Selling insurance is different from regular sales in many aspects. Insurance agents and sales reps must face objections from prospective customers even for two-minutes of phone calls. On top of that, there are several similar products in the market. Thus, to convince customers that your insurance product is better than others is a pressing challenge.

In short, selling insurance policies needs a different approach. That is where insurance sales training comes in.

In this article, we will discuss why training is crucial and how to automate insurance sales training to help agents/sales reps close more sales.

Why is insurance sales training crucial?

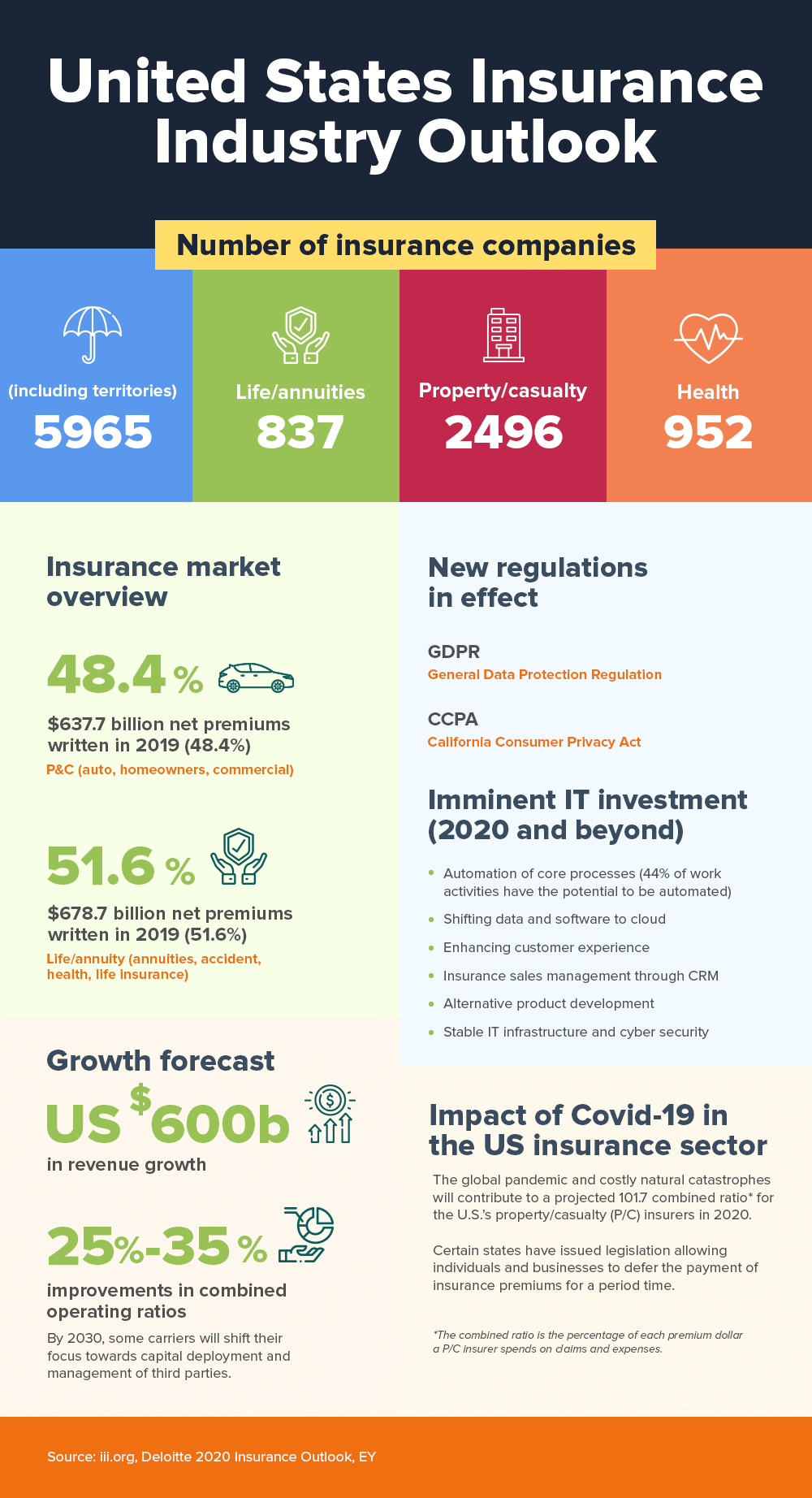

The U.S. Bureau of Labor Statistics states that the insurance industry attracts plenty of agents and brokers from around the world (there were 501,300 insurance sales agents in 2019 in the United States). Thus, it is even more challenging to get by as a new inexperienced insurance agent.

Manual processes are yet another problem. Salespeople on the field find it difficult to get access to information back at the office. Many insurance companies fail to acknowledge this fact. New brokers and agents face a lot of struggles in the field that can reduce their productivity and eventually impede business growth.

Experts advise insurance companies to onboard new agents with proper training. But again, many insurers don’t use technology for training purposes, and agents/sales reps end up exploring sales methodologies on their own. To avoid such circumstances, training is a must for agents and sales reps.

The phases of insurance sales

Online sales or STP (Straight-through Processing) in insurance have recently started to gain customer’s attention. While online or direct sales is convenient for both Insurers and customers, the role of human-to-human interactions to persuade customers is still intact. In 2018, in the United States, Independent agents and affiliated agents wrote 51% and 38% of all life insurance policies respectively. Surprisingly, only 6% of sales came from direct response to marketing efforts.

The insurance business has several representatives for their customers, and everyone has their own way of handling sales calls. It includes in-house sales representatives, agents, brokers, and call-center agents. However, on a high-level, there are five crucial phases of insurance sales. These are:

- Prospecting: It involves finding qualified leads through online channels, cold calling, and cold emailing.

- Preparation: It includes understanding the product, company policies, competitor’s offerings, customer-interaction guidelines, and persuasive communication strategies.

- Outreach: Here, the agents/sales reps contact the leads. They can either meet them personally or call on their phones. Insurers also need to train their salespeople about the technology they use, for example, cloud calling or IVR telephony.

- Handling objections: People do not always entertain sales calls. So, representatives also need training in handling dissents and rejections from customers.

- Closing: The final closure may require paperwork, identity verification, etc. You need to train your agents, brokers, or sales reps about the process of closing an insurance policy sale.

How to automate insurance sales training?

Even though it is imperative that sales training is crucial in the insurance business, many insurers don’t have enough training resources and technology to support end-to-end training. That is why there is always a gap between the agent’s knowledge and approach and the customer’s requirements.

However, it is possible to bridge these gaps by ensuring proper training for agents and sales reps. Here’s how.

Create online training modules

Let’s take an example. To understand a particular topic or to foster your interests, you must have taken an online course. For instance, you must have come across LinkedIn courses on Sales Skills or Udemy’s short, one-hour course on objection handling techniques.

These are the best examples of how organizations automate training. By taking inspiration from their style, duration, etc., you can create bite-size training modules covering all the aspects of training – from prospecting to closing. Now, you might be wondering how to ensure that the agent has studied the course? So, you can create assessment tests with grading to make sure that agents take the training seriously.

Also, apart from the product knowledge, agents and sales reps need to know the basics of cold calling, writing cold emails, drawing a proposal, and closing sales. Flooding all this knowledge all at once can be overwhelming for new joiners. Therefore, you can create internal certification courses that will keep fostering your agents’ sales skills. Many leading insurers follow this path. For example, Auto Club Group, one of the leading insurance firms of the United States, has introduced training and development programs for people who want to grow their career with them.

Cloud information repository

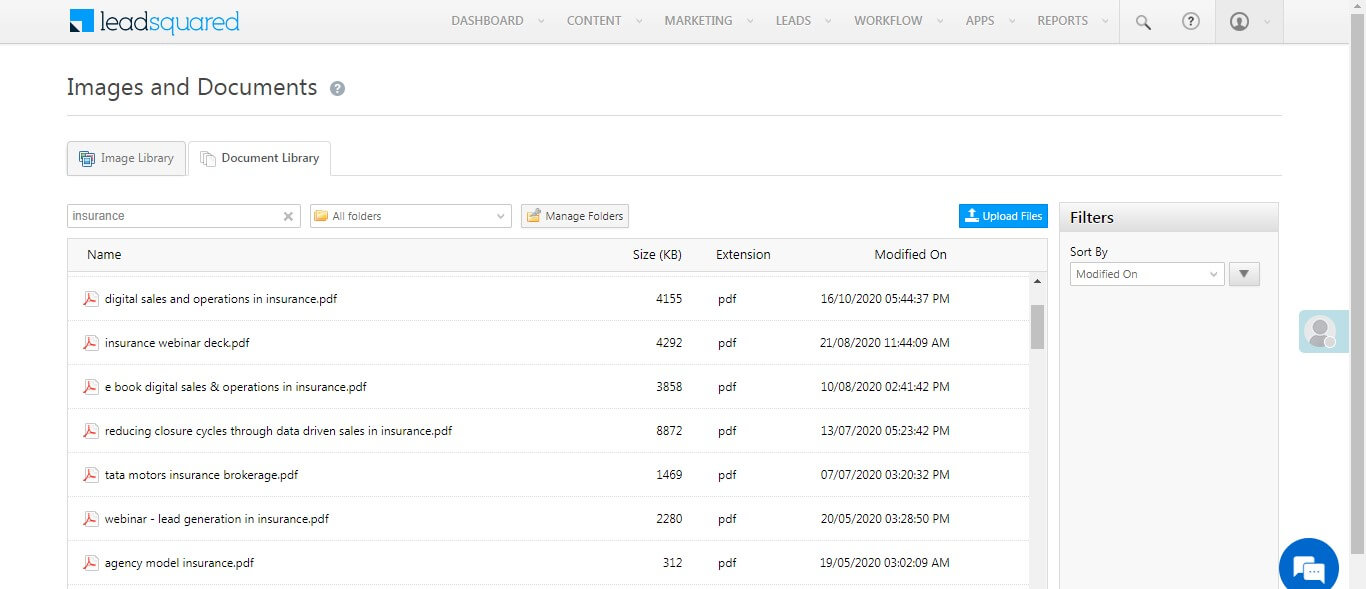

You can store the training modules in your Insurance CRM as resources. This way, agents can access the resources and the policy information whenever the need be. Moreover, it becomes even handier with a mobile CRM app. Here, agents can refer to these training materials and other resources (policy information, regulations, company policies, etc.) whenever they are traveling or waiting for the client meeting, and so on.

Another aspect where most insurance sales agents get stuck is on customer queries about tax benefits on insurance policies. Agents cannot remember the tax benefits of each insurance policy. Moreover, these policies keep on changing, and sharing outdated information is equivalent to misleading customers.

Information repositories come in handy at such times. Sales reps and agents can refer to the updated information anytime through the information library.

The following is a snapshot of the LeadSquared CRM cloud document library.

Automate onboarding

Another way to automate insurance sales training is by including the training modules during onboarding. Onboarding involves four crucial phases: pre-arrival, joining, orientation, and training.

While pre-arrival and joining phases mostly deal with documentation and verification, agents get trained in technology/app and company policies during the orientation and training phases.

For instance, if you use a CRM system for lead and customer management, then you will have to train your new agents on how to use the CRM system. During one of these phases, you can schedule a session for sales training as well. Or a refresher course for experienced professionals. You can also track whether the agent shows up for training, attends the sessions, and assess their learnings through quizzes/assessment tests.

Read more: What is onboarding automation?

Targeted training

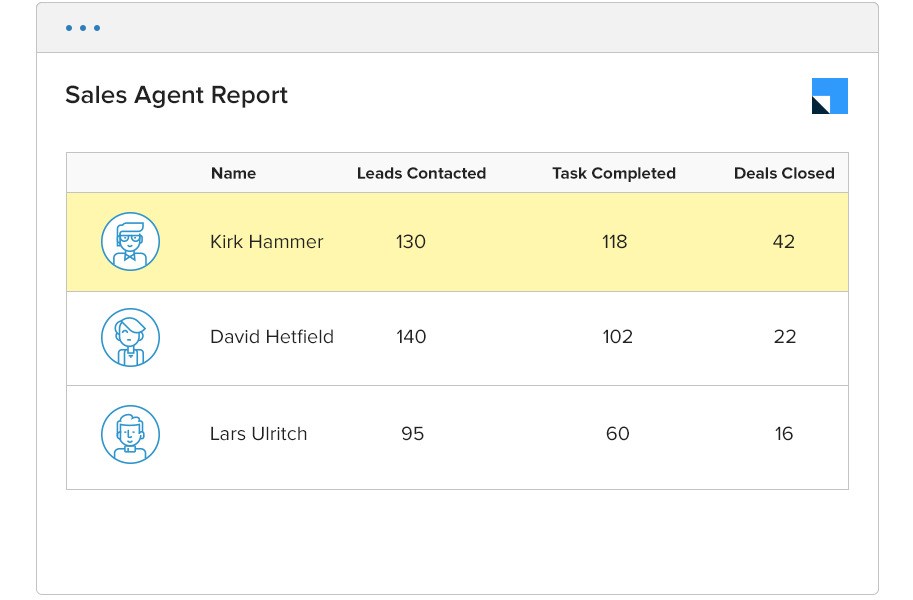

In an organization, some agents outperform while some underperform. By tracking the sales performance of your individual sales agents in your Insurance CRM system, you can identify the agents who need further training.

To take this a step ahead, you can also automate call quality audit and figure out the gaps in your agent’s sales calls that are preventing conversions.

Manage curriculum

It is true that year after year, you will have to update the curriculum to suit the current market trends. For example, yesterday, agents had to sell to Gen X, and tomorrow they will have to sell policies to millennials and Gen Z.

The different set of customers have distinct communication preferences. Thus, as a manager, you’ll have to keep updating the training modules from time to time. Automation is of great help here. You can easily replace parts or whole of the older modules with the newer ones without changing the entire workflows.

Insurance sales training benefits

In 2017, Brandon Hall Group conducted a survey on organizations that facilitated training for agents and reported the following business benefits:

- 67% reduced training costs

- 59% reduced travel time spent on facilitating/attending training sessions

- 61% increase in sales

(Source: https://www.cornerstoneondemand.com/sites/default/files/whitepaper/us-wp-ultimate-guide-insurance-agent-training.pdf)

Insurance CRM: a one-stop solution for automating insurance sales

What would you prefer? Individual software for individual processes viz. onboarding, sales, training, customer management, resource management, etc., or a unified system that handles most of these processes?

The latter, of course, because it will save your team’s time switching between platforms and eliminates the hassle of redundant information anomalies.

A customized Insurance CRM with an option to have training repositories, pitches and more enablement material is the best solution to onboard agents as they learn how to use the tool, maintain customers’ profiles, connect different distribution channels such as direct sales, call center, bancassurance, agencies, brokers, and field sales, and track your team’s performance. Plus, you can store all relevant and updated information for the agents and reps in a central repository.

Handy tips for insurance sales training

- Start by teaching new agents about business policies and processes. They need to understand the need for technology and why automation is an essential part of the sales.

- Every smart business ought to have top-notch training modules, formulated to meet their specific needs. With these modules, you can evaluate new employees. You can design tests and quizzes to test their comprehension of the subject matter.

- A pre-set test will be necessary to ascertain whether the new agents do understand your system.

- Be sure to automate the business repository/database with quality CRM software. So, they can access relevant information and resources without any hassle.

- Experts advise employers to monitor salespeople’s performance from time to time. It will give you a clear idea of the areas they are lagging. So, you can tell the appropriate training to tie the loose ends.

Further reading: