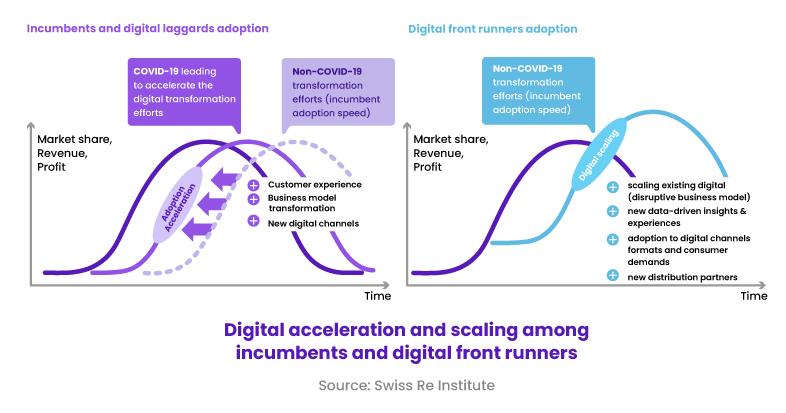

The year 2020 came with hard to anticipate digital disruptions in every major industry; insurance was no exception. We saw the business landscape across geographies and sectors completely transform. While some companies took a leap due to their digital-first approach, others suffered a significant hit to their business continuity and profitability.

The COVID-19 pandemic challenged the insurance industry on various fronts; at the same time, it represented an opportunity. The pandemic brought out the loopholes in the current business process and at the same time helped companies reevaluate the status quo by adopting new strategies and triggering structural changes in various sectors.

Where Does Insurance Stand in the Post-pandemic India?

To overcome the losses, most insurance companies moved their sales processes online. This ensured that they could tackle the growing demand in the best possible way. In order to thrive in the post-pandemic world, businesses need to transition fast to a contactless and paperless insurance process. A seamless process right from lead generation and follow-ups to medical underwriting and policy issuance will ensure minimal physical dependencies and clear handoffs at every stage. In addition, the digital disruption in the Insurance industry will bring the following benefits:

- Improved sales effectiveness

- Deeper insurance penetration

- Reduced operating costs

- Data-driven decision making

Learn more about Digital Sales & Operations in Insurance [Download Now]

How will Digital Disruption in Insurance Shape the Industry in 2021?

1. Blending Human and Digital Solutions

FY18 annual report by IRDA says that most insurance policies were being sold by individual agents, corporate agents, and brokers. In contrast, only 0.1% of the total insurance policies were sold online. One primary reason behind fewer policies being sold online is the trust deficit between the customers and insurers. As a result, the gap between the two parties made the customer experience different for online and offline channels.

Enter Phygital!

Phygital- a hybrid mix of physical and digital, is a marketing term that blends digital experiences with physical ones. The phygital model can add value to the insurance companies by enhancing the customer’s physical (one-on-one) interactions with relevant information while augmenting digital experiences with human connections.

“The way forward is definitely Phygital. Most of the insurance companies are getting their share of success through this model. There are case studies in the Motor insurance and health insurance sectors where they have experienced excellent sales through this model. Moreover, SME is the new space wherein a lot of traction is coming through the Phygital model,” says Nilesh Sinha, Business Head at one of India’s leading Insurance companies.

The sole objective of Phygital is to provide the ultimate 360-degree experience to customers, i.e., focus on relationships, life-cycle, and even life-stages.

2. Transforming through Advanced Analytics and Proactiveness

What is the primary objective behind selling Insurance? The answer is simple – to prepare the customers for any unexpected incident and help them survive the loss.

However, with COVID-19 introducing structural changes in the industry, insurers are now looking at shifting from the earlier reactive model to the new proactive one, thanks to innovations such as automation, machine learning, predictive analytics, and cloud computing, among others. The proactive model is based on assessing the risks beforehand by collecting significant data insights and preventing losses.

“With the onset of digital disruption in the Insurance industry, organizations need to find out some exciting ways to connect people and create mass awareness on the digital platform. Life Insurance is one of the most important parts of any financial planning. With digital campaigns, term insurance can penetrate across the country’s length and breadth, and consumers can be educated to calculate their human life value,” says Anjan Pani, Zonal Business Head at IndiaFirst Life Insurance.

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) can be used to make the rural consumer understand the need for enough coverage to take care of their family members in case of any mishappening. Secondly, savings and guaranteed products need to be an important part of financial planning. This will build a habit of long-term investing,” adds Anjan.

Role of Technological Innovations

Predictive analytics will help in understanding customer behavior based on their choices and preferences. Further, it will use historical data to identify patterns and trends to predict future unknown outcomes and build more profitable and efficient operations.

Secondly, Workflow automation will help reduce manual effort across processes – customer engagement, underwriting, policy issuance, and more. Similarly, Artificial Intelligence and Machine Learning will provide intelligent insights across all stages in the customer lifecycle. These tech tools enhance customers’ digital journeys by boosting efficiency, lowering turnaround times, negating the need for physical interactions, and proactively reducing risks.

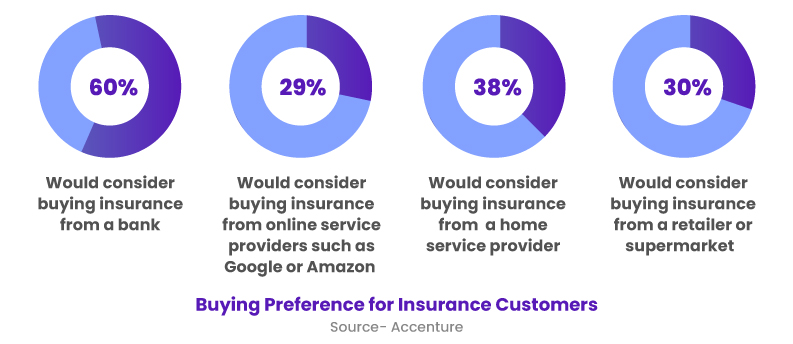

3. Changing Face of Insurance Distribution

For decades, agents and brokers have been at the forefront of insurance distribution. But with the nation coming under a strict lockdown, the on-field insurance selling suffered a significant hit. With one-on-one meetings wholly stopped, the insurance companies had no other option but to stop selling insurance policies through offline channels.

Despite the problems faced by the insurance companies, brokers and agents remain a vital component of the value chain. The insurers are revamping this distribution model by rebuilding their websites or application portals according to these needs.

They offer simplified products that are easy to understand for a customer along with a touch of personalization. Keeping the insurance policies uncomplicated also makes it easy for consumers to understand the product without any assistance.

Simultaneously, it is essential to maintain regular and personalized interaction with the end consumer. It will help insurance companies stay at the top of their customers’ minds.

In discussion with ET, KV Dipu notes that nearly 70 to 80% of customer servicing has gone digital.

“The landscape is evolving where we are waiting for the desire for insurance to turn to action. The challenge is the simplification of product and process in this new age distribution model. The customer grievances have fallen by 90% due to digitisation. We have launched apps for farmers in the crop insurance business, a one-stop-shop, as it allows them to interact with the government. If done right, digital can help pick up the pace for both rural and urban India,” KV Dipu, President and Head of Operations, Communities and Customer Experience at Bajaj Allianz General Insurance.

Watch the Webinar: Digital Sales in Insurance

To Conclude: Innovation is the Key to Thrive.

In short, digital disruption in Insurance demands the industry to undergo several readjustments. The growth of Insurance in the post-COVID era would be defined by the number of winners in the race of change to keep up with the new consumer behavior. This is a chance for insurers to pick apart the many moving pieces in a stand-still situation. To start with -maximizing the outcomes of the already existing infrastructure, which can be achieved with more analytical lead generation efforts or customer-centric brand positioning. At the same time, it’s important to map and leverage digital customer journeys to provide an enhanced customer experience.