Technology has been changing the financial services since the beginning of this decade. Facebook recently launched a digital currency of its own. Google announced a partnership with Citigroup. By the next decade, banking can look drastically different.

But the financial sector that is experiencing a dramatic shift is the lending business. With customers preferring digital-first platforms, financial institutions are scrambling to switch to digital. Also, financial institutions are now targeting Gen Z customers. The user base is now nearly 65 million in the United States (40% of total consumers). Soon, this digital-first population will become the primary customer base for financial institutions and there is no doubt that accommodating the new generation in legacy systems will be a challenge.

The 2022-23 lending trends involved lenders’ focus on matching borrowers’ expectations, leveraging omnichannel, and improving loan origination efficiency. Now, let us look at the lending business trends that will shape the industry in 2024.

1. End-to-end digitization

The most significant trend in lending will be increasing digitization. The switch will not happen instantly but will take place gradually. Digitization will allow banks and financial organizations to streamline their operations. These operations include customer information collection, organization, and analysis.

According to Accenture, over 50% of banking tasks are still manually performed. By using technology, banks in North America can save more than 70 billion USD through 2025. Automation can assist existing employees and increase the efficiency of financial organizations. Tech companies will also delve deeper into financial services. Automated platforms offer faster and more consistent credit approval. By using digital lending platforms, loan servicing takes much less time, and organizations can make decisions faster.

For starters, having the customer profile digitized is essential for easy access to customer information. Often, delays occur when relationship managers do not have access to relevant information. Having digital customer profiles also solves the issue of inconsistent or missing data.

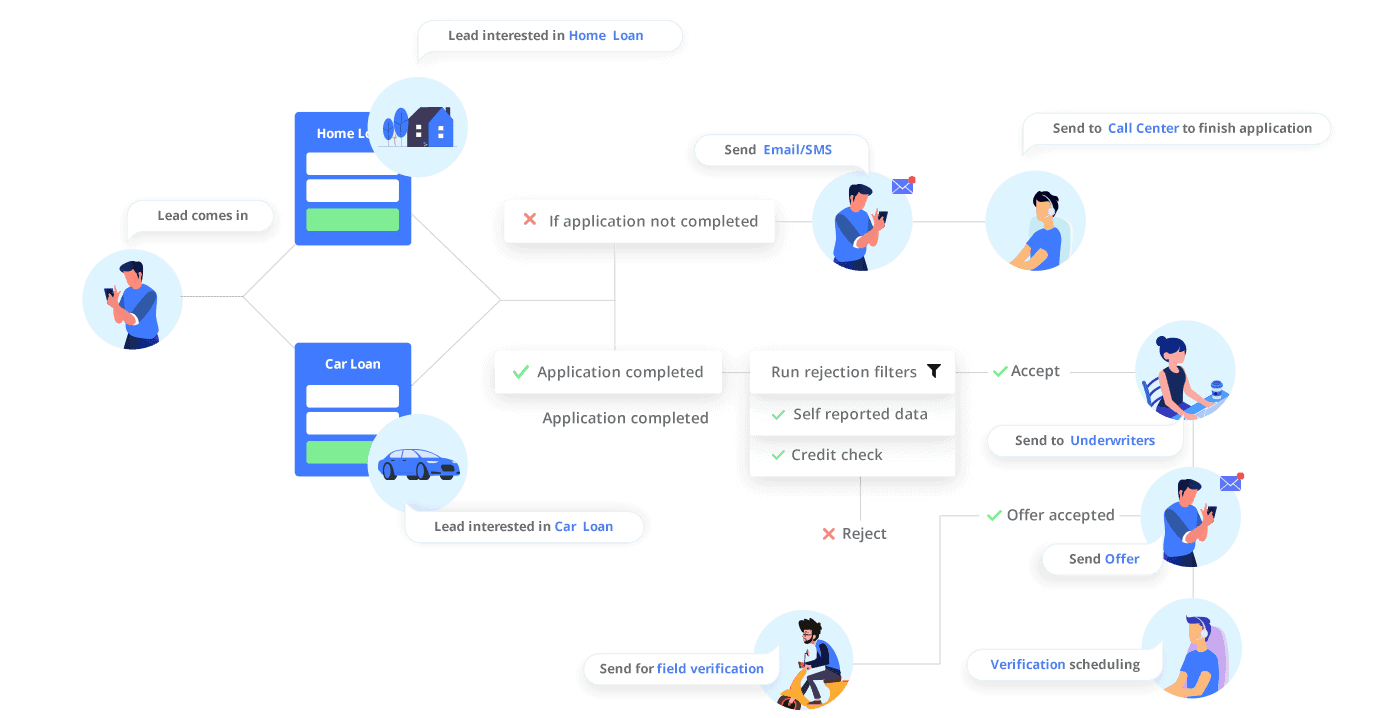

Businesses can implement this using online application forms. This method is something younger generation will also prefer. All the relevant customer information, including their financial history, will be centrally stored. The entire credit team will have constant access to customer information. Thus, it will reduce delays in processing loans. Loan processors can use the information to sync up data from third-party firms.

Loan approval is one of the biggest bottlenecks in the lending business. Moreover, because of inconsistency in information between teams, errors are unavoidable – increasing business risks. Digital lending software provides an automated solution for the entire team. Digital platforms also provide a unified dashboard that keeps everyone on the same page. The dashboard will help lenders monitor customer interactions and reduce risks. Digitized solutions also provide back-end functions such as intelligence and analytics.

2. Switch to integrative microservices

Loan management is still a paper-intensive process. Since accuracy is crucial in this business, a lot of manual labor goes into verifying documents. All steps – from loan application to disbursal and collection, involve manual work. The lending businesses that still rely on these legacy systems will need an extra push to digitize their operations.

For customers, digitization will bring convenience. They can apply for a loan with a few clicks. Lenders will also need to increase their response time by adopting automation. But automation may not always provide the desired outcome. In some cases, lenders may not get the results they want. The rush to replace legacy systems might cost them more in the long run. For this, the solution is to use integrative microservices. It allows lenders to digitize their operations at their own pace. The latest trend is cloud-based microservices. Companies can add these services as modules one by one. This system allows businesses to adapt to regulatory changes too.

For example, LeadSquared Lending CRM comes with pre-built integrations and data-exchange APIs to connect with multiple third-party apps like LOS, CIBIL, Experian Hunter, Perfios, NetBanking Connect, and PDF Statement Analyzer, to name some. It thus provides a one-stop solution to disburse loans faster.

3. New business models

Collaboration between banking and big tech has gained traction recently. Banks have been partnering with fintech for various services. For instance, NIBC bank is using the services of Oaknorth for credit analysis. It is an example of a collaborative model. Similarly, there exists a Point of Sale or POS transaction model. In this case, merchants can accept money using swipe machines. The aggregator model provides the consumer with all the lending options available. The peer-to-peer model allows consumers to borrow from many lenders who are willing to lend simultaneously.

[Also read: Retail lending – market opportunities and differentiator strategies]

4. Improved credit scoring systems

The credit scoring systems of traditional banks are not suitable for SMEs. There is a lot of overhead with conventional scoring systems. SMEs often do not get access to credit because of this system. Some issues include extensive documentation, high-interest rates, and long decision-making times. Now, Fintechs are providing an alternative scoring system. They use data-driven models along with bank details.

These data points include:

- Personal data, such as age, name, contact details, bank credit score

- Businesses data like cash flows, bank account statements, financial statements, and POS transactions

- Behavioral data, such as psychometric tests and spending patterns.

Fintech also uses other data points, such as education level, degrees, and occupation. These alternative methods improve the accuracy of data-driven automated models. It eventually reduces the time and cost of servicing a loan. Thus, end customers can get funds with minimal effort.

5. Increased collaboration and partnerships

Lending and Fintech partnerships will grow in the coming years. Lenders are willing to pair up with data providers, third party processors, and technology companies. The tie-ups will enable organizations to digitize their operations.

Moreover, Financial organizations will rely on the products and services from tech companies. The offerings include digital signing, fraud checking, credit scoring, ID verification, and video KYC. It will reduce manual labor to a great extent.

Technology will also replace numerous roles in the lending business. Organizations will have to restructure. Employees will have to upskill or reskill as lending will become more algorithmic.

6. Increased availability of small ticket loans

Not everyone is fortunate enough to get financial aid in times of need. Banks often do not entertain small loans because of high underwriting costs and smaller profit margins. In the present economy, millennials often have little or no credit history. Therefore, these young adults often borrow from friends and family when they need financial aid.

Now, this is where the new lending businesses are coming into the picture. Fintech lending companies are offering “buy now pay later” loans. Consumers can get a product they want without having to fill out an extensive form. Moreover, these loans often have a zero-interest rate, and borrowers can even replay these loans as installments.

7. Self-service and omnichannel capabilities

Borrowers can now get funds without having to visit the branch offices. Digital lending processes are chiefly self-serviced in nature. From applying for the loan to getting funds, the entire process needs little to no manual intervention. Customers will barely have to interact with the lender unless required. This automation also relieves the employees of redundant work.

Furthermore, digital lending also supports omnichannel communication – meaning that the customer can use any channel of their choice. They can communicate using the website, the app, text messages, or even social media platforms. Self-serve portals make lending businesses much more customer-centric.

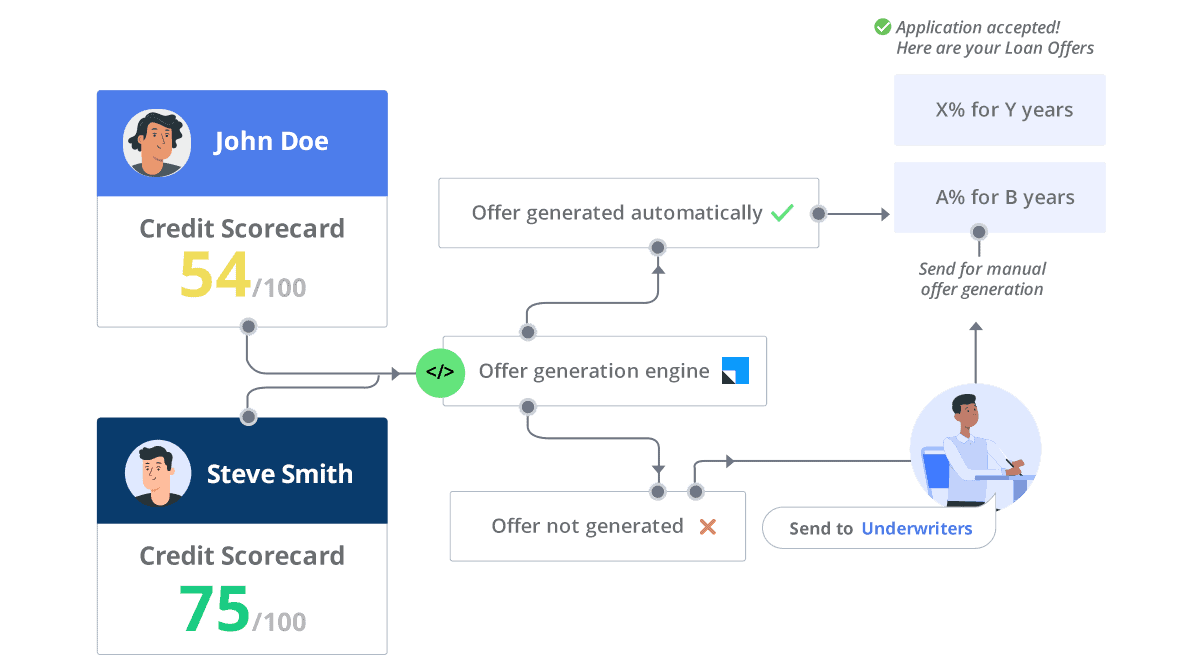

8. Increasing use of ML and AI in lending business processes

Machine learning and artificial intelligence are at the core of fintech. As ML and AI are progressing, fintech is incorporating them into more segments. Lenders are leveraging this technology to automate complex processes. Most of this is back-end work. ML and AI can help in checking for frauds, credit scoring, and automated loan offer generation.

We will see more applications of AI in the lending segment in the coming years.

9. Incorporation of Blockchain technology

Blockchain has been a groundbreaking technology for finances. The initial application of blockchain revolved around cryptocurrencies, but now it is helping improve financial products. Simply put, it is a shared, encrypted database – a distributed ledger. It makes the banking process faster and less bureaucratic. Blockchain is assisting in:

- Accelerating the loan approval process

- Tracking and managing loan payments

- Providing data on real-time transactions

- Connecting borrowers with private lenders

- Giving borrowers more control over the loan

10. Improved customer-centric practices

While traditional banking has reduced in-person communications, new-age lending businesses need zero. Consumers can interact with a simple digital interface. Mobile banking has already seen a massive increase. In the US, over three-quarters of the users prefer mobile baking. The digital interface is not just a form with menus and buttons. It can also be an intelligent and interactive chatbot. Customers no longer have to wait for human representatives to be free when they need help. It also reduces the workload of the employees without compromising on the quality of service.

Lending Business Trends 2024: In a Nutshell

Data and technology will dominate the future lending industry. Both consumers and financial institutions are embracing the change. Lending offers many opportunities in the current market. It is now more important than ever to improve the borrower experience. Complex compliance issues and regulations are here to stay, but digitization can simplify the process. To compete in 2024, lending businesses will have to digitize the loan lifecycle.