total annual fees by 12 to find your monthly pricing.

New MRR is also a tool that helps entrepreneurs better comprehend Net New MRR. We’ll get into this metric in the next section.

4) Net New MRR

The total new MRR for the month is Net New MRR. New and expansion consumers minus churn gives us Net New MRR. Net New MRR shows how much your revenue is increasing or decreasing. It is helpful when comparing the current month’s MRR to the previous month’s MRR.

Use this formula to compute Net New MRR:

Net New MRR= New MRR + Expansion MRR – Churned MRR.

When your Net New MRR is negative, it shows that you lost money. You lose money when your churn is higher than the sum of your New and Expansion MRR.

In contrast, if your Net New MRR is positive, it means you’ve gained revenue. It shows that your churn is lower than the sum of New and Expansion MRR.

For example:

Your New MRR is $650, and your Expansion MRR is $350. Your Churned MRR amounts to $200, and your Net New MRR will be $650 + $350 – $200 = $800. This is a positive Net New MRR as the churn is lower than the Expansion and New MRR.

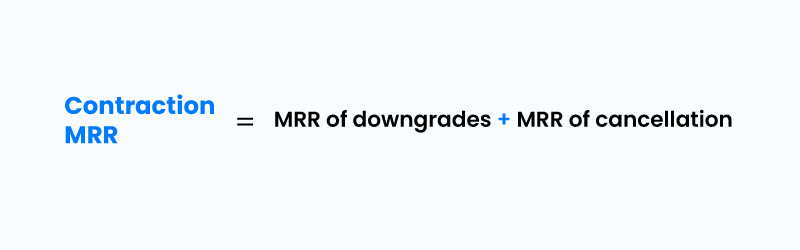

5) Contraction MRR

Contraction MRR refers to the reduction in your current MRR compared to the last month. Your MRR tends to reduce or contract when:

- A consumer drops a subscription and ceases paying for the product

- A customer switches from their current plan to a cheaper one

- A new client receives a sizeable discount

- A client discards or removes any add-ons

It considers both downgrade MRR and churns when used for forecasting growth. The formula for Contraction MRR is as follows:

MRR of contraction = MRR of downgrades + MRR of cancellation

Contraction MRR can assist you figure out how successfully your company keeps consumers. It also tells you how well your service scales with the growth of your clients.

These were some of the different kinds of MRR, and each is significant to subscription businesses. Now let’s get into how we can grow MRR.

5 Quick Tips on Increasing MRR

- Upsell, cross-sell, and promote add-ons wherever possible. MRR can grow substantially when you offer these options to your clients.

- If buyers primarily shop online, show notifications of other buyers’ purchases. For example, if you sell perfumes, notify people browsing your website when someone makes a purchase. Doing this offers social proof to browsers and pushes them to buy.

- Concentrate on increasing lead generation and distribution. Lead generation is the key to increasing MRR. Your sales reps can use LinkedIn Sales Navigator or LeadFeeder to find more leads.

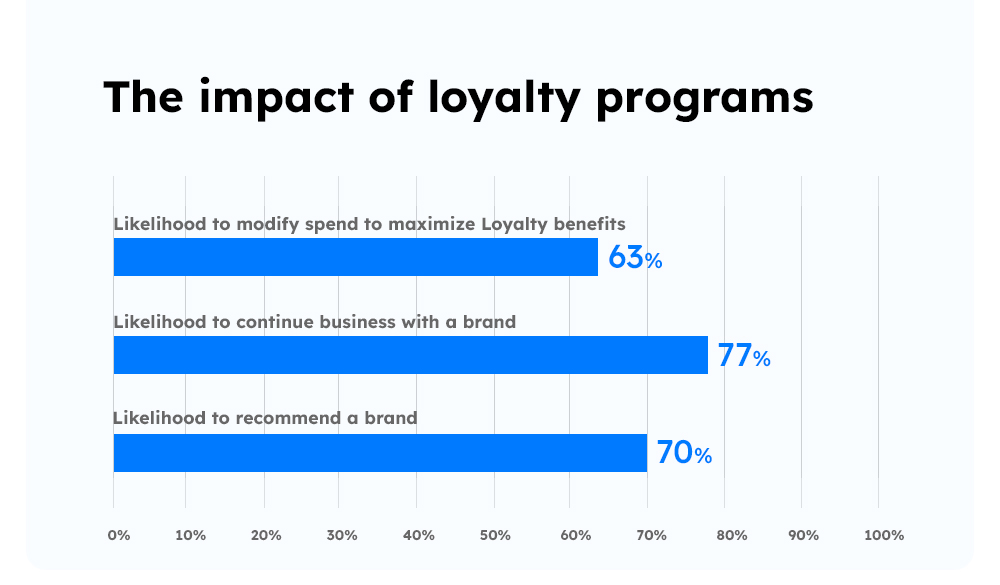

- Create loyalty plans to reduce churn and increase retention. A study by Bond and Visa reveals that loyalty programs heavily influence customer advocacy, retention, and spending.

- Try your hand at providing prepaid annual subscriptions. There’s a high chance that new customers will decline this alternative. But existing customers who are happy with your product are likely to sign up for this offer.

In Conclusion

The right metrics can inform you how well your company is doing and help you expand. Monthly recurring revenue offers valuable insights to businesses using a subscription model.

One of the most important things to remember is that MRR is a momentum-based metric. It keeps you informed about your current and future financial position.

It’s tough to manage a successful firm without a consistent income stream. MRR informs business leaders on the amount of money they can reinvest each month. Salespeople can also see the growth of the accounts they handle with MRR.

Measuring MRR is a necessity to help your company grow and fix any issues in the early stages. By tracking and analyzing your MRR, you can stay on top of the data your investors care about the most.

If you’re looking for a tool to track your MRR, revenue sources, and more, try LeadSquared. It is an all-in-one suite for high-velocity sales trusted by leading businesses like BYJU’S, Uni Cards, Practo, and more. Book a demo to learn more about the platform.

FAQs

MRR stands for Monthly Recurring Revenue.

ARR refers to Annual Recurring Revenue. It is a sales metric that shows the money that comes in every year for the life of contract (or subscription).

![[Webinar] Ace: The End-To-End Sales Performance Suite 9 Ace The End-To-End Sales Performance Suite](https://www.leadsquared.com/wp-content/uploads/2022/05/Ace-The-End-To-End-Sales-Performance-Suite-80x80.png)