How can insurance software benefit your firm? How do you make the best choice? In this article, we will talk about insurance solutions and their important features and benefits.

Every insurance carrier, agency, or brokerage firm deals with immensely complicated tasks. For instance, you must process claims, orchestrate, and renew customer policies on an ongoing basis. You also need to manage teams, vendors, and customers. Therefore, your day-to-day operations have too many arms and complexities.

Even so, the insurance industry is rapidly evolving. So, your firm must manage ever-changing customer demands and compliance needs. You need to deal with growing policy volumes and offer great digital products and experiences.

That is why you need to harness the technology advantage. Digitizing your interactions with customers and vendors will make it easier to meet customer expectations. Plus, you can ensure all your team members are aware of any change in regulation and follow the updates. So, consider investing in digital insurance solutions. However, the right choice begins in understanding what insurance software is and what benefits it can bring to your business.

What is insurance software?

Insurance software offers a plethora of tools to manage your day-to-day operations. At the core, it helps brokers, agents, agencies, and carriers streamline their operations and save time and cost. However, it should support both client and administrative sides.

The administrative side includes underwriting, issuing policies, managing teams, tracking claims, complying with regulations, and updating policy information.

In contrast, the client-side allows your customers to log in and carry out simple tasks such as checking their policy, checking eligibility, applying for insurance, filling forms, making payments online, and more.

So, insurance software has a scope from customer relationship to business process management. LeadSquared Insurance CRM, SEMCAT (now Applied Rater), Insly, and Jenesis Software, are examples of top insurance software products serving Insurers in different capacities.

W

Types of insurance software

There are different solutions catering to specific insurance needs. Many software solutions integrate with other tools and apps to provide end-to-end insurance management.

Let us investigate the types of software that insurance firms use and their features.

Document management software

Insurance companies need document management software to securely store, organize and access important documents such as policy applications, customer proofs, contracts, policyholder agreements, etc.

However, Insurers don’t necessarily need a standalone document management system since their CRM, ERP, or other internal systems provide this functionality.

Customer relationship management software (CRM)/Insurance lead management software

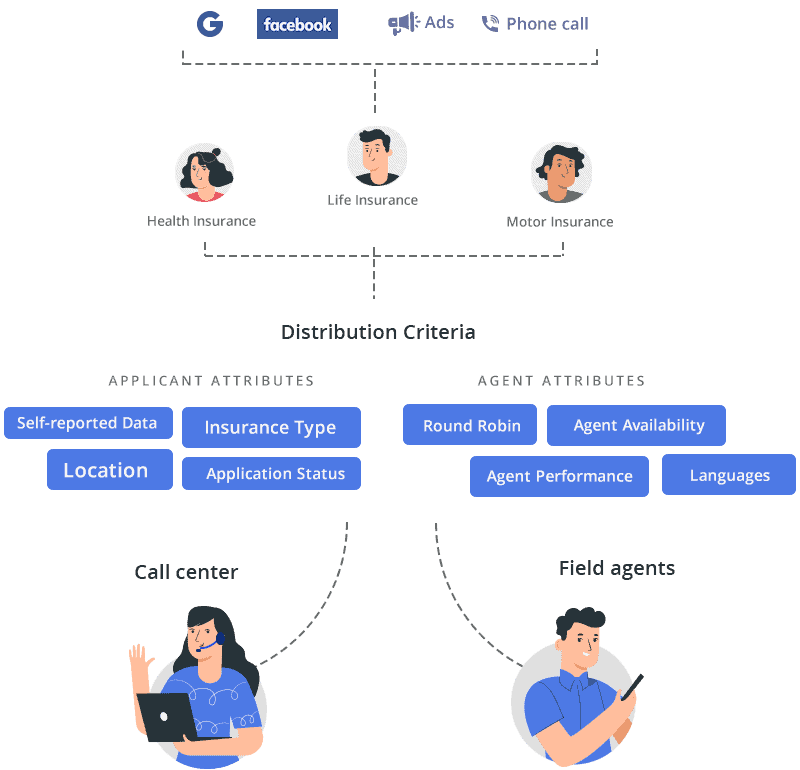

CRM software for insurance companies has evolved as the most useful solution for insurance processes. It connects teams, distribution channels, call centers, agents, and field sales to a unified portal. Apart from managing customer relationships, it has become a key enabler to the Insurers’ digital transformation.

While the insurance lead management system serves a specific purpose of managing leads, CRM is a step ahead. It lets you manage all your products, teams, intermediaries, and channels to increase operational efficiency. From verification to new policy sales, renewals, upsell/cross-sell, and field operations, it helps in digitizing insurance processes.

Insurance workflow automation software

Workflow automation is the act of using software systems to arrange, monitor, control, and coordinate different business processes that involve human resources, sales and marketing, lead management, and more.

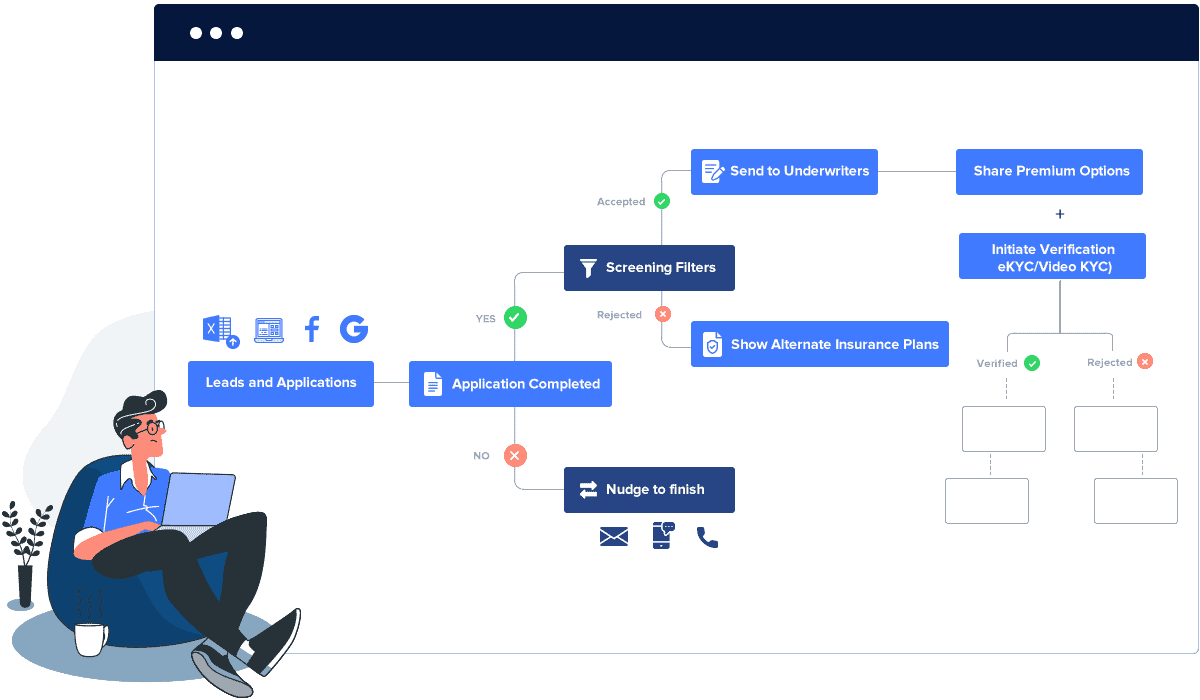

An example of workflow automation in insurance is – STP (Straight-through Processing) or digital sales. Here, the entire insurance process follows an automated flow – from lead generation and online application to verification and issuing a policy.

Insurance processes are usually complex and have multiple touchpoints. That is why insurance companies deploy automation in their sales, call-center, and applications to improve process efficiency and team productivity. Some CRM suites, such as LeadSquared Insurance CRM, offer a no-code workflow automation facility.

Also read: How to use insurance workflow automation to improve sales?

Policy management software

Insurers use policy management software to create, administer, and manage insurance policies. Some software allows facultative arrangements and reinsurance treaties. That way, you can reduce the insuring risks and handle reinsurance processes efficiently.

Underwriting software

Underwriting is the most crucial aspect of the insurance business as it evaluates the company’s risk in insuring a home, car, or an individual’s health or life. The purpose of underwriting software is to manage the underwriting process for insurance companies. It allows users to write rules and policies to execute automatically during the underwriting process – saving manual efforts and reducing human errors.

Insurers also use Enterprise Risk Management (ERM) solutions to digitize their risk assessment process.

Claims management software

Such software helps insurers to streamline claim management workflow, generate claim documents automatically, manage payments, check fraudulent claims, and integrate policy administration.

Enterprise Resource Planning software (ERP)

ERP solutions designed specifically for insurance companies help in tracking customer-credentials, transactional amounts, and legal agreement data. By integrating ERP and CRM, companies can effectively manage operations and customer relations in a go.

Also read: ERP and CRM integration benefits.

Mobile apps for field agents and reps

Insurance firms equip their field sales reps and field agents with mobile CRM apps to track their activities and help them plan their day, get meeting recommendations, get upsell-cross-sell signals, prepare and update meeting notes instantly, and more.

Call center software

It helps the sales reps and call center agents to communicate with existing and potential customers over voice, web, chat, or emails.

Nowadays, instead of deploying a separate software, insurance companies integrate their CRM software with cloud calling, VoIP, or telephony systems. It allows reps to call customers directly from the portal and saves the hassle of manually dialing numbers and updating records separately.

Agency portal

Insurance firms that rely heavily on agencies for distributing policies use agency portals to set up and manage agents. It allows real-time data exchanges between agents, brokers, and other users.

Video KYC/eKYC solutions

Since the onset of the Covid-19 pandemic, insurance regulatory authorities in some countries have allowed video-based KYC (know your customer) for onboarding customers. It supports video recording and screenshot, real-time verification, capturing geolocation, and picture verification (matching customer photograph with ID photograph).

Because of so many variables in the insurance sector, such as nation-wide regulations, policy preferences, customer demographic, etc., insurers preferred in-house software solutions for a long time. But now, cloud and SaaS (Software as a Service) are gaining popularity. For instance, in 2020, 84% of all insurance core system buying transactions were cloud-based. The available options to customize a SaaS solution to suit organization-wide needs are making things further simpler.

Benefits of insurance software solutions

Operations in insurance are complex and involve multiple stakeholders (for example, consultants, agents, and third-party agencies). Traditional processes had redundancies and dependencies – causing infinite delays. Fortunately, modern software solutions overcome these obstacles efficiently and deliver a better insurance experience to customers. The following are the remarkable benefits.

1. Improve efficiency and productivity

Your insurance software already knows the format of storing the information. It also allows you to search for all your data in one central database. It makes it easy for you and your agents to meet your goals while saving tons of time and resources.

2. Improve communication with clients

It helps your agents/sales reps in building positive relationships with clients. Clients and agents can access real-time information on form status, memos, and deadlines. It also reduces the chances of making grievous mistakes and miscommunication.

3. Help reduce overall costs

Such software systems streamline processing operations and help your employees work efficiently. It also means you can reduce and eliminate manual errors. Such errors usually demand twice as much time fixing. So, you can cut down the extra hours of operations, and in turn, reduce the cost of operations.

4. Improve communication with agents and carriers

Software solutions allow access to real-time policy information. Agents and brokers for multiple insurance companies and policies will find it useful. That way, they can easily compare rates and policies as fast as possible. In turn, it helps them meet customer requirements in record time.

5. Compliance management

Insurance software makes it easy to set up an in-built compliance protocol. It helps your insurance firm stay on top of the ever-shifting regulations. You need not worry about fixing costly errors or lose time trying to make sense of changing directives manually. The insurance system will ensure that every case progresses at the correct pace. Also, it can automatically highlight areas that require your attention.

6. Improved customer service

Your insurance software allows prompt communication with your clients. It makes it easier to assess their situations and provide the right quotes. It also ensures that your customers can perform service requests at their convenience. Insurance CRM software with opportunity management feature take this to the next level. By understanding the customer activities on your website, ads, or marketplaces, it sends upsell and cross-sell signals to sales reps and agents. Thus, helping in closing more deals and bringing in more revenues.

7. Improved data security

Choosing automation over papers and spreadsheets improves data protection immensely. Most insurance software solutions also come with user authentication and encryption protocols.

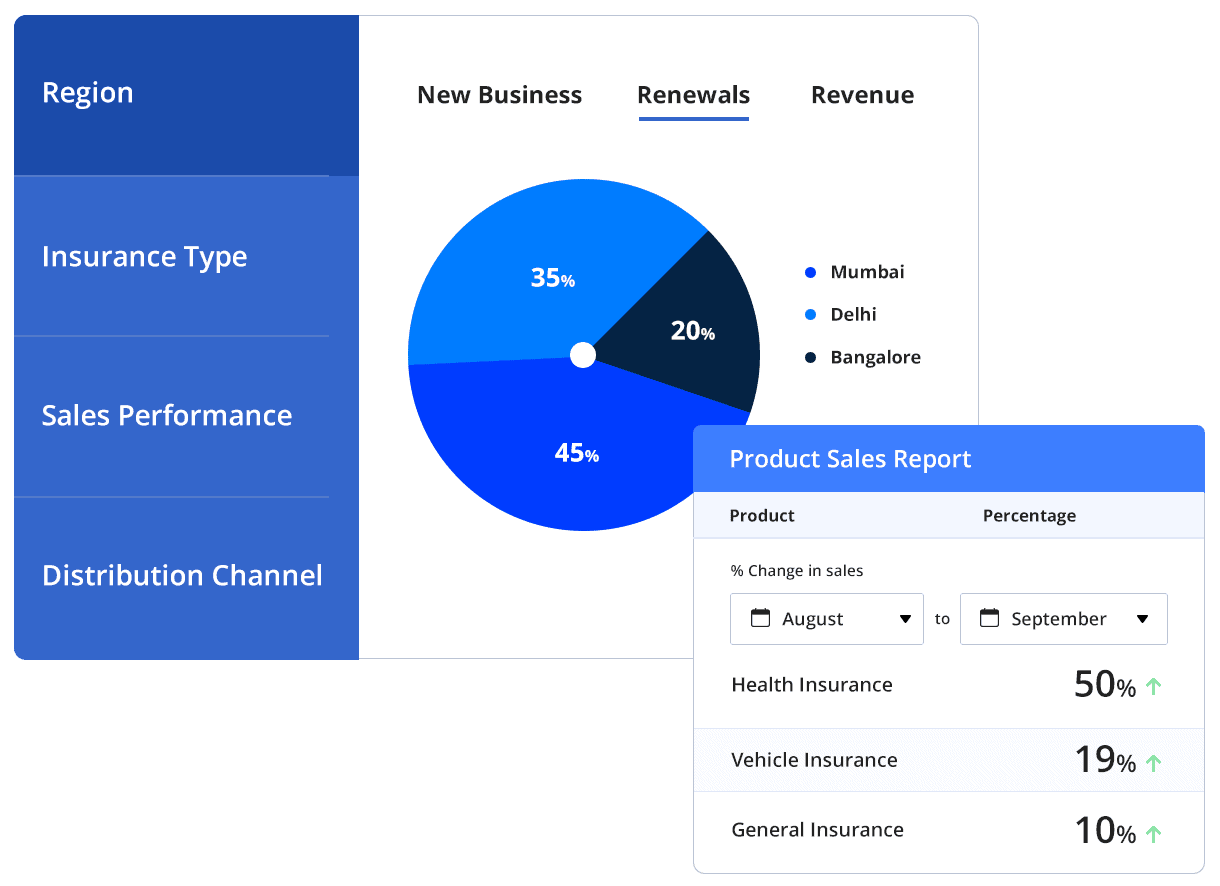

8. Analytics and reports

Data is key to staying aware of the performance of your insurance firm. Usually, companies do not deploy a separate system for analytics and reporting. The CRM/ERP systems cover analytics. They generate standard, statistical reports. You can even export these data for further insights.

9. Accuracy

Your insurance product should have built-in tools for authenticating data accuracy. Such includes QA systems, audit systems, payment verification systems, address converters, etc.

When the system automatically generates policy and document schedules, it further reduces errors.

Apart from these, there are dedicated insurance software solutions to help detect fraud claims and speed-up the investigation processes. Insurers are also leveraging Artificial Intelligence (AI) and RPA (Robotic Process Automation) based software solutions in their operations. A simple example of this would be AI-powered chatbots.

Choosing the right insurance software

Your unique insurance environment will help you decide the right one. Even so, consider these key factors:

1. On-premise or cloud-based

You can choose between cloud-based software or on-premise solutions. Each has its unique benefits. On-premise software provides more customization power. However, in most cases, on-premise solutions are bulky and may not integrate well with other core insurance solutions.

In sharp contrast, cloud-based solutions require fewer IT resources. Cloud-based solutions are dynamic, allow customizations without IT help (no-code/low-code), so much so that sales/process managers can modify customizations on the go.

2. Customizable

Whether you choose on-premise or cloud-based solutions, the degree of customization is still vital. The right product should tailor easily to your unique environment. It should allow you to manage users, control access, set discounts, manage pricing, etc.

3. Specific or comprehensive

You can consider solutions tailored to your specific environment or multiple insurance segments.

For instance, if you have several insurance products, you might need a software or tool to manage all the different sales processes/operations for all the products in one software itself.

Similarly, if you want to cross-sell or upsell, you will need opportunity management software as well.

So, be clear about the functionalities you need in your insurance software. Then, find that software that covers your business requirements. You can also try demo versions to make the right choice.

4. Integration

Your insurance software should integrate easily with your website, third-party apps, and existing systems. So, discuss with your vendors about the integration aspect.

That is, check whether the software integrates well with the software/tools that your intermediaries use. After all, you would want to manage their performances as well in one place.

For insurance enterprises that involve large-scale call center or mobile sales operations, an integrated insurance solution can be a go-to option.

Conclusion

Insurance software is no longer just an option to survive in this fiercely competitive industry. It is now necessary to gain and maintain an edge in the insurance market. Digital insurance solutions are also highly beneficial as they help you empower all your teams and meet customer demands effectively. Whether you are an insurance agency, brokerage, or carrier, the right solutions can boost efficiency, safety, and profitability.

An efficient solution to streamline operations and manage long-lasting customer relations is LeadSquared Insurance CRM software. Explore the features and benefits yourself. Try it free!