Manage your Insurance Sales & Operations Digitally [Download Now]

Hiring the best salespeople is one part of the puzzle. Yes, you should look out for the best talent out there, offer them irresistible remuneration, and open them to opportunities for growth. By all means, do everything you can to ensure they deliver on results and smash their sales targets.

However, this isn’t where it ends, especially for insurance sales teams where the competition for customers is just as stiff. There’s only so much that salespeople can do on their own. Without the right digital platforms, what you get is average at best. 54% of insurance CEOs agree with this, stating that technology contributes greatly to edging the competition. Hence, the role of CRM in the insurance sector cannot be overlooked.

Take a look at your current situation

If you’re wondering why you need a CRM in the insurance sector, all you need is a simple review of your current sales process.

Sorry, we spoke to another agent.

How many times have you had a lead say, “I’m sorry, I spoke to another broker”?

Just because you took a couple of hours before you reached out to them. Of course, it’s not even a day since they made filled an inquiry form on your website and they already contacted the competition. That’s because 78% of customers usually do business with the company that reaches out to them first. Your chances of making contact with a lead reduces 3000 times if you reach out 5 hours after their first inquiry.

This is what manual processes do; make you lose potential customers. Team members can easily forget that a lead reached out or unconsciously abandon one of your lead sources. Or there’s just really no way to respond in real-time – as expected with manual tools.

By adopting a CRM in the insurance sector, companies can see reduced lead response time. Insurance sales teams can automatically send out follow-up messages as soon as the inquiries come in. Automated responses assure your leads that you’re aware of the actions they took and someone from your team is going to contact them at the earliest.

Ultimately, it ensures that you’re the first agent they speak too.

What is the role of CRM in Insurance sector?

For every business, CRMs offer the best chance at understanding prospects and customers and forging productive relationships with them. Companies adopting CRM in insurance sector offers many benefits. Here are some of the roles a CRM software plays in helping your team meet its sales goals.

Improve customer experience

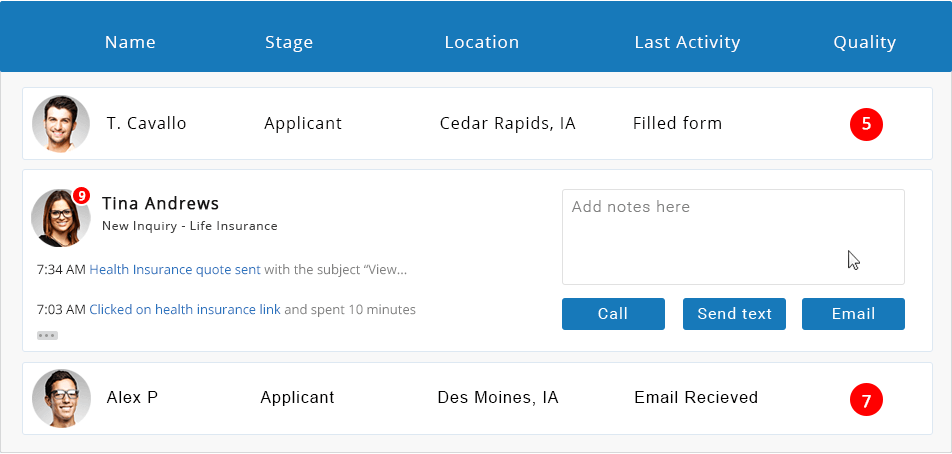

Since your agents have a better understanding of customers and prospects, it becomes easier to offer unique services per client. For instance, you can identify the best communication channel for each customer by simply including it in your inquiry forms. This information automatically stores in your insurance CRM and is readily available on your dashboard.

Some people prefer to have phone conversations rather than communicate via email. You don’t want to neglect these preferences as they make a core part of your customer experience; giving customers what they want. Also, customers may move to another company if their preferred mode of communication isn’t available.

The more satisfied your customers are, the higher your chances of getting referred to other prospects. As you already know, word-of-mouth remains one of the most potent marketing tools for businesses.

Adhere to Industry rules & Regulations

Data privacy laws are some of the most important regulations every business has to comply with. Hence, digital solutions have an obligation to facilitate this compliance. The ideal CRM in the insurance sector should be GDPR compliant and help insurance agents take better care of customer data.

Beyond just storing customer and prospect information, insurance CRM can help you maintain data security.

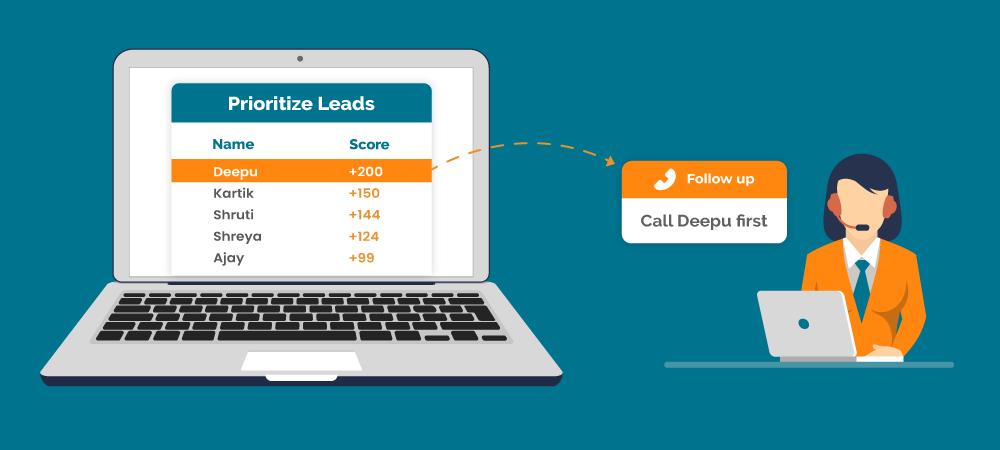

Identify the Biggest Sales Opportunities

Not every lead will turn into a customer. Maybe you already know this but what are you doing about it? Using a CRM in the insurance sector helps you to work on more potential leads. You can then focus your efforts on the most relevant contacts in your pipeline.

All you need to do is define the criteria for eligibility, such as age, financial status, interests, policy preferences, location, etc. Once you’ve set the criteria, the CRM then allocates scores to each lead in your system and prioritizes them as applicable. This way, your sales team can pick from top of the shelf.

Onboard Your Agents in a Matter of Minutes

This especially depends on the learning curve of your CRM, which is why it is important to choose an insurance CRM that is easy to use for all kinds of people.

Moving on from the onboarding process, the right CRM in insurance sector enables companies to save time on repetitive tasks. For instance, where members of your sales team would have to enter a customer’s details manually, a CRM automatically collects and saves them in the system.

Also, salespeople don’t have to look in different silos for a customer’s information. Everything they need is available right on the dashboard. They can quickly move on to other productive tasks.

Looking for a CRM in the Insurance Sector?

A dedicated CRM in the insurance sector performs many functions, but top of the list is to foster healthy relationships between businesses and customers.

If you need help deciding on the perfect CRM for insurance companies, look no further than LeadSquared’s insurance CRM software.

FAQs

How does a CRM system differ for insurance companies compared to those in other industries?

Focus on specific needs. Here’s a breakdown:

1. Industry-specific features: An insurance CRM might offer functionalities like policy management tools, claims processing workflows, and integrations with insurance data sources. These features might not be as prominent in CRMs designed for other industries.

2. Regulatory compliance: The insurance industry has stricter data privacy regulations. An insurance CRM should ensure secure data storage and compliant communication practices.

3. Customer lifecycle management: Insurance CRMs cater to the long-term relationship between insurers and policyholders. They might offer features for policy renewals, upselling opportunities, and personalized communication throughout the customer lifecycle.

What are the potential challenges of implementing a CRM system for an insurance company?

Challenges exist, but can be addressed. Here are some considerations:

1. Data migration and integration: Migrating existing customer data and integrating the CRM with legacy insurance systems can be complex and require careful planning.

2. Change management: Encouraging adoption of a new CRM system among insurance agents and staff might require change management strategies and ongoing training.

3. Data security concerns: Ensuring robust data security and compliance with data privacy regulations is crucial for the insurance industry. Evaluate the CRM’s security features and compliance certifications.

Can smaller insurance agencies benefit from a CRM system as well as larger companies?

Scalability for all sizes. Here’s why it applies:

1. Streamlined workflows: A CRM can improve efficiency for agencies of all sizes by streamlining workflows, automating tasks, and centralizing customer information.

2. Improved customer service: A CRM allows smaller agencies to provide a more personalized and efficient customer service experience, potentially helping them compete more effectively.

3. Cost-effective options: Many CRM solutions offer tiered pricing plans with features suitable for smaller agencies’ needs, making them a cost-effective way to improve operations.