At present, fintech has become synonymous with financial institutions. Individuals who do not even have their bank accounts can now pay digitally. Businesses such as grocery stores and neighborhood shops are now accepting digital payments through payment apps. In this fintech revolution, the MSME lending landscape has also changed a lot. With the emergence of alternative lending platforms, businesses that did not even have any financial records can now receive credit. Technologies such as artificial intelligence and machine learning are now aiding fintech companies to give loans to MSMEs more efficiently, allowing businesses to grow.

In this article, we will explore the MSME lending trends and emerging opportunities.

u003cemu003eWhat are MSME loans?u003c/emu003e

MSME stands for Micro, Small, and Medium Enterprises. Several financial institutions offer unsecured loans to MSMEs for meeting various business-related expenses. The Indian Government and RBI have defined such loans as loans for business enterprises for supporting their finance, infrastructure, and other business-related areas. There also exist multiple government schemes in India under which financial institutions can offer loans to MSMEs. Businesses must meet specific criteria to get all the benefits of an MSME loan.

MSME Lending: Market Opportunity

As of early 2020, the MSME lending sector in India faced a credit deficit of INR 16 trillion. Credit deficit has also been a reason for the slow growth of the MSME sector in the country. To address this concern, the government has advised banks to achieve a 20% YoY growth in credit to micro and small enterprises. However, the progress has been slow. The credit extended by banks to the MSME sector grew only 2.6% YoY as of February 2020 (from INR 10.67 trillion to INR 10.95 trillion).

The primary reason why banks shy away from giving loans to MSMEs is the inability and unwillingness of MSMEs to repay the loan.

The lack of repayment results in high NPAs or Non-Performing Assets, which is a pressing concern for banks. This situation arises when banks and NBFCs cannot assess the creditworthiness of an enterprise. They often do not have enough information regarding the businesses and how they are performing.

Also, a lot of MSMEs do not have the necessary collateral needed for borrowing. Therefore, underwriting such loans in the absence of collateral will require a deeper understanding of the borrower-profiles and behaviors. In such cases, the timely availability of accurate data becomes crucial for giving out loans.

Giving loans to enterprises that can productively use it can help stabilize the financial sector. For instance, in 2020, despite the Emergency Credit Line Guarantee Scheme, the credit available to MSMEs contracted even more, and only 53% of eligible MSMEs secured the loans. MSMEs are being cautious when taking a loan as the overall consumer demand for most products has drastically reduced after the pandemic.

1. Government initiatives

The Government of India has multiple schemes for MSMEs. These include employment generation, providing credit, technology up-gradation, quality certification, and more. There are also schemes for fundraising through traditional industries and for promoting innovation in rural sectors. While these schemes help create the demand for MSMEs, fintech startups are now providing MSMEs with the credit they need to fulfill that demand.

2. Alternative scoring

Fintech companies can use alternative scoring to understand the borrower profile better. They offer crowdfunding, MSME loans, credits, and other lending amenities digitally. Some of the fundamental contributions of fintech for MSMEs include enabling digital payments and easy fund transfers. They also provide platforms for peer-to-peer lending and credit scoring.

3. Fintech capabilities

When it comes to loans, Fintech solutions offer three vital services to its consumers:

- Data analytics: As mentioned before, a deeper understanding of the borrower profile is crucial to avoid NPAs. Calculating and identifying the credibility of a small business helps assess the collateral available. Fintech startups make use of machine learning-based methods to develop this understanding and provide the loan.

- Digital payments: With the advent of a unified payments interface (UPI) and mobile wallets, businesses can now receive payments swiftly and securely. Fintech platforms for payment services also provide additional financial services such as investments and short-term loans – all in a single platform. These platforms are conveniently accessible via smartphone apps. With the widespread availability of affordable mobile internet, MSMEs can now perform transactions and even apply for loans via mobile phones.

- Automated loan application: Many MSMEs lack the know-how of the financial processes needed to opt for a loan. Moreover, the paperwork for loan applications can be cumbersome. Fintech platforms enable faster processing of loans using AI-assisted loan applications. The application procedure is more intuitive and user-friendly. Often these applications are tuned according to the needs of the customer. So, not all businesses have to go through the same stages of verification to get a loan. It allows fintech services to disburse short-term loans immediately. By automating the process, fintech companies also reduce their operating costs. The reduced operating costs enable them to provide loans at lower interest rates.

4. Fintech’s contribution to the formal banking space

Fintech companies help address the funding deficit that exists in this sector. In India, there is already a lack of credit available for MSMEs. It has gone down further because of the pandemic. Access to bank loans is also sometimes not possible because of the challenging verification and authentication processes. Many small businesses do not often have the eligibility to get loans despite the existence of government schemes.

Fintech companies can fill this gap – they can contribute to the formal banking space, credit bureaus and even assist in direct government lending processes. They can provide advanced underwriting services to traditional lenders, such as banks. They can even act as an aggregator of financial products from different providers, providing more choice to MSMEs.

5. MSME business lending opportunity

MSMEs employ over a hundred million people that contribute to around 28% of the country’s GDP. They account for 40% of the exports and 45% of the industrial inputs. The internet has now allowed the sector to connect with global consumers. E-Commerce platforms now have separate programs that enable MSMEs to sell across borders directly without any middlemen. The connectivity that the internet provides also allows MSMEs to procure raw materials effortlessly. Therefore, fintech platforms have a window of opportunity to provide for MSMEs, given the economic condition.

The opportunity for financial institutions also lies in their quick implementation of cutting-edge technologies. For instance, AI-assisted decision-making, advanced data analytics, and technologies like augmented reality and robotics can further help accelerate the MSME lending sector.

MSME Lending Differentiator strategy

Since digital lending is still at a nascent stage in the country, fintech platforms have room to innovate and stand out from the crowd. Here are some of the differentiator strategies for fintech platforms.

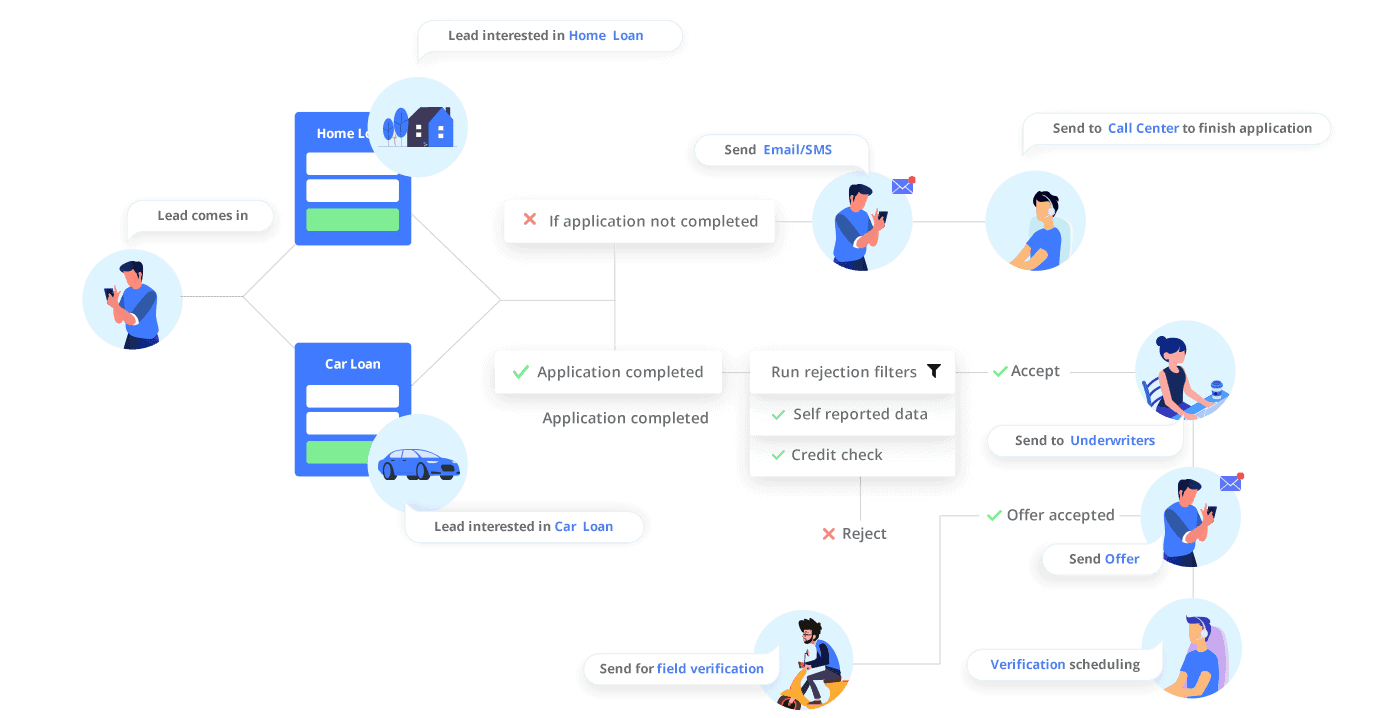

1. Tech-driven customer acquisition and underwriting

The primary issue that banks presently have with MSME loans is understanding if a business is at all eligible for a loan or not. The business loan application process also has a lot of challenges. There are numerous document requirements. Their verification also takes time. Smaller enterprises do not opt for these loans because they may not have all the required documentation.

Fintech platforms can help here by assisting lending institutions understand their borrower profile better. Alternative credit scoring methods can help the unbanked get loans. For example, CIB worked with a ride-hailing service to pilot an alternative scoring method where they used driver rating, their behavior, and customer comments to check if a driver is eligible for a loan or not. Software tools like Lending CRM can help crunch the numbers and smoothen the underwriting process even without all the documents.

“Due to pre-screening automation, we are able to reject files right at the onset. By doing that we are able to improve our main funnel quality by 60 to 70%. Only the quality data moves to the core underwriting process, and our underwriting bandwidth is not getting choked.”

Vaibhav Maheshwari, AVP, Profectus Capital

2. Enabling Peer-to-peer lending

Peer-to-Peer lending connects borrowers and lenders online. Fintech platforms have enabled online marketplace models where borrowers and lenders are matched based on their requirements. Lenders can get an interest rate higher than their bank saving account, and borrowers can get a loan having an interest rate lower than that of the bank.

3. PoS based lending

Fintech platforms can leverage Point-of-Sale card-swipe data to provide credit to MSMEs. For example, NeoGrowth offers businesses short-term unsecured loans monthly based on their PoS machine transactions. They give loans for 18 to 36 months and can go up to INR 50 lakhs. The adoption of PoS machines has increased in India. One of the reasons for the increased adoption is the increased use of digital payments by consumers.

4. Reducing borrower risk

Fintech platforms can use dedicated tools, such as CRMs that can collect borrower data and allow them to build a profile for underwriting. CRMs can segment borrowers based on what loans they have applied for, their credit history, demographics, and more. The software can automatically alert all stakeholders as required and, in turn, reduces the risk of having non-performing assets.

5. Strengthening collections

Fintech platforms can also help lenders with loan recovery. While providing advanced underwriting processes that enable MSMEs to get credit faster, they can also help lenders efficiently collect repayment. Fintech platforms can help financial institutions by improving and automating their workflows, adding collaborative capabilities, and making it easier to provide loans to the traditionally underbanked.

Conclusion

MSMEs make up an essential part of the Indian economy. However, the funding available to these smaller businesses is scarce. Fintech in India is gradually filling the gap and is serving these smaller businesses, enabling them to get loans faster.

If you are looking for digital lending solutions to streamline your operations, check out the LeadSquared Lending CRM tool. It has helped lending institutions disburse loans faster and make accurate credit decisions.

“LeadSquared helps us manage our lending partnerships with banks & NBFCs, and our internal processes across the lending lifecycle (sales, credit, verification & operations) to disburse loans 30% faster than before. Our DSAs are 55% more efficient than before, and all their work is trackable.”

Anuj Sachdev, VP – Product, Qbera

Further reading:

![[Webinar] How University Admissions Have Pivoted Post Covid 5 How University Admissions Have Pivoted Post Covid](https://www.leadsquared.com/wp-content/uploads/2022/04/Artboard-1-80x80.png)