Selling insurance can be tough work. I can attest for the numbers of times someone called me to sell some sort of insurance and I had to say no. Sometimes politely, and sometimes a little abruptly.

This is mainly because insurance is a high ticket, one-time purchase product that people do not actively seek. Until the need arises, that is. So how do you know when a lead is looking for insurance? Or when a lead is ready to insure something but doesn’t know it yet?

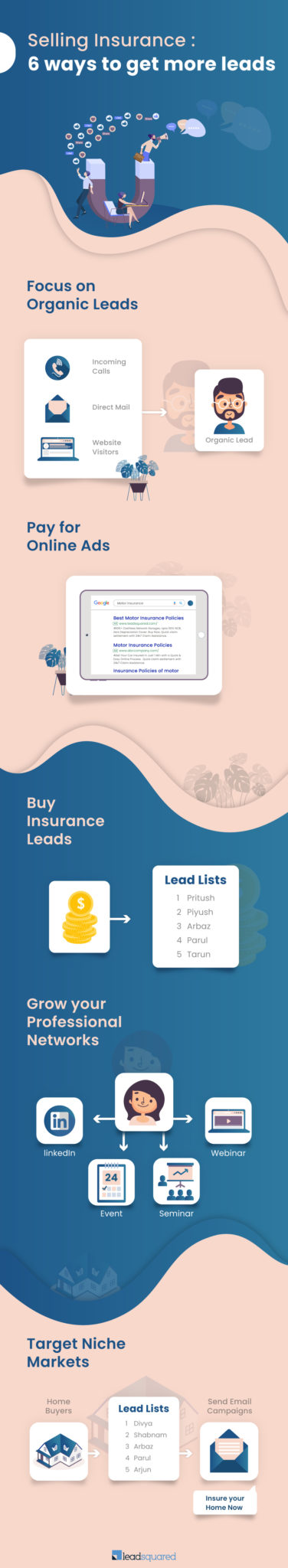

6 ways to simplify selling insurance

This lead gen guide covers six ways you can get quality insurance leads to fill your sales funnel:

Focus on Organic Leads

When you search online for a product and view the search engine results page, you’ll notice that some listings paid to be there and others didn’t. The ones that didn’t were delivered to you organically, meaning they were the best match for whatever you were searching for.

Organic SEO is a priority for agencies selling insurance because it helps you avoid having to pay for advertising. Instead, consumers find you naturally.

How do you end up in search results, exactly?

SEO is a complex ecosystem. In the simplest terms, you’ll want to optimize your website to include keywords that search engines will recognize. This way, the search engine can match your website with user searches accordingly. Check out this guide to learn more about SEO best practices and how to take advantage of organic results.

Pay for Online Ads

Organic SEO can take a while to pay off. To start getting leads quickly, you can pay for online ads using Google Adwords to increase your exposure. People generate more than 3.5 billion searches each day on Google alone, which equals about 1.2 trillion searches per year. With search engine marketing, you can skip the line and head straight to the top of the search results for people who are actively searching for what you offer.

Additionally, paid ads on social media are gaining steam. Platforms like Facebook and YouTube are conducive to advertisers who are looking to increase brand recognition, promote their services, and drive website traffic. They can also be effective in pushing leads into your sales and marketing funnels via lead magnets (think ebooks, forms, newsletter signups, quote requests, etc.).

Buy Insurance Leads Online

If you want to get leads quickly without laying a lot of groundwork, buying a list might be your fastest route. Companies like Double Digits, Web Dog, and Outsource 2 India provide lead generation services for insurance agents.

The best part about buying leads is that the leads are collected based on buying triggers. They’re actively seeking the products you’re selling, and may have greater potential to turn into sales.

The downside of lead gen services is not knowing the quality of the leads before you buy. If you find that a list has outdated information or otherwise doesn’t hit your target market, you’re going to have a harder time making back your investment. Make sure you carefully vet your lead gen provider so you’ll have the best chance of producing an optimal outcome.

Grow Your Professional Network

A lot of insurance marketing targets digital channels, but don’t neglect the power of the people around you. You have professional contacts, so take advantage of them to see if they can lead you to your next sale.

Also, keep in mind that you can never have too many people in your network. Attend events, host workshops, and connect with local business owners to continue building relationships in your community. You’ll not only make valuable contacts but also allow others to get to know you, too. They’ll be more likely to recommend someone who they know, like, and trust.

Target Niche Markets via Direct Mail

From newlyweds to new college graduates to other niche audiences, there are lots of people who may be more likely to buy insurance based on current life events. Consider enlisting the help of a direct mail service, such as Mail Order Solutions, that can help you target prospects and track your results.

Each direct mail campaign should be tailored to your unique audience. Make it attractive, highlight a specific offer, and include a call to action so your prospect knows how to take advantage of it.

Email Your Existing Clients

Don’t neglect the power of emailing your existing client base. You worked hard to earn their business, and since they already know and trust you, they may be more likely to buy life insurance from you.

The cool thing about marketing to existing clients is that it doesn’t cost nearly as much. Studies show that obtaining a new customer can be 5-25 times more expensive. Focusing on maintaining good relationships with your clients can not only help you retain them for longer, but also provide valuable upsell opportunities to help you sell more with less effort and expense.

But, even if these strategies help you to get more leads, you would need a good Insurance CRM. Not only will this ensure that you don’t miss out on any leads, but it can also making selling insurance much simpler. If you are looking for a good tool, I’d suggest LeadSquared. Book a demo now!