Digital lending solutions enable financial institutions to provide loans online and automate their processes, right from loan applications to disbursal and everything else in between. From a simple online loan application form to a complete digital lending suite, you can find a solution for every aspect of your business. 93% of FinTech SMEs prefer to find a technological solution wherever possible (EY Global FinTech Adoption Index 2019).

While you can find several solutions catering to the lending sector, it is essential to be clear about prevailing trends, relevant technologies, and most importantly – what your business needs.

In general, a digital lending platform should be robust, scalable, and should support multiple channels. But at the same time, it should make your operations more efficient through automation solutions and a collaborative environment.

We have consolidated the points that make a digital lending solution fruitful.

Support for omnichannel lending

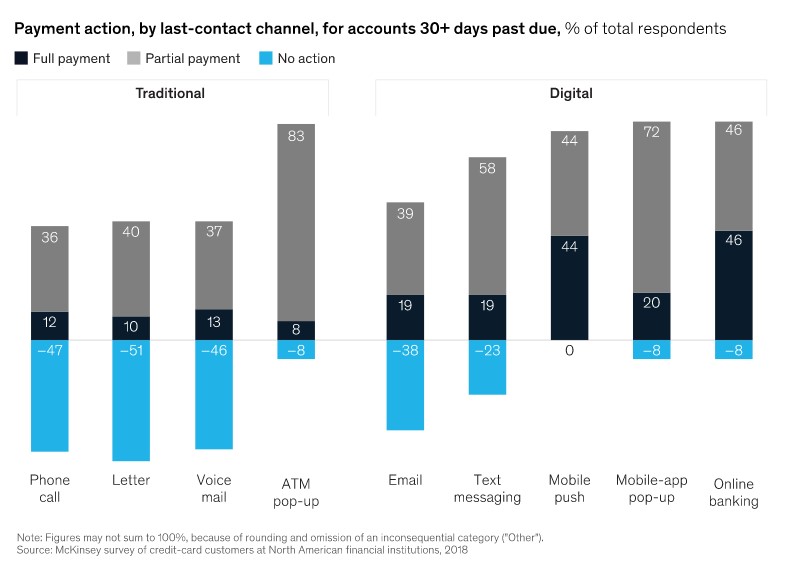

Today, customers prefer text messaging, email, and mobile channels for contact. According to McKinsey survey of credit card customers at North American financial institutions, 65% of issuers initiated contacts through traditional channels like phone, voice mail, and letters in 2018. The response rate was terrible and could have achieved 89-92% payment rates by using digital channels like online banking or mobile instead.

Omnichannel solutions are different from multi-channel solutions. In multi-channel solutions, the business considers only selected channels, and each channel operates independently. Omnichannel lending essentially connects several platforms and channels. It focuses on consumers – providing them with a seamless and personalized experience. An omnichannel lending platform unifies all the platforms enabling lenders to access borrowers’ information from anywhere. It also creates more opportunities for business through targeted and meaningful interactions. With omnichannel, customers are less likely to abandon the application and recovery responses.

Omnichannel lending also improves customer experience. It allows the customer to choose their preferred medium for contact. Whether a customer interacts with the business on social media or speaks to a call-center agent, every business representative will be on the same page about the interaction.

For a lender, omnichannel lending platforms provide several advantages. With multiple channels consolidated, the reporting is much more thorough and detailed. It provides transparency across all channels and puts all the teams on the same page. It can also show which channels are performing better and where to focus more. In short, omnichannel lending saves a lot of sales reps’ time by making communication more fluid. Plus, in an omnichannel approach, closing deals take less time.

Borrower life-cycle management

The traditional loan management system suffers from numerous bottlenecks in terms of managing borrowers. From loan origination to disbursal and recovery, lenders need to maintain updated borrower profiles in their system. Many companies still use calendars and spreadsheets for borrower data. Such manual processes make the operations extremely inefficient.

Some of the drawbacks of this process are:

- Delay in loan approval due to manual tracking

- Ambiguity in decision making because of inaccurate or incomplete data

- Human error during data entry or maintenance

- Time-consuming process because of repeated human intervention

- Difficult to aggregate information from various stages of the borrower journey

- Inefficiency in collecting borrower data from other resources

- Outdated borrower information

Borrower management is essential to address the above challenges. Digital lending solutions provide complete support across the borrower’s life cycle. Lenders always check the applicants’ credit score before processing their application. Digital solutions for lending also incorporate scoring mechanism by fetching borrower’s details from Experian, CIBIL, Equifax, and TransUnion, to name some. Lending-specific CRM (Customer Relationship Management) software or LMS (Lead Management system) allow pulling information from these sources and organize them for future use.

Next, documentation is a crucial part of any lending process. A digital lending system puts all the data in a secure and centralized system. This data is accessible to the sales reps, call center agents, field agents, and other stakeholders whenever required.

Learn more about field force management software.

Loan automation

A loan origination process typically involves 7 stages:

- Pre-qualification: at this stage, a potential borrower needs to submit a list of documents to qualify for a loan. It includes employment information, household income, tax returns, payment history, and bank statements.

- Loan application: here, the borrower needs to fill in the application form to apply for a loan.

- Application processing: at this stage, the lender verifies the borrower’s information, tallies his credit score, validates his ID, and more. A representative from the Lending organization contacts the borrower in cases of an incomplete application.

- Underwriting: keeping credit score, risk score, repayment duration, and other details in account, the lender proposes a loan amount and interest rates to the borrower.

- Credit decision: this is a stage of mutual agreement between a borrower and a lender for a loan. If the borrower agrees to the underwriting terms, the loan can be processed.

- Quality control: it is important that lenders follow internal and external regulations when it comes to consumer lending. This stage acts as a final check before loan funding.

- Loan funding: this is where a borrower receives the amount against a specified rate of interest and repayment duration.

When it comes to loan servicing, cost containment is a priority. Over time, loan servicing costs have increased. Modifications in compliance also lead to increased loan servicing costs. Lenders are switching to digital solutions to automate processes and reduce errors. Automation solutions are a must-have for lending enterprises to optimize operational costs.

Learn how to get started with a digitally-assisted lending journey:

Employee productivity:

Employee productivity is also of utmost priority for financial institutions. In lending, a lot of the process is dependent on manual data input. For instance, a loan application requires a signature, supporting documents, and ID verification. Companies usually have many departments to handle records, manage borrowers, and other aspects of the loan. In such systems, discrepancies in the process are imperative – leading to inefficiency and chaos.

Using automated systems can speed up your processes. With solutions like self-serve applicant portals, the process becomes effortless for both – lenders and borrowers. Furthermore, the digital lending platform can also configure the application process as needed. A digital solution can pre-fill many data fields for the applicant. It makes the application process effortless. The system also validates the data in real-time – making digital more accurate than manual methods. With a digital lending solution, the application process becomes much simple. Organizations can use signatures and video KYC for applicant verification. It eliminates the need for the borrower to visit the lender’s office.

Better collaboration

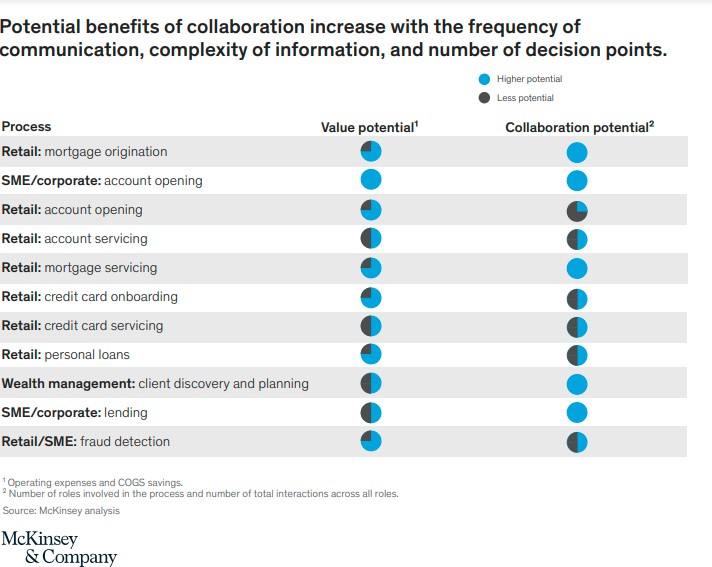

Digital lending solutions provide the tools needed to keep everyone on the same page. Traditionally, financial institutions had disconnected departments for each task, and team members were not aware of any business updates. With a digital lending solution, everyone stays informed. It encompasses the entire lending ecosystem. From loan origination to recovery, every stakeholder is in line with the processes. Furthermore, it also helps maintain the transparency needed in these cases.

For example, in the United States, a typical mortgage process takes about 46 days and costs the originating bank about $2000 to $2500 per loan. The delay is often due to a lack of collaboration among the stakeholders. Digital collaboration can bring significant improvements to the loan origination process including:

- Reducing cost per loan by 10%

- Reducing loan processing time by 15-40%

- Improving underwriting efficiency by up to 60%

Third-party integrations

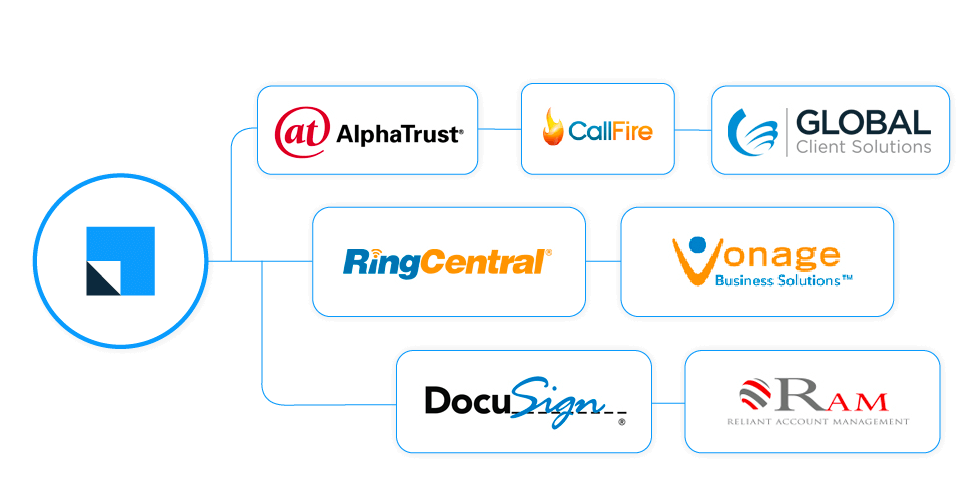

Even though fintech products have massively improved our lives, they have not done so alone. Most fintech services often rely on third-party services for individual processes. For example, lenders commonly integrate payment gateways for loan disbursal and recovery, Zapier integration to connect to several online services, Call Rail integration for tracking phone calls, to name some.

Building a new feature or a service from scratch can take a lot of time. While using a Third-party service and integrating it with the existing solution is necessary, it is also relatively easy.

When it comes to third-party integrations, data synchronization is at the core. Whether it is a customer data or business data, systems need to ensure that a change made in one place reflects appropriate information changes in all other instances.

Another advantage of using third party APIs is that it makes the system modular. A lending solution has multiple components – each with a specific function such as application process, data aggregation, analytics, etc. Other modules may be ones managing advertising and communication. If needed, they can be easily modified or switched. So, for example, one can implement an application for policy change by modifying just one module. Lenders need not change the entire system – ensuring that the core software stays clean and bug-free.

Decision-ready analytical dashboards

Digital lending systems offer a complete business overview via analytical dashboards. You need not depend on spreadsheet-based reports. Digital lending systems have built-in reporting tools that provide interactive and visual reports. They also let the lenders delve into the finer details. It helps the managers make better decisions that could otherwise be difficult. Advanced analytics allow the lender to understand team performances and existing bottlenecks. Managers can use this information to devise strategies to keep operations efficient. In short, when the right information is available at the right time, businesses can make better decision. With the help of analytical metrics, organizations can remain flexible and orient themselves according to the market needs.

Conclusion

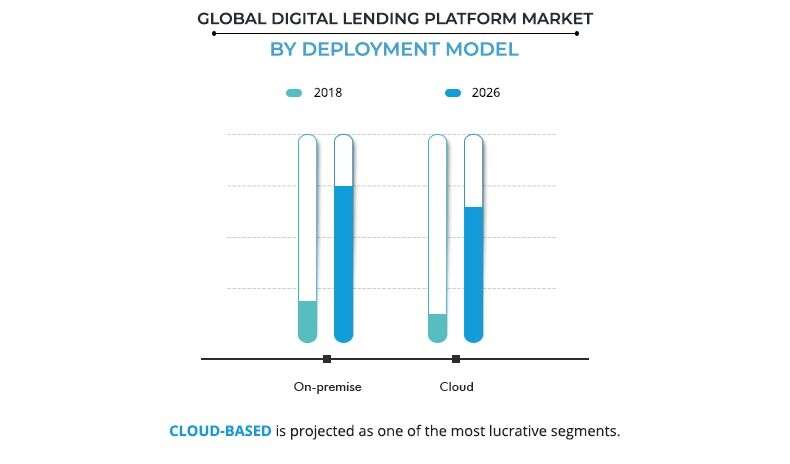

Lending requirements have evolved and to stay relevant, financial institutions need to go digital. Digital lending platforms provide end-to-end solutions for organizations of various sizes. According to the Orion Market Reports, by 2026, the global Digital Lending Platform market size is expected to touch 5333.1 million USD. As per Allied Market Research, cloud-based lending solutions will see higher deployment rates over on-premise solutions.

In cloud lending solutions, financial organizations can scale functionalities based on their requirements. This, in turn, increases the profits of the organization by reducing the time and expenses. Digital solutions for loan management also eliminates the friction associated with team management.

To sum up:

- The support for omnichannel lending makes it easier for agents/reps to stay in touch with customers.

- Detailed analytics help managers and team leaders make data-driven decisions.

- Digital lending systems also increase efficiency through automation. Automation not only reduces the time needed but also the chances of human errors creeping in. Moreover, it also reduces the servicing costs of loans.

- Digital lending systems supporting third-party integrations. This not only makes the system modular but also lets the lender leverage the best tools for any process. Decision-makers can add, change, or remove functionalities as needed.

- Finally, digital lending platforms also provide in-depth analytics for the organization. It also facilitates a collaborative workflow, keeping everyone on the same page.

If you are looking for a solution to automate your lending and recovery process, you should definitely check out LeadSquared lending CRM.

Lending Solutions FAQs

u003cstrongu003eWhat is loan management system?u003c/strongu003e

A loan management system is a digital solution to manage borrowers, automate loan processing, and recovery.

u003cstrongu003eWhat are the types of lending?u003c/strongu003e

The three main types of lending are-u003cbr/u003e1. Mortgage lendingu003cbr/u003e2. Direct lending (banks and credit unions)u003cbr/u003e3. Secondary market lending (Fannie Mae and Freddie Mac)

Further reading:

- How GPS Tracking for Sales Reps Improves Sales Performance

- Video KYC solution to onboard customers and partners remotely

- What is field force automation?

- What is sales process automation?

- How debt collection software resolves recovery automation?

- What is cloud-based CRM and how does it benefit your business?