Agencies are the face of the insurance carriers. Even though digital and direct sales channels are gaining momentum, clients still prefer going to a local agency when they have problems or questions. They trust the agencies more and prefer buying policies from them.

However, as the business grows, it becomes difficult for agencies to manage existing clients and new inquiries simultaneously.

The best way to manage your agency’s book of business is to use digital tools. For instance, customer (client) relationship management software helps insurance agencies keep track of policyholders, coverage obligations, etc., from the time of first interaction (lead) to conversion and beyond.

“Our agency principal, Jeff Arnold, has really done a top-notch job in making sure we have all the tools we need to sell and service our clients,” says Cheryl Forman of Rightsure Insurance Group – Tucson, Arizona (source).

With an insurance agency management CRM, agencies can automate routine tasks and make their agents’ lives easier. Let’s delve into the agency challenges and discuss some simple examples of automation that can help.

3 Simple examples of automation for insurance agencies

Problem #1: New client acquisition

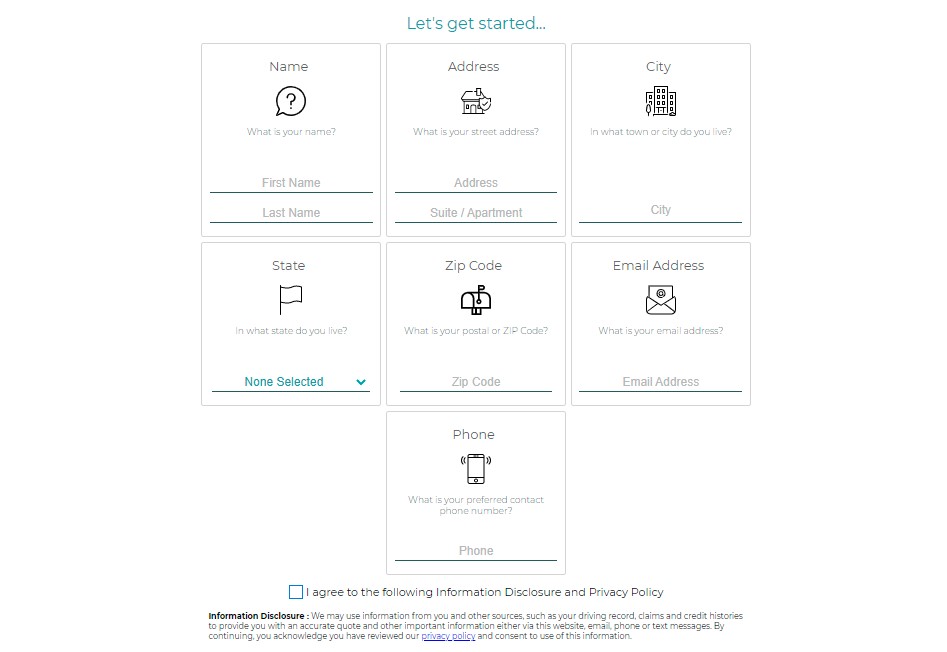

Typically, insurance agencies get leads from their website, ads, etc., and route them to the agents based on certain attributes such as location, type of insurance, etc.

While many agencies have a website to collect leads and generate quotes based on the provided details, not every client completes the application online. Hence, agents need to intervene to understand the client’s requirements and suggest appropriate policies.

But the problem is, most agencies do not have the right tools to make the agent’s work easy. Agents still struggle with spreadsheets to access client details, their requirements, etc. On the other hand, prospects, when looking for insurance, approach several local agencies simultaneously. That’s why your representatives must reach out to them asap, address their requirements, and close the deal. Also, sometimes it takes more than one attempt to sell a policy. Communicating with new prospects, managing existing clients, etc., are too much for agents, and therefore, the following example of automation can help.

Solution: Client relationship management software

Agencies can integrate their website and other lead generation sources with insurance agency CRM software.

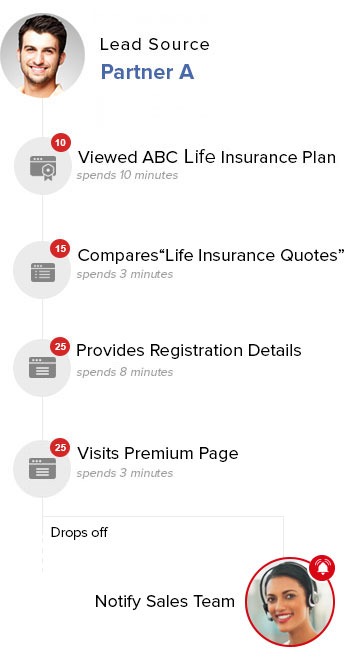

When a prospect does not complete the application and drops-off, the lead will get assigned to an agent (based on attributes like product interested in, location, etc.). The agent can then take it further.

Using agency software is especially helpful when you get hundreds and thousands of inquiries every day. To speed-up your sales, you must identify the qualified leads and prioritize communications with them.

The insurance agency CRM software helps in the following ways:

- Lead scoring: It helps you determine if a lead is ready to buy a policy instantly. It assigns scores to them based on their activities such as website page visits, eligibility, etc. Then, you can prioritize follow-ups with qualified leads. It will also help your agents meet their sales targets.

- Lead distribution: Insurance agencies usually have a network of agents, and every agent specializes in a certain insurance product. The insurance agency software maps the lead’s requirements and the agent’s specialization and distributes them accordingly. Also, you can cap the number of leads assigned to an agent. This way, all the agents get an equal number of leads in a day.

- Notifications and follow-up reminders: Whenever a new lead enters the system and is assigned to an agent, the agent gets a notification email. The agent can then call the lead and record the disposition. If the lead does not respond to the call, the system sends a follow-up reminder to the agent.

Another benefit of using automation is that based on lead score, the system automatically moves the lead up and down in the sales pipeline. For example, if a lead applies for a quote on your website, the system will identify that the lead wants the policy and hence move it to the opportunity stage. It will also help the agent understand the lead’s intent and propose a policy accordingly.

Problem #2: Calling

Insurance agents spend a lot of time calling-up prospects and noting down the disposition. The main problem here is, they have to look at the laptop for the lead record and then use their phone to call the prospect. Also, they have to memorize the clients’ requirements or refer to the sticky notes hidden somewhere on the desk.

It is very time-consuming, and agents may lose the context of conversations. Also, if the manager has to step in to resolve an issue or another agent has to pick-up follow-ups with the lead, they might not know both sides of the story. The following automation example shows how agencies can resolve this challenge.

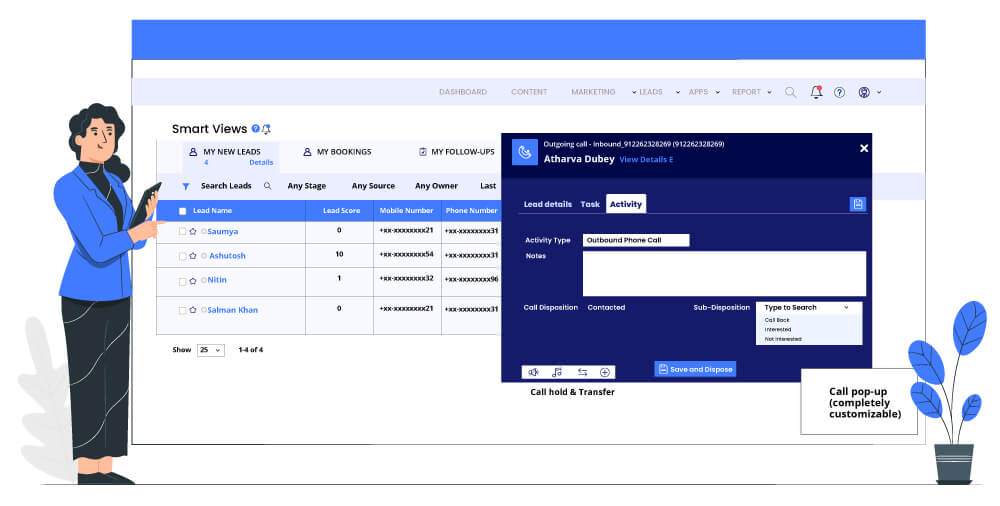

Solution: Use automated calling and call disposition feature of LeadSquared Insurance Agency CRM

LeadSquared provides a click-to-call feature to help agents work more efficiently. With this, agents can call a prospect from the portal directly. Moreover, during the call, agents can record disposition (contacted/no response) and sub-disposition (interested/not interested) and add notes.

It saves a lot of their time as now they don’t have to go back to the spreadsheet and update the lead status. Moreover, it reduces the chances of error while recording disposition against a lead record.

Another benefit of this automation example is that the system records the call, and managers can refer to the recordings for quality audit purposes.

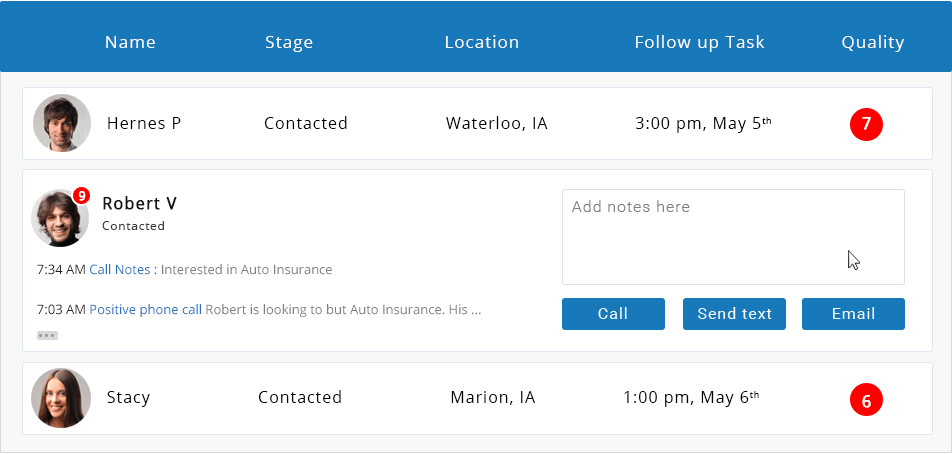

The following image of the LeadSquared application illustrates this.

Problem #3: Client administration

Since insurance agencies represent several carriers, agents must be aware of all the policies and recommend the one that covers all/most of the client’s requirements.

However, the challenge is, there are several moving parts, such as premium calculation, documentation, and client onboarding. Moreover, in the instances of claims, clients reach out to agents first for resolution.

Thus, in a way, agents are not just selling policies. They are managing end-to-end client relationships. Howsoever simple it may sound; it is seldom easy if done manually. That is why tools such as insurance CRM are a must for agencies.

Solution: Insurance Agency CRM software

“The most helpful thing in growing my book of business was the decision to be an expert in understanding the policies we help clients purchase,” says Brett Cutchin, Lipscomb & Pitts Insurance LLC – Memphis, Tennessee (source).

Agents agree that the key to their success is the consultative approach in selling. It may be easy when there is only one client. But when an agent has to consult several clients in a day – with different requirements and in different stages of the sales pipeline, they will definitely need a digital tool.

For example, LeadSquared, built specifically for insurance agencies, helps agents manage client relationships by:

- Organizing all the interactions with the client as a lead record. This way, agents get a complete context of the conversations even when they get in touch with the client after a long time.

- Notifying the agent and sending automated communication to the client for policy renewal, premium payment, etc.

- Sending reminders for follow-up with the prospect based on previous call disposition, client activities, etc.

- Allowing agents to visualize the number of leads in the pipeline, their stages (interested/not interested/accepted), policies sold, commissions earned, and more.

- Easy client onboarding through the CRM portal itself

- Service request handover to the carrier for claims

What we learn from these examples of automation?

Automations don’t need to be complex. When you use technology daily to automate simple tasks like bill payments, birthday reminders, booking cabs, playing music, making coffee, then why not use it to manage and boost your insurance agency’s book of business?

David Duford of Duford Insurance Group says – agencies must create a blueprint of success, and multiple agents should be able to duplicate it. Build scalable processes that are workable for agents, as this is what will maximize your income.

When it comes to building scalable processes, you will definitely need digital tools. And there’s nothing better than a CRM built specifically for insurance agencies.

“LeadSquared helps us manage our partnerships with carriers & agents, and our internal processes across the sales cycle. It is a key part of our digital ecosystem that will enable us to build great customer experiences and deliver value back to the business.”

– Andrew Day, Global Chief Data Officer, Pepper Insurance

Our customers have experienced a 75% increase in process efficiency just with simple sales automations. You can achieve the same results too.