Automated loan processing systems have many advantages over traditional lending processes. Lending software helps in automating the different stages of the loan service cycle. These include document verification, loan processing, and more.

Tradition lending processes have always been cumbersome and time-taking. The loan processing software addresses the drawbacks of the conventional lending process.

For instance, an applicant needs to visit the branch office and fill out the necessary forms. The applicant also has to submit all KYC documents. Then somebody will manually verify the documents against originals. In short – the process would take a lot of time.

Now, this is where digital lending solutions come into play. The digital lending solution is a fast-growing segment in fintech. Allied Market Research projects the market growth of digital lending platforms to reach $19.88 billion by 2026, registering a CAGR of 19.6%. The reason for this growth is the convenience it brings to the lending processes.

Hence, as lenders, it is crucial to digitize operations with digital lending tools. Here are a few ways in which lending solutions can streamline loan servicing.

Reduce loan origination costs

Loan origination is the first stage of the lending process. Lending software eliminates the repetitive manual tasks of the loan origination process. It can thus increase loan disbursal efficiency and deliver better customer experience.

1. Reduce risks and bad debts

A pressing issue in lending is the collection.

Loan servicing software reduces the risk of bad loans. It can help identify critical situations before they take place. The lenders can act and deal with the issue – before they happen, thus saving time and money. With automated lending platforms, such unfortunate losses stay avoidable.

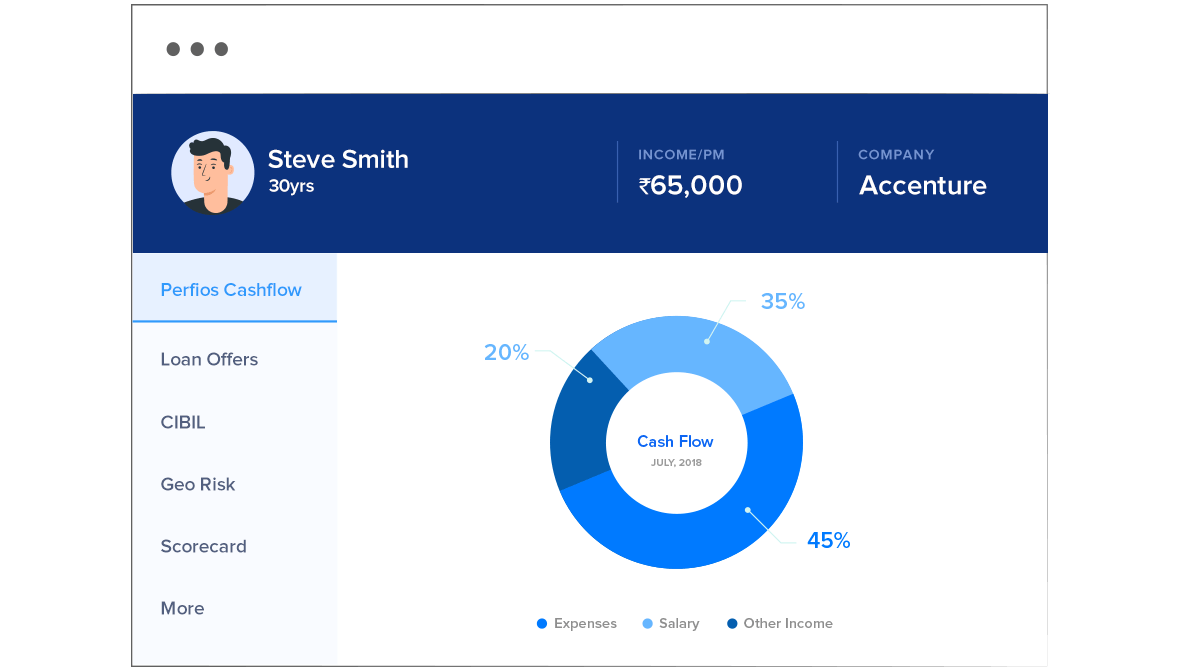

Lending platform can track how the money is flowing, alert borrowers, and enforce late fees. In short, digital lending solutions help lenders in risk management. It also encourages borrowers to make the payment on time.

[Free download: Must-have features in your debt collection CRM checklist.]

2. Automate underwriting and track borrowers

The lending business involves a lot of variables. Keeping track of money can be a tricky job. Therefore, most financial organizations rely on some form of automation. Even for commercial lending, lending software takes care of this. The undeniable benefit that comes with automation is zero calculation errors.

It reduces underwriting efforts as well. It can access relevant data from loan origination systems and other tools and automate the loan offer generation process. With this, you can disburse loans faster.

Good loan process system provides you with all the tools you will need to track your borrowers.

3. Mobile CRM features and e-signing

Lending CRM solutions also come with support for mobile features. It allows the entire loan processing to take place over mobile devices. It is especially beneficial for field sales and collection agents.

Mobile features can include app support, SMS gateway support, and support via phone calls. Your field agents can use the app to feed meeting notes, access tasks assigned, and more.

It can also help plan your agent’s day with route guidance and goals for the day. You can track your agent’s activities with geofencing check-ins and conversation tracking tools. Lenders can also use the app for reporting and analytics.

Furthermore, you can also use the app for e-signing loan documents and KYC verification. E-signing makes both signings and requesting for signature. It also speeds up the application process.

[Resource: A definitive guide on customer verification using e-KYC]

Optimize Operational Costs

1. Improved user and customer experiences

Digital lending software makes organizations much more friendly to users and customers.

The lending platform usually has a separate web-based interface for the customer. Here, the customer can browse products, can apply for loans, or can get in touch with the organization. The customer can also check if they are eligible for a loan.

It is especially beneficial for small business, where time and resources are limited. Managers can automate most of their origination process – freeing human for sophisticated tasks.

The entire process is automatic. The customer can do it from any web-accessible location. Furthermore, the ease of access makes it more likely for the customer to apply for the loan.

Digital lending platforms are scalable and configurable. Organizations can have different application forms for different types of loans.

The applicant can also check their eligibility right when they are filling up the form. Interactive and guided forms help applicants to enter the correct information. Also, the software can check if the applicant has provided valid information. The validation check happens before sharing the Lead information with the sales reps.

All this allows the lender to get the required information much faster with zero error.

Watch latest webinar recording on Transforming Lending: How to ensure a contactless and paperless lending process.

2. Improve collaboration with lending software

With a unified platform, it becomes easier for all stakeholders to stay on the same page. Different departments can have visibility on what others are doing.

Moreover, the borrower can also get relevant information when they contact the organization. Cloud-based lending CRM is even more beneficial when it comes to convenience.

3. Faster and accurate decision making

Automation helps in the customer evaluation process. Lending software removes the repetitive manual steps in decision making.

Although you can execute all the steps automatically, there’s still scope for human intervention. Managers and sales reps can intervene whenever required.

The organization can program their own decision rules. It allows them to approve or decline an application without wasting time. Reps can verify the applicants’ credit information using third-party data services.

It combines predefined rules and the availability of rich data to help lenders make informed decisions faster. Furthermore, document verification happens instantly. No document gets misplaced. It thus allows decision making to be a predictable process.

Reduce Debt collection Costs

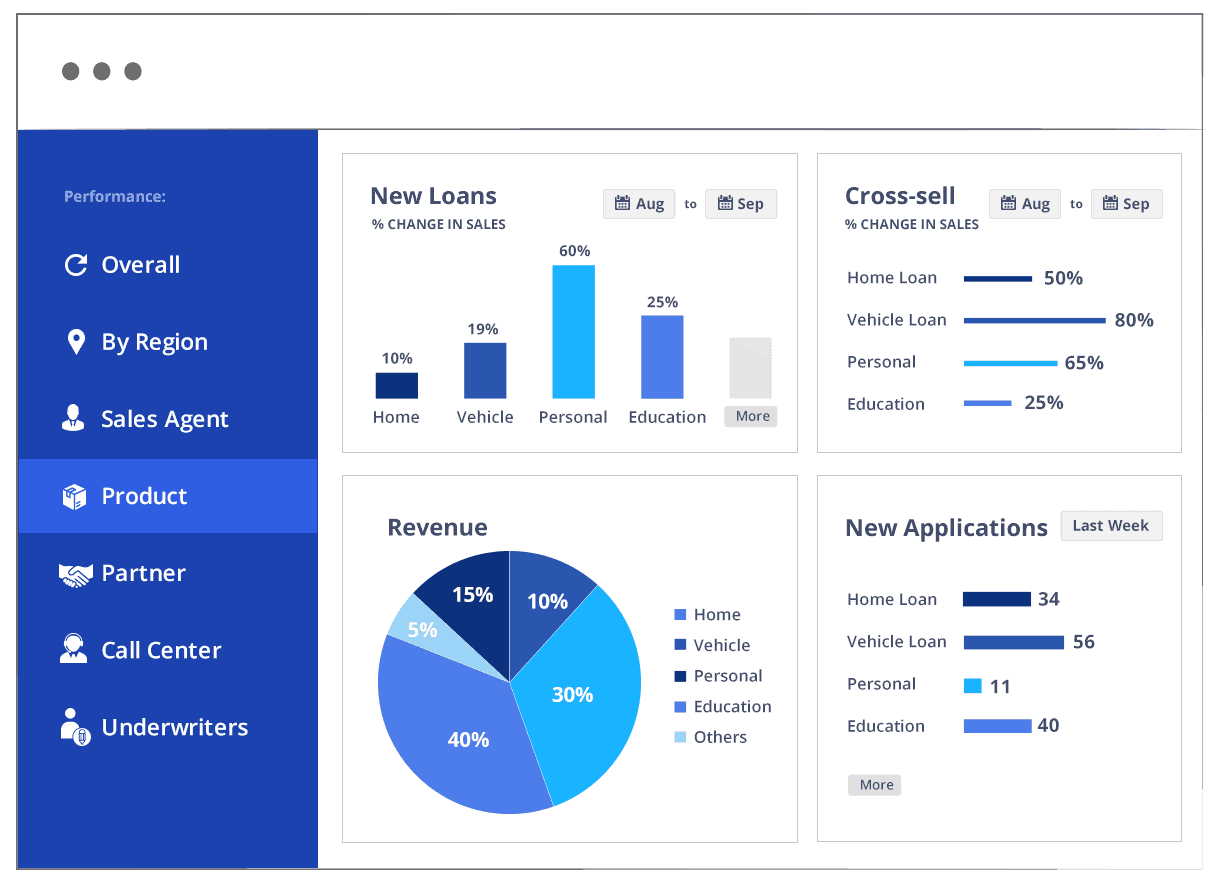

1. Analytics for business improvement

One of the clear advantages of loan management software is analytics.

Digital lending provides an overview of how lending practices are affecting the business. It also helps lenders to dig deep to look at the weaker areas. Analytics serve various purposes. The following are the remarkable ones.

- Since digital lending is not geographically restricted, it can help lenders understand different markets. Lenders can tweak products accordingly based on market needs.

- It can help determine which factors affect loan performance. It allows lenders to select borrowers faster. The lender can also use the data to market loans to a specific group.

- Organizations can reduce risks associated with bad debts using data analytics.

- Analytics can also help reduce the time-taking processes in the loan life cycle.

- It is an essential tool in understanding how a lender can better use the lending platform. Automation improves the efficiency of the organization. Analytics helps in fine-tuning those automated processes for maximum efficiency. In a competitive market, analytics and automation work together to increase revenues.

2. Omnichannel interactions

Omnichannel lending allows lenders to interact with customers over different platforms. Moreover, the lending lifecycle can take place over any platform the customer prefers. Omnichannel lending is different from multichannel lending. In omnichannel, the customer can switch between channels.

Automated lending systems give lenders great flexibility in choosing a platform. Plus, omnichannel allows lenders to push notifications across many channels. The obvious advantage is the reduction of printing and mailing costs.

Furthermore, digital alerts are much more secure. With this, lenders know whether the customer has received the notice or not. Also, it removes the hassle of storing paper documents.

3. Better tracking and transparency

Lending software allows organizations to keep eyes on the ongoing processes.

Digital customer portals simplify customer interactions with the companies as well. An applicant can see the stage of his application.

At the same time, lenders can track customer engagement, application progress, and more. Lenders can see, flag, or verify the documents in just a few clicks.

Any follow-up verification is also effortless as nothing is ever lost. It is much faster than paper-based systems. Moreover, lenders also get a better view of conversion rates and lead sources.

To sum up:

Lending software is the center-piece of digital lending.

Financial institutions can leverage cloud lending CRM tools to speed up their processes. It allows organizations to evaluate and select the right applicants. The organization can underwrite more confidently and notify borrowers instantly. Moreover, automated decision making helps in reducing risk.

Loan servicing system makes the organization more customer-focused. With omnichannel support, customers can use their preferred channel to interact. Lenders can also switch channels without loss of information.

The speed and accuracy of the application process are much better. It also helps reject many applications that do not meet the criteria. It frees up a lot of time for employees and reduces the instances of human errors. Digital lending platforms also have the option of human intervention wherever needed.

Finally, lending software is an advisable tool for improving business processes. It provides thorough reporting and analytics of the entire business. The organization can use this to understand areas where they need to improve.

Further Reading: