What makes companies lose over $1.6 trillion worth of business every year?

Customers switching over to their competitors. Or in other words, customer churn.

B2B and B2C businesses take a hit when customers stop buying their products or services. It’s even worse when there’s a decline in subscription plans sold. Let’s dig in it a bit more.

What is Customer Churn?

Customer churn is the number of customers a business loses in a specific time frame. This happens when they no longer require your service, find a better product/service, or are unsatisfied with the service they receive from your business. It is also called attrition, and the annual rates for customer churn are around 24% for B2B companies and 31% for B2Cs.

But you might wonder why customer churn is such a big deal because your salespeople consistently work towards adding new accounts and users every day.

Why is Customer Churn Important?

It’s because when a customer leaves your business, all the effort and resources that went into onboarding them are wasted. And an ongoing customer brings you around 50% more revenue than a new customer.

Even though a focus on acquiring a larger market share requires you to focus on customer acquisition, a lower churn rate ensures that you retain the market share while achieving profitability.

Churn is inversely proportional to annual revenue. So, aiming for a monthly churn of under 3% can tremendously improve revenue because:

- A 5% increase in retention can improve profits by 25-95%.

- Recurring customers spend 67% more than new customers on upgrades and new product launches.

- It costs 16 times more to bring that new customer to the spending level of your repeat customers.

Achieving these results is possible when you improve customer retention and lifetime value. Both depend on customer churn directly. Let’s identify the root cause for customer churn and how it differs for B2B and B2C businesses.

What Causes Customer Churn?

Even if your product or service is known to be the best, and you couple it with top-notch customer service, it’s impossible to bring customer churn down to zero. It’s because each customer and their requirements differ by a lot!

Yet, B2Bs and B2Cs can bucket the most probable factors for churn and start working on it. Here are a few aspects that these businesses need to focus on:

Customer Churn for B2C businesses:

B2C companies with a recurring purchase model face a lot of competition from other B2Cs in the market. Customers switch to another business for better products, prices, or services. Individual consumers may also want to try out different services or their requirements also change over time. Hence, the priority for B2Cs is to ensure that they don’t lose out to their competitors and update their services to match their customer’s evolving requirements.

Customer Churn for B2B businesses:

B2B businesses, especially in niche markets, face relatively lower competition as compared to B2Cs. Since most B2B services solve a particular long-term challenge for a business, the user’s requirements don’t change frequently. A B2B consumer usually looks for an alternative if the solution is too expensive for them or the customer service provided doesn’t match their expectations.

Along with these voluntary reasons to look for a change, there are a few involuntary causes of churn. In the case of involuntary churn, the subscription or recurring payment fails due to an error in a financial process. This could be due to insufficient funds, payment gateway failure, or missing the pay date. Unlike voluntary reasons, the churn may be temporary, and the situation has a quick fix in involuntary churn.

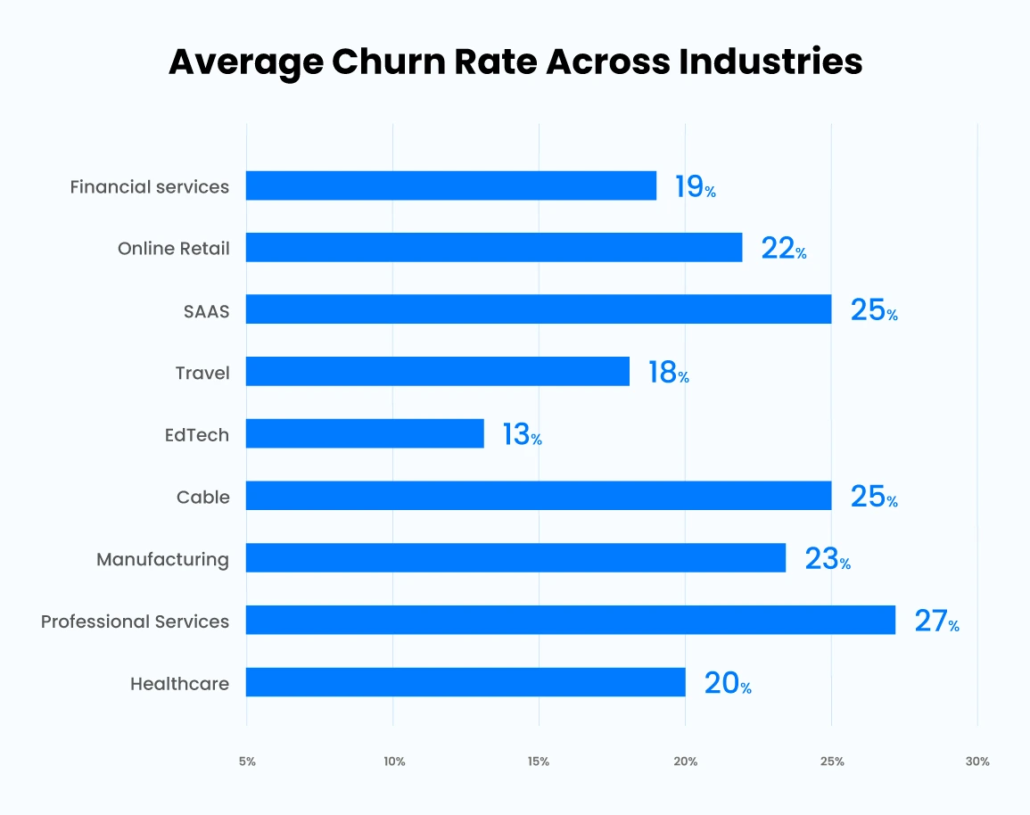

As a salesperson or a sales manager, it is important to understand the industry and churn rates across the industry. It helps you predict churn and plan your forecasts accordingly.

Average Customer Churn Rate across Industries

Here are some average user churn rates across B2B and B2C businesses. It helps your business aim for an overall churn below these averages.

It is important to note that these churn rates depend on the kind of business model a company follows, its sales and customer service strategy, and retargeting processes. To compare your churn rates against these numbers, you need to know how to predict and calculate them for your business.

Key Considerations

- B2B vs. B2C: Generally, B2B (Business-to-Business) contracts tend to be longer and have lower churn rates than B2C (Business-to-Consumer) models.

- Company Maturity: Startups often experience higher churn as they establish their brand and product-market fit.

- Data Variations: Churn rates can vary depending on the data source and methodology used.

How to Predict Customer Churn?

“Predicting customer churn helps you not just retain but also expand your business. Every negative or delayed response, or lack of adoption, can indicate towards churn, and it’s important that you address the issue as early as possible.” –

Prashant Ahlawat, Vice President-Analytics, LeadSquared

A few warning signs for churn that salespeople and customer support can look out for are:

1. NPS Customer Satisfaction Metrics

Net Promoter Score (NPS) tells your user’s feelings about your product because it reflects customer satisfaction. An NPS survey highlights customers most at risk for churn and those who will stay loyal to your brand.

Based on the scale of 1-10, in an NPS survey, you ask your customers how likely they are to recommend your product/service to a colleague/another business. Using their response, you know what percentage of your customers your promoters, passives, and detractors (highest risk of churn) are. But these surveys receive responses from only 15-30% of businesses, so it’s a metric that can’t be a standalone representation of churn.

2. Poor User Adoption

User adoption differs for businesses based on their ability to adapt to new products and technologies and the implementation phase they go through. For B2C product, user adoption depends on how well the product is suited for the user.

Salespeople need to ensure the right product-user fit to improve user adoption. Slow implementation or challenges impacting adoption are signs that the customer service team needs to step up to decrease churn.

3. Employee Turnover

Employee turnover can take place in two ways, either the customer support employee from your business may leave or the champion employee from the user’s end. A champion employee trusts in your business and behaves as a promoter at the user’s end. If they leave the user company, the new decision maker may opt for a different service with which they are more comfortable or have more experience.

On the other hand, the customer support representative at your end is who the user trusts the most. When they leave your organization, the transfer of responsibilities is coupled with the transfer of your user’s trust. The new rep must maintain the relationship with the customer to prevent churn.

4. Delayed Renewals and Payments

A delayed payment or hesitation towards signing up for an annual plan indicates that the user may not realize the full potential of your product to find value in it. If the opportunities to upsell are new and the user opts out of any upgrades, even at a good price, it might be a good time to talk it out with them to eliminate churn.

Since a lot of factors impacts churn, and we know that it needs to be regulated, there are a few quantitative signs, such as customer and revenue churn rates that businesses can track.

How to Calculate Customer Churn?

As a business, you can calculate churn in more than one way. It can represent the number of customers you lost or the change in monthly recurring revenue.

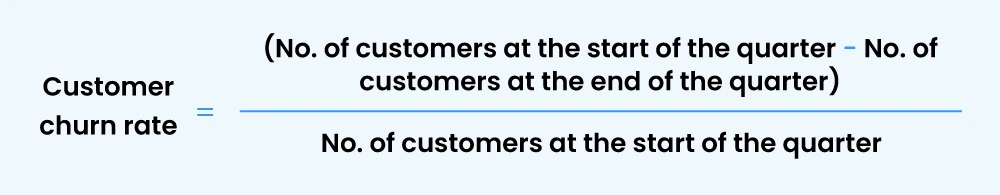

1. Customer churn rate

You only estimate how many customers have left your business in this calculation. So, you take the difference in the number of customers over a specific time period and divide it by the number of customers at the start. Here’s the formula to calculate the churn rate:

For example, business A has 200 customers at the beginning of the quarter. Over three months, they onboarded 30 and lose 50 customers, which brings the total to 180 (200 + 30 – 50) at the end of the quarter. The customer churn rate will be: (200 – 180) /200 = 0.1 or 10%.

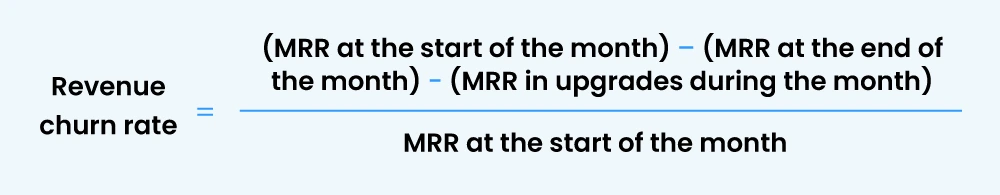

2. Revenue churn rate

A recurring revenue loss occurs when a customer downgrades their subscription or cancels it altogether. But at the same time, revenue from new businesses and upgrades is added to your business, too. These additions should not be considered because you’re calculating the revenue lost only from churn. Here’s the formula to calculate the revenue churn rate:

For example: A business starts the month with an MRR of $20,000. The MRR at the end of the month is $16,000, and the MRR for new upgrades is $6,000. The change in revenue is -$2,000 ($20,000 – $16,000 – $6,000). The revenue churn rate is –0.1 or –10%. The negative sign indicates that you’ve made a profit.

A common rule of thumb is ensuring that your MRR from upgrades is higher than the amount you’ve lost in revenue churn. This rule keeps your business profitable every quarter.

The revenue churn rate is an important sales metric for teams that have multiple product lines or different levels of subscription plans. Even if businesses lose just one customer in the quarter and the customer churn rate is low, the actual fiscal impact can only be measured by the revenue churn rate. The account may have a high MRR and the customer churn rate downplays this loss, whereas revenue churn gives an accurate account of the situation.

But the fact remains that even though tracking customer churn rates are a proactive approach to decreasing churn, you only notice it once it’s too late. By the time these signs become apparent, your user might have already made up their mind and even found an alternative product/service to move to.

But all hope isn’t lost! We spoke to a few sales experts and shortlisted 8 best practices that help you eliminate churn right from the onboarding stage.

Customer Churn Analysis

This process identifies the factors that lead customers to discontinue using a product or service. Since retaining existing customers is often cheaper and more effective than acquiring new ones, it’s a vital practice for businesses of all sizes. By analyzing this, businesses can find out trends and patterns that signal churn risk.

Here’s a breakdown of the key steps involved in customer churn analysis:

Step 1. Data Collection: The first step involves gathering customer data from various sources. It includes customer relationship management (CRM) systems, purchase history, support interactions, and website activity.

Step 2. Customer Segmentation: You can identify groups with a higher churn propensity. For that, segmente customers into groups based on demographics, behavior, or product usage. This will allow you to target interventions to address specific customer needs.

Step 3. Cohort Analysis: This technique involves grouping customers by their acquisition date and tracking their churn rates over time. It helps identify churn patterns at different lifecycle stages and pinpoint periods where customers are more likely to churn.

Step 4. Survival Analysis: This statistical method helps predict the likelihood of a customer churning within a specific timeframe. It’s useful for pinpointing churn risk factors and prioritizing customer retention efforts.

Step 5: RFM (Recency, Frequency, Monetary) Analysis: This classifies customers based on their purchase history. It helps identify valuable customers who haven’t purchased recently (at risk of churn) and allows for targeted re-engagement campaigns.

By implementing these steps, businesses can gain valuable insights into customer behavior and churn drivers. This knowledge empowers them to develop targeted strategies to reduce customer churn, improve customer satisfaction, and ultimately boost long-term profitability.

8 Best Practices to Decrease Customer Churn Rate

1. Optimize User Onboarding

Once the deal has been signed, salespeople must ensure that all the promises made to the user are acted upon, and their implementation process goes smoothly. While onboarding, you can introduce multiple contact touchpoints to support users and cater to their doubts.

It’s a healthy process to touch base with the customers weekly or monthly. Utilize this chance to understand their product usage and any challenges they may face. These calls help businesses with a recurrent purchase model because you get an opportunity to justify their purchase and encourage them to revise their subscription or upgrade it for the next quarter.

Akhil Pandey, Team Manager – Revenue Assurance, LeadSquared

Tips to improve user onboarding:

- Decrease the time it takes to onboard new users with onboarding automation. It also decreases errors and simplifies verification processes—for example, eKYC onboarding for Insurance businesses.

- Customize the onboarding based on the user’s requirements.

- Decrease the number of steps/clicks/stages it takes to complete onboarding.

- Implement checklists for the important stages. We all love the excitement that we get from completing a task! It’s also a great way to track the onboarding stage and utilize reminders to complete the onboarding tasks quickly. (It works like a charm for admission applications for EdTech businesses!)

2. Prioritize Customer Service

32% of customers agree that one negative customer experience service is enough for them to stop doing business with a brand or company. Even if they previously loved their customer service. So, as a business, it’s important for you to ensure that customer service never falters.

Tips to raise the bar for customer service:

- Shorten the turnaround time with automation to respond to customers on their service requests.

- Collate all the customer-related information, previous requests, and product usage, on a common CRM platform for personalized and effective customer service.

- Enable self-service portals or help centers where the user can find a quick resolution to their challenges.

- Opt for an omnichannel customer service experience by integrating all your customer service efforts onto a customer relationship platform.

3. Implement Effective Targeting and Re-Targeting

Businesses that have a niche product, or cater to specific industries, might have identified a certain Ideal Customer Profile or Buyer Persona to target. Focussing on selling your product/service to this specific segment, or industries where the adoption is simpler, will ensure a lower rate of customer churn.

The same principle can be applied to retargeting, as the data related to previous industry/customer-segment-based cross-selling and upselling help you identify the right opportunities to increase customer lifetime value.

Here’s how you can go about it:

- Create a dashboard for easy access to segment wise purchase data. It’ll help you identify what kind of product or service works best in certain industries or regions.

- Record data for each cross-sell and upsell opportunity at every stage.

- The marketing teams can use this data to optimize their acquisition and retargeting strategies using automated marketing campaigns, which will instantly lead to deals with a lower churn potential.

4. Improve User Engagement

Engaged customers who relate to your brand or build a relationship with it have a lower chance of looking for an alternative. 15% of B2B businesses prioritize proactive customer engagement to decrease churn. And while there are many ways in which user engagement works, here are a few ideas for your team:

- Implement technology for conversational marketing using chatbots (with scripts and conversation flows) or Artificial Intelligence.

- Engage your customers with frequent product updates or guides via marketing campaigns so that they know all the resources available. You can also organize webinars or send out emails with the intent to educate your customers. It can improve the usage experience, help you get renewals faster, and prove super helpful for your customers.

- Engage your customers weekly by utilizing your online presence on various social media channels.

- Schedule frequent calls with the CEOs or decision-makers to ask for feedback and understand their growth trajectory so that your product/service can continue to support them in the long term.

5. Introduce Discount and Loyalty Programmes

Word of mouth influences around 20-50% of purchasing decisions, especially for a first-timer. The value that a referred customer generates is also 16% higher than a non-referred customer.

Membership programs are a great strategy used by product-based businesses. A membership card that guarantees discounts is a great incentive for customers to stick to your business. A loyalty program helps your business decrease churn in the following ways:

- Strategically placed discounts the customer can avail of close to their renewal period to ensure higher retention periods.

- Rewards on non-transactional exchanges, such as customer testimonials, improve loyalty because promoters publicly vouch for your products publicly.

- Offering discounts on product bundles can help you increase the deal value and cross-sell products at the same time.

6. Utilize Customer Survey Data

You would be crazy to not do everything you can to find out why customers are cancelling. That kind of knowledge is power. This is the kind of feedback you need to build a great product.

Pat Walls, Founder- Pigeon

Whether it is positive or negative feedback, it helps your business grow either way. Even more so, if it is negative. You can use your offboarding process to find what you might be doing wrong and use it to improve the experience for your other users.

Before you utilize this data, you must ensure that all your customer surveys are designed to derive actionable insights. Here are a few ways in which you can improve customer surveys:

- Ask close-ended questions to collect quantitative data.

- Personalize the feedback form based on different customer segments for insights to improve your sales process and customer engagement strategy.

- Test multiple-choice surveys with simple options and the opportunity to select more than one response.

- Include a few open-ended questions to identify the exact challenges and situations that led to customer churn.

- Ask questions related to why they left your product/service and the competitor’s offerings that enticed them the most.

7. Improve Customer Retention Strategies

96% of businesses believe that they lose customers for reasons that can be managed or fixed. While it may not be as easy as just giving them a call, a few customer retention tactics can be employed to prevent churn.

Tips to help you fix a churn situation at the exit stage:

- Create a dedicated team to focus on the exit challenges. Understand why they’re moving away from your business. Is it the service, the representative, or the product itself?

- If it is a finance-related issue, you can excuse one round of payment or offer the opportunity to pay after a few months. By doing so, you retain business and customer trust in the long run.

- Offer the option to pause the subscription for a short period of time. Until they have re-evaluated their situation.

- Put your best salesperson at the job to ensure that the discussion to prevent churn is carried out in the best way possible.

8. Automate Workflows for Customer Retention

Automated workflows mean that your customer success team and salespeople spend a lot less time managing these customer inquiries. All of the tips discussed above can be part of the workflow to standardize customer experience and increase customer churn. You can use a CRM as a one-stop solution because it collects all the data, enters it into these workflows, and helps you quantify the outcomes of your efforts.

Automation for customer retention includes:

- Educational nurturing sequences

- Feedback loops

- Personalize communication with segmented lists

- Set reminders for renewals

- Effective and simpler onboarding

- Track analytics related to customer lifetime value and churn

Customer Churn Management

Keeping existing customers is just as important as acquiring new ones. This is where customer churn management is important. It’s the strategic process of identifying customers at risk of leaving and implementing proactive strategies to retain them. Here’s how it works to predict customer churn:

- Identify the Threat: The first step is to identify customers at risk of churning. This involves analyzing customer data like purchase history, support interactions, and website activity. Key metrics to monitor include churn rate, customer lifetime value, and Net Promoter Score (NPS).

- Understand the Reasons: Why are customers leaving? Analyze data and gather feedback through surveys or direct outreach to pinpoint churn triggers. Common culprits include poor product experience, lack of value perception, or inadequate customer service.

- Take Preventative Action: Once you know why customers are churning, you can develop targeted strategies to address their concerns. This might involve product improvements, personalized communication, loyalty programs, or proactive customer support for at-risk customers.

- Measure and Optimize: Track the effectiveness of your churn management efforts. Analyze which strategies resonate with customers and refine your approach based on ongoing data insights.

The Churn Management Toolkit

By implementing a proactive customer churn management strategy, you can be rest assured of:

- Significantly reducing customer churn

- Boosting customer retention

Here’s how it can be done:

- Customer Segmentation: Group your customers based on demographics, behavior, or product usage to personalize retention efforts.

- CRM Systems: Utilize CRM systems to manage customer interactions, identify churn signals, and streamline communication.

- Customer Satisfaction Surveys: Assess customer satisfaction regularly to identify areas for improvement and nip churn in the bud.

- Win-Back Campaigns: Design targeted campaigns to re-engage customers who have shown signs of churn.

Wrapping Up

Customer churn isn’t something that happens at a specific point; it’s an outcome of the entire customer lifecycle journey. A business needs to visually sketch customer and prospect journeys, identify pain points and drop-off areas, and plug the leaks to prevent churn.

No matter what your business goal at the current moment is—new customer acquisition, dormant lead reactivation, increasing upsell/cross-sell rates, increasing renewal ratios, or anything else—a CRM, like LeadSquared, allows you to build end-to-end customer journeys across communication channels and devices.

Our team at LeadSquared can help you decrease churn and achieve all your business goals. Get in touch with us to know how!

FAQs

Customer churn refers to the percentage of customers who stop doing business with a company over a specific period. It can be measured by the number of customers who cancel subscriptions, stop using a service, or otherwise cease to be paying customers.

There are several strategies to tackle churn and boost customer retention:

i) Identify churn reasons

ii) Improve customer experience

iii) Offer incentives

iv) Proactive communication

v) Gather feedback

vi) Personalize your approach

Consider a subscription-based fitness app. In case a customer signs up for a monthly membership but cancels it after two months without using the app features, that would be considered churn.

Here are some signs of customer churn:

i) Decreased usage

ii) Increased support interactions

iii) Delinquent payments

iv) Negative feedback