Insurance selling is an ever-evolving business in terms of operations, products, and distribution. Rapid digitization, changing customer expectations, Government regulations, demography, and economy are the factors that influence insurance sales. Moreover, with the rise of InsurTechs and insurance marketplaces, selling insurance just through traditional modes has become hard to imagine.

There are popular sales models in insurance:

- Direct sales: Here, insurers reach out to customers directly without giving commission to an external broker or agent. Customers find a policy via the Insurer’s website or ads. Direct sales have evolved into STP (Straight Through Processing) that involves integrated application forms and portals. It may also include call-centers and field agents, but these are on the payroll of the insurer.

- Agents and Broker-based sales: Also known as indirect selling, insurance brokers or agents act as middlemen between Insurer and customers. Insurers need to pay commission per sale and can leverage their services for selling policies. Digital marketplace and online brokerage platforms are on the rise recently.

- B2B2C sales: Leveraging third-party apps to sell policies. For example, Allianz Business System has introduced open-source APIs for apps/vendors to sell Allianz policies to their customers.

- Bancassurance: Here, banks sell insurance on behalf of insurers. Read more about the advantages of the Bancassurance and Bancassurance model.

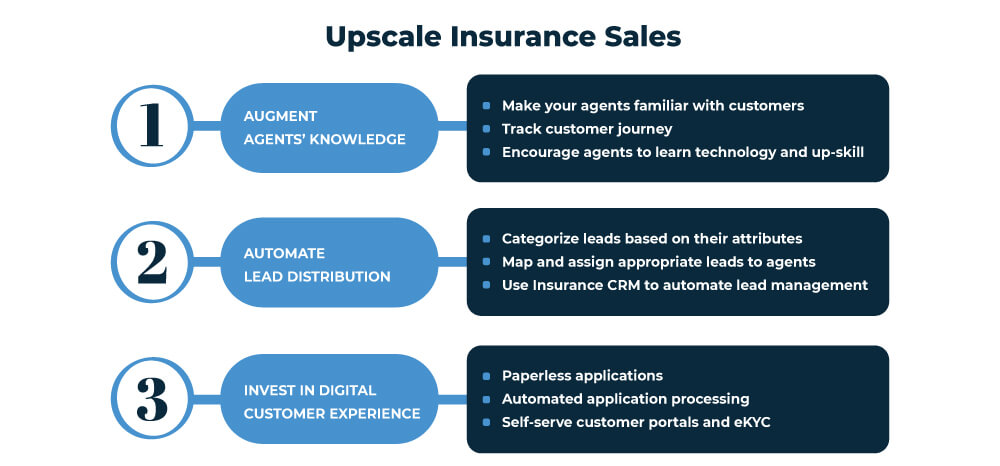

To succeed in sales, Insurers need to pursue multiple models simultaneously and digitally enhance their core selling capabilities. Here are three insurance selling tips in line with the above sales models that you can incorporate in your process.

1. Make your agents familiar with customers/prospects

Insurance selling tips for agent-based sales

Of course, you cannot personally introduce your agents to your customers and prospects. What you can do is – let your agents know your customers before starting any interaction.

Not knowing anything about a prospect is like stepping into completely unknown territory for the agents. They need to form a connection with them before they can sell anything to them. It is not easy and requires genuine efforts to pull off selling policies. But, with relevant information available to them, your agents will be able to strike meaningful conversations and turn prospects into customers.

The prospect information you can provide to your agents includes age, profession, financial preferences, social standing, and if they already have an existing policy with you.

Also, knowing the customer journey on your digital assets (website, social media, advertisements), as well as prior interactions (via phone calls, emails, face-to-face meetings, etc.) can help your agents figure out the perfect approach.

Let us take an example. If you know that a prospect came to you after researching other products in the market, you should share this information with your agent. The reason is – other insurance companies will also be pursuing the same prospect through drip campaigns and remarketing. In this case, an agent needs to think on their feet, act fast, and have all the right answers to the customer queries. It is also essential for agents to emphasize what differentiates your product from the competitors.

Why is an understanding of customers important in insurance sales?

Understanding customer behavior was once a tedious process. But today, we can track customers’ needs better than ever before. With the right technology and tools, we can understand consumer demands and plan their possible responses. Further, we can use this information to reach out to the right prospects.

Consider two scenarios. There are two leads interested in your product. They start to fill the online application form, but somehow do not finish it and leave the site.

The first prospect is married and interested in a family cover plan. He has filled in most of the details along with his salary, the policy he finds suitable, and the premium he can afford. Unfortunately, he did not complete the application and left your website at the document upload stage.

The other lead is a student who has filled in his email and phone number and has left the site.

Of the two, the first lead (married individual) is more likely to buy life insurance. Therefore, it makes sense to reach out to this prospect first.

The point is – if your agent knows the prospect journey, their intent, and the buying stage they are at, he/she can take appropriate action. It will also improve the agent’s sales performance.

Help your agents help them

Here are a few other things you can do to assist your agents and improve their performance:

- Motivate them to attend insurance training programs. Such programs are essential to keep the agents up to date with your new products. Interestingly, some mobile CRM apps support video tutorials, resources, etc. to help agents on the go.

- Help them with case studies of successful insurance salespeople that they can read.

- Encourage your agents to enroll in certified training courses. After all, customers regard well-educated and trained insurance agents.

- Teach them to focus on relationship management values and characteristics.

Insurance selling tips #1: Give 360-degree leads profile to your agents.

2. Assign appropriate leads to agents

The competition is tough in the insurance sector. There are over 5969 insurance companies in the US alone. Plus, the range of products each company offers is also huge. However, only 22 percent of global customers receive experiences based on a deep understanding of their needs, preferences, and past interactions.

From a consumer’s perspective, selecting the best insurance product from a pool of options is tiresome. The decision becomes even more challenging when almost every product qualifies at a glance.

Consumers tend to explore and understand insurance policies before buying. People rarely select the first thing offered to them. When there is a plethora of options to choose from, and thousands of firms are eager to provide niche solutions, it becomes imperative for agents to know what prospects need.

For that, agents need to know the products they are selling inside out. As you may know, this is not always the case. Sometimes, agents have in-depth knowledge about one product. But they barely know other policies offered by the same insurance firm.

Customers often do not know what they want and what is best for them, even after the best of research. And agents can guide customers only if they understand the policies. The insurance agent acts as an advisor to the prospect, and therefore domain expertise is a must.

Now let us consider another scenario. Suppose a prospect shows interest in a life insurance policy, but the agent the lead gets assigned to is well-versed in health insurance products. If the agent was an expert in life insurance, the chances of closure are higher. But this challenge is easy to resolve with smart lead distribution.

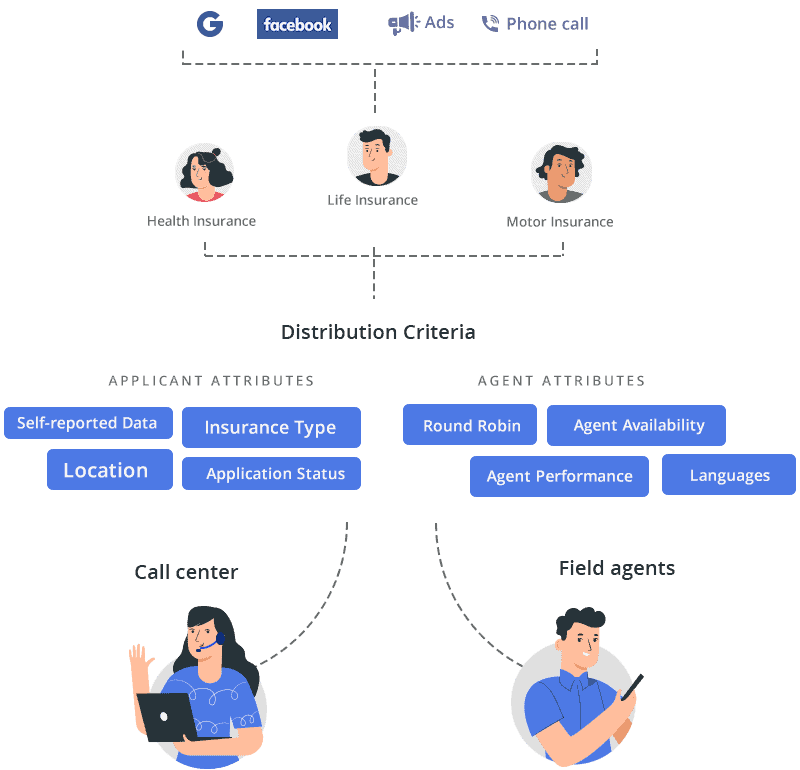

How can Insurance CRM make lead distribution easy?

By using Insurance-specific CRM, you can map leads with the agent’s domain expertise.

You can set up your distribution logic to assign the right agent to the incoming prospects. Moreover, you can select different attributes like agent availability, performance, and language for appropriate lead distribution.

Insurance selling tips #2: Cater to the specific demands of each customer with specified agents.

Know more about lead distribution automation.

Deliver better and digital customer experience

Insurance selling tips for direct sales

A significant 47% of users turn to a competitor due to bad customer service. By ensuring customer experience (CX), you can avoid this fate.

Insurers are moving towards a completely digital process or Straight Through Processing (STP). STP is an automated process for sales, agent onboarding, and financial transactions that require the least manual interventions. It aims to improve the customer experience as well as reduce operational costs. STP involves building automated workflows across the customer journey.

Since interactions are becoming increasingly digital, you need to equip your agents with digital tools. You will also need to train your agents to resolve customer queries around online applications or buying a policy online. Insurance companies across the world are adopting the following measures to enhance the customer experience.

Digital tools to enhance insurance customer experience

- Paperless Application: A prospect interested in an insurance policy can fill an online application form. The application can change progressively, based on the prospect’s inputs. You can save the progress of the application form at different steps – allowing the applicant to pick up from where he left later.

- Progress Tracking: It is an online process that allows you to track application completion or drop-offs.

- Automated Application Processing: You can automate and move prospects to the next stage of the sales funnel based on their activities. For example, you can move prospects to the verification stage automatically if they complete the application. Or you can nudge them to complete the application (in case of drop-offs).

- Customer Portals: You can leverage self-serve portals to upload documents, check application status, and receive verification & approval notifications. Such portals allow applicants to log in and check the status of their applications.

- eKYC verification: It is possible to schedule a video KYC as per the applicant’s and verification agent’s convenience. It helps in onboarding customers virtually. VCIP (Visual Communications and Image Processing) eliminates the need for in-person verification.

Although most of the above processes seem automated, the role of insurance agents is not off the picture. By leveraging automation tools and training agents, you can give your customers a wholesome experience in their digital insurance journey.

Insurance selling tips #3: Go digital and make agents a part of your digital transformation journey.

Summing up

Despite uncertain economic conditions, the insurance industry has successfully maintained profitability and growth – reflecting the willingness of Insurers to adapt according to changing customer preferences.

The recent advancements in insurance sales include leveraging technology & automation, upskilling the workforce and affiliates, and delivering superior customer experiences. The best process automation solution to accelerate sales is CRM – custom-built as per the insurance sector requirements. The real estate, insurance, and consulting sectors account for over 50% of the prospective CRM buyers. The time is ripe for Insurers to invest in the right technology and tools to drive high-velocity sales and deliver first-class customer experiences.

Know more about Insurance CRM.

Insurance Sales FAQs

Here are insurance selling tips that you can implement immediately:

1. Maintain a 360-degree prospect profile and let your agents understand your prospects’ preferences.

2. Opt for automation and distribute leads effectively.

3. Invest in delivering superior customer experiences through digital and self-serve portals.

It is important to choose words carefully while dealing with customers. You can go for one of the following sales closing techniques depending on the lead persona:

1. Assumption-based close: Here, the agent assumes that the prospect has agreed to buy a policy. E.g. “when do you want to receive the policy?”

2. Option-based close: Here, agents can give your prospect an option. E.g. “what should I mention in the policy start date – Monday or Wednesday?”

3. Suggestion-based close: If you have a good repo with the prospect, you can suggest a deal. E.g. “I would suggest renewing your policy a month before expiration. It will preserve your term benefits.”

4. Urgency-based close: Here, the agent pressurizes a prospect to decide. “limited period offer,” “only for this month,” etc. are some of the terms associated with this type of close.

Further Reading: