Everything in life at times boils down to one word – timing. Insurance agents can and should apply this concept to every sale they make. Cross-selling is one such area that largely depends on two things – timing and intent.

In simple terms, cross-selling is getting your customer to buy a product alongside what they were planning to buy, especially if it is a complementary product.

For example, when selling home insurance, your customer might open up about his son getting his driver’s license, which is an opportunity to cross-sell auto insurance to him.

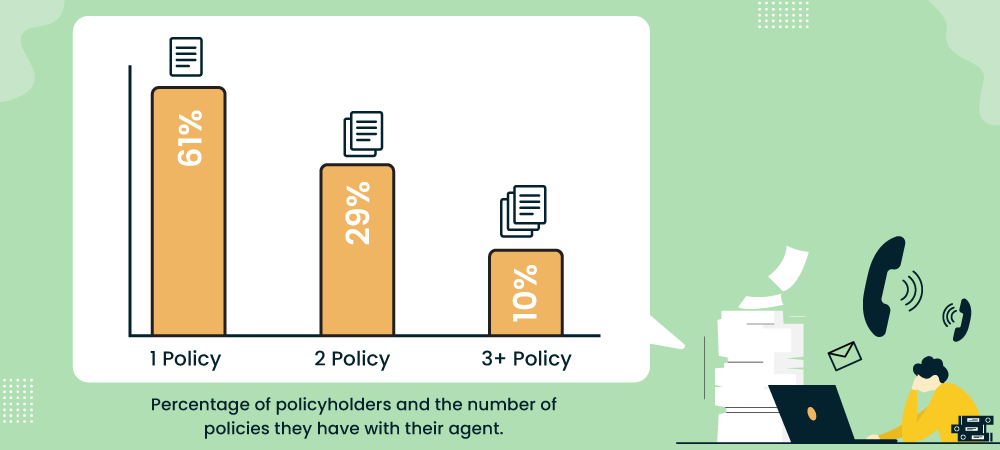

So, there are two rules here: customer convenience and complementary/relevant/useful products. The correct cross-sell insurance model is always customized to your customer’s needs. Insurance cross-selling statistics show that:

- 61% of policyholders have only one policy with their agent.

- 29% have two policies with their agent.

- 10% have three or more policies with their agent.

These statistics show us that there are multiple existing opportunities for cross-selling within the insurance sector. Amazon has stated up to 35% of its revenue comes from cross-selling. Both the “Frequently Bought Together” and “Customers Who Bought This Item Also Bought” sections advertise items that are similar to the one you’re looking at. When you’re cross-selling, look at products that inherently work well when paired – like a razor with shaving cream.

You might be wondering, what’s the best strategy to cross-sell successfully?

1. Understand your client’s needs

None of us like being pushed into buying something we don’t need. The same goes for your customers when cross-selling policies or products. When pitching your sale, your primary objective should be to understand your client’s current situation.

Several individuals may recommend selling when policy renewals are taking place, which is excellent advice when done at the right time. But if your customer is in a financial bind or has little time to sit and chat, don’t push for purchases. Instead, the first and foremost step when selling is to ask-

- “Do you have a couple of minutes to answer a few questions?” If no, thank them for the call and ask if there’s a chance to reach out to them at a better time.

- “Thank you for taking the time to have this conversation. Is there a better time I can call?” If yes, go ahead and clarify with them the following-

- “Do you have (insurance product) coverage right now?”

For example, your customer does not possess disability insurance. But statistics show that one in four workers entering the workforce will become disabled and unable to work before retiring.

Many employers offer both short- and long-term disability insurance as part of their benefits package. If your customer’s employer doesn’t, present them with the facts and statistics and inform them of the necessity of being covered by disability insurance.

So, enquire with the following insurance cross-sell script

- “Do you have disability coverage right now?”

- If no- “That’s quite surprising as statistically speaking, 1 in 4 workers entering the workforce tend to become disabled and are unable to work before retiring.”

- “Your current employer’s coverage does not include disability protection which is more important than most of us may realize, especially because you are the sole earner in your family.”

- Then, “Would you be interested in your long-term disability coverage options? It can be bundled with your current (insurance product) plan and save you money.”

- Confirm that it is a good time to call, or if not, inquire as to when a better time would be to call them back for a disability insurance quote. If they say no, thank them for being a valued client and offer to contact them again if you come across a service they may be interested in.

If their employer offers coverage, find out whether it is long-term-

- If yes- “Oh wow, does your employer offer long-term coverage?” If not, present a few facts about the costs associated with disabilities and explain how long-term disability insurance helps protect them and their family’s income if they’re the breadwinner.

- “Your current employer’s coverage does not cover long-term disability protection, which is more important than short-term coverage as you are the sole earner in your family.”

- Then, “Would you be interested in your long-term disability coverage options? It can be bundled with your current (insurance product) plan and save you money.”

- If yes, confirm that it is a good time to call, if not, inquire as to when a better time would be to call them back for a disability insurance quote. If they say no, thank them for being a valued client and offer to contact them again if you come across a service they may be interested in.

2. Tracking and customer segmentation

Understanding customer intent and being on the same page is crucial when cross-selling. Customer segmentation based on specific criteria, such as location, type of insurance, age, family size, and more, can significantly help when it comes to cross-selling insurance.

Tracking client behavior is also essential to cross-selling at the right moment. When you track their policy purchases and coverage, you can visualize cross-selling opportunities for products they don’t currently possess.

For example, when selling any policy, it becomes a lot more appealing when personalized for the customer’s needs. 74% of consumers say “living profiles” with more detailed personal preferences would be helpful to curate personalized experiences, products, and offers.

Let’s take a look at two examples of cross-selling scripts, one that is personalized and another that is generic.

Personalized Script

“Hello, Sir/Ma’am. I was looking at your account and because you have a swimming pool, I always suggest getting an umbrella policy. What this means for you is, if there were ever an accident, you would have another $2 million in protection after your home insurance policy runs out at $500k. With people suing more than ever today, for $20 per month, wouldn’t you agree we should add that on?”

Generic Script

“Thank you for giving me the chance to assist you with your (insurance product) needs. Several clients bundle our insurance products under an umbrella policy to save money. Would you be interested in a new quote to check if you can save money on your (insurance product) policy?”

The first script is more convincing due to its personalized nature; in the first script, you know the client’s current residence. It is far easier to sell policies based on your customer’s unique needs than treating them as just another opportunity to cross-sell.

3. Automated cross-selling campaigns

Cross-selling through email campaigns is a popular method of reaching customers who aren’t available for calls. Automated campaigns are easier to personalize based on the segmentation of your chosen criteria. Once you create a template for your target audience, you can trigger a workflow that creates email journeys based on the same.

Create a drip campaign that markets a new line of business to your existing clients. For instance, one client’s business may be rapidly growing, which provides a wonderful cross-selling opportunity. For their insurance cross-sell email campaign, your template can be written along these lines-

Subject line- Hey Bob, protect your data before its too late

Hello (Name),

I wanted to congratulate you as I noticed that your business is booming! I also realized that currently you’re only coming under the commercial insurance coverage. As your company revolves around the use of technology, I greatly recommend investing in our Cyber Insurance. Cyber insurance protects your data from any external attacks which you may encounter as your company grows.

Plus, it means you don’t have to juggle multiple carriers; all your insurance is in one place.

Please call me on ———— or reply to this email so we can discuss different coverage options and your preferred policies.

Looking forward to catching up,

Signature

4. Policy reviews and renewals

Your greatest cross-selling opportunity will almost always be during times of policy review and renewals. It’s the perfect window of opportunity to keep your customer aware of the benefits of a different policy they’re yet to invest in.

When your customer arrives for their review and renewal, ensure that you’re aware of their needs. Don’t enter a renewal having little to no knowledge of your customer’s current lifestyle and living circumstances, whether they reside with their family of four, their age, financial health, etc.

When a client’s policy is up for renewal, use an insurance cross-sell script to offer a bundled discount.

Simply ask if your client would like a free quote for coverage they don’t have after you’ve searched their account for products. Tell them if they qualify for a discount on a specific type of coverage.

Exclusive deals are popular among loyal customers. For example, a customer coming in for renewal has an 18-year-old son. This is typically the age of getting a new car, which provides you the opportunity to cross-sell auto insurance during the renewal.

But keep in mind that you can only do this if your customer is looking to get their son a car. A script to cross-sell in this setting would be along the following lines-

- You: Hi, how have you been? Do you have some time to spare? I noticed something pretty interesting.

- Customer: I have some work to get to, so not right now, please.

- You: I understand. Shall I give you a call tomorrow, or what time suits you?

- Customer: Okay, tomorrow works.

If the answer is yes, then you can continue with the pitch.

- You: Do you currently have car insurance?

- Customer: Yes.

- You: Great, I was wondering if your son did as well, as we spoke about him getting a driver’s license a couple of months back.

- Customer: We’ve recently bought him a car. I’m not sure if he requires it yet, as he’s still learning.

- You: I understand, but I think it would be wise to invest in auto insurance earlier rather than later as accidents may happen while learning.

- Customer: I’ll talk it over with him and get back to you.

- You: Sounds great, do reach out to me whenever you need to.

If the customer already has an insurance policy, ask him when the expiry date is and follow up accordingly. If the customer does not have the other insurance policy, it is the best time to pitch your product immediately.

5. Create a client evaluation checklist

Finally, when cross-selling to a new client, you need to get a clear idea of their current policies. The best option is to send an online, paperless form that inquires about your client’s current life. The form can have objective and subjective questions relating to their home, family, health, and business.

A short and sweet form for your busy clients can still give you insight into new developments in their lives. Ensure that the questionnaire you create is relevant to the client answering it. When they finish filling it, you can segment your customers into smaller units.

For instance, if your client has a family history of certain health complications such as cancer or Parkinson’s, you can confirm if their health insurance covers these ailments specifically.

Also assess other details regarding their partner, children, and occupation. If they’re in the process of moving into a new home, you can recommend different insurance policies based on their residence.

For example, if the new area experiences flood more often than where they previously resided, you must suggest flood insurance. An evaluation created based on the policies your agency sells can instantly open new cross-selling opportunities. It won’t take much of your client’s time and will give a 360-degree view of the policies they require.

When you’re done evaluating your client, enter their information into your existing database and reach out to them accordingly. The most crucial aspect of cross-selling, as stated at the start of this article, is timing. When you have a system that tracks and captures client behavior in a quantifiable manner, you’ll have increased cross-selling opportunities.

If you’re interested in investing in one such software, try LeadSquared’s CRM to identify clients in need quickly.