The insurance industry has always been at the forefront of significant changes, and in turn, gets affected by them too. The environmental, operational, and technological changes have led to the evolution of this industry. The growth of the industry is also a source of funding for both financial markets and the economy. A technological and financially developed insurance system helps increase productivity and subsequently the economic growth.

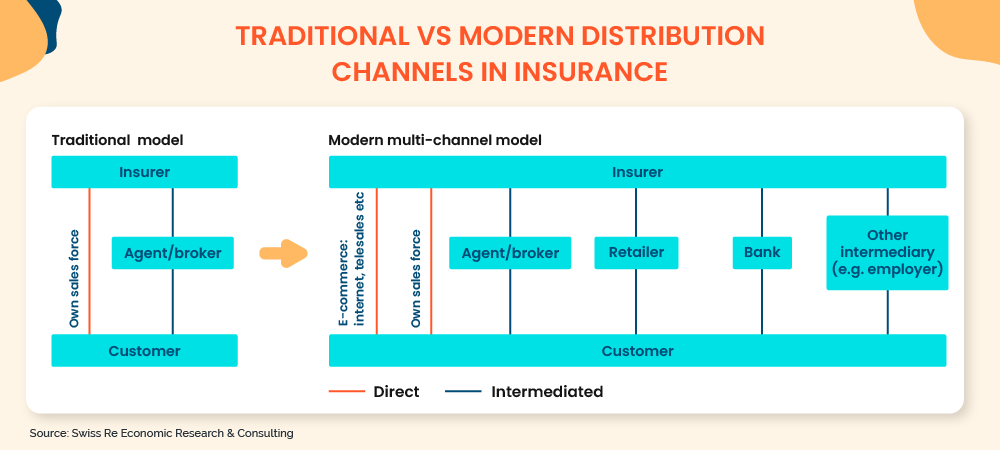

As the companies now become more customer-centric, changes in customer behaviour have caused a fundamental shift in the way insurance is sold. Insurance distribution is a vital function of the value chain. Over time, face-to-face selling through agents and brokers has been accompanied by various other online and offline modes of distribution. And with the evolving technology, consumer expectations have gone up when it comes to buying insurance from various channels.

The Evolving Landscape of Distribution:

Insurance selling methods have been evolving over the years. Insurers have tried and tested various insurance distribution channels. But one channel that has been prevalent all this time, is the intermediary channel.

An intermediary has a distinct role to play in the entire life cycle of a product, from the point of sale through policy servicing, up to claim servicing. Insurance intermediaries serve as a bridge between consumers (seeking to buy insurance policies) and insurance companies (seeking to sell those policies).

If we talk in figures, more than 99% of life insurance policies are sold through face-to-face distribution or intermediaries in terms of premium. While for the remaining 1%, premiums are paid through web aggregators or online channels. In terms of the number of policies sold, the share of face-to-face distribution reduces to 98.75%, whereas online and web aggregator channels contribute 1.25%.

For the non-life insurance sector, the major contribution also remains face-to-face channels such as agents and brokers.

These numbers shed a light on the importance of in-person interactions with the customer in the insurance sector.

With the introduction of multiple distribution channels, each channel requires different resources to be effective and impact the pricing structure. The type of insurance business model determines its structure, strategy and placement in the market. Take, for instance, India. The market size of the online insurance business in India is currently $15 billion, but the overall insurance penetration rate is just 3.7% (Statista, 2018). In order to improve the penetration across regions, here are the key trends that will be changing the insurance industry:

Key Trends in the Insurance Distribution

Trend 1: Digital Shift in Insurance Buying Behaviour

Today, people sitting and working from any corner of the country have easy access to the internet via computers, mobile phones and any hand-held devices. They use the internet for gathering information on their insurance policy, comparing two policies and making transaction to the insurer.

The buying experience might differ based on the type of insurance products. For say, customers still prefer to take advise from agents and brokers while buying life insurance products. Whereas, products like home and motor insurance are more commoditized and require less involvement of a personnel.

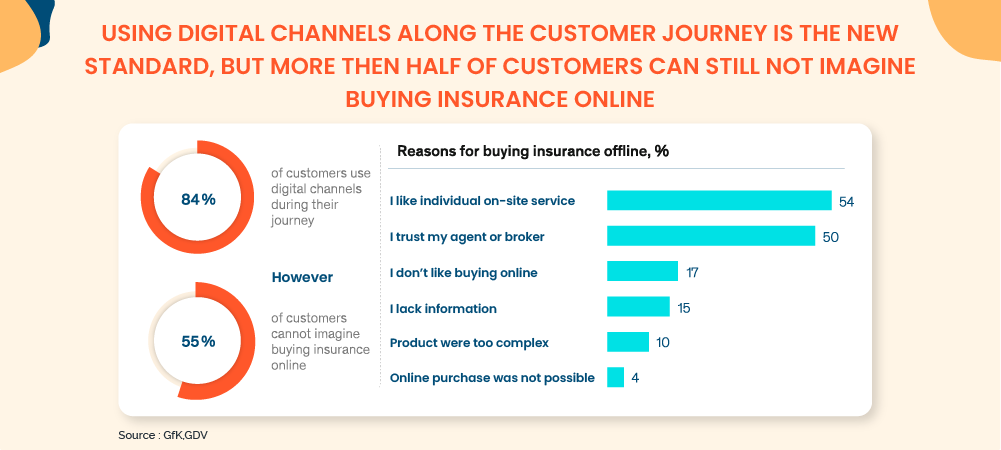

As per a report by McKinsey, using digital channel along the customer journey has become standard. But more than half of the customers can still not imagine buying insurance online.

In order to attract the millennial generation customers, insurers need to leverage the mobile and internet channels to sell their product. This can be done in ways such as:

- Integrating robust self-serve portals within the customer journey

- Identifying the products that are likely to be sold online

- Analyzing the customer behavior and creating targeted marketing strategies

This will help in reducing the operational workload while increasing the customer satisfaction.

Trend 2: Multi-channel Insurance Distribution with SaaS Solutions

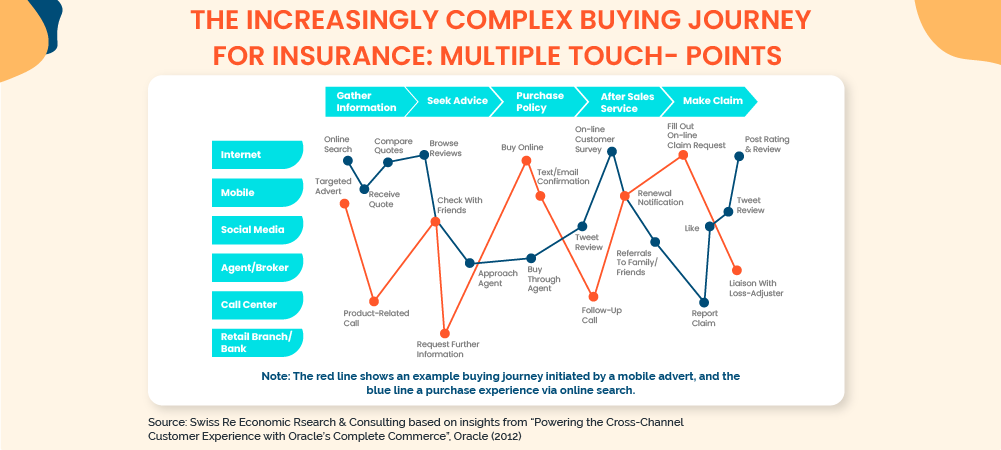

With the advancement in technology, there has been an increase in the number of insurance distribution channels. Therefore, new technology platforms have come into play to provide a streamlined customer journey.

Today the purchasing journey of a customer is fragmented and dispersed across different touchpoints: insurer, intermediary, and customer. The following figure by Swiss Re depicts the increasingly complex buying journey for insurance:

Additionally, increased competition from various insurance providers requires accelerated product and service deployment across various channels.

Industry analysts estimate that the SaaS market will grow by more than 20 per cent annually, reaching nearly $200 billion by 2024, a level that would represent nearly one-third of the overall enterprise software market. With enterprise values for SaaS businesses reaching approximately seven times forward revenue, insurance companies should leverage SaaS solutions to interact with the consumer and sell insurance through the customer-preferred channel.

This can be done by:

- Providing consumers with personalized services across the various channels used by the customer.

- Staying on top of the mind of the customer and reaching out to them when they need you the most.

- Using reports from SaaS platforms to analyze the performance of various channels.

- Analysing customer behaviour to predict customers next move and act accordingly.

- Using third-party integrations to interact and follow-up with the customers through various social media channels.

Trend 3: Digitisation of the Existing Distribution Channels

Only 40% of insurers have a digital strategy, although most claim a set of best practices, yet two thirds of insurance executives believe digital adoption will be a trend even after the pandemic. But will strategising only about digital be enough?

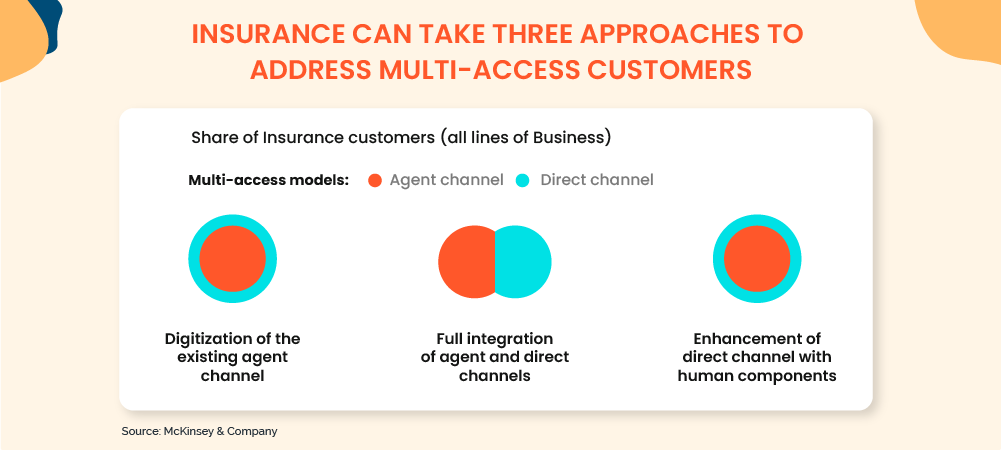

Today, intermediary channels like bancassurance, agents and brokers sell insurance. In order to fulfil the demands of the customer, digitisation needs to start from the existing distribution channels.

The idea behind this is to support the sales activities of the existing insurance agent network. The intermediaries need to leverage the digital tools to enhance the customer experience. This can be done by:

- Training insurance agents to advise the prospective customers through digital channels.

- Providing agents with digitised tools to carry day-to-day processes such as scheduling meetings and following up on payment.

- Notifying the agents through in-hand digitised tools for any upsell or cross-sell opportunity.

- Collaborating agents and direct channels on equal footing

This functionality improves convenience for the customer while maintaining the human component of the traditional channel.

To Conclude

With new challenges emerging every day within this complex market, the insurance sector is looking at digitizing the distributions channels for optimizing costs, improving overall accuracy and maximizing returns.

Insurers can use intelligent automation to quickly automate the critical processes to achieve higher efficiency and streamline the cost of operation. The right CRM system allows insurance companies to support customers throughout their lifetime, extending their journey with the company instead of merely providing services at the moment.

The future will see a shift from a product-centric approach to a customer-centric one. It’ll be shaped by new digital advancements, with social and peer-to-peer networking and smart devices all playing a part. By undertaking customer behavioral prediction, data can immediately be accessible, which in turn can help optimize sales efforts. This way, consumers will feel that their needs are understood and met in a way that is “fast and convenient” and will eventually help in strengthening customer loyalty.

Not sure how to streamline your online and offline insurance distribution channels? Take a look at how LeadSquared’s Insurance Solution can help you reach your growth goals.

FAQs

Insurance companies can sell their policies through numerous distribution channels. These distributions channels can be direct channels such as E-commerce: internet, telesales etc., and own sales force or intermediary channels such as agents, brokers, retailers, banks etc.

A direct-distribution channel or zero-level channel is when the insurer sells directly to the consumer. For say, selling directly through the website, through a physical store, or using one’s own sales force.

Online & offline distribution channels can be streamlined in ways such as:

1. Digitizing the existing distribution channels

2. Collaborating with both agents and direct channels on equal footing.

3. Providing intermediaries digital tools.