Creditors need to contact a debtor multiple times to settle an account balance. If the amount owed is to be recovered in installments, then you can imagine the additional amount of communications required. However, Fair Debt Collection Practices Act (FDCPA) imposes strict communication guidelines on collectors restricting the time, place, and number of contacts that can be made.

Debt collectors can contact borrowers through phone, letters, email, or text messages only within the prescribed time. Maintaining a list of borrowers, selecting the mode of communication, recording the response, and following up with debtors from time to time for recovery makes the entire process complex and time-consuming. As a result, credit companies fail to ensure 100% collection revenues.

Debt Collection CRMs address this crucial aspect of the collection process and streamline the overall collection strategy. You’ll find several products catering to the lending sector. But selecting the best collection CRM for your organization can be confusing. To ensure task automation, improve team productivity, and achieve maximum ROI, we have consolidated essential features to investigate while purchasing a collection CRM.

Quick checklist for selecting the best debt collection CRM

Whether you have already shortlisted products or just starting to explore, check out if the debt collection CRM provides a solution to the following questions. In the subsequent section, we will discuss why these are important.

- Does it cover user management across the organization?

- Does it provide client (borrower) management?

- Is it customizable to the organization’s needs?

- Does it work on mobile? Is there a mobile app for debt collection CRM?

- Does the CRM system send reminder notifications and alerts?

- Does it integrate with call center software, Payment gateways, VoIP diallers, and other CRMs?

- Is it possible to export/import data from other systems?

- Does it support workflow automation?

- Is the report dashboard utility-focused and customizable?

Download must-have features in your debt collection CRM checklist.

5 things to keep in mind while selecting a debt collection CRM

1. Borrower and user management

Borrower management: Borrower relationship management is important for every creditor. Healthy and timely communication with borrowers can improve loan recovery efficiency. Expected features from a debt collection CRM in terms of borrower management include:

- Consolidated borrower profile information covering borrowers’ financial details, CIBIL score, and relevant information from other sources.

- Account history: a comprehensive loan history to provide a reference for training or error correction in future strategies.

- Cross-channel communications forreaching out to debtors on their preferred communication channels like SMS, call, email, or WhatsApp for reminders about repayment dates.

User management: The collections process involves stakeholders from the contact center, field agents, support team, legal team, and fraud control team. Each team has their own method of dealing with debtors. While selecting the collection CRM, you should check whether the system covers the relevant team members.

- Call centers/contact centers: for distributing cases to call center agents to review loan defaulters and follow up for debt recovery.

- Field agents: to manage field operations by planning agents’ field visits and collection follow-ups.

- Support and legal teams: to resolve technical and legal issues, respectively.

- Fraud control: to update stakeholders about debtors’ wrong intentions and initiate legal actions.

2. Customization

Products like Collection CRM, Accounts Receivable Management Software, Collection Software, etc. correspond to making the debt collection process more efficient. However, there may be a fine line between these products in terms of offerings and customization.

The common notion is that CRMs are mostly used by the sales teams. But the individuals responsible for collections are not usually salespeople. Plus, sales and collection teams have different tasks. Thus, you must check whether a CRM can accommodate different sets of users and collection activities.

The point is – the nomenclature may differ for different products. That’s why you should look at the features that are customizable for users and integrate with internal and third-party applications. The best approach is to go for CRMs designed specifically for debt recovery processes.

3. Automation

Improving cash flows and optimizing collection costs are the bottom line for automation in collection processes. We are long past hardcover registers for keeping the record of debtors. The automation in the collection industry refers to an integrated system that can communicate with borrowers, allocate cases, notify agents for in-person communication, receive payments, and track every activity in the system.

You must check the level of automation a CRM software provides. The important automation features to look for in a debt collection CRM include – workflow and recovery automation. Let’s look at these.

Workflow automation

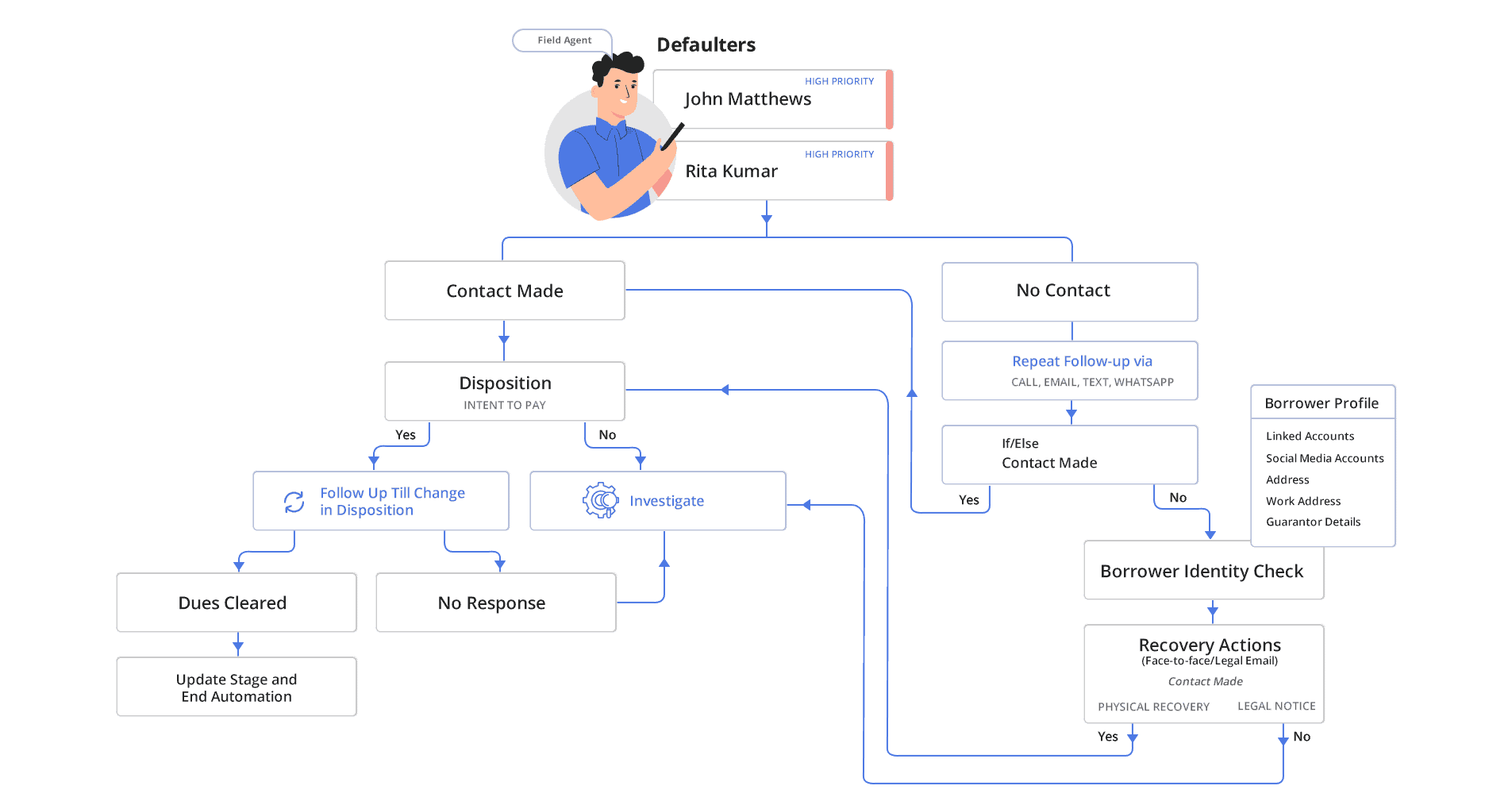

It allows you to create a series of tasks based on certain triggers. Take an example. You want an automated workflow for the field collection process. Whenever an account is over the Days Past Due (DPD), the system should trigger a task and notify the field collection agent to visit the defaulter. Depending on the borrower’s disposition, the system can trigger further actions. If the borrower intents to pay, the system can send a payment link. In situations where the borrower is not reachable, the system can repeat follow-ups via call, email, WhatsApp, or SMS. If there is no response from the debtor, the creditor can initiate investigation or recovery actions against the borrower.

Recovery automation

Debt recovery automation corresponds to the computerized collection procedures that require minimum to no human interventions.

- Borrower segmentation: classification of borrowers into debt buckets based on DPD (Days Past Due), credit repayment history, the amount due, and repayment intent.

- Account prioritization: assigning priorities to accounts based on the borrowers’ profile information including – DPD, asset classification, due amount, product type, delinquency bucket classification, willful defaulter, and fraud identification.

- Case distribution: mapping and distributing cases based on the availability of collectors, agents, and location.

- Mobile CRM: useful for field agents to update their activities on the go.

Apart from these essential features, if you need automation for any other internal process, you can ask the vendor for the product trial or demo.

Collection process automation Demo

4. Integrations

Today, almost every Financial Institution uses digital tools for collections. However, within an organization, there are too many systems for individual processes. This creates a disparity in information across teams. Managers also complain that their core systems do not integrate with contact centers, SMS, diallers, or email gateways. As a result, users have to fill in the account information manually.

Therefore, you must check whether the Collection CRM you’re exploring has ready-to-use APIs and integrates properly with IVRs, Telephony services, WhatApp, Email Gateways, ERP, Call Center Software, and other third-party applications. CRM Systems that integrate with information sources like CIBIL, Experian, and even social media help in maintaining a 360-degree borrower profile information.

Integrations are crucial as they will save your team’s efforts in switching from multiple systems to submit and access information.

5. Analytics

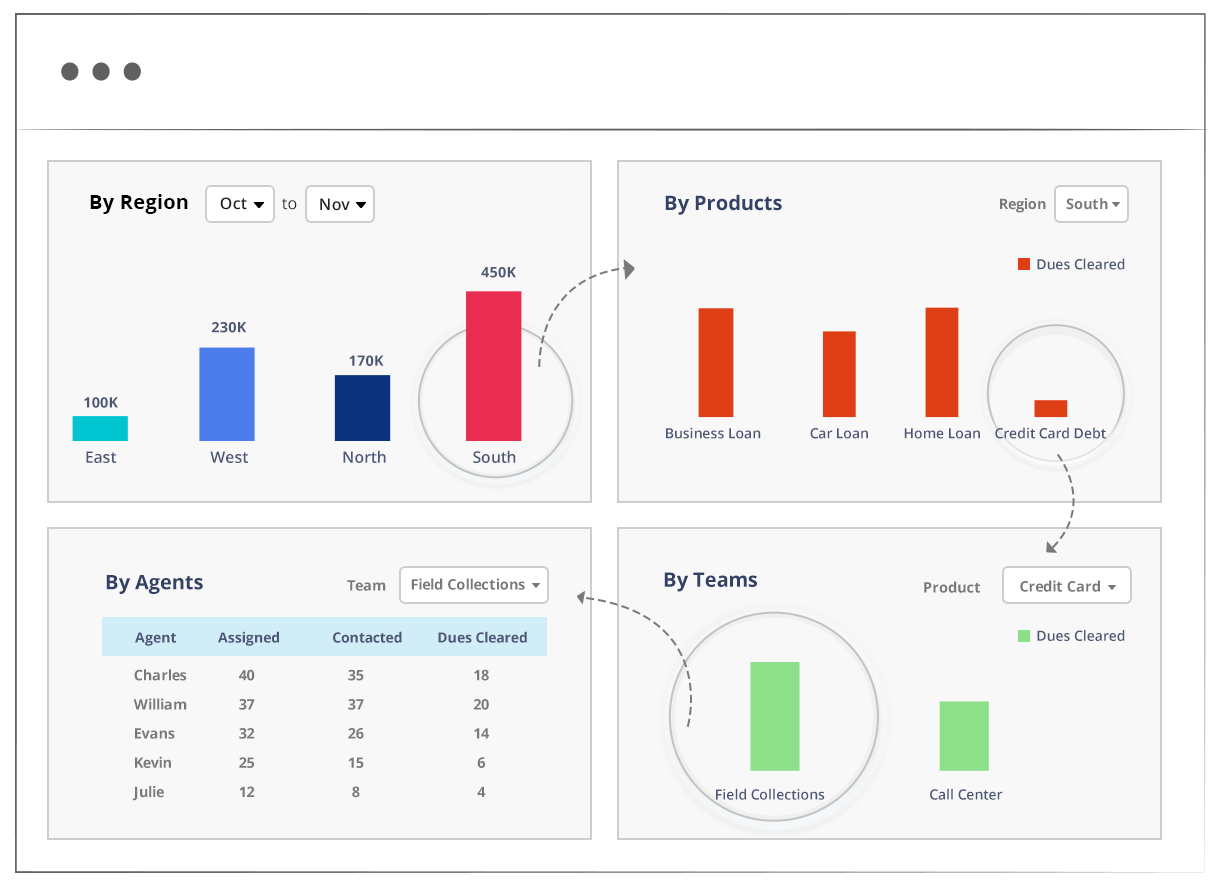

Fact-based insights on customers, collection efficiency, and team performances can help you eliminate bottlenecks from the collection funnel. You can also evaluate ROI (Return on Investment) from usability-focused dashboards.

Analytics also unfolds trackable reports on the number of debts recovered, intends to pay, non-responsive debtors, and the average time required for the debt recovery. Team members can access these reports and need not create individual reports – eliminating duplication of efforts.

Different teams track different metrics. For example, the recovery team usually tracks metrics like days sales outstanding, the number of promise-to-pay accounts, accounts closer to days-past-due, to name some. Therefore, while exploring different CRM systems for collection management, you should compare analytics usability as well.

Concluding remarks

Traditionally, large enterprises used on-premise Collection CRM, designed specifically for their needs. However, the organization had to resort to the application developer for every feature enhancement. Plus, there was a very limited scope of mobility.

Cloud-based Collection CRMs are gaining popularity mainly because of their -as a Service (SaaS) model. You can test run the software and if it doesn’t work, you can terminate your subscription. Earlier, security was a concern for some organizations. But today, the cloud is considered as secure as any on-premise software.

Apart from the above features, you can also consider the following while selecting the best CRM software:

- Deployment type: Cloud-based or on-premise. Cloud-based CRMs offer more flexibility and mobility. Some large enterprises used to prefer an on-premise CRM system for data and privacy concerns. However, cloud CRMs are equally secure and are more elastic to the scalability requirements. Gartner indicates that cloud-based or SaaS CRMs represent 75% of the total CRM spend across industries.

- Industry: Financial Institutions (Banks and NBFCs), Collection Agencies, Healthcare, Government, Telecom and Utilities, Real Estate, and Retail industries have specific debt recovery processes and compliances. Instead of a generic product, you can opt for your industry-specific CRM that serves all the requirements.

- Geography: Every country has its regulation on consumer protection. CRM software for debt management that is customizable to regional requirements makes the best choice.

Organizations that use digital debt collection solutions reduce their Days Sales Outstanding (DSO) by 10-20%. You can also make debt recovery easier, faster, and more organized with LeadSquared Collection CRM.

FAQs

In general, CRM or Customer Relationship Management system handles customer interactions via different channels into a centralized system. Collections CRM is a CRM designed for the lending sector that serves industry-specific communication requirements and manages employee interactions. Collection software, on the other hand, is more focused on workflow automation.

For end-to-end collections automation, LeadSquared’s Collection CRM is the best choice. Details.

The set of strategies, tools, people, agencies, and processes deployed to recover loans from debtors is known as debt collection management or loan recovery management.

Most of the debt collection CRMs allow integration with the loan management system, ERP, and other third-party applications.

Further reading:

![[Webinar] Monoliths, Silos, and Broken Journeys: Breaking Free for Better Lending in 2025](https://www.leadsquared.com/wp-content/uploads/2025/02/LOS-webinar-popup.gif)