Home loan interest rates are at a 16-year low. Over the past year, banks and NBFCs have been competing to become the most attractive option. For example, Kotak Mahindra Bank is offering a 6.5% interest rate on any loan amount, one of the lowest rates in the industry right now. HDFC recently reduced its rates to 6.7%. PNB Housing slashed its home loan interest rates to 6.65%. But why is the Indian home loan market undergoing a frenzy competition?

A simple answer is housing finance companies want to improve homebuyers’ confidence. The coronavirus pandemic has caused economic instability, and as a result, many prospective customers shelved their plans for buying homes. But now, as the situation is improving, the demand has started to surge again. According to Anarock, real estate sales have risen 93% YoY in Q2 of 2021, and sales across many cities will grow faster. Additionally, corporate credit growth has stalled for many lenders (especially the banks). So, these Financial Institutions have turned their focus on retail home loan products. Home loan is a secured product, making them safer than any unsecured products in case of any delinquencies.

According to Amit Gupta, VP of ICICI Securities, banks have added nearly ₹1,25,000 crores in new home loans to their loan books in the past 12 months.

What is the broader customer acquisition strategy?

To acquire more borrowers in this competitive environment, various lenders are making their offerings more attractive through:

- Lowering interest rates

- Not charging processing fees

- Introducing doorstep services

- Increasing the flexibility of repayment plans

But over the last year, lenders have realized that digitizing the borrower journey is the key to better customer acquisition rates.

This article covers the insights from a discussion between leaders of the home finance industry – Mr. Ram Naresh, CBO, Aavas Financiers, and Ms. Jyothirlata B, CTO, Godrej Housing Finance, where they discuss the emerging pockets of opportunity for lending businesses. They also share their outlook on how a digital lending journey can vastly enhance the customer experience and improve conversions.

You can watch the webinar in its entirety or read the takeaways below.

State of the home loan market in India

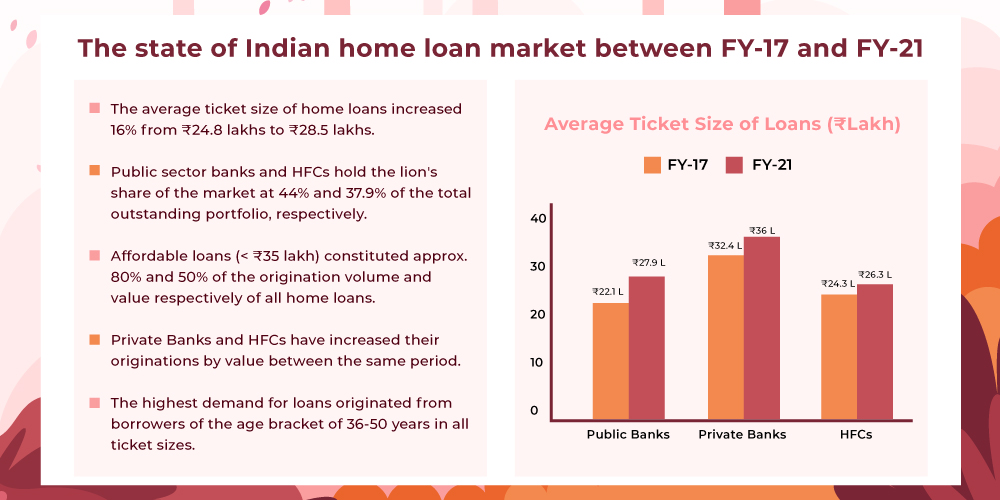

Before we move on to the discussion itself, let us observe the growth levels in the current home loan market. A new report by CRIF Highmark sheds some light on the current status of the industry.

At the end of FY-21, the outstanding loan portfolio of home loans in India stood at a whopping ₹22.4 lakh crore, growing 12.1% since its size in FY-20. Also, between FY-17 and FY-21, the Indian home loan market grew by 32% CAGR.

Experts believe the market will show strong growth levels, nearing 22% CAGR between 2021-2026. And one segment that may drive these growth levels is the affordable housing market.`

So, let us peer into the concept of affordable home loans and find out why they could be the focus for many home loan businesses.

Affordable Housing Finance in India

If you look beyond the top 50 towns, more than 100 crore people reside in the rural segments. With nearly 20 lakh retail loans in this segment, the penetration of home loans is <1% that shows massive untapped potential for new home loan businesses.

Ram Naresh, CBO at Aavas Financiers

The biggest problem for the affordable home loan segment has been the credit outreach. Many credit institutions find it difficult to access these customers because many borrowers beyond the top 50 towns are unaware of their eligibility to get loans. But all that is changing slowly. The home loan market is experiencing an enormous opportunity due to increasing internet and smartphone penetration. Between FY-20 and FY-21, affordable home loans showed a YoY growth of 8%, reaching ₹13 lakh crores in portfolio size. Hence, many existing and new market players are eyeing the profit pool that this segment holds.

But, since the profitability margin may initially be low, operating in this segment can be tricky.

Lenders can either opt to cut their cost of borrowing through digital or merge with other home loan businesses to access a bigger pool of prospective customers.

Jyothirlata B, CTO at Godrej Housing Finance

This indicates that digitization is integral to operating in the affordable housing loan segment. Hopefully, in the next few years, the market will see the rise of many new players in this segment. Additionally, the rising competition can also pave the way for partnerships, especially with Fintech.

How can digitization improve new customer acquisition?

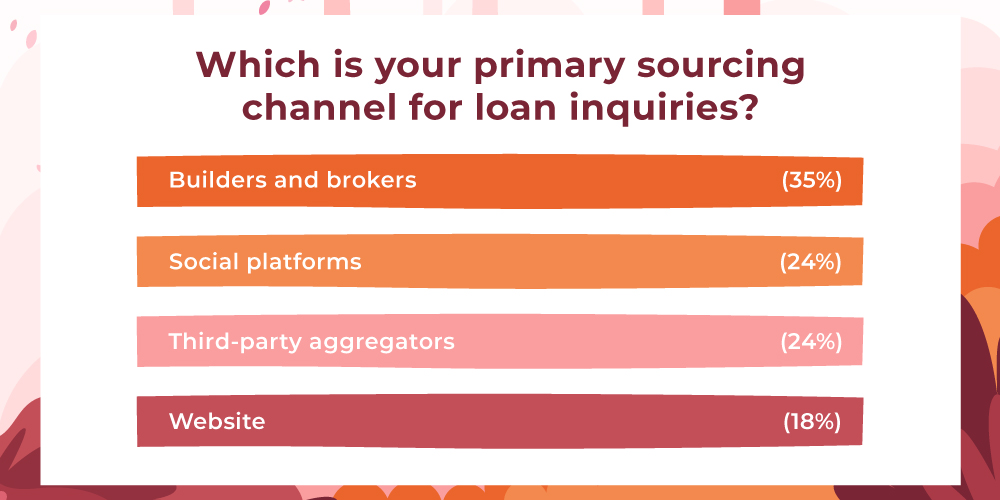

During the pandemic, the need for accessibility shaped various aspects of the industry. It led to a shift in customer preferences, pushing lenders to focus on digital sources of acquisition.

A couple of years back, we were doing zero business through digital channels, but today, approximately 45% comes through our website. So, these digital channels are changing pretty fast.

Ram Naresh, CBO at Aavas Financiers

According to a LeadSquared survey, nearly 42% of home loan businesses stated that the majority of their new inquiries come from digital channels. Hence, lenders need to accommodate digital-savvy borrowers and build convenient journeys for them.

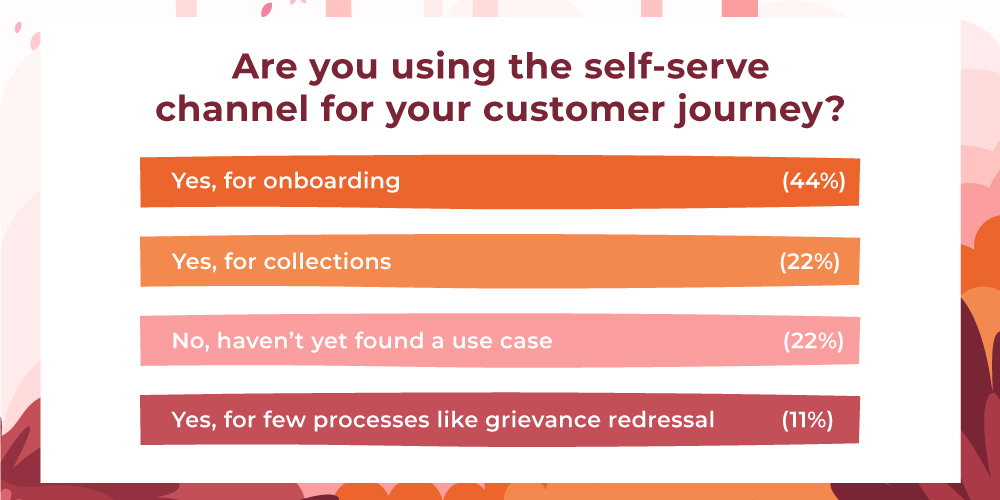

Self-Service on the rise

Transitioning to self-serve application portals is another way of adding accessibility for the customer. Customers can fill their applications at their convenience, thus enhancing the experience. Due to their digital nature, the document collection process also becomes highly simplified. On the other hand, lenders can track the application journey for their prospective customers and reduce the chances of drop-offs significantly. Based on another LeadSquared survey, nearly 44% of the lenders have already employed self-serve forms in their customer onboarding journeys.

Measuring creditworthiness

There were not many fintechs a few years ago, and everything used to be dependent on your credit underwriter, how good your credit underwriting person was. Overall, it was a highly subjective process. But now, we are getting a lot of data, and AI/ML technologies are making it possible to score customers with higher accuracies. With this, the area of credit underwriting is really evolving.

Jyothirlata B, CTO at Godrej Housing Finance

Earlier, identifying the creditworthiness of a customer was a judgment made by underwriters. But today, lenders can use thousands of data points to analyze bank statements through cutting-edge algorithms.

Additionally, with evolving digital infrastructure of the country, lenders can leverage various services such as Digi-locker, e-KYC, Account Aggregators, OCEN, and more to understand the customer better.

Shorter and convenient journeys

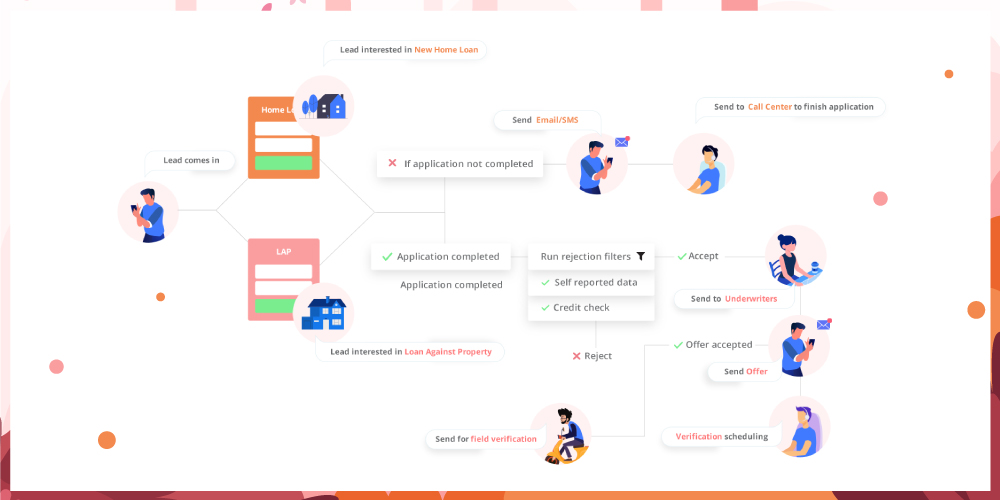

Longer borrowing timelines, disparate systems, and disconnected touchpoints were very challenging for lenders. With the increasing demand, this meant the loss of many prospective customers due to inefficient processing.

Stages in the origination process such as sourcing, verification, cash flow underwriting, sanctioning, and disbursement are often processed in silos. Due to this disconnect, it becomes very difficult to manage data, and leads go for a toss. This mismanagement only increases the loan disbursement timeline and results in poor customer experiences. Therefore, lenders need a platform that can help visualize different stages of the loan journey by connecting operations. A digital lending platform can improve the overall process efficiency.

Reducing TATs and increasing sales efficiency is the priority for 53% of the lending business professionals. Whereas improving customer experience is the prime focus of 32% of lending professionals. Digitization of the loan processes can help lenders achieve both.

I think digital is the way forward. Lenders must learn to leverage the power of process automation as it improves accessibility to several aspects of the loan journey – for both agents and customers.

Ram Naresh, CBO at Aavas Financiers

How can LeadSquared Help?

We are using Leadsquared for sourcing, and it adds a lot of value in the complete digitization of your lead management process, up until the beautiful analytics that we get from it. It will really improve your lead conversion.

Jyothirlata B, CTO at Godrej Housing Finance

Loan origination and collections platforms like LeadSquared can integrate all lending processes and supercharge the sales efficiency.

LeadSquared gives you many capabilities such as:

- Ready to deploy API Connectors for sourcing leads from all your channels.

- Portal Builder with integrated Self-Serve forms for improved onboarding experience.

- Pre-screening functionality with checks such as Aadhar, PAN, CIBIL, Experian, and more.

- Automated underwriting capability to generate home loan offers to customers.

- A Workflow Builder to create highly flexible and agile borrower journeys in just a few clicks.

- An intelligent Cross-sell/Up-sell engine to identify customers in need of loans and offer relevant products/packages to them.

- Rich data analytics and reporting to help make strategic decisions.

- A robust Collections Platform that can help you maximize your collections efficiency.

To understand how LeadSquared can help you make your home loans future-ready, take a demo now!

FAQs

Launched in 2020, OCEN (Open Credit Enablement Network) is a digital layer that will allow loan service providers such as Fintech companies to synergize better traditional NBFCs and Banks. Most lenders have their custom parameters for evaluating creditworthiness. OCEN will help standardize data from individual lenders so that any NBFC or bank can utilize it to measure creditworthiness more accurately. It will reduce the overall cost of acquisition for many lenders and significantly improve financial inclusion.

Account Aggregators (licensed as NBFC-AA) are a new set of market players that will enable borrowers/businesses to share their data with lenders more easily and securely. Borrowers can choose to share their data with any AA, and any lender that has partnered with the same AA will have access to the customer data. The AA initiative aims to facilitate faster journeys while cutting borrowing costs and improving the accuracy of the credit evaluation process.