InsurTech is a combination of the words “insurance” and “technology”. It’s a part of the greater fintech industry where businesses concentrate on:

- Creating,

- Distributing, and

- Aggregating digital insurance products.

InsurTech companies enable us to buy insurance plans through mobile apps and websites. Startups that focus on statistical or risk discovery models are also available to users.

Businesses that use InsurTech are working with various features and new pricing strategies. These include:

- Using machine learning and artificial intelligence to conduct research

- Improving insurance agent onboarding and selling processes

- Offering new insurance pricing plans based on the customer’s behavioral patterns.

Indian InsurTech firms raised $1.8 billion between 2014 and the first quarter of 2022. This represents 8.18% of the $22 billion in the overall fintech industry capital.

InsurTech as a sector is still in its nascent stages in India. There is an ever-increasing number of players in the Indian InsurTech industry. This list showcases some of the top InsurTech companies and their products.

Top 10 Indian InsurTech Companies

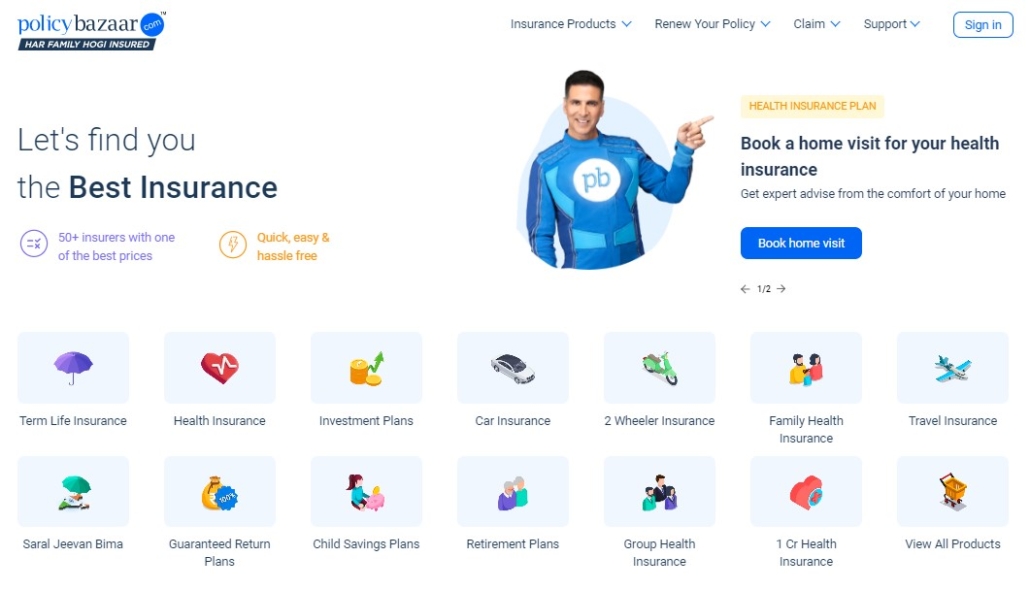

1) PolicyBazaar

Website: https://www.policybazaar.com/

Location: Gurgaon, Haryana, India

Employee Size: 1,001-5,000 employees

Total Funding: The total funds raised from 2014 to 2021 is $766.6M. The lead investors were True North, SoftBank Vision Fun, and Alpha Wave Global.

PolicyBazaar is one of India’s finest marketplaces and insurance aggregators. They offer several plans, including:

- Life insurance,

- Medical insurance,

- Auto insurance,

- And other insurance plans like group insurance and travel insurance.

Through partnerships with numerous insurance brokers, PolicyBazaar can obtain information about insurance plans straight from the insurer.

PolicyBazaar’s USP is the simplification of the insurance plan buying experience.

They offer comparisons of the various market-available schemes. It evaluates items based on their costs, qualities, and features. Policybazaar ultimately enables customers to make informed purchasing decisions.

The company provides more than 250 insurance policies from about 50 insurance companies on their site. Visitors to the platform can easily compare different plans and purchase policies depending on their unique insurance requirements.

“I came to Policybazaar.com to buy health insurance for my family. I found a lot of plan options on the website from top insurance companies and so, I could choose a good plan for my family. I paid the premium for the shortlisted plan and got my family health insurance policy without any hassles.”

Rekha, Nagpur

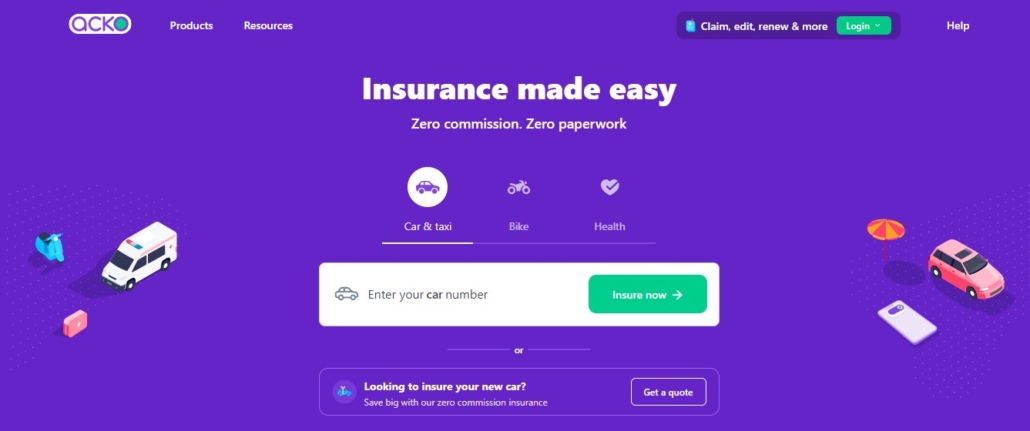

2) Acko

Website: https://www.acko.com/

Location: Bangalore, Karnataka, India

Employee Size: 201-500 employees

Total Funding: The total funds raised from 2017 to 2021 is $458M. The lead investors were Multiples, General Atlantic, and Munich Re Ventures.

Acko is the first digital general insurance firm in India. It was originally founded in 2017 and uses data analytics to offer clients personalized rates.

It analyses the communication styles and customer behavior to make personalized suggestions. Acko currently insures over 40 million Indians, obtaining 8% of all online vehicle insurance premiums in India.

Acko offers insurance for:

- Vehicles and cabs

- Bikes

- Health

- Mobile

Additionally, one of their more unique offerings is their Ola Trip Insurance. It is an Acko microinsurance solution that aids in cab passenger insurance.

Acko offers customized pricing, immediate insurance, and incredibly quick claim reimbursements. Several companies such as Ola, Zomato, Amazon, and others, are partners with Acko.

“The best place for excellent general insurance. Be it bike, car, or health, the experience through the digital form is awesome. There is no documentation or paperwork to insure a vehicle. It’s quick and fast. It’s also affordable for claims.”

Gurumoorthy Nataraj

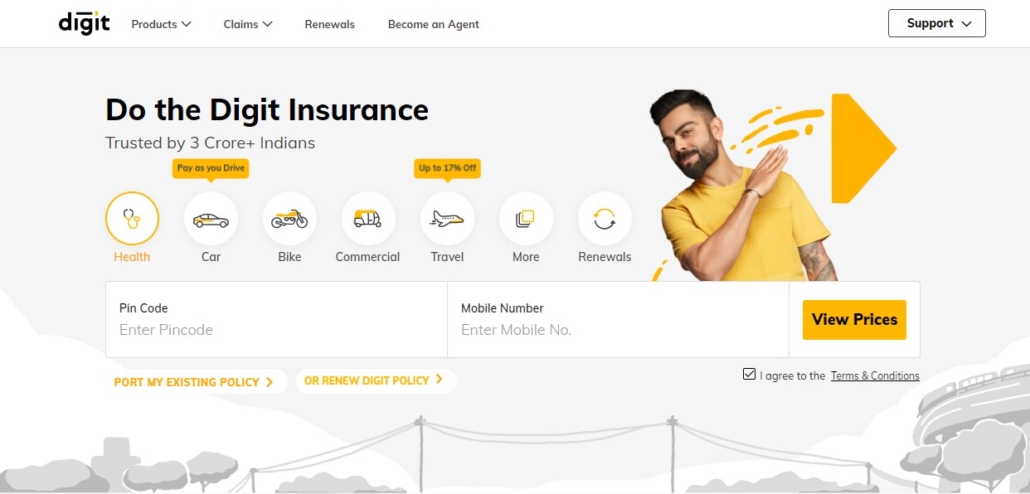

3) Digit Insurance

Website: https://www.godigit.com/

Location: Bengaluru, Karnataka, India

Employee Size: 1,001-5,000 employees

Total Funding: The total funds raised from 2017 to 2022 is $585.6M. The key investors were TVS Capital Funds, Sequoia Capital India, and Wellington Management.

Digit offers services such as car insurance, travel insurance, house insurance, commercial vehicle insurance, shop insurance, trip insurance, fire insurance, and other small-ticket insurance.

The company’s objective is to restructure pricing processes and reimagine items. One of the notable features of Digit Insurance is that it guarantees coverage for flight delays of 75 minutes and more. This is much different compared to standard travel insurance firms, which only cover delays of six hours or more.

Digit unveiled an interesting new feature on July 18th that empowers customers who drive. The feature is automobile insurance, which they call “Pay as you Drive” (PAYD). With this addition, clients who drive less will spend less on their insurance.

It was a quick and easy settlement process. I would definitely recommend it to anyone. Abhishek Kumar, the surveyor, did an amazing job.”

Digit customer

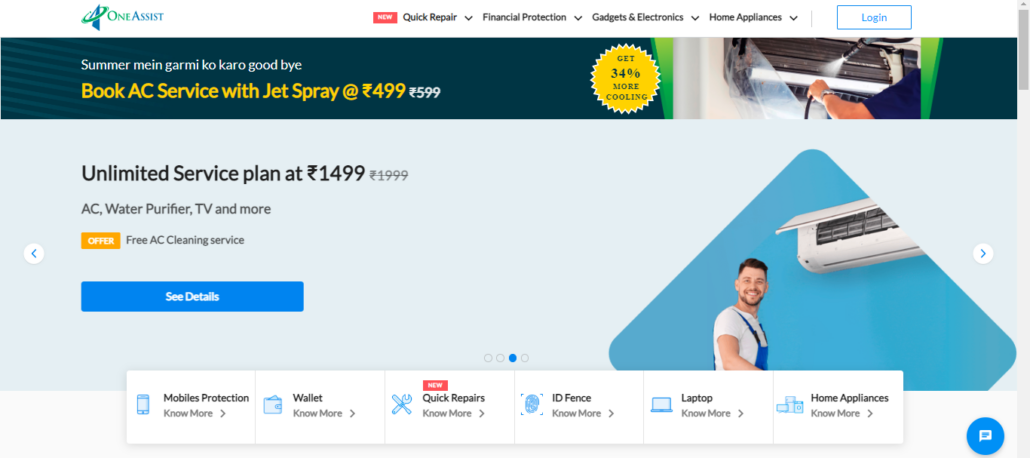

4) OneAssist

Website: https://www.oneassist.in/

Location: Andheri East Road, Mumbai, Maharashtra 400059, India

Employee Size: 201-500 employees

Total Funding: The total funds raised from 2012 to 2018 is $33.2M. The lead investors were Sequoia Capital India, Trifecta Capital, and Arun Sarin.

OneAssist has become a top supplier of insurance solutions during the last few years. The business provides coverage for data security and protection for electronics.

The company’s major goal is to give customers access to a universal platform for support and protection solutions. Among others, OneAssist has partnerships with Yes Bank, Axis Bank, ICICI Bank, and Amazon.com.

OneAssist offers protection for:

- Credit cards

- Smartphones

- Payment cards in case of loss or theft

- Damage insurance protection

- Including doorstep services to pick up and repair the phone

- Hotel bill settlements

- Assistance for missing passports

Internet users are also alerted of potential dangers via OneAssist’s Identity Risk Calculator thanks to its cutting-edge software. Moreover, they have recently rolled out a new service they call quick repair. They state that it covers fixing home devices like geysers, refrigerators, TVs, and air conditioners.

“Excellent customer service! Whenever I needed something, they were there for me.”

Haresh Dangar

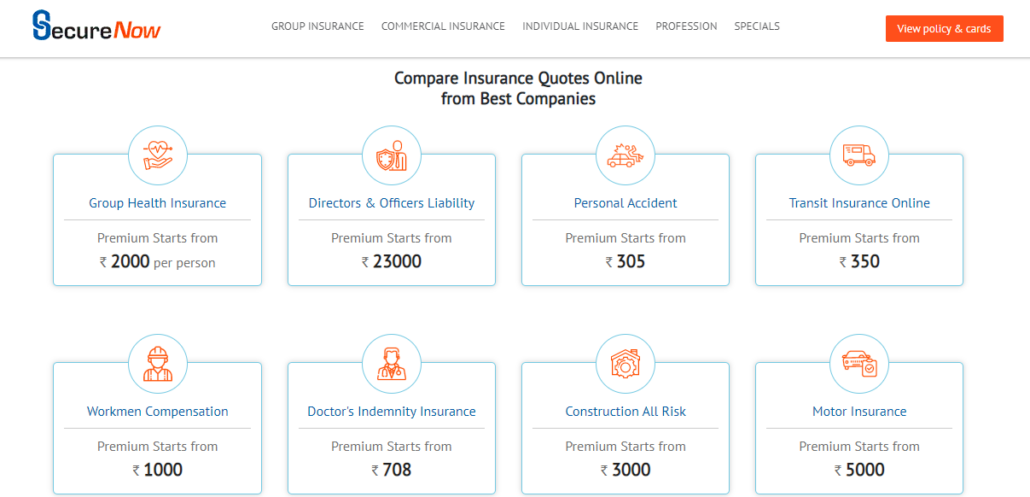

5) SecureNow

Website: https://www.securenow.in/

Address: Plot – 68, Ground Floor, Sector 18, Gurgaon, Haryana 122001, India

Employee Size: 51-200 employees

Total Funding: The total funds raised from 2016 to 2021 is $9M. The key investors were Charan Singh, Apis Partners, and Elevar Equity.

Abhishek Bondia and Kapil Mehta launched SecureNow in 2011. With the help of an end-to-end InsurTech system, they offer small and medium-sized businesses pure-risk commercial insurance coverage.

They offer a highly user-friendly and intuitive smartphone app Notify. Moreover, they offer a CRM software platform, PAM, to provide insurance and streamline the claims procedure.

They provide services to 25,000 small enterprises in over 150 locations. The company manages all its major business insurance needs. They offer a wide variety of insurance products, such as liability, building, marine, and group medical insurance. On behalf of customers, they also manage grievances and insurance services.

“A company offering end-to-end risk solutions, with complete individual attention to its clients. From advisory to claims servicing, everything is top notch in the industry!”

Saket Sharma

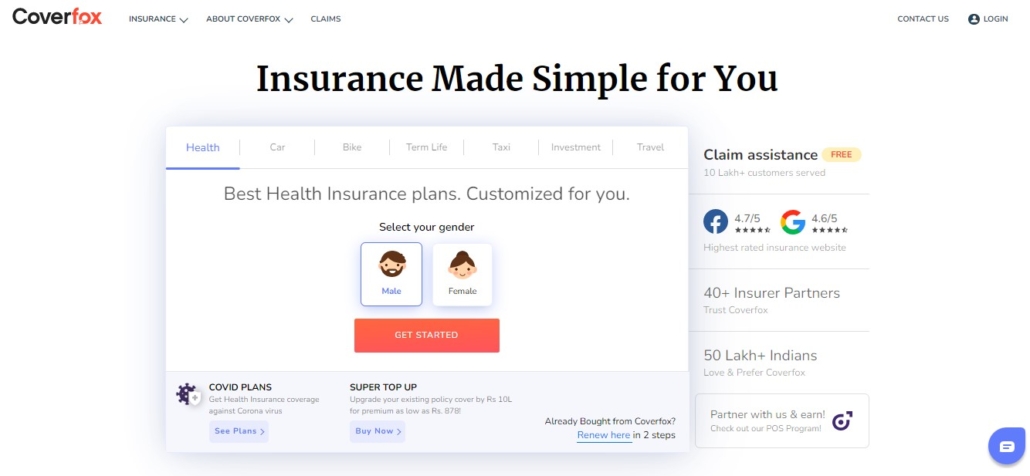

6) Coverfox Insurance Broking

Website: https://www.coverfox.com/

Location: Mumbai, Maharashtra 400072, India

Employee Size: 1,001-5,000 employees

Total Funding: The total funds raised from 2015 to 2020 is $51.3M. The key investors were IFC, Aegon, and Accel India.

Coverfox is a rising InsurTech company launched in 2011. It offers 360+ insurance products in India, including medical, automobile, bike, term, and travel insurance coverage, through more than 50 partners.

According to CoverFox, its no-jargon language and reliable algorithm simplify and improve the accessibility of policy documents for clients.

Some of their significant features are:

- Instant quotations from insurers are available to customers, hastening the purchasing procedure.

- They provide smooth post-purchase solutions like easy renewal, digitalized policy updates, and a quick claims procedure.

- Its secure interface ensures that customers may purchase and renew insurance plans conveniently.

- It also offers a trustworthy venue for resolving any insurance-related issues.

“Cover fox is a really good online insurance company. The experience I had with them was satisfying. My husband and I were looking to get Insurance for the bike, And we were running around to find people who would do it. Then a friend suggested we go with Coverfox.com, and we did. After that, the process was so easy and well done by the representatives. I chose the best deal for the bike insurance, and it was very cost-effective. Must try site for all.”

Priyanka

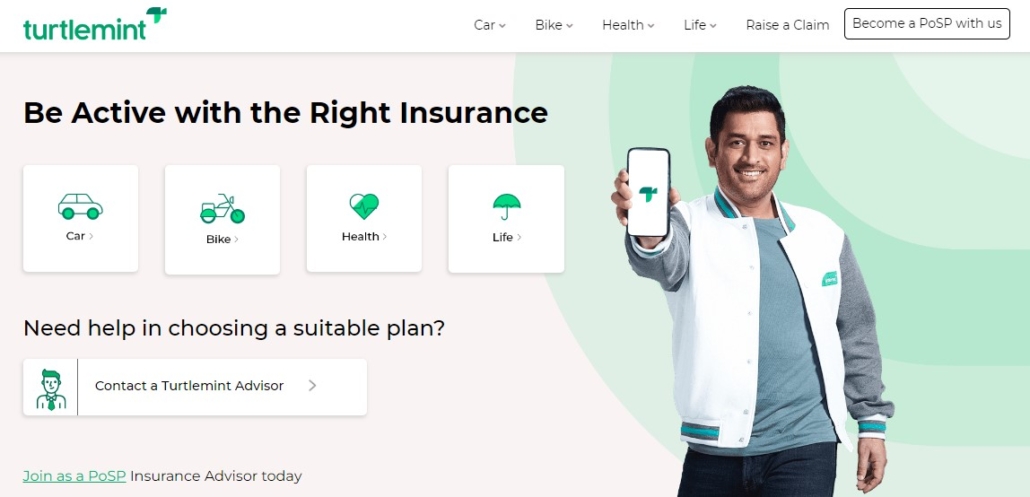

7) Turtlemint Insurance

Website: https://www.turtlemint.com/

Address: Kolbad Road, 303, Cosmos Mary Park, 116 /B, Thane, Maharashtra 400601, India

Employee Size: 1,001-5,000 employees

Total Funding: The total funds raised from 2016 to 2022 is $197M. The lead investors were Amansa Capital, Jungle Ventures, and Nexus Venture Partners.

2015 saw the launch of the digital insurance aggregator TurtleMint. The firm currently provides coverage for the car, health, and life insurance sectors. It is an insurance marketplace that aids customers in selecting and purchasing the best insurance coverage. Its objective is to simplify insurance by decoding any technical language.

Turtlemint offers a number of digitized solutions, including training, licencing, and verification procedures for insurance agents.

This allows them to complete the entire customer onboarding process considerably more quickly. Additionally, it enables agents to make tailored recommendations to clients. They offer savvy tools to help people choose the best option for their insurance needs.

The software solution is accessible mainly through an app, helping insurance advisors access data instantly.

“Buying health insurance was really easy!! They offered a great recommendation and helped me in the entire process.”

Ria S

8) Toffee Insurance

Website: https://www.toffeeinsurance.com/

Location: Gurgaon, Haryana 122018, India

Employee Size: 51-200 employees

Total Funding: The total funds raised from 2017 to 2019 is $7.1M. The lead investors were Accion Venture Lab, Omidyar Network, and Kalaari Capital.

Toffee Insurance is an entirely digital InsurTech firm that offers millennials insurance solutions to match their needs. The startup’s mission is to make insurance fair by providing frequent, non-critical routine risks with products that are easily accessible, effective, and reasonable.

Millennials are more likely to take risks that they can immediately identify in their daily lives than longer-term risks that require purchasing life insurance. The company distinguished itself by concentrating on developing bite-sized insurance covers for urgent lifestyle requirements.

Some of these are:

- Losses or damages to bicycles or backpacks

- Injuries sustained at the gym while running or during daily commutes

- And mosquito-borne illnesses like dengue and chikungunya

Toffee uses behavioral and consumption data with artificial intelligence, machine learning, and other tools to empower customers in their insurance journey.

“It’s an awesome experience, very easy & smooth services for Claim settlement. Best services for a bicycle Insurance policy.”

Munender Yadav

9) RenewBuy

Website: https://www.renewbuy.com/

Address: Plot No – 94, Sector 32, Gurgaon, Haryana 122001, India

Employee Size: 1,001-5,000 employees

Total Funding: The total funds raised from 2015 to 2021 is $84.4M. The key investors were Evolvence India Fund, Apis Partners, and Lok Capital.

RenewBuy is an online insurance aggregator that provides agents with improved ways to renew insurance policies. The business’s platform uses unique technologies to provide an easy, transparent, and seamless experience. Their USPs are:

- They research and analyze over 100 policy types to empower agents and customers.

- They offer a multi-company agency force employing a “point of sale” interface.

RenewBuy can hire an agent for one-tenth of the price that an insurer would pay by using this digital-only business model. Moreover, a RenewBuy representative can provide a customer with ten insurance quotes with the help of its innovative platform.

“One of the best and most hassle-free ways to renew insurance online. The team working behind the scenes sometimes going out of the way to accommodate and serve their clients.”

Tushar Chaudhary

10) Kenko Health

Website: https://kenkohealth.in/

Location: Mumbai, Maharashtra, India

Employee Size: 51-200 employees

Total Funding: The total funds from 2021 to 2022 was $13.7M. The lead investors were Orios Venture Partners, BEENEXT, and Sequoia Capital.

Kenko Health, a company founded in 2019 by Aniruddha Sen and Dhiraj Goel, works with insurance carriers to offer a subscription-based service that covers medical costs for OPD and hospitalization.

Additionally, they provide healthcare insurance for big, small, and medium-sized firms, people, and families. The healthcare-focused business intends to use the new funding to bring in consumers. They also have ambitions to expand the scope of OPD coverage. They want to do this by including areas such as:

- Coverage for out-patient procedures such as doctor visits

- Dental work

- Skin and hair treatments

- Scans and prescription drugs

- Monthly subscription plan with no upfront costs for the entire year

- Plan for prepaid benefits

- Flat rates for all clients

“I took their 1999/- plan, and I am glad that all the OPD expenses were covered by Kenko. The claim was settled within 72 hours as promised at the time of onboarding.”

Kenko Customer

Our Research Methodology

Each InsurTech company on our list fosters the creation of cutting-edge products to improve insurance processes. These businesses are creating fresh insurance models and redefining the user experience.

Insurance agents should research these products to see what best matches their demands. For those of you who are wondering, the selection criteria for the top Indian InsurTechs were as follows:

- All the InsurTech companies on this list have obtained a sizable amount of capital through funding. For instance, Digit and Acko are among the Unicorns of India, and other InsurTech companies are moving on the same path.

- The InsurTechs that provide unique solutions. For example, Acko provides coverage for taxi services. Digit recently proposed a Pay as your drive plan as well. Furthermore, companies like Turtlemint offer solutions for insurance agents’ training and licensing.

- Last but not least, all the InsurTechs on this list have generally favorable ratings and reviews on various websites. The businesses on this list are all working to develop streamlined insurance experiences.

We provide sales, marketing, and onboarding automation solutions to leading Insurers like Kotak General Insurance, Universal Sompo, Symbo, Exide Life, and many more.

If you’re looking for a solution to automate your processes, book a free consultation with our experts.

FAQs

What are some key factors to consider when choosing an InsurTech company in India?

1. Your Specific Needs: Identify your insurance needs (health, life, auto, etc.) and compare the product offerings of different InsurTech companies. Look for companies specializing in your specific requirements and offering plans that align with your budget and coverage preferences.

2. Customer Reviews and Ratings: Research online reviews and ratings to get insights into customer experiences with different InsurTech companies. This can reveal valuable information about claim settlement processes, customer service quality, and overall user satisfaction.

3. Technology and User Experience: Evaluate the user-friendliness of each InsurTech company’s platform. Consider factors like ease of application, online account management tools, mobile app functionality, and overall user experience design.

pen_spark

How does the claims process work with InsurTech companies?

Claims are crucial. Here’s what to expect:

1. Online Claim Submission: Many InsurTech platforms offer a convenient online claims process. This allows you to submit claims electronically, upload supporting documents, and track the progress of your claim in real-time.

2. Customer Support: Ensure the InsurTech company offers reliable customer support channels to assist you throughout the claims process. This could include phone support, email assistance, or live chat options.

3. Partner Networks: Some InsurTech companies might partner with traditional insurance providers for claim processing. Research their process to understand who handles your claim and the potential timelines involved.

Can I get traditional insurance products (like term life insurance) through InsurTech companies?

Product offerings vary. Here’s a breakdown:

1. Focus on Niche Products: Many InsurTech companies specialize in specific insurance categories, like travel insurance, gadget protection, or micro-health insurance.

2. Partnerships with Traditional Insurers: Some InsurTech platforms might partner with established insurance companies to offer a wider range of products, including traditional options like term life insurance. Research their offerings to see if they align with your needs.

3. Emerging Trends: The InsurTech landscape is constantly evolving. New InsurTech companies might be entering the market with a broader range of products, including traditional insurance options in the future.