There are over 5965 insurance companies in the United States, which were netting total premiums of $1.22 Trillion (iii.org, 2019). Life insurance accounted for almost 49% of the total premiums – that is $618 Billion.

Life insurance is a fairly saturated market. The competition is fierce, and customers have several options with them. And on top of that, short-term and on-demand insurance trends are capturing the market.

Changing customer preferences make it even more difficult for insurers to find qualified leads. However, it’s not impossible.

It is high time for you to take a step back and strategize. Or you might end up burning your precious resources on Insurance Leads that may not give you the desired ROI.

Try these five innovative ways to find exclusive life insurance leads. We have curated this list after working closely with Life Insurance leaders like Max Life, Bharti AXA, Exide Life Insurance, Get Magik Insurance Services Inc, and many more.

In this article:

- Strategies to Find Exclusive Life Insurance Leads in a Competitive Market

- Final Remarks

- FAQs

Strategies to Find Exclusive Life Insurance Leads in a Competitive Market

1. Reanalyze your Life Insurance Lead Generation Strategy

You might have already tried lead generation activities on some scale. Now, you need to analyze what helped you generate leads in the past. Also, try to find out what hasn’t worked and how to improve the plan.

Ask yourself:

Has your previous strategy worked for you? Did you get any qualified leads? What attracted the lead? Was it the discount on premiums? Was it social media marketing?

By answering the above questions rationally, you’ll be able to identify the loopholes in your previous plans. This way, you can create a strong lead gen strategy next time.

Another thing you can do is – find the hidden ‘gems’ in your policies that may appeal to a particular demography. Accordingly, you can strategize your lead generation campaigns.

2. Take Control Over the Process and Decide

With your marketing budget, you could either go all in or allocate resources on separate campaigns depending on your findings and experience.

Sometimes, in the hustle of work, we subconsciously overlook the fact that our customer is a human too.

However, when you look at the emotional component of your insurance customer and promote your insurance product/service accordingly, the results could surprise you.

Potential customers have a pre-purchase phase where they are shopping for insurance information and advice.

This research phase helps them make educated decisions. Ensuring that you provide your prospects the information they need at this point can really tip the scales in your favor.

Take a step back, re-evaluate the digital insurance market, look at all the information available to you about the prospect before running your next marketing campaign.

3. Go Aggressive on Your Insurance Lead Generation Activities

A formulated strategy can only take you so far. We do not mean to allocate all your digital marketing expenses in one go.

All you need to do is align and focus all your resources – teams, campaigns, software, etc. to a single point and analyze the data before moving forward.

It is also one of the best practices adopted by the leaders in the insurance space.

You can run affordable marketing campaigns and monitor them through Insurance CRM by targeting specific regions and customer types. Here are the new ways to find life insurance leads:

Tie-up with Influencers and Popular Websites

The nifty trick here is to tie up with influencers on social platforms such as Instagram, Youtube, Twitter, etc. You’ll find many influencers across almost every domain. But you have to identify the ones who resonate most with your target customers.

For example, think over who will need life insurance?

Most probably, a family person.

Can every family afford the premiums of a comprehensive life insurance policy?

Certainly not.

What are the attributes that distinguish your target customers?

They travel in business class, own a house, work in a senior management role, have kids, etc. are some of the possible attributes.

Accordingly, you can tie-up with bloggers, vloggers from specific niches to influence their audience into buying your policies.

For example, you can see the US Life Insurance policy review by an insurance brokerage firm Quotacy.

Strengthen Your Inbound Strategy with Impressive Website and Widgets

Almost every insurance company, big or small, has a website. Thus, your website must stand out from your competitors to create an impact.

You can design beautiful landing pages that exactly describes your product and its benefits without much distraction.

At times, people hesitate to fill a form – worrying that the insurance agent will call them repeatedly. Thus, you can use a live chat widget on your product/landing page that can resolve the customer query without making them feel pressurized.

Some of the useful widgets for exclusive life insurance lead generation are:

- Live chat

- Automated chatbots

- Premium calculator

- Self-serve portals for buying a policy

Look at the Haven Life’s insurance premium calculator widget.

Now that you have made your website interactive and impressive, you need to give it a little more push through SEO (Search Engine Optimization), PPC (Pay Per Click Ads) campaigns, and content marketing strategies.

While PPC might bring you an immediate ROI, organic lead generation will take time, but it pays off in the long run. You must track and measure the effectiveness of your strategies towards finding exclusive life insurance leads to improve it further.

Adopt Insurance CRM Solution to Manage Leads

Generating leads is just one end of the puzzle. Converting them into prospects and customer is what matters more.

Even today, Life Insurers use legacy systems and siloed software for individual processes. As a result, the sales and marketing teams end up piling excel sheets. The struggle to extract meaningful insights is unimaginable with such systems.

Insurance CRM is a one-stop platform for your sales and marketing efforts. With good insurance software in place, you’ll never lose a lead. Here’s how it helps:

- Capture leads from all channels into a unified platform including Digital Sales (STP), Bancassurance, Agencies/Brokers, Captive Agents, and other Intermediaries.

- Track interaction history (online chat, a phone call with an agent, email conversation, etc.) and use it for assigning a lead score.

- Categorize leads into buckets, automatically assign them to agents/call-centers/in-house sales teams.

- Identify cross-sell/upsell opportunities and notify agents about the same.

4. Omnichannel Marketing

Customers shop across multiple channels and through many devices. Omnichannel is a concept of using all your marketing channels; digital, traditional, point-of-sale, in-store, handouts, online experience, etc. to create a seamless and unified experience for your customers.

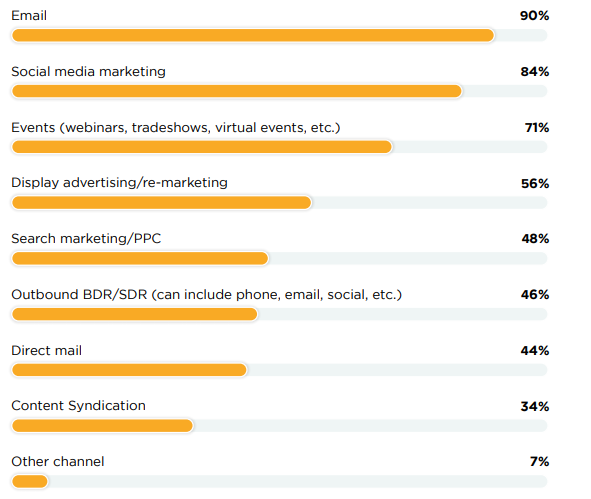

The Business2Community survey reports that marketers get better ROI through omnichannel campaigns.

Thus, you leverage all possible channels to generate life insurance leads. The following are some of the proven ways –

- Build a strong online presence. A shopper uses about 10 sources of information to buy a product/service.

- Use marketing automation tools to stay connected with your customers across every single touchpoint.

- Integrate data across all channels to avoid leads duplication.

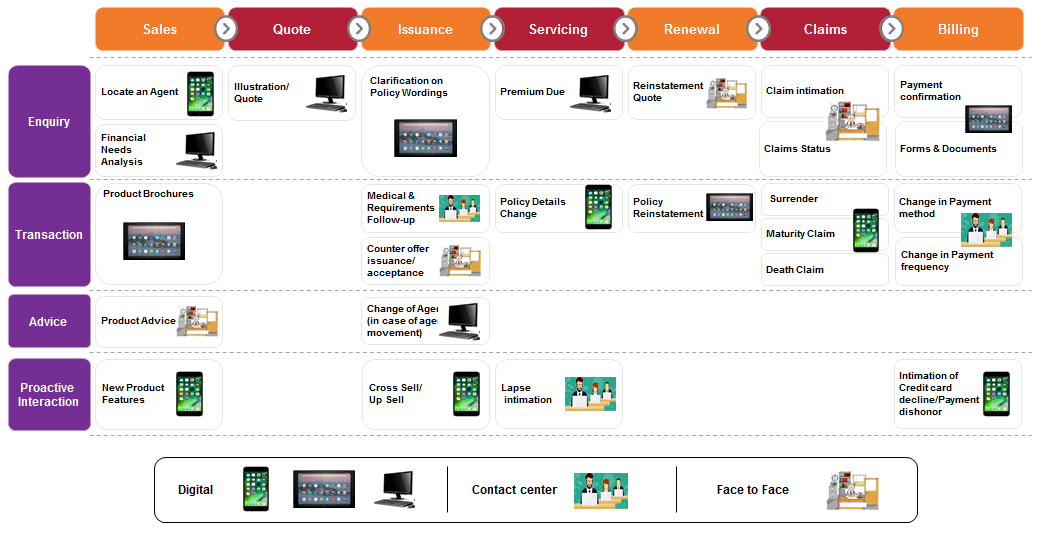

The following graphic from MindTree illustrates the omnichannel customer journey while buying a life insurance policy.

For optimized life insurance lead generation and ROI, you must have all your business platforms aligned – customer retention, sales, and upsells will effortlessly follow through.

A CRM with omnichannel marketing and sales capabilities lead to higher lead conversion and retention rates.

5. Cross-sell and Up-sell

Most big insurance companies bundle insurance packages and offer multi-line discounts. However, this type of marketing reach is limited.

Customers are becoming more aware of the advantages of buying insurance policies in bundles rather than multiple policies from various insurance carriers. Moreover, if your customers are satisfied with your services, they will certainly prefer buying policies for friends and family from you. You can also consider this as a referral opportunity.

It is easier to sell to existing customers. New customer acquisition is 5-25 times more expensive than retaining and cross-selling/upselling to the existing ones. Moreover, by increasing the customer retention rate by 5%, you can increase profits by 25-95%.

The point is – find opportunities with your existing leads. The simplest way to do it is to understand the lead persona. You can also use Opportunity Management CRM to capture, track, and close all opportunities from every single contact/lead.

Final Remarks

Finding exclusive life insurance leads can be tricky and demands dedicated efforts. Also, you would not want to spend time handling junk leads. Therefore, you must plan a strategy to find and filter qualified leads.

To sum up, the following methods will help you generate exclusive life insurance leads:

- Map your policies to your target customers. Accordingly, you can plan campaigns.

- Step back and re-evaluate your lead generation strategy. You’ll discover what has worked for you and what has not. By doing this, you’ll be able to put resources and budget on things that have brought you more results.

- Start your campaigns aggressively. There shouldn’t be a scarcity of leads for salespeople. You can use PPC ads, install a widget on your website, invest in SEO for finding organic leads, and leverage influencer marketing strategies.

- When it comes to nurturing leads, invest in good Insurance CRM. It is because you’ll be finding more opportunities to retain and cross-sell to the existing customers.

- Don’t underestimate the power of omnichannel marketing. It connects you with your leads across multiple touchpoints.

- Finally, wherever possible, upsell and cross-sell to your customers.

If you’re looking for software that can streamline your lead generation activities, then you must try LeadSquared Insurance CRM.

Further reading:

- 3 Insurance Selling Tips You Can Implement Right Away!

- Challenges in Life Insurance Marketing and How to Solve Them

- Understanding Why You’re Not Selling Enough Life Insurance Policies and What to Do About It

FAQs

There are several ways to generate insurance leads. You can add a quote generation plugin on your website, use LinkedIn, use SEO to generate organic inbound leads, and try “social listening” to find people interested in buying a particular insurance product.

If you want to get life insurance leads for free, try social media listening (engage with people looking for advice on a particular insurance policy on social media) and use your website to attract inbound leads.