Automation will be a key growth driver for insurers in the coming years. By automating regular workflows, insurance providers can reduce operational expenses by 40%.

In this article, we’ll look at 5 insurance workflow automation examples you can implement for sales and distribution.

5 Insurance workflow automation examples

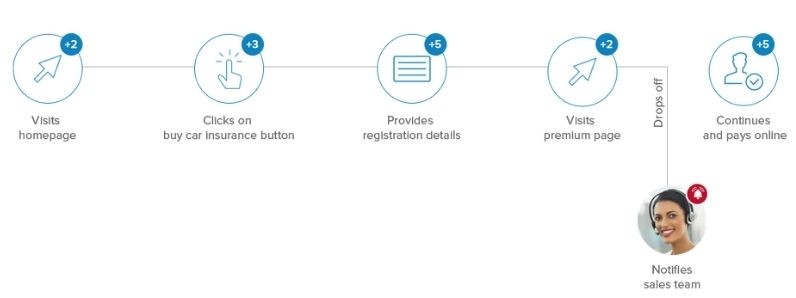

Online selling or STP (Straight-through Processing) is one of the most cost-effective ways to sell policies online. However, not all website visitors convert into customers. The insurance sales reps or call-center agents follow-up with the inquiries through calls, emails, SMS, etc., and influence them to buy insurance policies.

However, not all leads are qualified, and the agents end up calling the leads who will never buy.

Automation can be of great help here. By filtering leads automatically based on their activities on your website, call response, and other measurable attributes, sales teams can prioritize follow-ups with them.

Let look at how you can use automate routine insurance workflows.

1/5 Lead creation and scoring

Insurers get leads from many sources. For instance, website, app download, social media, through brokers, customer referrals, etc.

Instead of managing them on excel sheet, you can integrate the sources of lead generation with your CRM and capture all incoming leads into one centralized platform. It will also help you maintain a standard format of lead info, which can make your further data analysis more accurate.

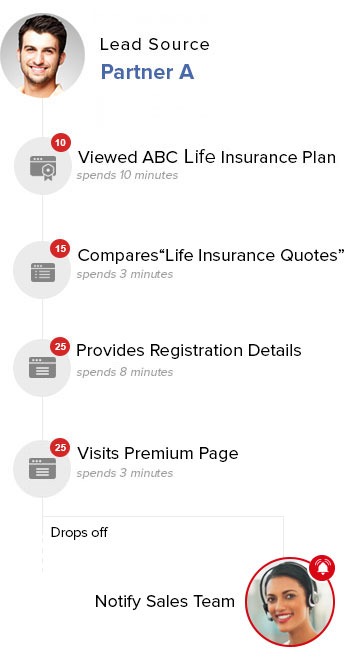

Another benefit of using an automated system for lead creation is – the system can assign scores to the leads based on their source, campaigns, activities on your website, etc. It will help you identify their intents and qualify them. For instance, people who navigate the pricing page are more interested in buying policies and have better chances of conversions. The system can assign better scores to such leads.

2/5 Lead distribution

The key to automation is adequate information. CRM software can track the location, language, and other attributes of the leads and include them in the distribution criteria.

Another benefit of location tracking is that you can map and assign leads to your agents/sales reps in those locations. It will help the sales agents speak to the customers in their language and overcome the barrier of time zone and language differences.

Following up with customers on a first-come-first-serve basis may not be effective, especially when you’re dealing high volumes of inquires. Based on the lead score and your business logic, you can prioritize leads and assign them to the sales agents for calling.

Also, CRM systems record the timestamps of each interaction. You can use this data to identify the best time to contact your prospects. For example, if you have identified that most of the leads receive calls during off-work hours; you can create task automation that will nudge sales reps to call prospects during those active hours.

This way, you can immediately follow-up and not lose the leads that have high chances of conversions.

3/5 Lead deduplication and activity tracking

Many Insurers face duplicate leads issue because they work through multiple intermediaries and distribution channels. Duplicate leads pose several challenges. Not only would they make your long-term nurturing efforts ineffective, but might also take up bandwidth from multiple agents, and end up irking the prospects because of several agents contacting them for one request. Imagine the same email being sent to the same customer at the same time because there are two instances of the prospect in your lead management system.

For example, if a lead has requested a quote for health insurance and after a day or two, he takes the quote for car insurance, then many legacy systems create two instances of the same lead.

The correct scenario is – creating a single instance for a lead and updating the activity status from time to time. In the above case, the lead created for health insurance buyer should have an activity update for requesting a car insurance quote. Automation can help you deduplicate leads and track the complete customer journey. CRM systems with lead capture automation prevent lead duplication and track leads even after they turn into customers. Tracking lead activities diligently also helps in opportunity management.

4/5 Task reminders

Salespeople must make multiple calls every day. Maintaining their follow-up calendars can be an unnecessary overhead to their primary task – that is calling.

Workflow automation can help here. Based on the last interaction/lead activity history and your business logic, the system can create a task reminder for salespeople.

Moreover, managers can create a complete workday plan for agents, in addition to notifications. When an agent has a list of tasks defined, and if new leads/inquiries come in, they can get added to their task list based on the urgency of the request/pin codes/locations of the agents. It will make them much more efficient than if they were following a static calendar.

Let us take an example. You found a lead who has spent over 10 minutes on your website and has also browsed the pricing page. You even tried to contact the prospect immediately after he requested a quote. But the lead was not reachable then. Now, you might want to call him again the next day.

If you have automated your sales workflows, then the system will automatically create a reminder to call that lead at the most suitable time. It will save a lot of your agents’ time as they need not refer to their excel sheet or calendar to find the next task in their schedule. The same case holds for in-person meetings, emails, and other interactive jobs.

5/5 Automating policy renewal, cross-sell, and upsell

Instead of manual book-keeping, you can use automation to send policy renewal emails/SMS or notify sales reps for calling the existing customers.

In terms of opportunity management, a single prospect may be a prospective customer for many products. For instance, your customers may be interested in buying car insurance, term insurance, and health insurance for their different family members.

Based on their activities like browsing product pages, forwarding emails, clicking ad links, etc. you can identify the opportunities to cross-sell and upsell. After all, selling to an existing customer is a lot easier than acquiring a new one.

The bottom line

Every Insurer has its business logic. It distinguishes them from their competitors. However, implementation and execution at scale is the key to the business success.

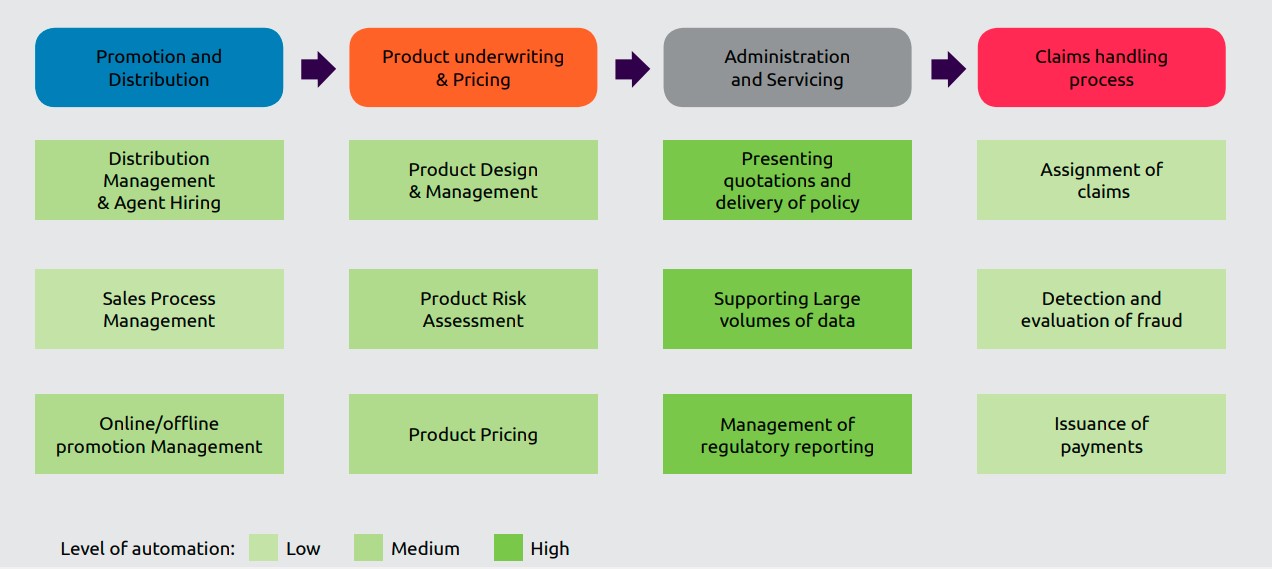

So far, Insurers have invested in automating their administration and servicing. Such as presenting quotations and delivery of policy, supporting large volumes of data, and management of regulatory reporting. Automation in sales process management holds the potential to reduce operational costs and increase speed-to-leads.

The following exhibit from Capgemini illustrates the state of automation in different insurance processes.

By reducing the salesforce time spent on unproductive tasks, you can improve their productivity to a great extent. Automation not only eliminates manual processes but also ensures accuracy and timeliness in lead management.

The automation system that you’re looking at must be customizable to suit your business logic. For instance, in addition to its no-code automation builder, LeadSquared Insurance CRM also allows you to code and implement complicated processes, via LAPPS and automated workflows.

“We have observed that with the introduction of LeadSquared, the average sales per day per agent has moved up by 40%. The lead-to-sale ratio has also increased by 35% in three months,” says Mayank Gupta, Director of Business, Acko General Insurance.

If you are looking for a solution to improve your sales process, then you must try out LeadSquared’s Insurance CRM.

FAQs

With the help of CRM, you can automate several insurance processes such as policy distribution, lead creation and prioritization, task reminders, quote generation, customer engagement, and claims processing.

Automation can improve employee productivity by eliminating manual, repetitive tasks. From the insurance industry standpoint, automation can help in faster policy distribution, maintaining accurate customers and leads records, and claims processing.

By automating workflows, Insurers can maintain updated customer interaction and transaction records, track their activities, and provide better post-policy sales support.

Insurance workflow software helps you streamline your sales, underwriting, and claims processes and manage them efficiently. Insurance CRM software can also help you automate workflows and sell more policies from all your distribution channels. It includes STP (digital sales), call center, bancassurance, agencies, brokers, and field sales.

Workflow management in insurance refers to overseeing processes like insurance applications, underwriting, claims processing, and more. Insurance workflow management system helps by automating processes, enabling collaboration between teams, and centralizing data so that all stakeholders stay updated with the current and accurate information.

Further reading:

- How to sell more policies with automated and personalized communication?

- 3 Insurance selling tips you can implement right away!

- How to find exclusive life insurance leads in a competitive market?

- What is the insurance sales funnel?

- Advantages of bancassurance for customers, banks & insurance carriers.