Cost of sales is key to any business. It’s like having a map to guide your financial decisions, to set your prices, and ultimately to know your profit.

Whether you’re a seasoned financial guru or just starting out your own business, this blog will help you understand everything you need to know about cost of sales.

We also have an online Cost of Sales Calculator; if you’d like to go directly to it, Click here!

What is Cost of Sales?

Cost of Sales (COS) is a financial metric that shows the direct costs to make goods or services that a business sells in a given period.

In simple terms, it’s the total amount of money your business spends to create the products or services you sell to your customers.

For example, if you own a manufacturing business that makes electronics, your cost of sales would include expenses for raw materials, labour, and manufacturing overhead. For a service-based business, it would include the wages of employees directly providing the service.

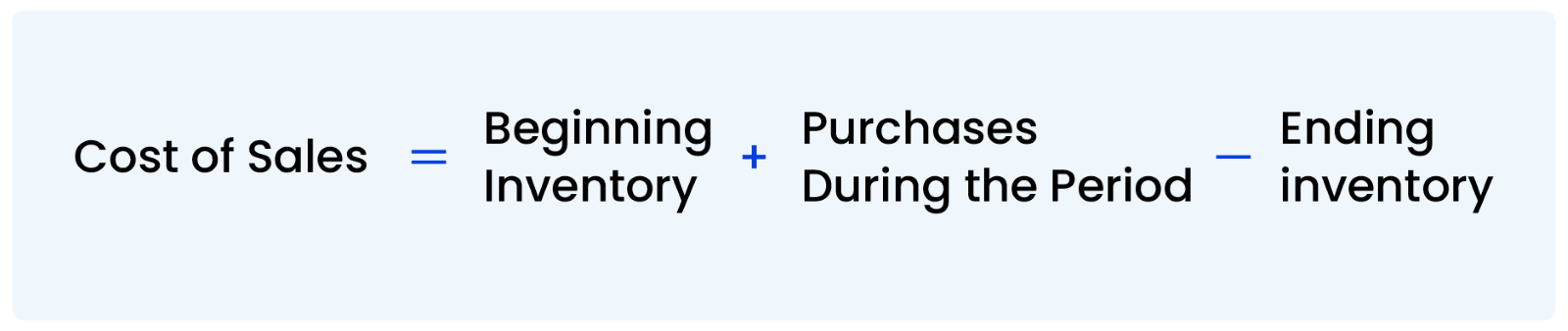

The Formula for Cost of Sales

The cost of sales formula is simple, but informative. To get it right you need to understand each part of the formula.

- Beginning Inventory: The value of your inventory at the start of the accounting period.

- Purchases During the Period: The total cost of additional inventory or materials purchased during the period.

- Ending Inventory: The value of your inventory at the end of the period.

This formula will calculate the cost of the goods sold during a period.

How to Calculate Cost of Sales

Let’s make it practical with an example.

You run a business that manufactures office furniture. Here’s your data for the quarter:

- Beginning Inventory: $100,000

- Purchases During the Period: $200,000

- Ending Inventory: $80,000

Now, using the cost of sales formula:

Cost of Sales = $100,000 + $200,000 – $80,000 = $220,000

So, your cost of sales for this quarter is $220,000. This is the actual costs of making the furniture sold during this time.

Online Cost of Sales Calculator

Cost of Sales Calculator

What To Include in the Cost of Sales Calculation?

To get cost of sales right you need to know what to include and what to exclude. The key is to focus on direct costs:

- Raw materials: The basic materials used to make your product.

- Direct labor: Wages of employees directly involved in the production process or service delivery.

- Manufacturing overhead: Indirect costs of production, such as factory rent, equipment maintenance, and utilities.

- Shipping costs: If applicable, the cost of delivering raw materials to your manufacturing facility.

What not to include:

- Sales and marketing expenses: These are operating expenses, not part of the production process.

- Administrative costs: Salaries of executives, office supplies, etc.

- Research and development: These costs are usually separate and not part of direct production costs.

Impact on Profitability

Your business’s profitability is directly impacted by your cost of sales. If your COS is lower, your gross profit will be higher, assuming your revenue is the same. Let’s get into why this is so important:

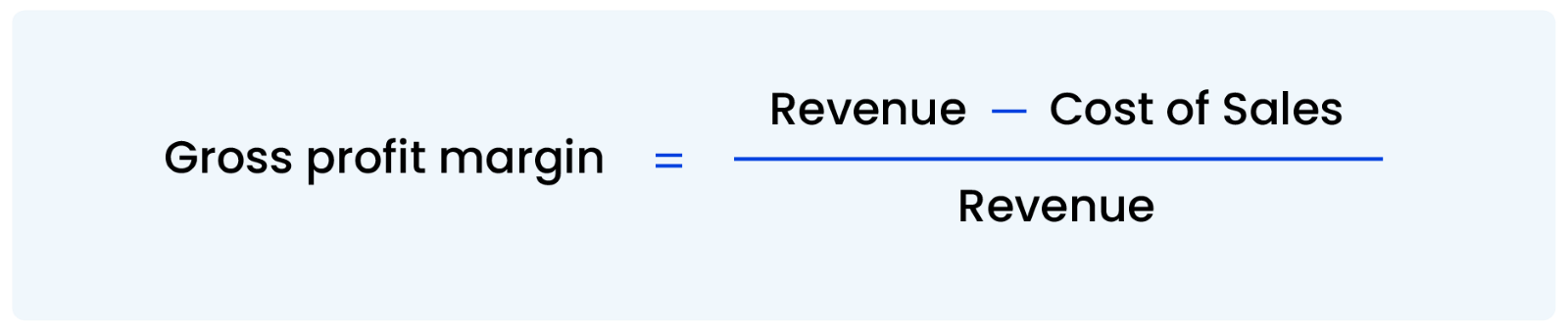

Gross Profit Margin

This is calculated as:

Lowering the cost of sales increases your gross profit margin. This is important because it helps cover operating expenses and get net profitability.

Knowing your cost of sales (COS) is key to setting competitive prices. If your COS is too high, you may need to adjust your prices or find ways to reduce production costs.

In addition, Accurate cost of sales (COS) calculations help with better financial planning, so you can plan for future expenses and investments.

Importance of the Cost of Sales Formula

Using the cost of sales formula isn’t just about numbers, it’s about making informed decisions to grow your business. Here’s why:

- Inventory management: It helps you track your inventory levels so you don’t have too much or too little stock.

- Cost control: Calculating your cost of sales (COS) regularly will show you where your production process is not working efficiently. This will help you find ways to save money by making necessary adjustments.

- Financial reporting: COS figures are critical for financial statements, especially when reporting to stakeholders or preparing for audits.

Difference Between Cost of Sales and Cost of Goods Sold

“Cost of sales” and “cost of goods sold” are often used interchangeably, but there is a subtle difference, especially in certain industries.

Cost of Goods Sold (COGS)

The term refers to the direct costs of producing physical goods. It is more specific to manufacturing and retail businesses.

For example, let’s say you run a small manufacturing company that produces custom-made furniture.

- Materials Used: You buy wood, screws, varnish, and other raw materials to make the furniture.

- Direct Labor: You pay carpenters and workers to assemble the furniture.

- Manufacturing Overhead: You have expenses such as electricity for the machines, rent for the factory, and equipment maintenance.

COGS: For this manufacturing business, the COGS would include the cost of the wood, screws, varnish, the wages of the carpenters, and the factory overhead costs directly related to the production process.

Cost of Sales (COS)

This includes COGS and direct costs of services provided, making it more relevant to service-based businesses.

Say you run a digital marketing agency that offers services like managing social media, creating content, and optimizing search engines.

- Direct Labor: You pay salaries to content writers, social media managers, and SEO specialists.

- Software Subscriptions: You buy software tools to manage clients’ social media accounts and optimize SEO performance.

- Freelancers: You hire freelancers to create graphics or write special content for your clients.

COS: For this service-based business, the COS would include the salaries of the writers, managers, and specialists, the cost of software subscriptions used for client projects, and payments to freelancers.

In the furniture manufacturing business, cost of goods sold is about the physical materials and labour involved in producing the products that are sold.

In the digital marketing agency, the cost of sales is broader, including not just labor, but also other costs directly tied to delivering the service, like software and freelancers.

Cost of Sales in Manufacturing, Retail, and Service Industries

Depending on your industry, the cost of sales might include specific items or require adjustments:

- Manufacturing: Involves tracking of raw materials, labor, and overhead. Sometimes, additional items like spoilage, defects, and rework costs are included.

- Retail: The focus is on the cost of buying inventory for resale, including any shipping and handling costs.

- Service: Since there’s no inventory when calculating the cost of sales, the focus might be more on labor costs and any materials directly related to the service.

Common Mistakes to Avoid in Cost of Sales Calculations

Incorrectly calculating your cost of sales can lead to big financial mistakes. Here are some common traps:

- Including Indirect Costs: As mentioned above, including overheads that are not directly related to production can increase your COS.

- Not Updating Inventory Values: Failing to update inventory values can result in inaccurate COS figures and affect your gross profit calculation.

- Ignoring Discounts and Returns: To calculate the cost of sales accurately, make sure to include any discounts received on raw materials or returns from customers.

Conclusion

Cost of sales is not just a line on your income statement; it’s a key metric that guide your business towards profitability and growth.

By knowing how to calculate COS, what to include, and its impact on your financials, you can make better decisions for your business.

So, keep this guide handy —because understanding your COS is not just about knowing your costs; it is also about understanding your business.