The importance of insurance sales CRM cannot be overlooked when you are a part of a trillion-dollar industry like insurance. What matters most is that you stay on top of trends in order to be ahead of the competition in the market.

Imagine what a not-so-busy Monday looks like at an insurance company.

Allow me to venture a guess.

Twenty percent of their day will have them tending to emails and phone calls, and another twenty percent would probably be towards board meetings where they make and draft policies. A larger chunk of their day will be at their desk, completing paper works for existing clients, sending welcome emails to new customers, mailing policy applications to prospective clients. Sometimes it gets so busy that they barely have time for lunch or coffee.

Can you see where the problems lie?

The fact that your sales team is always playing out routines that are mostly unproductive such as following up with customers and filing paperwork. There is rarely any time to attract new customers or any real way to create strategies for customer retention, and ultimately generate more revenue for the business. No time, right?

Why is Insurance Sales CRM Important?

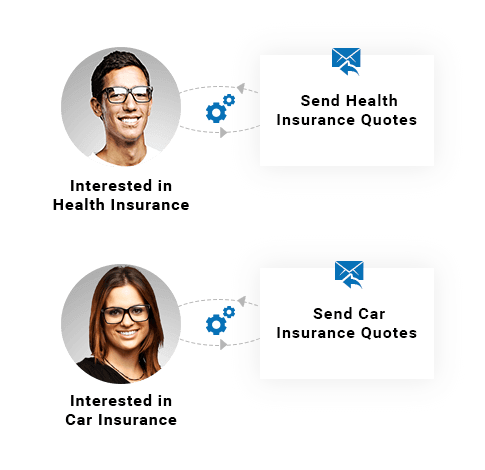

Simply put, the CRM software acquires and manages customer information in such a way that it can be easily used for generating more customer engagement. Information provided by the CRM helps you to give personalized consultation to your prospective clients, thereby increasing your sales numbers. For instance, when insurance agents gather information from their clients, they expect that the information furnishes usable data, such as their needs, goals, etc.

With this data, your agents can reach out to your prospects and target their sales conversation around the area that interest’s your clients.

Now, CRM does that, and even faster.

Here are some reasons why you need an insurance sales CRM.

Insurance is still perceived as a commodity

It is a general challenge that sometimes, target customers do not know why they need to purchase an insurance policy. They also can barely identify the difference between a policy presented by one company and another. This gives insurance agents and companies the opportunity to capitalize on Millenials as their target focus. They are everywhere; social media, email, and other online communities. Nick Chadwick, who is a senior researcher at Fuel Cycle, once advised insurance firms on focus on Millenials, who would soon take over baby boomers.

Competition

Just like it is between Burger King and McDonald’s, competitions grapple the attention of every industry. Technological advancement, cutting edge software, smart innovations are a few factors that set industry high flyers apart.

How do you stand apart in an industry that boasts intelligent decision-makers?

By delivering a remarkable experience for your customers right from the welcome mail to retain their attention and curiosity with campaigns, newsletters, offers, and even more.

The list goes on and on. However, this list divulges a question that is urgent and needs answers. How can you, as an insurance agent, or an insurance company, increase your productivity with insurance sales CRM?

A specialized insurance sales CRM can save the time you spend at your desk, repeating daily unproductive routines by 75%, giving you time and allowing you the opportunity to focus on customers and customer experience.

How Insurance Sales CRM Increases Productivity

At the end of the day, your major goal is to see your team members perform at their optimum and close more deals than ever before. Let’s look at how insurance sales CRM can make this dream come true.

Organize your Leads Better

Prospects come through several channels; referrals, marketing campaigns, partnerships, and so on. However, as an insurance agency, it is essential to know about your prospects. How old are they? What kind of jobs do they do? Do they have a history of severe illness? How many people are there in their family? What kind of insurance policy are they seeking?

Having relevant information about your customers is very important, it helps you to serve them better.

So how do you reach out to your prospects?

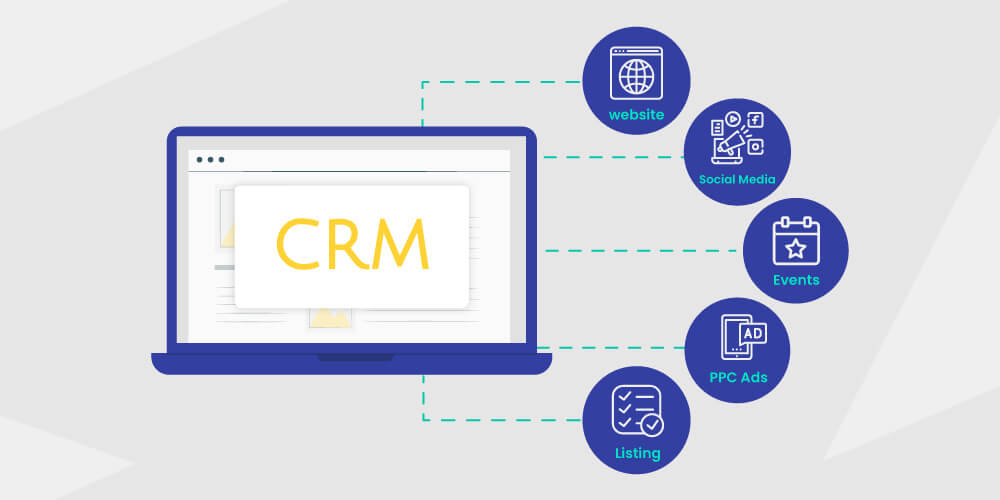

There are several ways an insurance sales CRM can help you achieve your goals. First off, set up web forms aimed at capturing information about your prospects on your website. Once you have established communication with your leads, you will need to determine which leads to go after.

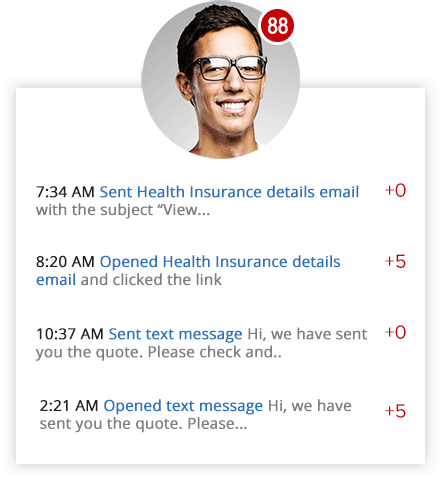

You can use lead scoring to prioritize your leads. Lead prioritization is based on the prospect’s level of interaction with your business. To nudge it further, you can customize lead scores based on the activities each customer performs. For instance, you can assign a higher score to any client who views the pricing plan. On the other hand, lower scores can be given to leads that barely engages with you in any way.

Get an Overall View of all Customer Activity

Insurance salespeople spend a lot of time trying to manage, track, and oversee the activities of their clients using multiple tools. Sometimes they even get lost trying to evaluate the history of interaction between each customer.

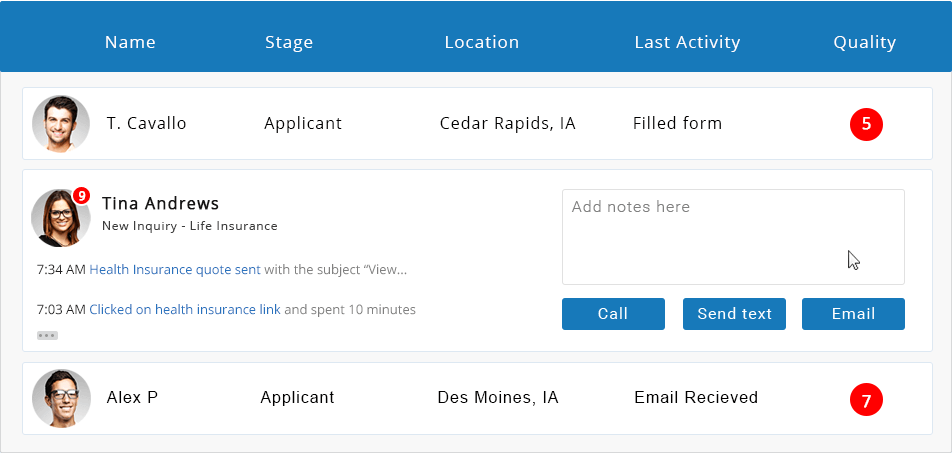

An insurance sales CRM can provide an all-round timeline view of every interaction you’ve had with each of your clients through phone calls and emails. This helps you to track your conversation faster, keep a tab of your appointments, set reminders for renewing SLAs, and keep track of the progress you have made with each customer.

[Also read: CRM for Insurance Agents]

Evaluate Your Progress

Over time, you will start dealing with clients who are at different stages of purchasing a policy. You might have a different sales process for each client or product, so how do you keep a track?

Insurance sales CRM provides a visual sales pipeline that can help you track all your leads in one place.

With CRM, you can create a daily, weekly, and monthly sales report. It enables you to determine how your business is growing, and which areas require attention.

Automate the Process

At the beginning of this article, I mentioned, an insurance salesperson spends 60% of their time working on manual data entry. So what if you can automate most of these tasks?

What if there is a more straightforward way to clear your daily, weekly, and monthly to-do list?

Insurance Sales CRM helps you take charge of your own time. It allows you to do what you need to do, without any hassles. The software performs tasks for you while you focus on essential things. Now you can send reminder emails, set internal reminders, send letters, update customer policies and more, automatically.

Leadsquared’s Insurance Sale CRM

Invest more time on reaching out to customers about new and existing policies, planning better ways to deliver smooth customer experience.

LeadSquared’s insurance sales CRM software helps you understand your customers, get more out of your leads, keep the conversation going, and drive in even better results.