The insurance industry is one of the fastest-growing sectors in India and across the globe. With insurance products like Life, Health, Motor, and more, the industry figures speak volumes of the immense opportunities in the market.

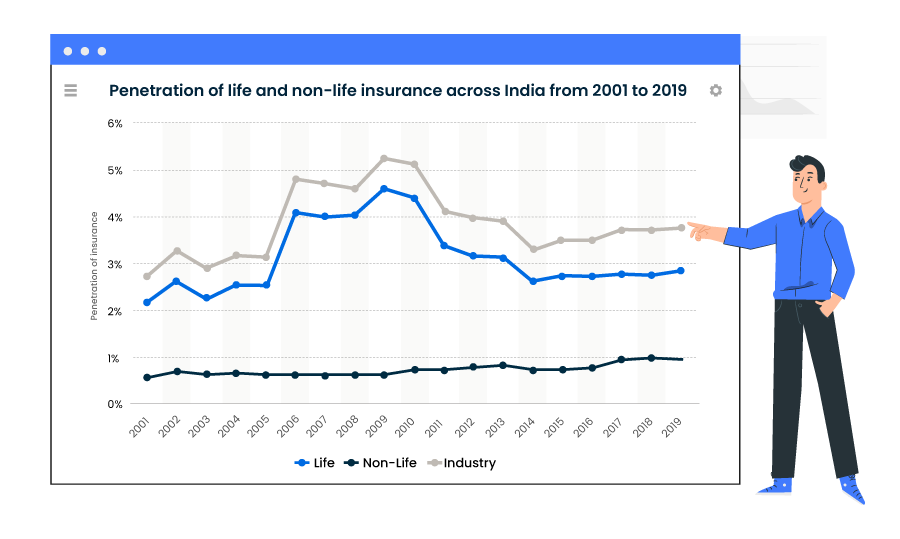

Indian Insurance sector saw a surge in the gross premium earned in recent years. However, the penetration of insurance in the country is only 3.7% of the gross domestic product. This indicates the need to address the challenges and promote growth.

The distribution of insurance products in India happens through various channels such as direct and intermediary channels. Intermediary channels include agents, brokers, bancassurance, retailers, and more. Amongst these, the only channel that represents the customer and not the insurer is Insurance Broking. The insurance brokers provide expert advice on the insurance policies suitable to the customer. In return, they are paid brokerage by the insurance company whose policy is chosen.

However, the channel is still evolving and needs to meet the risk management requirements of customers comprehensively. This article talks about the landscape of the insurance broking industry, its evolving expectations, and, more importantly, the steps you must take to promote growth.

What is the Broker Channel of Distribution?

An insurance broker is an individual who acts as an intermediary and sells, solicits, and negotiates insurance on behalf of a client for compensation. But they can’t bind coverage on behalf of the insurer. In simple words, unlike the rest of the insurance intermediaries, an insurance broker works for the benefit of the customer.

People prefer buying insurance from a broker as it saves time and money and results in better coverage. Brokers can get a client better rates on insurance policies than individuals buying insurance directly from the company. That is because insurance companies know that brokers have the experience to guide their clients to the right policies with the proper level of coverage.

Day-to-day Activities Performed by an Insurance Broker

An insurance broker performs various activities as a part of his daily routine, such as:

- Understanding the client’s business

- Providing consultancy about insurance products

- Highlighting market knowledge

- Comparing various policies

- Assisting customers in value-added services

An insurance broker is responsible to help his clients with their individual, family, or business liability risks. He provides comparison documents and quotes as per the needs of the client. Based on this information, the client can make an informed decision about the type of insurance to buy.

As insurance sales through direct channels grow, insurance brokers need to act proactively. The need of the hour is to take desired measures to find new ways to optimize processes and reduce costs. Hence, find better ways to connect with their customers. Brokers need to invest in automation tools while expanding the use of mobile devices.

Landscape of the Insurance Broking Industry

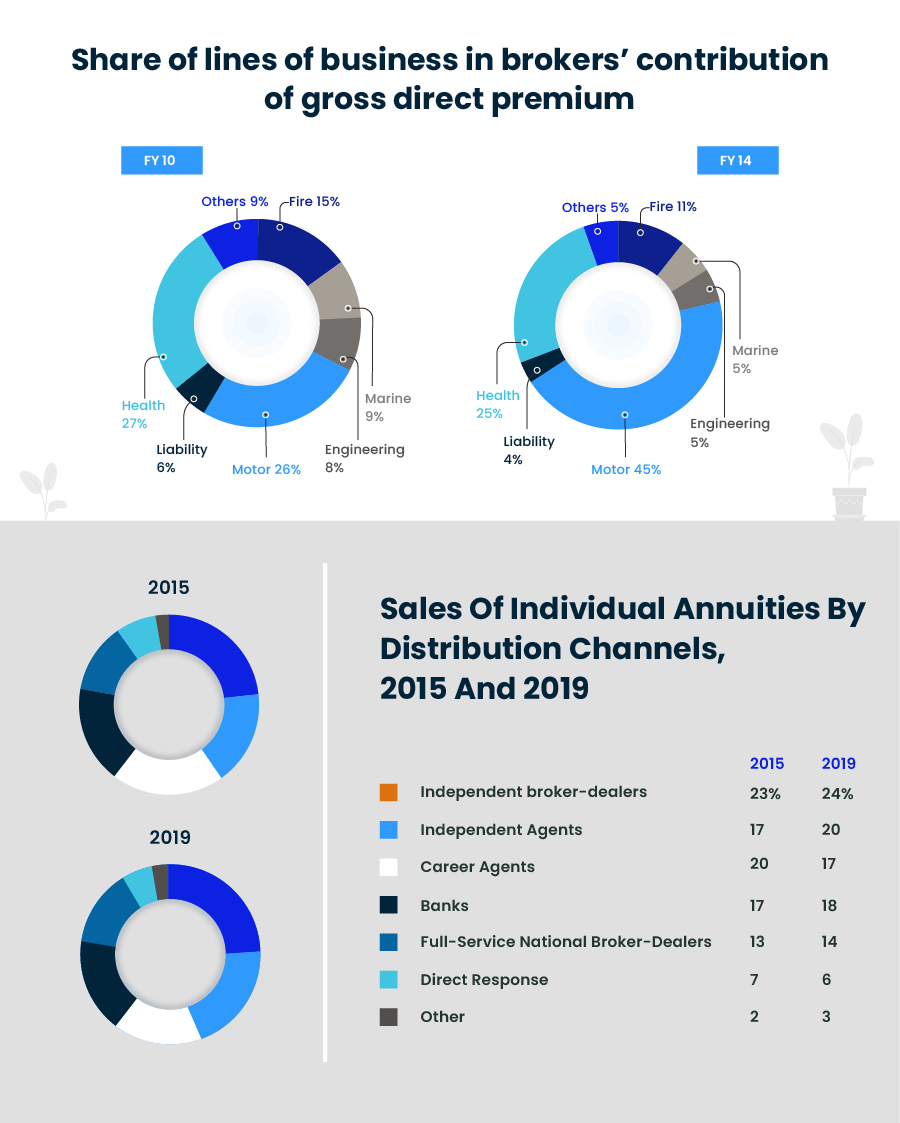

The number of brokers in the insurance broking industry has significantly increased since the last decade. As of July 2020, 468 insurance brokers have been licensed by the IRDAI. Brokers are the preferred channel of business in India as they account for more than 70% of commercial lines. These lines include marine, aviation, construction, engineering, risk, and liability insurance. Further, the dynamic and conducive regulatory landscape in the country is expected to propel industry growth in the coming years.

The insurance broking channel of India has changed drastically over time. With the advancement in technology, changes in human interaction, and the sudden onset of a pandemic, insurers are trying to change the traditional face-to-face insurance distribution. But with a large population of India still believing in the importance of human interaction while buying a policy, the broker channel of insurance will still thrive for long.

As the Indian insurance market continues to grow organically with increasing population and insurance requirements, there remains a massive opportunity for disruption through technology.

Challenges in the Insurance Broking Industry

The number of insurance brokers in the industry keeps increasing every year. But this role is still misunderstood and often not performed to its full potential. Few challenges that prevent the insurance broking industry from succeeding are:

1. Lack of knowledge among people while buying insurance

The concept of insurance has been highly misunderstood in India. The reasons for this are multiple- minimal guidance on the insurance policies, complex products, and high prices.

According to the 2018 Insurance Barometer Study conducted by Life Happens and LIMRA, 44% of millennials overestimate the cost of insurance by up to 5 times the actual amount. Not only that, people resist buying insurance due to minimal or no guidance from the insurers.

This is where insurance brokers come in. Their sole role is to advise people on the kind of insurance to buy based on the clients’ needs. Hence, by educating people about the various aspects of insurance, such as policies, coverage, claims, benefits, and more, brokers can increase their market share.

2. Poor penetration in semi-urban and rural areas

Insurance penetration continues to be a challenge. It only marginally improved to 3.76 percent in 2019 from 2.71 percent in 2001, the Economic Survey 2020-21 shows.

The geographical analysis highlights the concentration of brokers in major states and cities, preferably in industrial areas implying low penetration in other areas. This is more severe for the semi-urban and rural retail and SME segment.

The low penetration can be attributed to-

- Lack of insurance knowledge amongst customers

- Tons of paperwork

- Complicated policies

- Poor perception of risks

- Broker’s high cost operating model

3. Lack of product innovation and training

Insurance policies are often complicated and hence, difficult to understand. An insurance broker is responsible to advise and sell policies to a customer. However, if the broker is unable to understand the policy, it will be difficult for him to convey it to his clients.

Therefore, insurers need to simplify their products. Alongside this, brokers should be trained properly about the policies so that they can justify their roles.

These challenges have been a part of the industry for a prolonged period. But as the insurance sector makes a shift towards digital, it is set to witness significant growth in various aspects.

Key Trends in the Insurance Broking Industry

1. Embracing Digital Landscape with Cloud Technology

COVID-19 has brought some unexpected changes in various sectors across the globe. One trend that remains common in all industries is the reliance on technology and digital products.

Technologies like Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), and Intelligent Automation (IA) are a few of the many trends that will pave the way to the future of insurance broking.

Automations minimize manual work, simplify document collection, speed up underwriting, and streamline communication. Internet of Things (IoT) provides clients, brokers, and insurers extensive data and insights to design holistic risk management tools and systems. This boosts their customer information repository and enables them to offer timely, pertinent coverage based on individual needs.

Moving to cloud technology and Software as a Service (SaaS) will help in engaging with the client online for all processes- from making the first contact to selling renewals.

2. Aligning Insurance Products to Customer Needs

The needs of India’s new-age consumers have changed drastically over the last few years. Health insurance was once predominantly perceived as a necessary solution only for senior citizens and people inching closer to retirement. But today, the consumer includes more millennials.

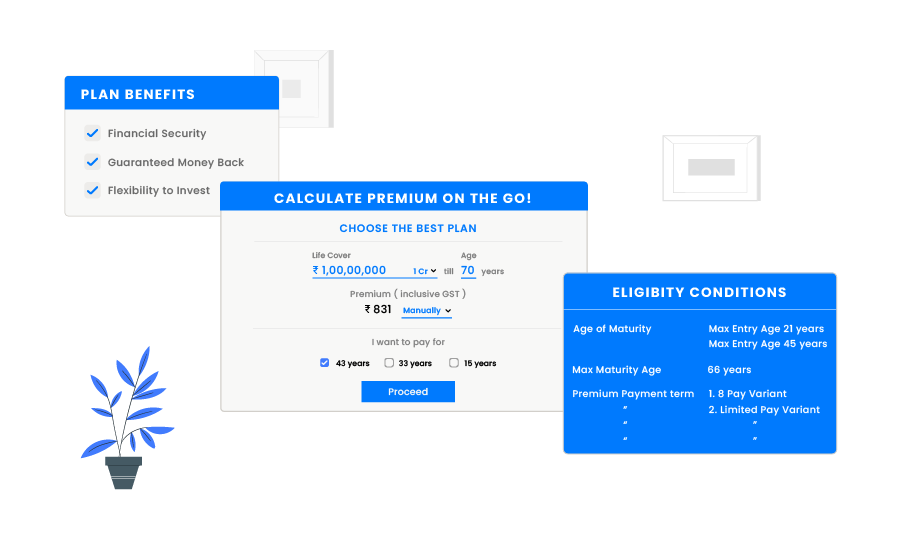

As more and more people understand the value of insurance, companies need to start building customer-centric products. Complicated policies are the major reason why people are reluctant to buy insurance. Customers don’t have complicated needs. They want to be able to choose from a good selection of policies that provide clear, transparent information along with smooth, hassle-free interactions.

Since brokers directly interact with consumers, they can help insurers with data and intelligence to customize their product for the target consumer group. Brokers can also help customers compare policies from several insurers (similar to online brokerage platforms) to make the best decision. This way, they can help bridge the gap between insurer and consumer.

3. Redefining the Role of Insurance Brokers

2021 is the year of digital transformation. As the insurance industry embraces technology across all distribution channels, redefining the roles of advisors becomes a necessity.

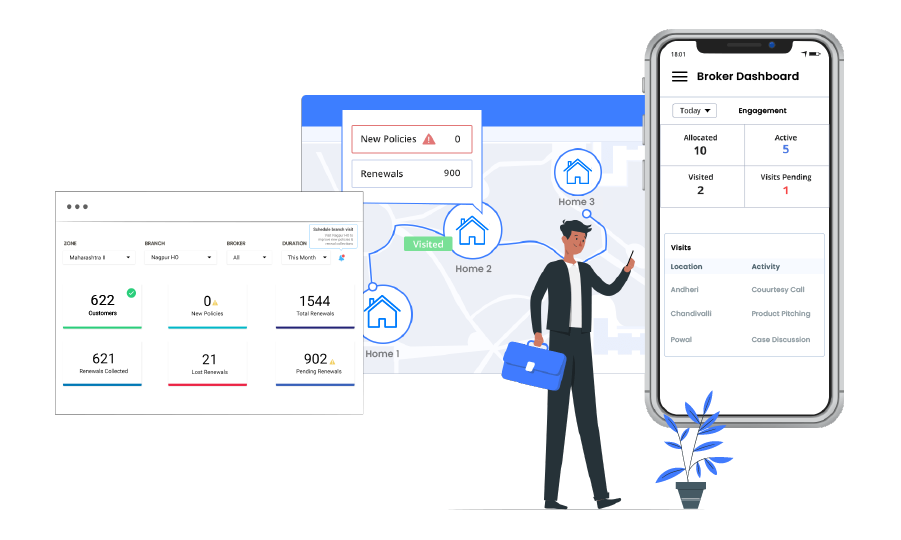

Technology has changed the way people sell and buy insurance. Products are personalized and focused on the needs of the customer. Hence, insurance brokers should leverage this technology to redefine their role as advisors in order to increase their sales efficiency.

Insurance companies should work closely with the brokers to train them regarding the product offerings. They should provide clear success metrics, roles, and responsibilities to every broker to keep them at the top of their game. Automated insights into individual broker statistics – premium collected, new leads, and renewals will help in assessing individual performance and understand glitches in the current process.

4. Constructing an Omni-channel Strategy for Customers

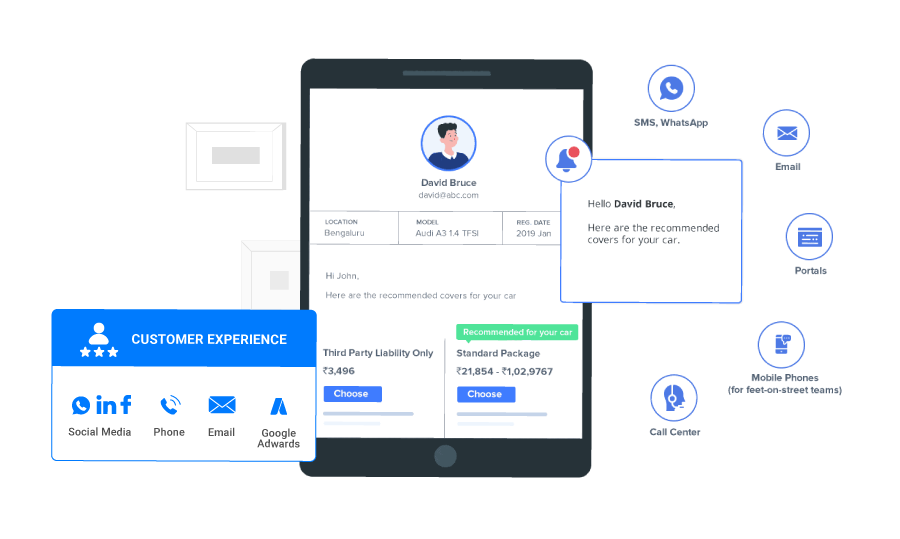

Omnichannel is not just about providing multiple platforms to the customer to interact. It’s about maintaining regular and personalized interaction with the end consumer across various channels.

To put customers first every step of the way, brokers need to proactively communicate during the information phase, focus on personalizing interactions with customers on diverse channels during the purchase phase and create a blend between personal contact and digital tools to elevate support and claims.

They need to provide consumers with personalized services across the various channels- email, phone, SMS, WhatsApp, and more. Staying on top of the mind of the customer and reaching out to them when they need you the most will help in building a strong relationship. Customer behavioral analysis will help in predicting customers’ next move and acting accordingly.

5. Focusing on Risk Management and Compliance

As all major insurers start focusing on leveraging technology, they need to pay attention to issues such as customer and data protection and privacy. They should also focus on the company’s code of conduct, risk culture, and customer outcomes. This will put an emphasis on customer protection, including product design and transparency as well as distribution.

Digital sales models raise new and more complex concerns over financial crime and buyer verification. And the increasing use of big data demands that privacy and data protection requirements be addressed for an ever-growing body of information.

Those that tackle the challenges and move quickly to establish best practices in their organizations will reap the rewards of customer trust.

In a nutshell

The Indian insurance industry is at a very critical juncture. It has a very high potential for significant growth if progressive actions are taken. Proactive and collaborative action by the stakeholders — insurers, brokers, regulators, and other stakeholders can help realize this potential.

The penetration of insurance needs to increase. This can be done by building a strong digital network. Insurers need to spread awareness amongst customers, create policies that are easy to understand and make processes like renewal and claims smooth and consistent.

Intelligent automation can be used to quickly automate the critical processes to achieve higher efficiency and streamline the cost of operation. The right CRM system allows insurance companies to support customers throughout their lifetime, extending their journey with the company instead of merely providing services at the moment. The future is customer-centric and only those insurers will drive growth who understand customers’ current and evolving risks and modify their products accordingly.

FAQs

Who is an Insurance Broker?

An insurance broker is an individual who acts as an intermediary and sells, solicits, and negotiates insurance on behalf of a client for compensation.

What does an insurance broker do?

An insurance broker is responsible for understanding the client’s needs, providing consultancy about insurance products, highlighting market knowledge, comparing various policies, and assisting customers in value-added services.

What is the difference between an agent and a broker?

The major difference between an insurance agent and a broker is that an agent represents the insurer while a broker represents the customer. A broker can’t bind coverage on behalf of the insurer.