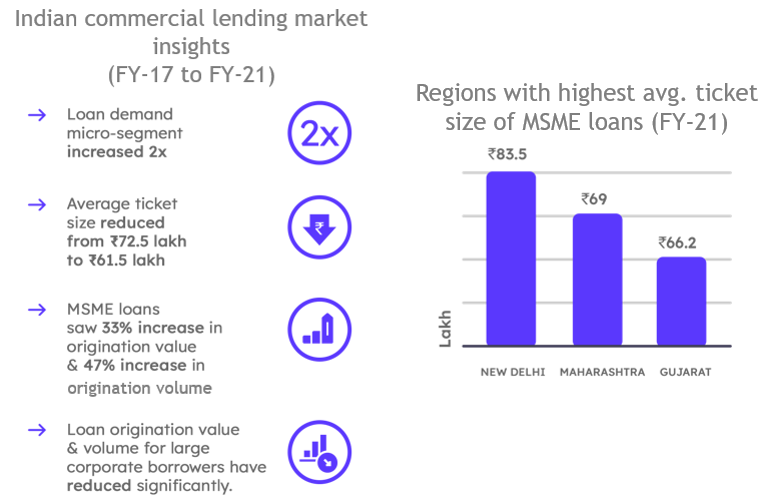

According to a recent report by CRIF High Mark, the Indian lending market has grown 100% between FY-17 and FY-21. Furthermore, commercial lending in India has grown 93% in the same timeline.

While the above data shows an overall growth, the past two years have been difficult for the commercial lending segment. For instance, the surge in demand for commercial loans in the first few months gradually fell, and credit growth has been slow since then. However, with the efforts from the government and lenders, the sector has slowly picked up the demand.

In this article, we will look at the latest trends and market opportunities that are shaping the commercial lending segment in India.

But before we dive into the state of the commercial loan market, let us understand the purpose of these loans.

What are Commercial Loans?

Commercial loans are the type of loan borrowed by businesses to fulfill their financial needs. Some of these needs may include:

- Purchasing different types of equipment

- Creating new infrastructure

- Expansion into new geographies and markets

- Paying salaries to employees

Commercial loans can be of two types – secured and unsecured. TransUnion CIBIL categorizes these loans into nine broad categories:

- Term loans (short-, medium-, and long-term loans)

- Bank overdraft facility

- Letter of Credit

- Bank Guarantee

- Lease Finance

- SME collateral-free loans

- Construction equipment loans

- SME Credit Card

- Commercial Vehicle Loans

The state of commercial lending in India

Data from the CRIF High Mark report suggests that commercial lending in India stands at 49% of the total lending share. MSME loans (<50 crore ticket size) constitute nearly 85% of the market share of these loans.

Between FY-20 and FY-21, the total outstanding portfolio of commercial loans grew 2.3% to ₹76.9 lakh crore, while the YoY growth of active loans in the portfolio grew 17.6% to ₹48.92 lakh crore.

Overall, the total demand for loans gradually improved YoY as the Covid restrictions have eased.

The growth drivers in the commercial lending segment

Last year, the financial sector saw many ups and downs due to the coronavirus pandemic. The situation remains unpredictable concerning the possible third wave. However, according to CRISIL, the credit outlook for FY-22 looks positive.

Let us observe the trends driving this positive outlook into the commercial lending ecosystem.

Credit infusion by the government into the MSME Segment

The Indian government, on multiple occasions during the pandemic, infused cash into the MSME segment. The purpose was to rebuild the disrupted supply chains and restore normalcy.

Recently, the Indian government expanded the cap on the Emergency Credit Line Guarantee Scheme (ECLGS). The new limit is set at ₹4.5 trillion (previously ₹3 trillion) to allow more cash-strapped MSMEs to improve their cash flows. Many experts hailed ECLGS as a success as borrowers appreciated the move.

Under this scheme, banks and NBFCs can lend to MSME borrowers looking to meet their working capital requirements. Additionally, the funds have 100% guaranteed coverage by the National Credit Guarantee Trustee Company (NCGTC).

Borrowers can get up to 20% of their outstanding debt amount financed under this scheme. They can apply for a loan under this scheme by 30th Sept 2021.

Fast-tracked digital transformation in lending

Digitally assisted journeys have taken a central role in lending today. Additionally, increasing internet penetration, rise in alternative credit scoring techniques, changing customer profiles, and rapidly evolving customer preferences have pushed lenders to become more agile.

Many businesses don’t have an organized credit history, which is a challenge to avail formal credit.

In such cases, India’s digital infrastructure has evolved to fill in the gap. Digital initiatives such as Aadhar, Pan, GSTIN, e-KYC, OCEN, and Account Aggregator are helping lending institutions score such borrowers better and improve credit decisioning.

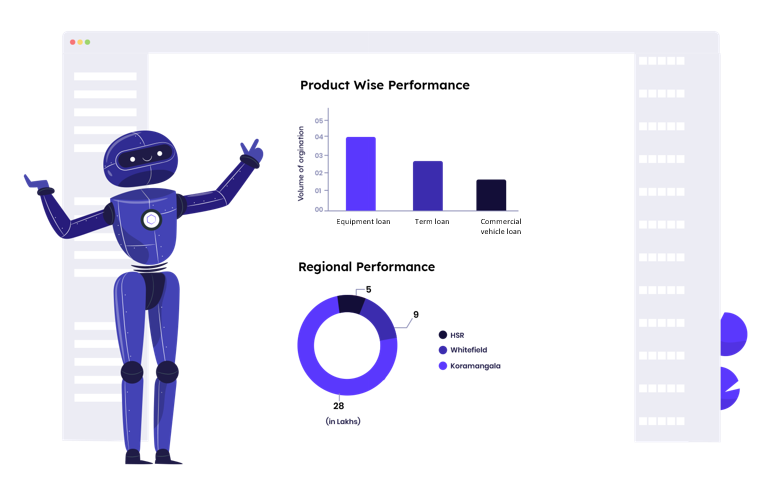

Intelligent automation and data analytics

According to K.V. Srinivasan, CEO of Profectus Capital,

“Understanding the customer behavior better and anticipating their needs while maintaining the discipline to follow up on time will further provide you the edge needed to stay ahead of the competition.”

Many banks and NBFCs are also looking to simplify their commercial lending process flow and improve their customer experience through their tech stack. As a result, they are turning to commercial lending software vendors like LeadSquared to improve the borrower onboarding experience.

A commercial lending software like LeadSquared can help lenders:

- Pre-screen prospective customers

- Build self-serve portals and multi-step forms

- Automate lead management

- Integrate with IVR services

- Help create workflow automation

- Automate credit underwriting

- Assist in the collections process

- Access extensive data analytics

For example, Profectus Capital – one of the leading MSME financers in India – improved its funnel quality by 70% with LeadSquared.

Data analytics is another frontier that is helping lending businesses understand the customer mindset and deploy a proactive strategy. Some avenues where data has helped lenders cut risks are credit scoring, underwriting, and collections. Lenders are utilizing cutting-edge algorithms and thousands of data points to identify creditworthy borrowers during the origination phase and create a healthier loan book.

Additionally, businesses can use data to build personas to cross-sell various loan products or customize existing products to individual business needs and improve convenience for the borrower.

Traditional commercial lending meets new-age Fintech

While public and private banks hold most new originations, Fintech companies have emerged as strong competitors in the commercial lending segment. Due to the informal nature of their operations, MSMEs have struggled to access organized credit.

The Indian Fintech Industry is bridging this credit gap by using AI and ML to analyze outstanding debt and repayment behavior and materialize a usable credit history.

Additionally, due to their agile nature, Fintech companies are penetrating mid-tier cities rapidly, where most of the MSME businesses exist. Simple application journeys and faster disbursal timelines make these players more attractive than traditional institutions.

Hence, many banks and NBFCs have started to realize the game-changing potential of Fintechs. So, traditional institutions are leveraging this opportunity by partnering with Fintechs and financing innovative loan products through co-lending programs or cross-selling their products to existing Fintech customers.

For example, in July 2021, Bank of Baroda entered into a partnership with U GRO Capital, a Fintech in the MSME lending space. The program, Pratham, aims to disburse 1000 crores worth of loans by the end of FY-22. 80% of the loan portfolio will be on the bank’s balance sheet, and the rest 20% on the U GRO Capital.

Many traditional lenders are opting to use this model because it reduces liability and increases financial inclusion.

Conclusion

The commercial lending space is witnessing several innovations. ETB (existing to banking) and NTB (new to banking) levels have reverted to higher than pre-covid levels, indicating a recovery in credit demand. Additionally, lenders are looking to bridge the existing credit gap through a mix of technology and products.

For instance, companies like SOLV, Zip, Veem, and Funding Circle are foraying into SME BNPL to improve loan accessibility. Additionally, the entrance of non-BFSI market players into the financial space through partnerships with these lenders is a sign of emerging pockets of opportunities.

It will be interesting to see the new milestones in the next few years in the commercial lending industry.

If you want to grow your loan portfolio and stay ahead of the competition, check out the LeadSquared Lending CRM now!

FAQs

Yes, Fair Lending Practices Code or FLPC is a mandatory code applicable to all Indian scheduled commercial banks and financial institutions irrespective of their primary loan product. However, RBI has given all institutions the flexibility to design their own FLPCs. In cases where lenders do not adhere to fair practices, RBI has the authority to penalize them.

Commercial or Industrial loans are products that primarily cater to well-established businesses having growth and expansion-related credit requirements. These loans generally have stringent eligibility rules, longer repayment timelines. However, the interest rates are lower because the businesses already have an established cash flow.

A commercial lending or commercial loan origination software is a digital tool that enables lenders to disburse loans faster. For example, LeadSquared Lending CRM, an end-to-end loan application management platform, helps lenders increase process efficiency, manage teams, and borrowers across their lifecycle.

Commercial lending is an arrangement wherein a borrower (a business) seeks loans from a financial institution like a bank or NBFC to meet its credit demand.