For several small businesses, managing positive cash flow is the biggest challenge. Credit businesses cannot function efficiently without having enough cash at hand. It often leads them to a sea of frustration. It can also go to a whole new level when businesses find themselves chasing customers.

Every business has customers who cannot repay, will not pay, or will disappear when the payment is due. Therefore, it is crucial to have a strong debt recovery strategy. It will help your small business with a steady stream of revenue, thus, ensuring your business can seamlessly conduct their day-to-day operations.

In this article, we will discuss strategies for debt collection for small businesses. Let us get into more detail and discuss how you can improve your debt collection process.

Debt Collection for Small Business

Small businesses don’t always have time or resources to spare for secondary operations. Since they have a smaller team size, they cannot neglect operational efficiency at any cost. Therefore, debt collection for small businesses requires a targeted strategy. Of course, reducing the costs can be your concern, but maximizing the utilization of available resources remains the primary goal. The following are the nine most efficient debt collection strategies for small businesses.

1. Automate Communication to Debtors

Creditors need to contact debtors several times to settle an account balance. However, the Fair Debt Collection Practices Act (FDCPA) imposes strict communication guidelines on collectors. It restricts the time, place, and number of contacts between creditors and debtors. Debt collectors can contact borrowers through phone, letters, email, or text messages but only within the prescribed time. Not following these regulations may encourage a debtor to file a lawsuit against the creditor.

Automating communication with debtors is a great way to make debt recovery easier.

The Collections CRM software from Leadsquared that can automate the communication process and streamline the associated tasks.

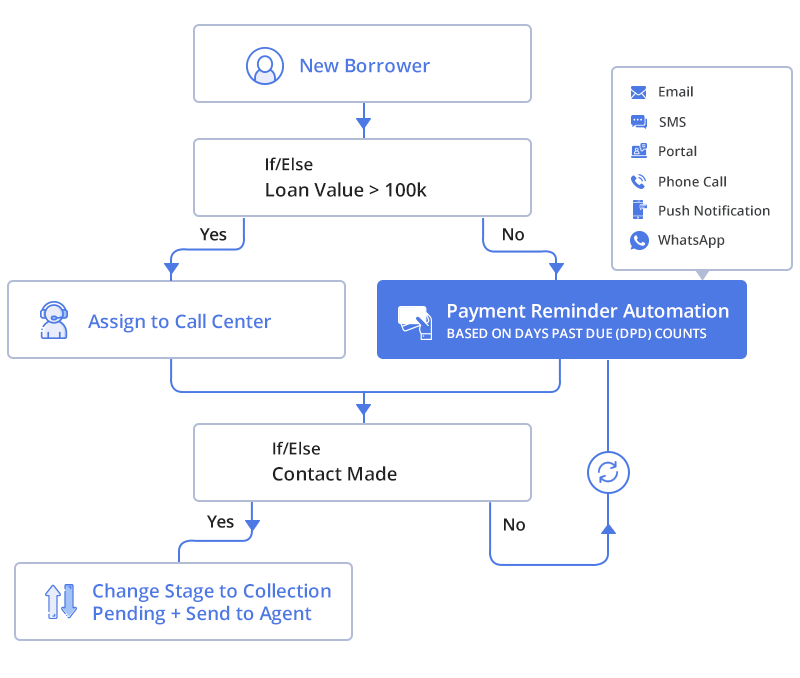

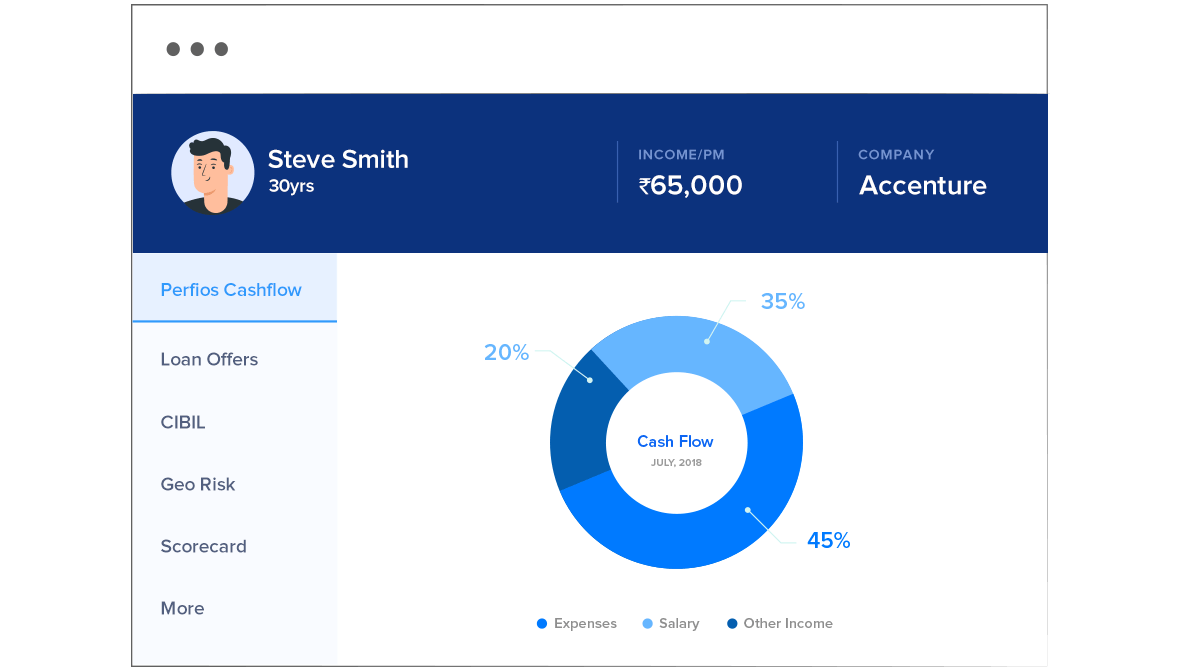

The debt collection software helps you in segmenting borrowers depending on several factors. These factors include kind of debt, repayment history, financial status, and much more. Based on this information, you can maintain relevant communication with debtors.

Sending payment notification to customers will ease debt collection for small businesses. Using the software, you can send messages to borrowers through SMS, mail, and other communication channels. Moreover, lenders can also integrate a payment link into the messages sent to borrowers. It will allow them to make the repayment instantly.

2. Adopt a Multi-channel Contact Strategy

Lenders can achieve their goals faster through digitization of the debt collection process. Businesses can record the contact preferences of borrowers during application processing.

Of course, digital channels are the most efficient way to contact borrowers today. However, you must include behavioral segmentation and contact preferences in your strategy. It is because a customer-sensitive contact strategy will help gather responses much faster. Leadsquared collections CRM software allows you to communicate through several channels. These channels include Email, SMS, Phone Call, Push Notifications, Portal, and WhatsApp. Thus, allowing you to deliver messages to the customers through their preferred channels.

3. Categorize Borrowers and Define Collection Strategies

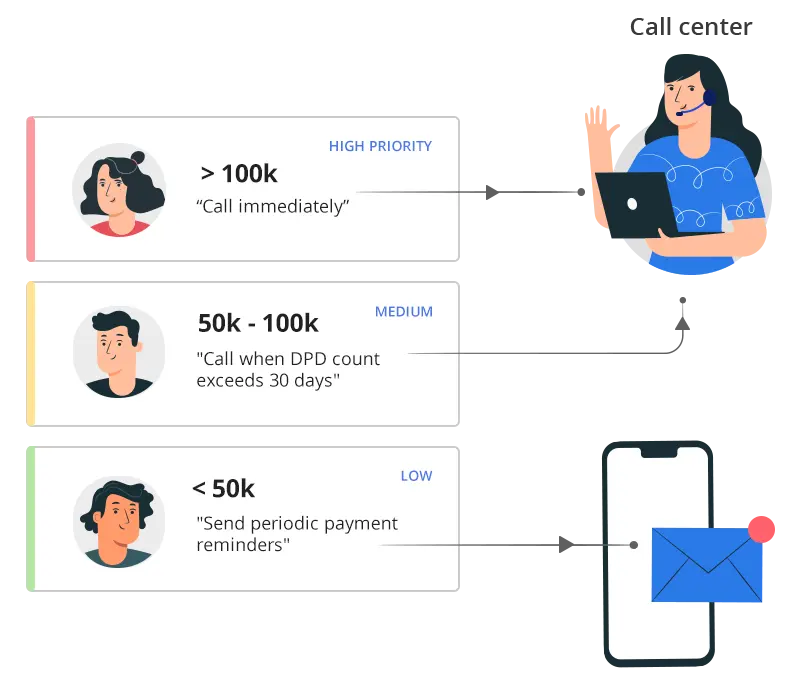

Debt collection for small businesses is tedious. And it becomes more cumbersome when the collection process is not organized. Therefore, it is essential to categorize your borrowers. You can segment them on high, medium, and low priority. Based on these priorities, you can define the collection strategies. For instance, agents will personally contact high priority defaulters, and you can send automated payment reminders to low-priority ones.

Depending on the business and the geography you serve, you can define your own categorization rules, such as loan type, location, DPD (Days Past Due), default amount, past loan/default history, and more.

Leadsquared collections CRM software allows you to categorize your debtors as necessary. Moreover, it also lets you define collection strategies based on the attributes that matter to you. Thus, ensuring that your team is focusing on high priority defaulters first.

4. Connect Teams for Smooth Operations

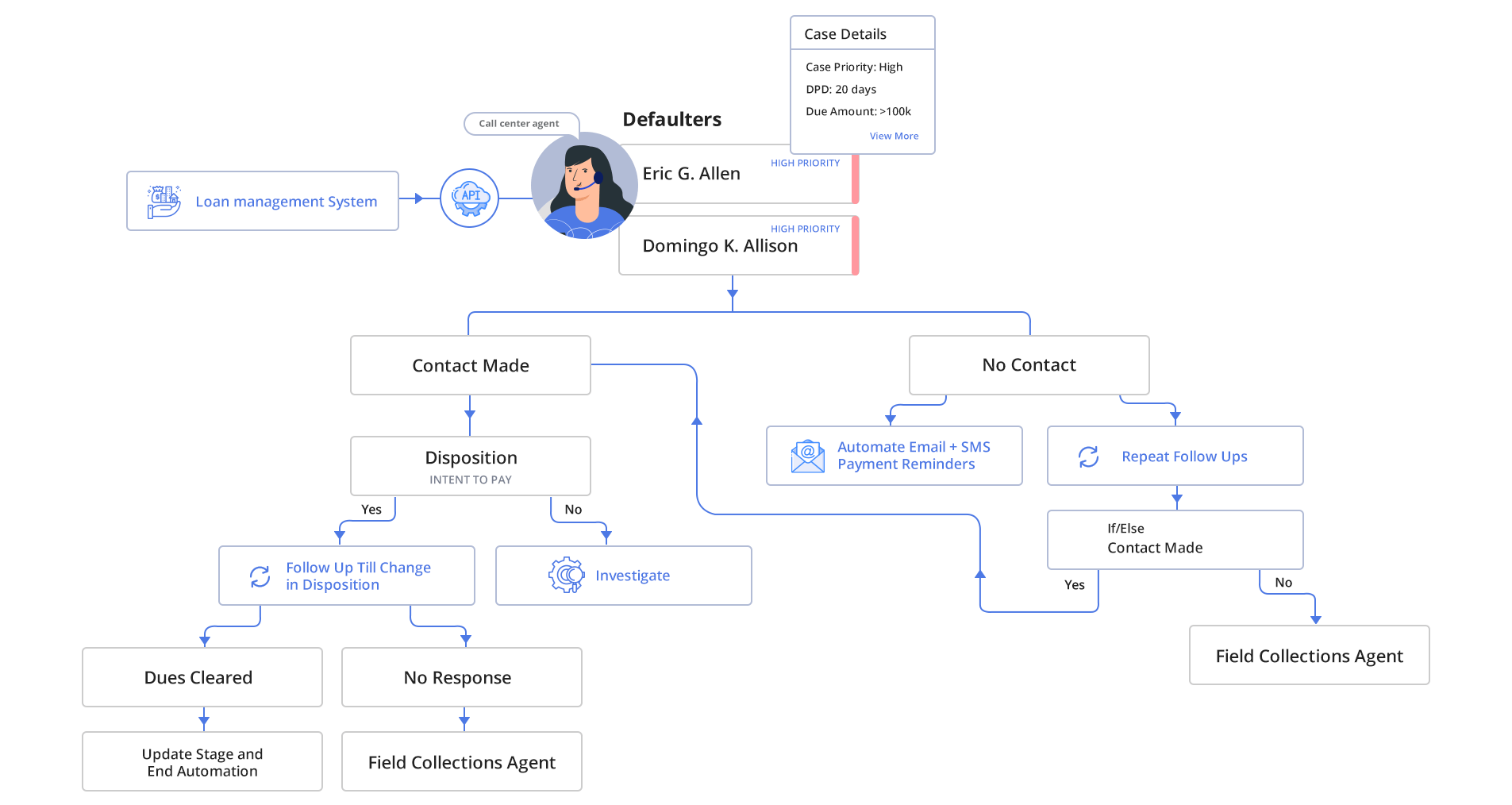

Your debt recovery process is only as efficient as your collection team. Therefore, your teams must stay well-connected for greater efficiency. With interconnected teams and staff, you can ensure smoother recovery operations for your business.

Using a collection CRM software can ensure that all your teams are in the loop. With this, call centers can review the profiles of loan defaulters. Thus, making sure that they follow-up immediately for collection with reliable information.

The interaction history also helps collection teams to gauge the intention of the borrower. For instance, there are cases when borrowers do not pay the loan even though they have promised to repay on a particular date. The recovery teams can take a different approach when they are aware of the past interactions with the defaulters.

Now, in extreme cases, the collection team has to send recovery agents to the fields. Managers would want to ensure that the field agent has met the borrower and has shared the right updates. With the geotracking and geofencing features of the mobile CRM app, it is possible to track these field activities precisely and accurately.

Another benefit of keeping an open channel of communication between teams is instant technical support. For unanticipated issues, the customer support team can connect with agents to provide updates on technical issues. Leadsquared collections CRM provides such collaboration functionalities and ensures smooth debt recovery.

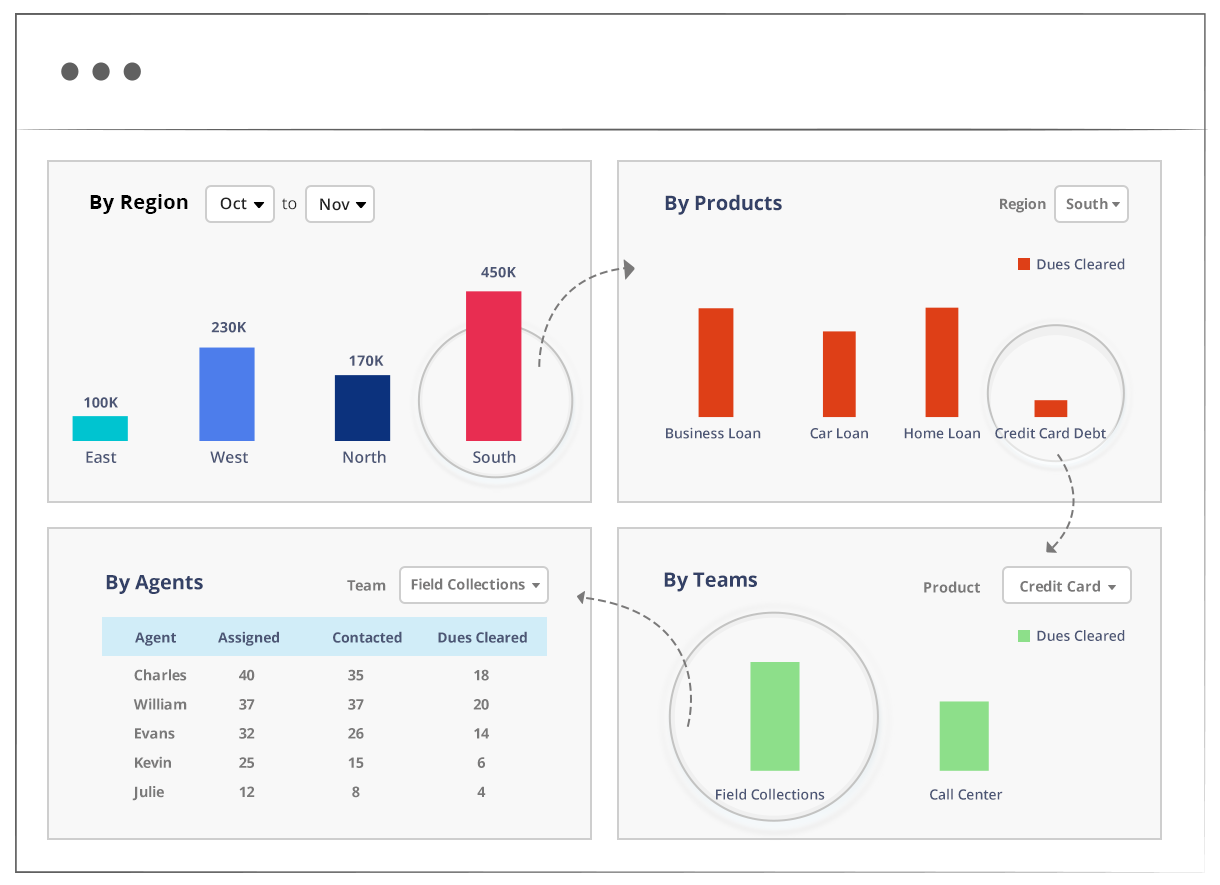

Digitizing collections for faster debt recovery:

5. Monitor Activities in Real-Time

Businesses can benefit from monitoring their customer-activities in real-time. Using such a system can make things simpler for debt collectors. They will become aware of the activities of their borrowers. Businesses will know immediately when the customers process the repayment. It will make sure that you are not bothering borrowers with unnecessary follow-ups.

Moreover, real-time notification about debt recovery will save lenders a lot of time. They no longer have to go through unwanted recovery procedures. Agents will not have to visit customers or call them asking for debt collection.

It will also ensure that lenders are focusing more on borrowers who did not make the repayment yet. Thus, allowing them to handle debt recovery cases more efficiently.

6. Trace Debtors

Some debtors might relocate without providing you with their new address. Such defaulters can make the debt recovery process much harder.

However, there are ways through which you can locate such defaulters. Several reliable tracing services helps lending companies find their defaulters. By integrating such services, lenders can trace defaulters and recover bad debts.

7. Plan the Day for Your Collection Agents

For efficient debt recovery, you need to maximize the efficiency of your agents. However, to increase their productivity, you need to plan their daily activities. It will lead to a higher number of recoveries per day.

Leadsquared collection CRM helps you in planning the daily activities of your collection agents, prioritizing their meetings, finding the best routes to follow, and much more. The CRM software can help in increasing the productivity of your agents. Therefore, allowing your business with a great debt collection strategy.

On the other hand, the field agent may require route guidance, alternative contact details, information about the guarantor, etc. while being on the field. If field agents have to meet more than one borrower in a day, then they will have to plan their schedule. Again, the CRM app can do this task for them. It can plan their day based on priorities, the best route to follow, goals for the day, and more.

8. Do Not Ignore FDCPA (Fair Debt Collections Practices Act)

Some regulations govern the debt collection process of businesses. Thus, making debt collection for small businesses a tricky process. Lenders cannot mislead or harass their customers. For fair collection practices, debt collectors have to abide by the Fair Debt Collections Practices Act (FDCPA).

If you use unlawful practices, the customers can sue for debt collection practices. Therefore, ensure that you are following the compliances.

9. Review Your Strategy and Performance

Unlike other businesses, lending requires regular updates on operational processes. Revising the plan only during the quarter end is not enough. It is because outstanding debts can make it difficult for businesses to remain operationally afloat.

Therefore, decision-ready analytics is crucial for lenders. It gives management and team members a broader perspective on debtors’ profiles, collection funnels, and agent and collections performances. With these insights, teams can take appropriate action in time and prevent the losses.

Final Thoughts

Efficient debt collection for small businesses is essential for running a successful business. However, not many financial services companies give the debt collection process much priority. For instance, in the US, the consumer-debt grew to $14 trillion in 2019. It indicates that businesses are not doing much to collect their money from consumers.

However, bad debts and long outstanding debts can bring challenges to the lending firms. Therefore, you need effective strategies to boost collection. You must monitor your cash flow every month. It will provide you a better understanding of your outstanding debt.

The above-discussed strategies will help you increase your collection efficiency.

LeadSquared’s Collection CRM can streamline your collection strategies. Moreover, the software will also help you automate communication with the debtors, thus reducing the time, resources while also saving operational costs.

Further reading:

- Bad debt recovery strategies

- 5 Effective ways to improve debt collection through automation

- Debt Collection Software: An Efficient Solution to Recovery Automation

- Case study: Canadian Customer Debt Relief

Debt Collection for Small Business FAQs

u003cstrongu003eHow can a small business collect a debt?u003c/strongu003e

To collect an outstanding debt, creditors can send a former letter followed by phone calls. If the customer will still not pay, creditors can take the help of collection agencies or consider taking legal action.

How to collect debt effectively?

To collect debts efficiently and on time, use collections CRM to identify potential bad debtors and act quickly, handle overdue payments, and contact customers. In the cases of defaults, you can employ debt collectors or lawyers.

u003cstrongu003eWhat are small business debt collection laws?u003c/strongu003e

Every country has its debt collection laws. Lending businesses in the United States follow the Fair Debt Collection Practices Act (FDCPA). In the UK, recovery agencies and debt collectors need to follow Financial Conduct Authority (FCA) guidelines, FTA (Fair Trading Act), and the OFT (non-governmental department the Office of Fair Trading) regulations. In India, the Recovery of Debts Due to Banks and Financial Institutions (RDDBFI) Act governs the debt collection processes.

![[Webinar] Email Personalization for Admission Teams 7 email personalization](https://www.leadsquared.com/wp-content/uploads/2021/11/email-personalization-80x80.jpg)