Finding quality insurance marketing leads isn’t just expensive, it can also be downright frustrating. It’s tough to market your agency online without going into three figures or more per campaign, especially if you’re using Google Ads or retargeting. Insurance marketing is the best way to increase your lead inflow.

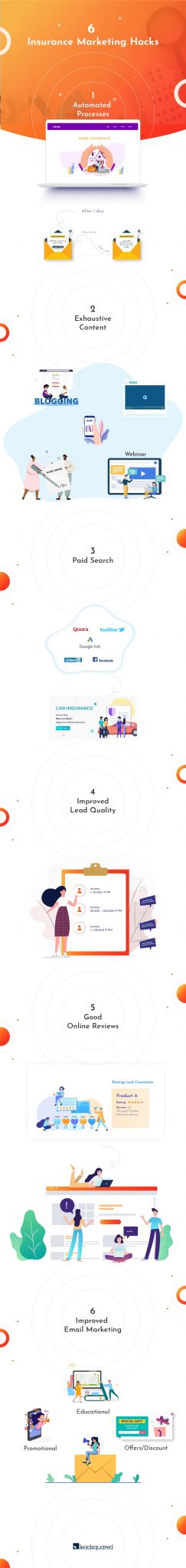

The following six hacks are tried-and-true for effective insurance marketing and lead gen, plus they won’t bust your budget before you’ve had a chance to see results:

#1 – Focus on Repeatable, Scalable Systems

Taking a hands-off approach to insurance marketing and putting it on autopilot might sound like something from the future, but there’s actually a lot you can automate.

For starters, you might include a chatbot on your website that can provide real-time communications with prospects, even when you’re not around to take calls or chat with them yourself.

You can also set up email drip campaigns that send out scheduled content on your behalf without you having to click the Send button yourself. For example, you could build an entire email marketing funnel that helps you build your brand and authority with no involvement from you once it’s set up. Users can opt-in to receive your emails, then the rest is automatic.

Granted, this one takes some setup and fine-tuning to get rolling. But nearly 50% of companies that use marketing automation feel it’s worth the price (Source: emailmonday).

#2 – Build Your Content Arsenal

Insurance is required for a variety of things, and it’s become something of a commodity that makes it hard for people to understand what makes your agency better than others.

Content marketing is particularly beneficial to insurance agencies to combat this issue. Your audience can get to know you through the content you produce and learn the difference between your unique brand and other agencies. You position yourself as the resident expert and a valuable resource in the community.

There are many different ways you can use content marketing. One of the easiest ways is to start a blog that provides helpful resources to your audience. Blogs are published on your website and shared via email marketing and social media to increase exposure. You could also empower video as part of your blogging strategy that highlights helpful tips for homeowners, businesses, or anyone who needs your services.

#3 – Invest in Vertical Search Advertising

If you’re trying to target specific niche markets or industries, skip the traditional search engine in favor of the vertical search engine. They’re essentially the same, except vertical search engines target specific industries.

One example of a vertical search engine in insurance is QuoteLab. You can place ads that display quotes or services to customers who are actively searching for insurance, which typically results in higher quality leads.

#4 – Get Better Lead Quality with Income Targeting

Would you try to sell a $10,000 life insurance policy to a billionaire, or boater’s insurance to someone who’s barely scraping by? Probably not.

Insurance agents can get better lead quality when you target by income. This helps you to appear only to the audience segment that’s most likely to benefit from what you’re selling. Use your own data to see what income range and product price point your customers fall under, then tailor your digital ad campaigns to reach people in a similar bracket.

#5 – Show Some Love to Your Online Reviewers

Keeping your finger on your online reputation pulse can be one of the best ways to add the human element to your brand. Studies show that 84% of people trust online reviews as much as a recommendation from a family member or friend, which means many of your clients will scope you out online prior to requesting a quote or buying a policy.

People are going to talk about your agency anyway, so you might as well join the conversation. Reply to their reviews and thank them for their kind words. Or, if someone leaves a scathing remark, take the opportunity to make it right.

At the very least, people who read your reviews will see you’re making an effort to connect with your clients, you’re accessible, and you aren’t afraid to reach out when there’s an issue.

#6 – Improve Your Email Marketing

There are 3.7 billion email users in the world that sent more than 269 billion emails last year. As long as people are still using email, insurance agencies should do everything they can to get into prospective clients’ inboxes.

Email remains one of the most effective insurance marketing tools and smartest ways to spend your budget. Studies show that for every $1 you spend, you get a $44 ROI — that’s huge!

Check out our upcoming guide on building an email marketing funnel to maximize your efforts.

Insurance Marketing Made Easy with LeadSquared!

Are you looking for a better, easier strategy for your insurance marketing? LeadSquared thinks you deserve it!

Our lead generation and marketing tools are designed to help you get the most from every lead, from checking lead quality to providing timely follow up so you can close them while they’re hot! Try LeadSquared free for 15 days and let us help you growth hack your insurance marketing!