Imagine this, you’re a professional racing driver. So, you’re going to be constantly thinking of ways you can be efficient with your resources, increase your speed and maximize your results much ahead of the next race. Apply this in the context of the lending sector, financial institutions like banks and NBFCs are always pivoting towards better, faster, and smarter ways to fast-track loan disbursals. While there are many aspects involved in simplifying loan disbursals, we’re kicking this roundtable off with a very crucial aspect- credit decisioning.

Key Discussion Points

- How we’re breaking the myth of the perfect credit score

- Ways in which loan origination systems can help lenders make informed credit decisions and streamline loan disbursals

- The role of data to make credit decisions inclusive and improve access to credit

- The impact of soft factors like educational background, employment stability, etc in credit decisioning

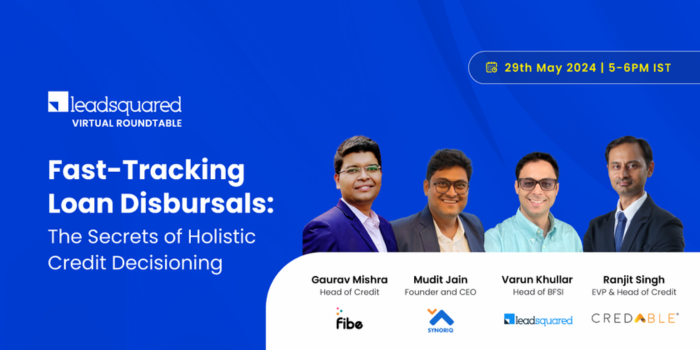

Ranjit Singh

EVP & Head of Credit – CredAble