The year 2021 came with its ups and downs. While specific industries were still trying to keep their feet strong during the COVID wave, other industries tackled the problem and came out even more substantially. The financial sector saw COVID as an opportunity. They used digital methods to reach out to customers and prospective audiences. As a result, the industry that heavily relied on direct human interaction successfully digitized the customer journey and defined a new customer experience in insurance.

This article covers the insights from a discussion between the insurance industry leaders- Jaimit Doshi, CMO- Marketing & Digital at Aditya Birla Sunlife Insurance; Rishi Mathur, Chief Digital & Strategy Officer at Canara HSBC OBC Life Insurance and Nimish Aggarwal, Senior VP & Head of Marketing at Max Bupa Health Insurance. The discussion revolves around turning customer experience into one that ranks with leaders inside and outside the insurance industry. It also talks about ways to innovate the customer service approach.

But before we dive in, let’s have a deeper look at the statistics. Let us understand what should be the number one priority for insurance companies in the coming years.

Upcoming Trends in the Insurance Industry

The need for insurance to tweak themselves, reinvent themselves, make the process as seamless for the customer as possible, is what you will see the market push itself and drive itself to. And that’s how it will evolve.

Rishi Mathur, Chief Digital & Strategy Officer, Canara HSBC OBC Life Insurance

Despite the challenges brought in by COVID-19, the insurance industry effectively managed its investment in emerging technologies. For 2022, most insurers expect an accelerating economic recovery and an upward trajectory.

Research shows that the pandemic only amplified the importance of digital experience intelligence. Nearly 77% are now more comfortable with digital-only businesses due to the pandemic. And for an equal number of 77% of Indian consumers, a personalized digital experience is now vital to them if they are to return to a brand time and time again.

As a result of low sales and few claims, insurance companies realized the importance of catering to their customers across various platforms. As per a report, 55% of customers prefer digital channels over traditional channels, and 40% of customers won’t do business with a company if they can’t use their preferred channel.

Since inception, the insurance industry has seen a lot of adoption. Earlier insurance was once only bought and sold as a financial instrument. However, today consumers have become a lot more inclusive and look at other benefits of insurance apart from it being a safety net.

Nimish Aggarwal, Senior VP & Head of Marketing, Max Bupa Health Insurance

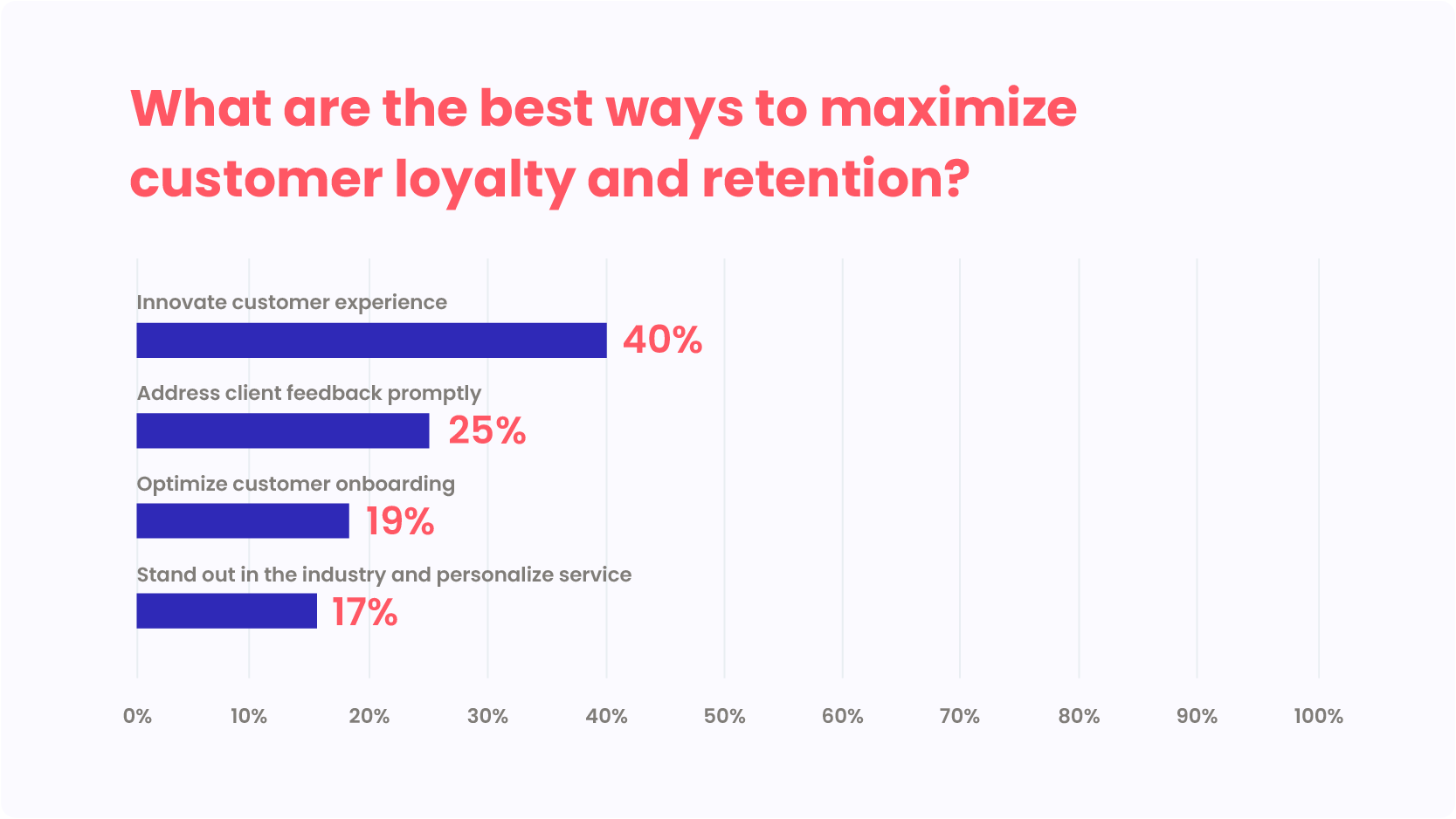

Customer experience in insurance has fast become a significant priority. And with the organizational benefits that it brings, 2022 will be no different. But why are so many insurers focusing on the customer experience, and why is it critical for insurers to adopt?

Seamless Omnichannel Customer Experience is the New Reality

It is safe to say that a good customer experience is a key to the consistent growth of a company. 86% of buyers are willing to pay more for a great customer experience. Similarly, another study found that at the end of 2020, customer experience overtook price and product as the key brand differentiator.

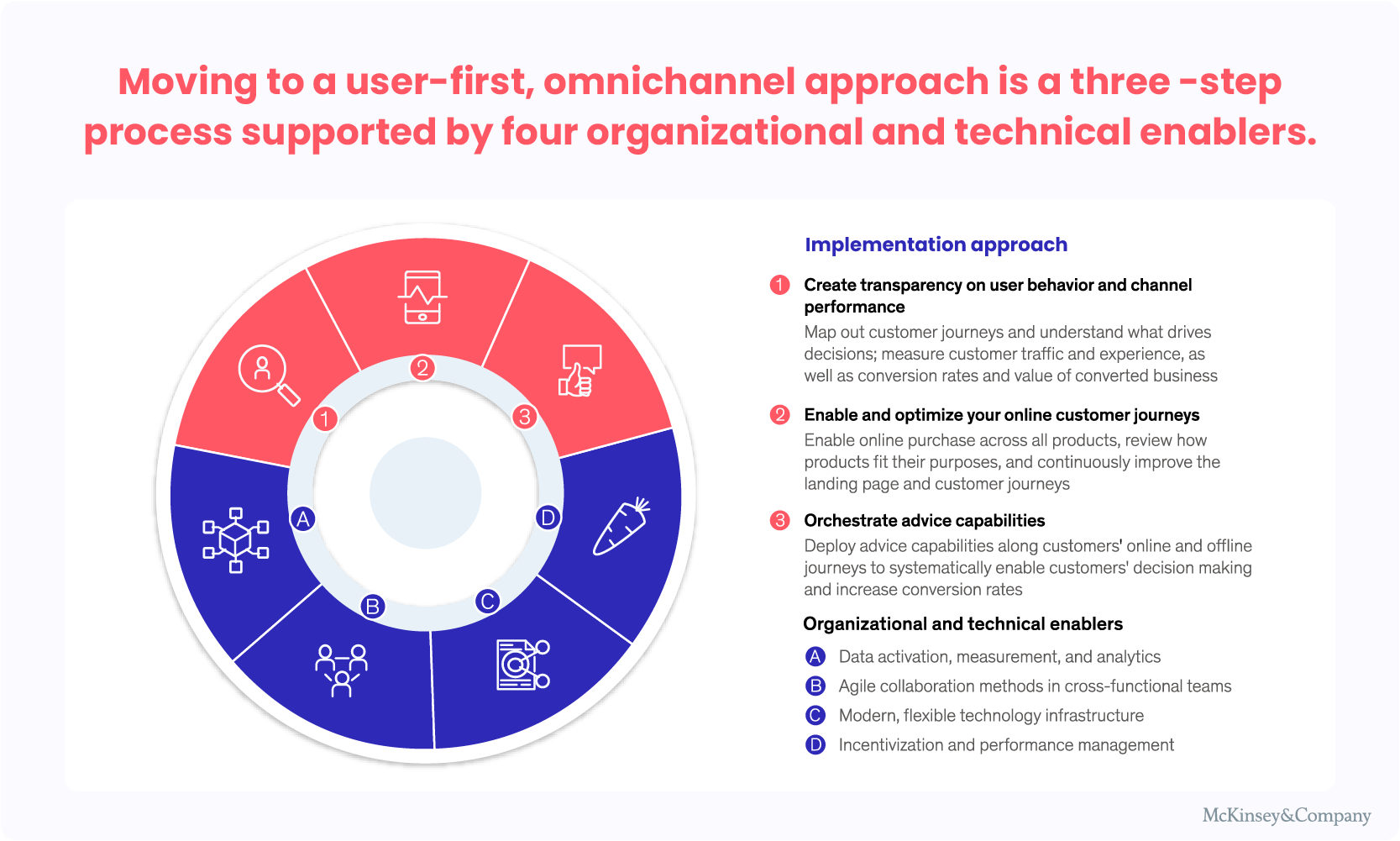

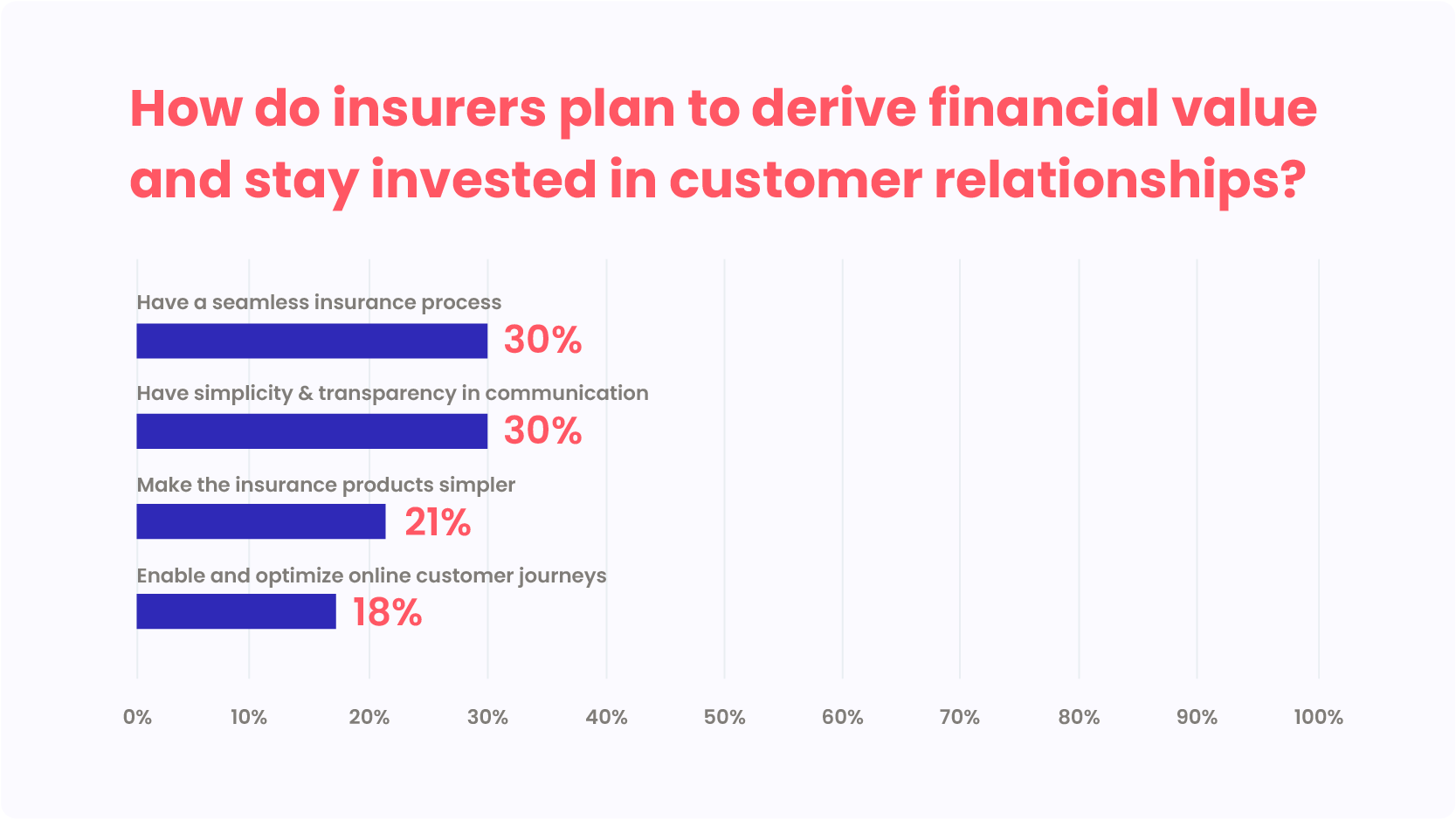

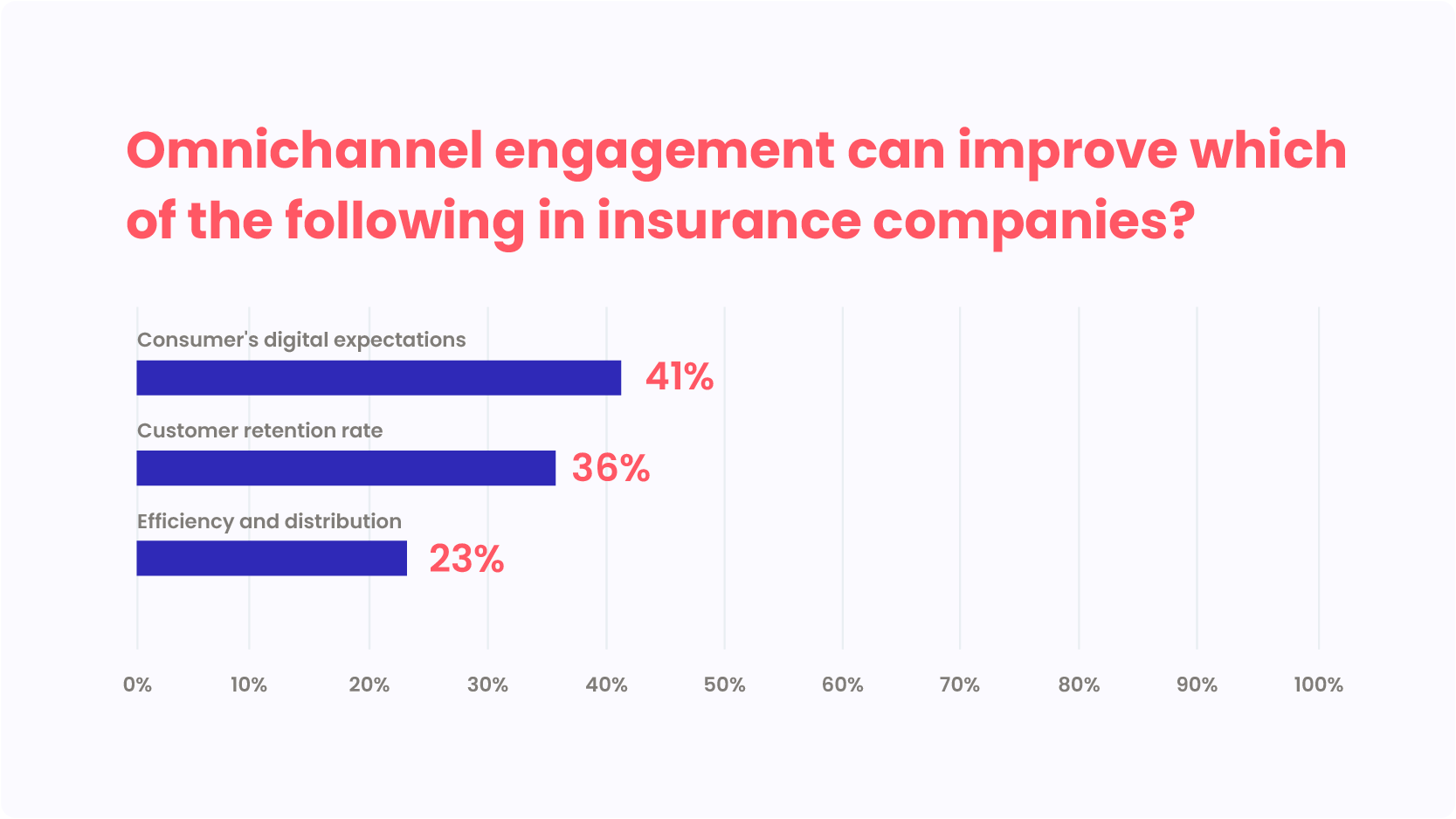

Catering to a customer through their channel of preference is what makes an insurer stand out from the rest. This is known as omnichannel customer servicing. It is an approach that allows insurers to provide a seamless experience to their customers. This experience is provided across various channels throughout their insurance journey.

The continuously changing insurance industry allows its customers to obtain and purchase services digitally using any channel on any device. Hence, such an intimate relationship with the customer results in customer loyalty, a better retention rate, increased process efficiency, and lower costs.

A Capgemini report survey highlighted that, on average, more than 50% of customers prefer to use three or more channels to research and purchase insurance coverage. Each channel is valuable in different ways for consumers, and they enjoy a comprehensive set of omnichannel benefits.

Omnichannel engagement becomes even more critical for post-purchase support. More than 50% of customers said they use the chat features offered on their insurance firm’s website, mobile app, or call center, together with traditional channels (branch/agent/broker) to get answers to questions.

Seamless omnichannel delivery is essential for every insurer – because as many as 75% of surveyed customers said they would switch insurers in pursuit of convenient and seamless policy service options.

Hence, it is valuable to utilize omnichannel marketing to provide a new customer experience in insurance.

Key Elements for Providing New Customer Experience in Insurance

Delivering a superior customer experience is not an easy task. It requires constant research about the new trends, relentless product messaging improvement, and not to forget significant time investment. Improving the customer experience is critical, but it requires a shared vision and a new level of coordination across teams.

Below are the few ways that can help improve customer relationships in the insurance industry:

1. Understanding the customer needs and behaviour:

One thing the insurance market does need is more understanding and education of the customers. Why is the customer buying a policy and what is the benefit that they will get tells a lot about a customer.

Rishi Mathur, Chief Digital & Strategy Officer, Canara HSBC OBC Life Insurance

If you think closely about it, what does an insurance customer need? A customer doesn’t have complex needs. They want to choose from a wide range of policies at reasonable prices. They want comparisons between policies from different insurance companies. Information on policies and benefits associated with them should be easy to understand. Communication should happen from time to time on their preferred channel. Above all, they should have an easy claim settlement process if needed.

All that an insurer needs to do is listen and understand their customer’s needs. This can be done by:

- Making targeted sales efforts based on customer’s likelihood to buy

- Enhancing purchase process by better connecting customer concerns with insurance’s importance

- Reinforcing product’s value with post-sales support

- Improving awareness amongst consumers using sources like youtube videos and ads

- Generating significant consumer data to identify and proactively predict life events

- Training intermediaries so they can educate the consumer about the benefits

Every intermediary is a simple human being with a complete veneer of technology. If you’re able to train your intermediaries and in return train the customer and everything is at scale, that is when digital is most beneficial.

Jaimit Doshi, CMO- Marketing & Digital, Aditya Birla Sunlife Insurance

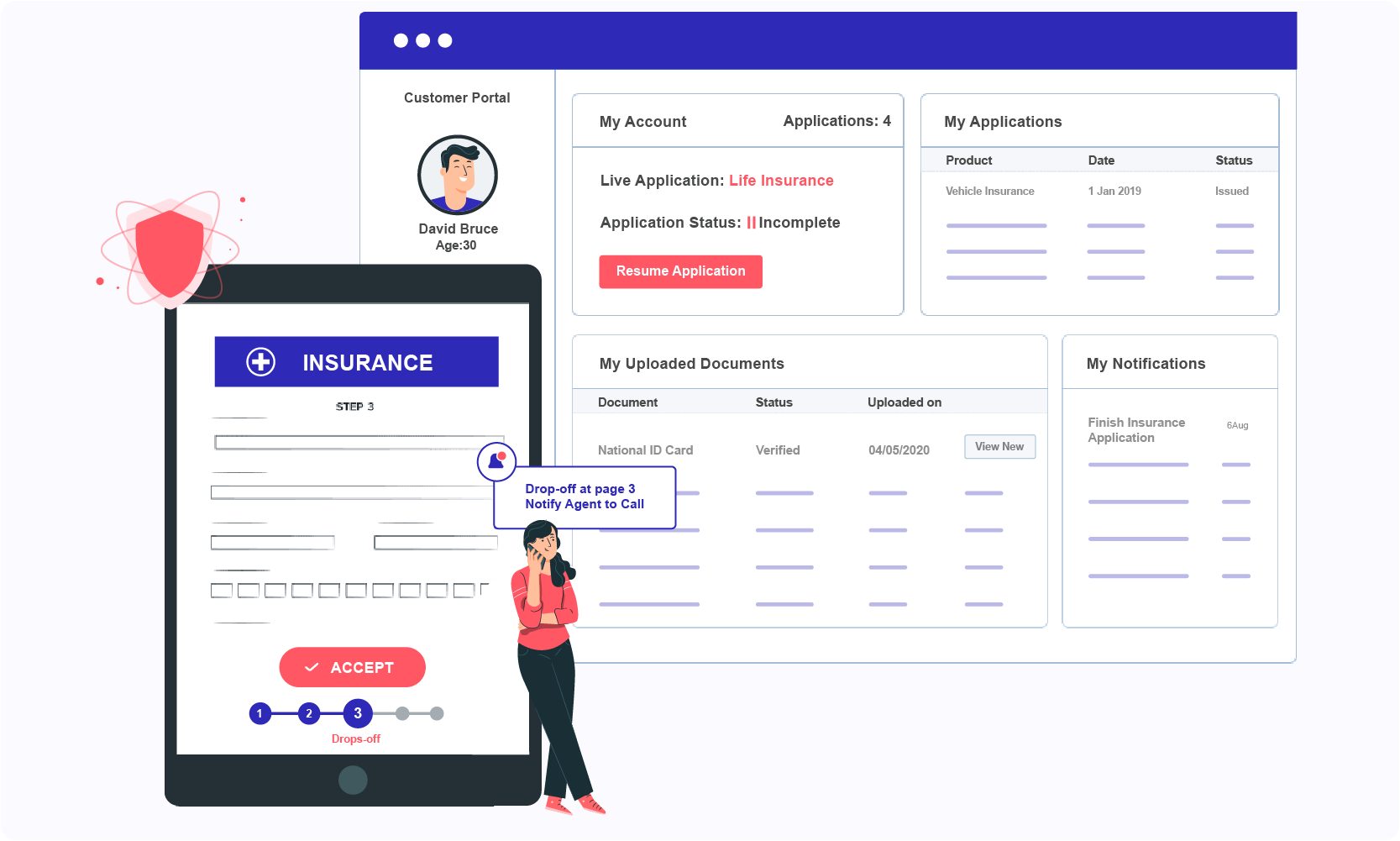

2. Using a Self-service Approach

Today, every purchase is a finger touch away. Thanks to the likes of Amazon and other online retailers who have made accessing and buying products so much easier. Similarly, as consumers, we expect our policies and insurance resources to be accessible 24/7 and in an understandable format.

This is where self-service portals come into play in the insurance industry. A self-service portal is a way to help users address everyday needs without any external help. As a result, a self-service portal solves most consumer concerns like signing up for a new policy, policy renewal, claim settlement, and access to policy resources. Any complicated issue can be redirected to the service employees. This process not only helps in saving time but also reduces operational costs.

This enables customer data collection so that the insurer doesn’t waste time collecting information in case of a returning customer. Small details like this help build customer trust and loyalty.

A self-service portal complements the human service agents and hence, should not be considered a replacement. The various benefits of following a self-service approach in insurance are:

- Allows 24/7 access to services

- Improves customer acquisition

- Improves customer retention

- Enables real-time notifications

- Lowers customer acquisition costs

- Speeds up the claims process

A large percentage of the D2C (Direct to consumer) sales still has an intermediary and is not completely self-service. Infact, 95-98% of the market still works through an intermediary. When we look at digital, it is not necessarily pure D2C. It is a hybrid model. Hence, in order to improve productivity, we don’t just need to digitise our consumer end but also the intermediary branch.

Jaimit Doshi, CMO- Marketing & Digital, Aditya Birla Sunlife Insurance

3. Delivering Personalized Experiences to Customer

A McKinsey & Company report states that “personalization is the future of insurance marketing.” Subsequently, it defines personalized insurance as reaching customers with targeted messaging, offers, and pricing at just the right time. Data collected from the customers through self-service portals or human interaction helps send out personalized content.

An Accenture survey found that 80% of insurance customers seek personalized offers, messages, pricing, and recommendations from their auto, home, or life insurance providers. Moreover, endless reports suggest the benefits of using personalized marketing as a source of customer acquisition and retention.

But personalized experience can be provided in various ways. It isn’t just limited to the content you send out to your customers. It also depicts the messaging and positioning of your content on social media or your website. We cannot stress enough that the simpler the product messaging, the better the conversion rate.

Today, youtube is the answer to all our questions, from operating a mixer grinder to changing Stepney in a car. Insurers should leverage such platforms to reach out to their customers and educate them about their offerings.

YouTube is the second-largest search engine in the country. A short video can help you find out so much about insurance and the benefits associated with it.

Nimish Aggarwal, Senior VP & Head of Marketing, Max Bupa Health Insurance

4. Providing an End-to-end Digital Customer Journey

An insurer’s work doesn’t just end once a sale has been made. An insurance company has to take care of the post-sales operations as well. Hence, ensuring an end-to-end digital customer journey. This can be done effectively using Straight Through Processing (STP). This refers to an automated process that can be performed without human involvement.

The various processes that can be improved using digital intervention are:

- Application Processing: Self-serve forms and portal is mobile friendly and ensures a smooth application experience for the insurance applicants.

- Customer Onboarding: eKYC and video KYC verification helps in eliminating lengthy verification processes and ensures faster and efficient customer onboarding.

- Sales Automation: Automating sales processes like lead capturing from multiple sources, distribution, attribution and prioritization helps sales people focus on important tasks.

- Proactive Intervention: Capturing live signals via prospect tracking on website and direct integrations enables automatic intervention via the right channel- email, text etc.

- Real-time Reporting: Performance reports for policy sales and renewals for all teams helps in keeping a check on the team productivity.

In short, all these processes help improve process efficiency and enhance the customer experience in insurance.

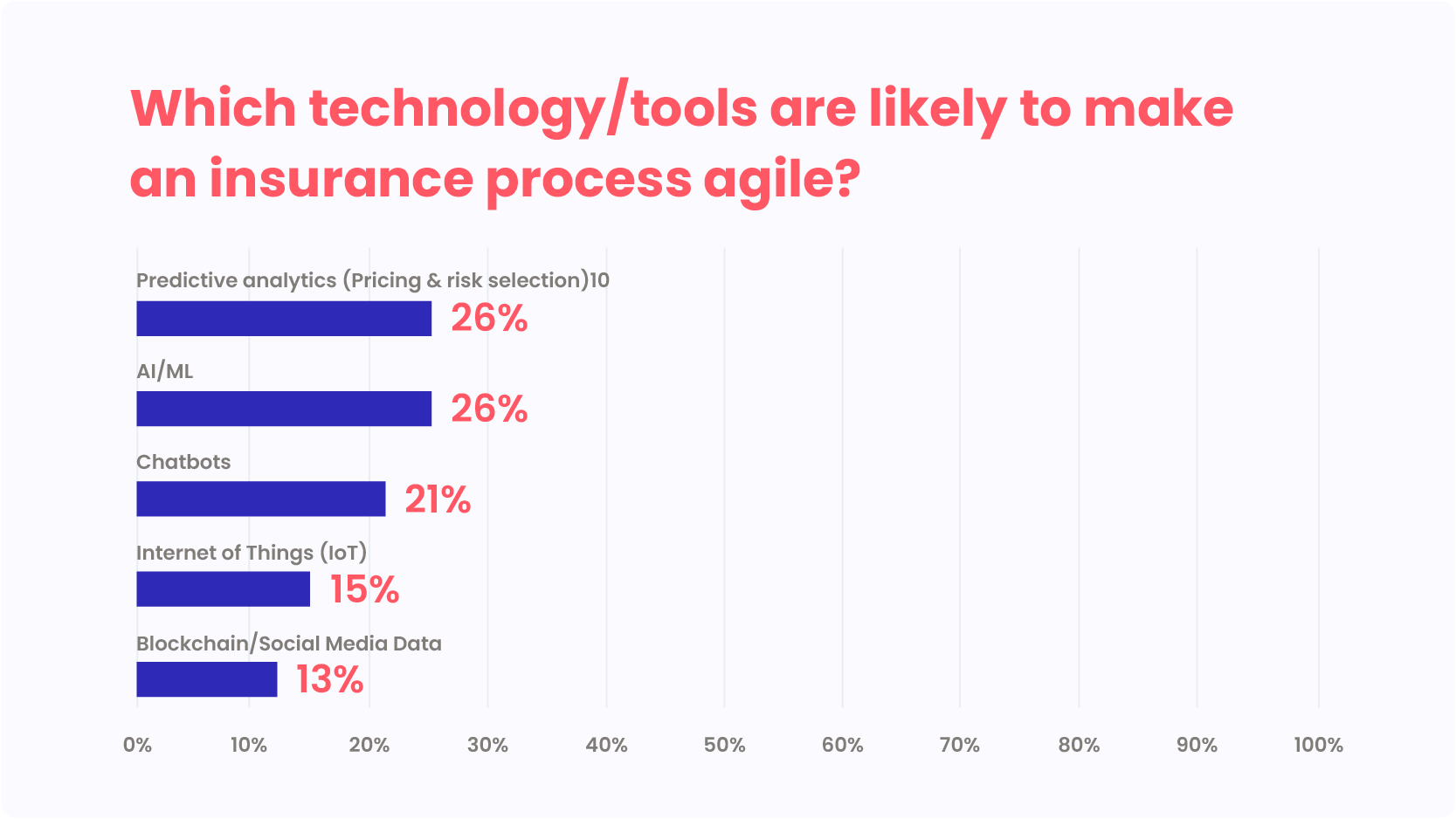

5. Introducing Technical Enablers to the Insurance Process:

Today, insurers with better technical capabilities have the upper hand than traditional brokers. Technological enablers such as Artificial Intelligence (AI), Machine Learning (ML), predictive analytics, intelligent automation, and many more help insurers in agility, better growth, and cost ratios.

Below are a few IT tools that are constantly evolving and making insurance companies grow faster:

- Predictive Analytics: Data is the biggest advantage for an insurance company. Insurers can use the collected data to determine events, information and other factors to make informed decisions and enhance efficiency.

- Smart Automations: Automating tasks and worflows for sales people decreases the work load and results in innovative ideas that convert into business value

- Artificial Intelligence/ Machine Learning: AI/ML helps in executing complex computations at a faster speed and provides deeper insights. It is used in processes like claims processising, fraud detection, underwriting and customer service.

- Chatbots: Chatbot is a virtual assistant that is capable of completing certain tasks with prospective customers. In addition to answering questions, chatbots are available 24/7 to give basic advice, check billing information, and address common inquiries and transactions.

How can LeadSquared help?

Insurance sales and renewal CRM platform LeadSquared manages multiple processes and teams on a single platform and improves operational efficiency.

In conclusion, from capturing client data from various sources to automating communication across channels and ensuring client retention, LeadSquared solves all end-to-end problems. To understand how LeadSquared can help define the new customer experience for your insurance company and be a digital transformation partner!

FAQs

Omnichannel customer servicing means catering to a customer through their channel of preference. It is an approach that allows insurers to provide a seamless experience to their customers. This experience is provided across various channels throughout their insurance journey.

Good customer service is the key to the consistent growth of any company. Therefore, understanding the customer’s needs, simplifying the insurance products, and meeting consumer demands throughout their journey helps improve customer service.