Productivity remains the gold standard for how well a team is performing, including your insurance sales team. nd selling insurance is indeed hard work, especially in India. In addressing the issue of productivity, insurance CRM software has proven to be a life-saver, often becoming the difference between successful and unsuccessful insurance sales teams.

As a team lead, while you may not be into the entire details of how your insurance salesperson is going about it, what you’re definitely interested in is the results. How many sales are they bringing? What can they show for all the hard work? A

What is an Insurance CRM Software?

Basically, it is your CRM software but for the insurance sector. In a world where specialization is becoming increasingly important for growth, an insurance CRM software enables you to automate everything concerning your business according to requirements. It is a robust platform for managing all your daily tasks, from sorting policy inquiries from prospects to gathering valuable insights from customer information. And everything between.

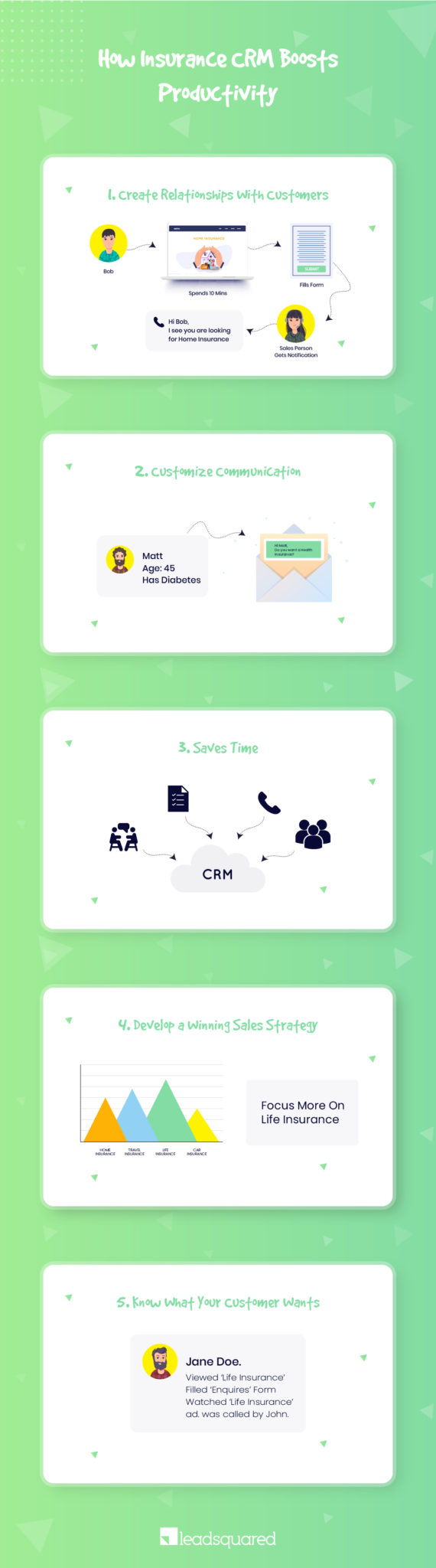

How Insurance CRM Software Boosts Productivity

Every insurance CRM software comes with a range of features that promise efficiency, some more than others. However, it may be difficult to understand all the benefits you’re getting at first glance. Some solutions can be ambiguous. Here are 10 ways you can improve productivity by simply adopting a robust CRM tool.

#1. Create meaningful relationships with your customers

Before thinking about retaining your customers, you must have first established a relationship that makes retention much easier to achieve. It all starts from the first time they clicked on your website. Or, maybe when they made that phone call to inquire about your insurance policies. How quick was it for an agent to reach out in response to these inquiries? How much do you and your agents know about these prospects even as you pitch your services? These are often conflicting issues that insurance agents face when the process is completely manual or half-automated.

Adopting an insurance CRM software allows you to stay on top of communication. This helps in creating a relationship that grows over the customer acquisition cycle. For instance, a CRM tool enables you to create customer profiles that let you understand each customer, including their age, financial status, interests, locations, policy preferences, etc. All of these are the foundations for which a fruitful business relationship can be established.

#2. Customize your communication

Since you already have a profile for every customer, customization becomes the least of your worries. With this, you can hit the bull’s eyes in your sales endeavors. If your records show that a prospect has a medical condition, the rational thing to do would be to pitch them your health insurance policies.

This is against pitching a vehicle insurance policy whose major concern is taking care of their health, something that the manual process often leads insurance sales agents to do. Customizations will help to convert a prospect into a paying customer faster than you can imagine.

#3. Save time

The efficiency of your sales team is a measure of how much time they spend doing certain tasks. And, also on the level of integration your CRM tool offers. Having an insurance CRM software that works both online and offline and integrates all information greatly reduces the amount of time spent profiling prospects. Take a scenario where an agent who has just finished a meeting with a client in Mumbai. But, he gets an emergency to see another client in the same area because their colleagues couldn’t make it. An integrated tool ensures that they have all the information right at their fingertips and can engage the customer at a moment’s notice.

#4. Develop a winning sales strategy

The best strategies are formed from actionable insights. In this case (insurance sales), one of the best ways to develop a strategy that works is to understand your customers. And this is not a luxury that manual processes can afford you. An automated insurance CRM software does the trick of not only gathering customer information but to also help your team identify the best sales opportunities. This information often shows your customer’s biggest needs. For example, the kind of jobs they’re doing, age demographics, etc. All of which will be major considerations in developing your strategy.

Take for instance, if the bulk of prospects visiting your website for a particular period are people who work within the Indian government. And they are parastatals looking for vehicle insurance, your sales strategy, will be targeted at creating a Car Insurance Package for government workers.

#5. Better awareness of your customers and their activity

Because the insurance sector is a big pond with sub-sectors, it is often easy to get caught in the midst of activities. From categorizing your customers based on policy inquiries (life, health, property, etc.), to monitoring the due date for certain renewals, there’s a whole lot of work to do. So much that you get involved with tasks that are insignificant in the long run. This bites deep into the team’s productivity.

An insurance CRM software gives you a clear view of all the activities and communication that has resulted from them. With lead tracking, you can ensure your sales team has all it needs to follow up on a customer. This includes the policies they are interested in, the ones that they have already bought, and other details. No more sorting through tons of mail conversations. Smart Views can be created for agents to efficiently carry this out. The renewal process, on the other hand, can equally be automated by automatically sending notifications to customers before the due date.

More Than Productivity

In the grand scheme of things, the goal of every sales team is to increase sales. For insurance agents, it is already hard enough, with productivity being a major challenge. Insurance CRM software, addresses productivity. It will also provide an opportunity to sell more insurance policies by adopting a process change.

Check out LeadSquared’s powerful insurance CRM software and get started for free.