A digitally forward insurance industry calls for insurance agents to be smarter, quicker, more efficient with technology tools, and solutions they have at their disposal.

This is why artificial intelligence and machine learning tools like ChatGPT are gaining momentum.

Because,

ChatGPT by OpenAI is a Natural Language Processing (NLP) platform driven by Artificial Intelligence (AI).

It taps into advanced algorithms to make sense of user inputs and responds with precision and relevance.

ChatGPT’s capabilities have certainly seen a fitment across industries. Particularly in the insurance industry, ChatGPT has a huge scope of being implemented to ensure seamless KYC procedures, underwriting for better decision making, claims management, and other processes across the policy tenure.

In this article, we will discuss its application in the insurance sector and specifically how insurance agents can make the most of it during their day-to-day tasks.

Role of ChatGPT in the Insurance Industry

What comes to your mind when you think of an insurance plan’s lifecycle?

Typically, there are two lifecycles:.

- The lifecycle of an insurance policy — entails product development, policy application, underwriting, servicing the policy owner and claims administration.

- And the lifecycle of an insurance claim — includes claims adjudication, document submission, payment, and processing.

Currently, out of these, ChatGPT can be resourceful in processes such as customer service, underwriting, lead generation, sales, marketing, policy recommendations and management.

In the coming sections, find out how ChatGPT can be leveraged in different contexts.

Leveraging ChatGPT for Customer Service

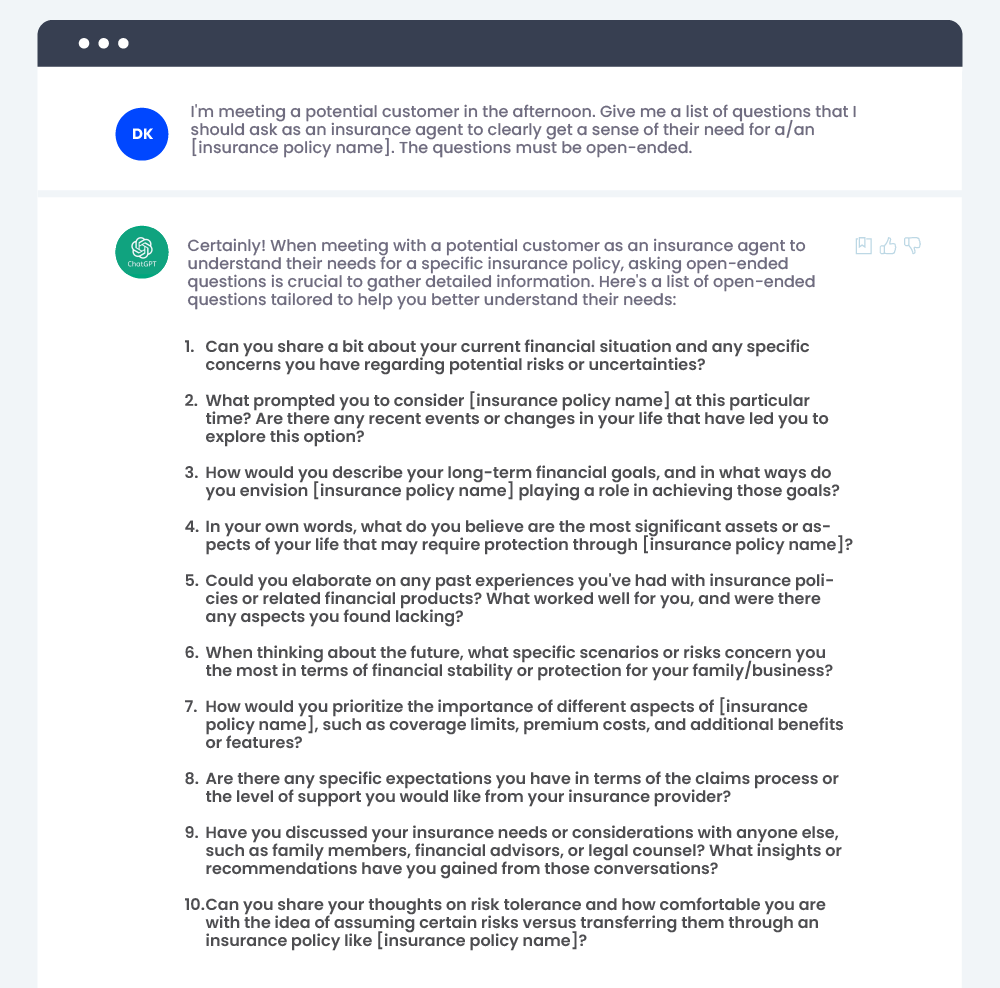

1. Needs assessment

When insurance agents are meeting a new customer and want to know how exactly they can cater to their needs, the questions they ask in this preliminary meeting can help clarify a lot of aspects to roll out contextual policy offerings.

I’m meeting a potential customer in the afternoon. Give me a list of questions that I should ask as an insurance agent to clearly get a sense of their need for a/an [insurance policy name]. The questions must be open-ended.

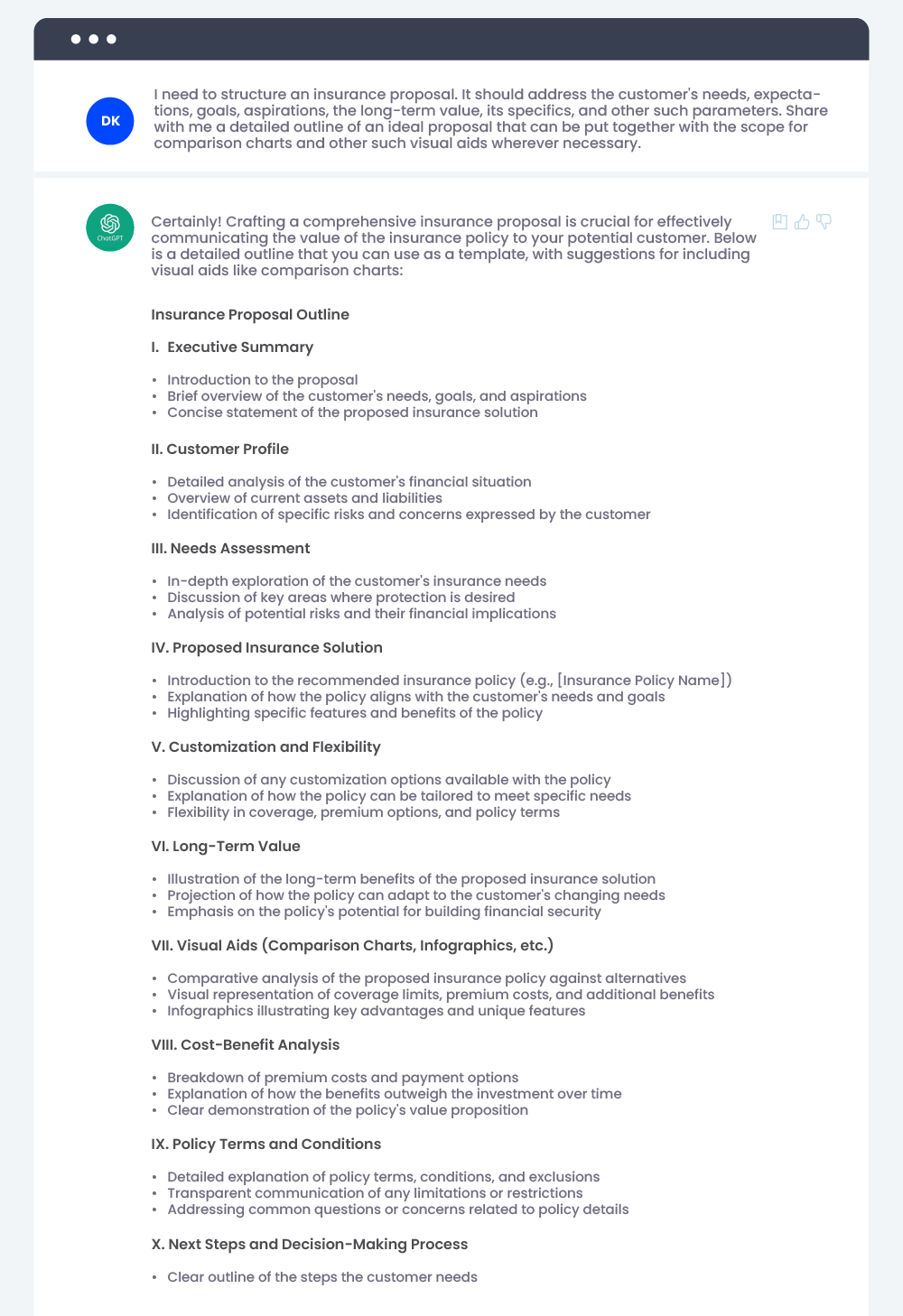

2. Developing an insurance proposal

Once the insurance agent has identified a potential sales opportunity, it’s the proposal that’ll really help him break through the clutter. Here’s a sample of a prompt that you can tweak according to your liking:

I need to structure an insurance proposal. It should address the customer’s needs, expectations, goals, aspirations, the long-term value, its specifics, and other such parameters. Share with me a detailed outline of an ideal proposal that can be put together with the scope for comparison charts and other such visual aids wherever necessary.

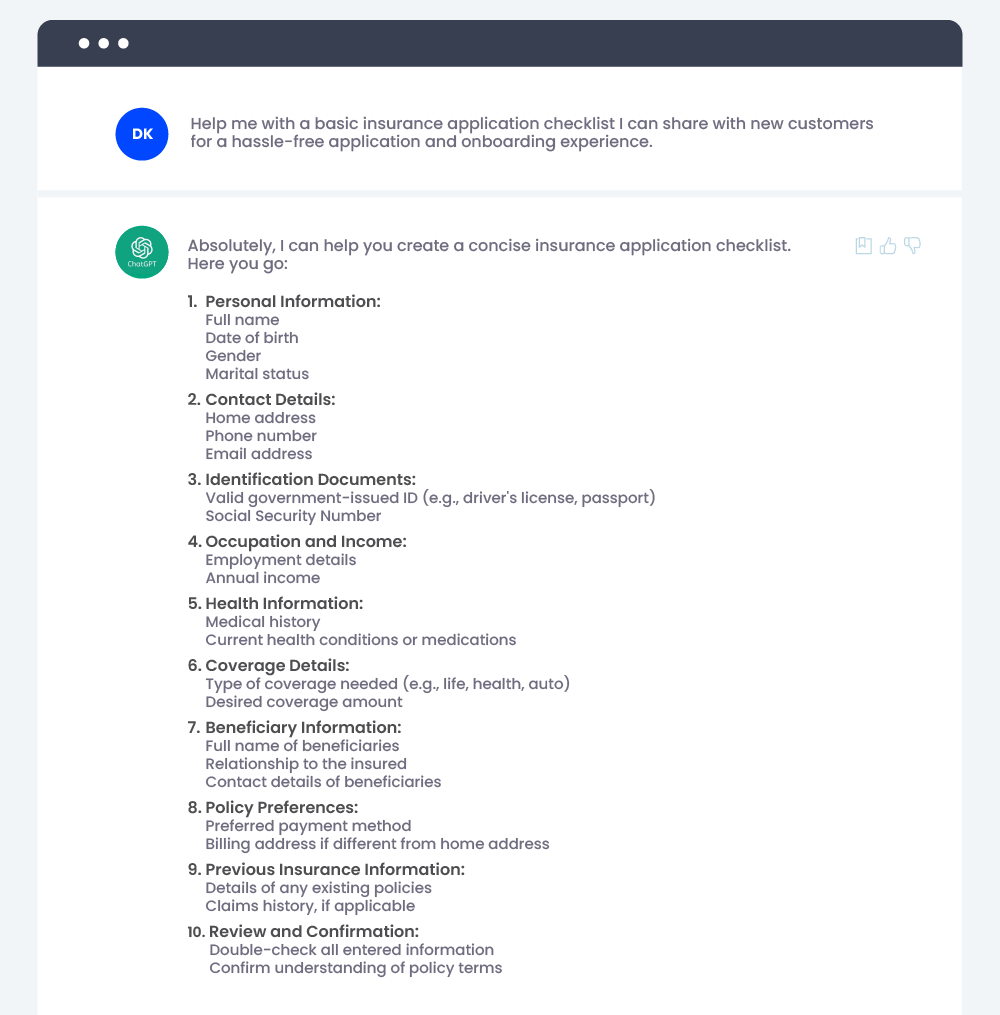

3. Application guidance

The application process can clearly define how good or bad their customer experience can be. Customers can have a bunch of questions about that they need to fill in and the kind of documents that they need to have to get a policy. Which is why insurance agents must be responsive at such times or have material that can guide them in this process. Look at this example-

Help me with a basic onboarding insurance application checklist I can share with new customers for a hassle-free application and onboarding experience.

4. Personalizing recommendations

As stated earlier, mobile and web applications managed by the insurer can be integrated with ChatGPT though APIs (Application Programming Interfaces). Thus, AI models such as ChatGPT can translate customer data into personalized and meaningful insights.

5. Customer engagement

ChatGPT isn’t just limited to the English language. With multilingual customer support, customers can feel more inclusive. When linked to a CRM system (Customer Relationship Management), it can also understand the customer’s data and provide personalized responses to their queries, making customer engagement even more efficient.

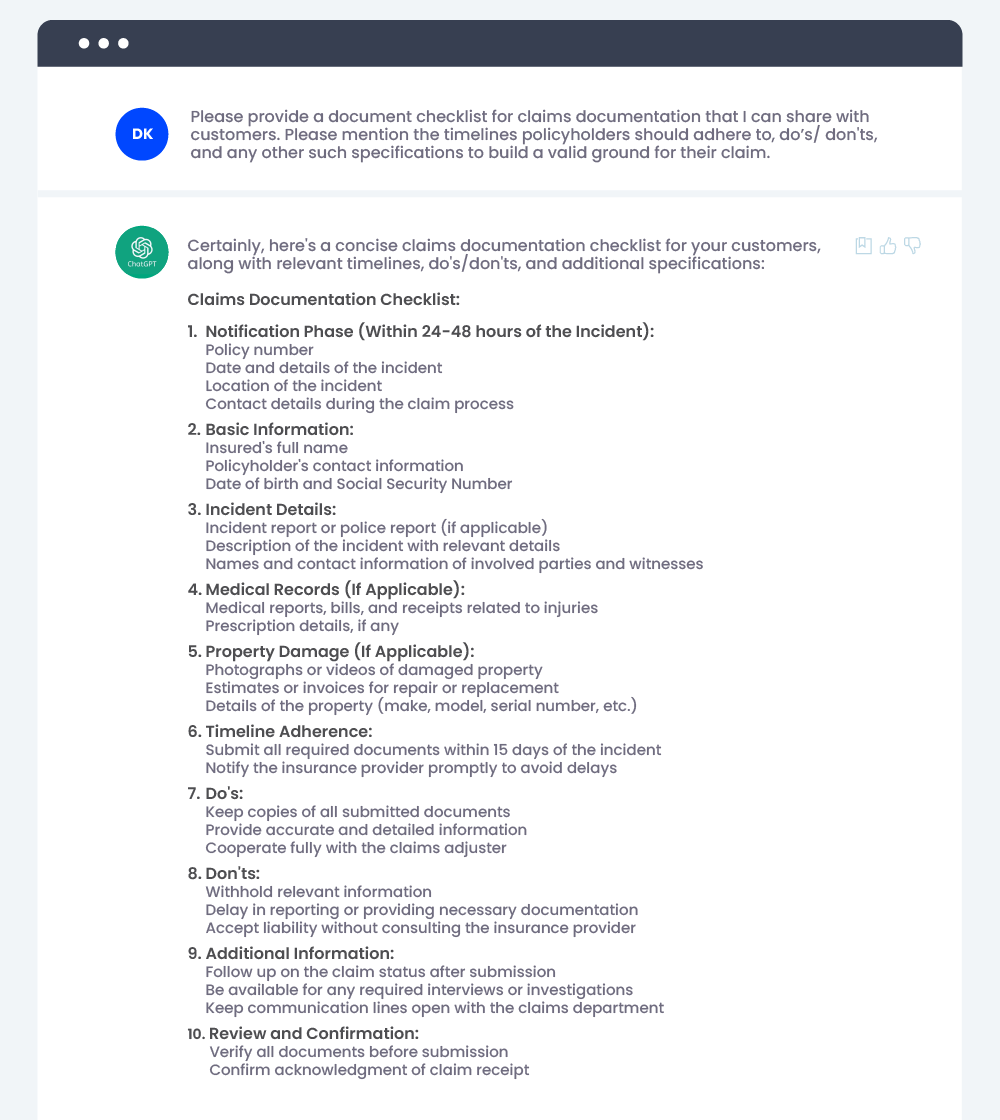

6. Claims assistance

This encompasses walking the customer through the claims process, the documents that need to be submitted, explaining the coverage for the claim, etc. Here are a few sample prompts to give you a better idea!

I’d like to explain to [customer’s name] the potential coverage in line with their claim. Help me draft a document that addresses the [policy name]’s terms and conditions.

Please provide a document checklist for claims documentation that I can share with customers. Please mention the timelines policy holders should adhere to, do’s/ don’ts and any other such specifications to build valid ground for their claim.

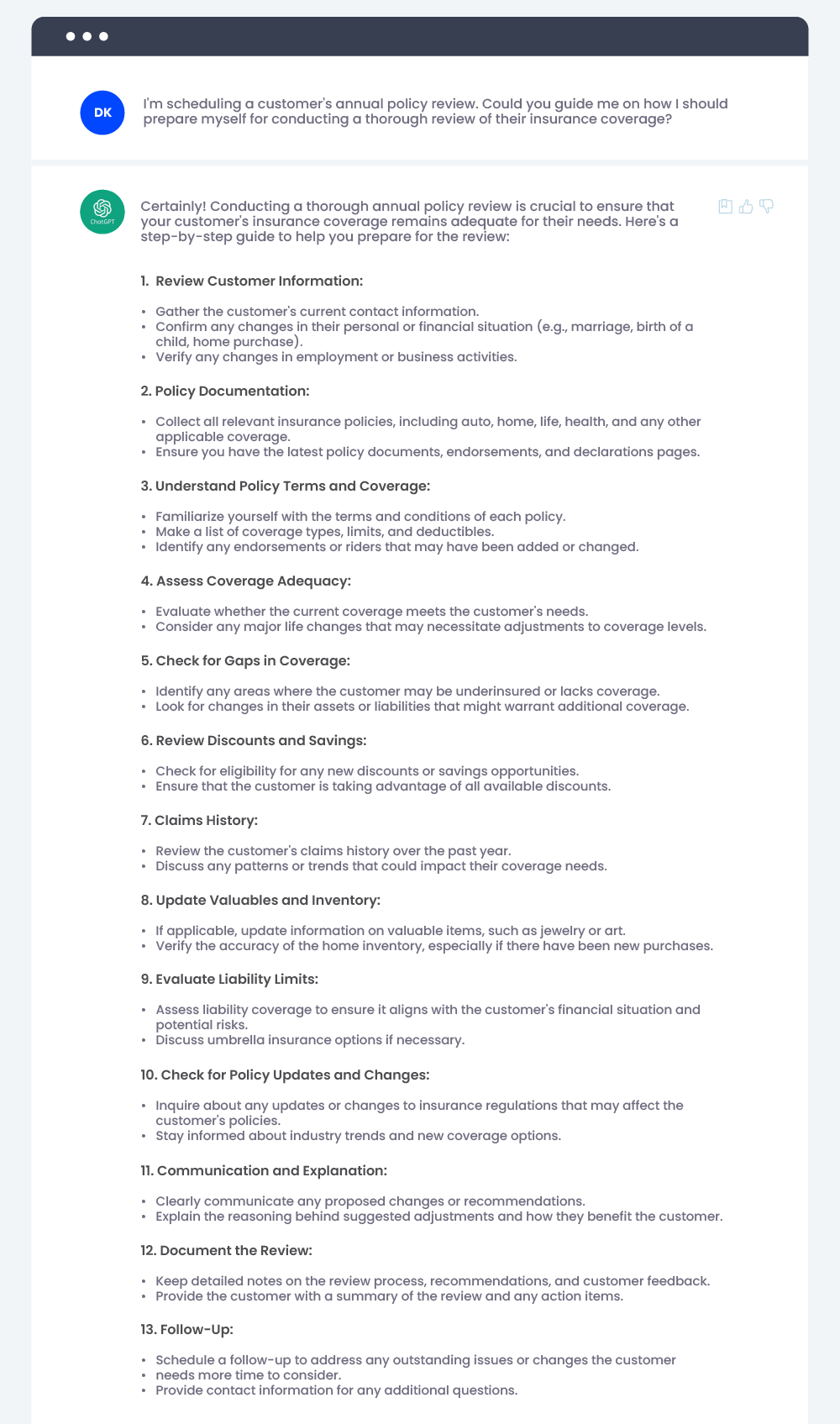

7. Annual policy review

As an insurance agent, it’s standard practice to review a customer’s policy to ensure it isn’t outdated, estimate fair coverage based on the latest market developments, any policy adjustments to be made, and flag instances of non-compliance according to new regulations.

I’m scheduling a customer’s annual policy review. Could you guide me on how I should prepare myself for conducting a thorough review of their insurance coverage?

Here’s another prompt you can also try using when a tool like ChatGPT is integrated with a CRM:

I want to understand how [customer’s name] insurance needs have evolved since their last review. Could you help me in creating [needs assessment/comparison with life stage] to tailor our recommendations?

ChatGPT Prompts for Accelerating Insurance Sales

ChatGPT can have an impactful effect on sales in a number of ways. Whether it’s creating engaging sales content pieces along the sales funnel or crafting a sales proposal, ChatGPT can always be leveraged. We’re going to walk you through a few key ChatGPT prompts for insurance sales!

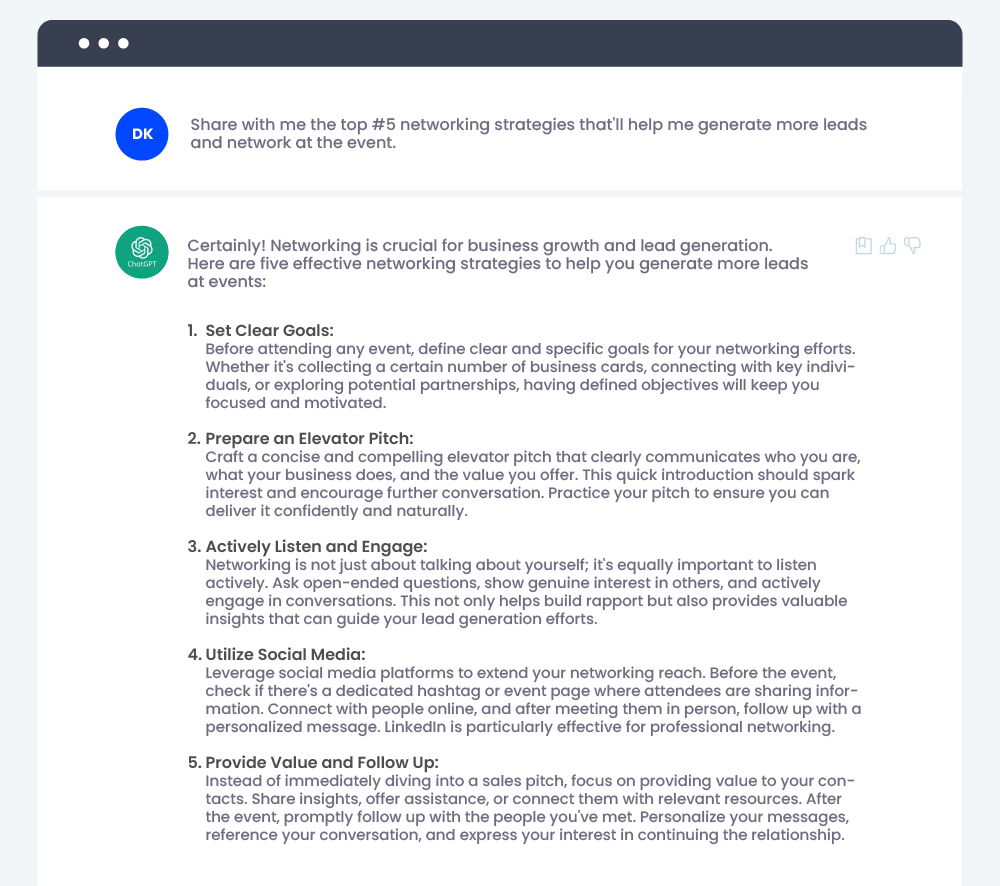

1. Networking strategies

Insurance agents often like being a part of events to network with industry enthusiasts and carry out lead generation activities. ChatGPT can certainly be helpful to define strategies for a clearer action plan when at the event!

I’m going to be at the [event name]. Share with me the top #5 networking strategies that’ll help me generate more leads and network at the event.

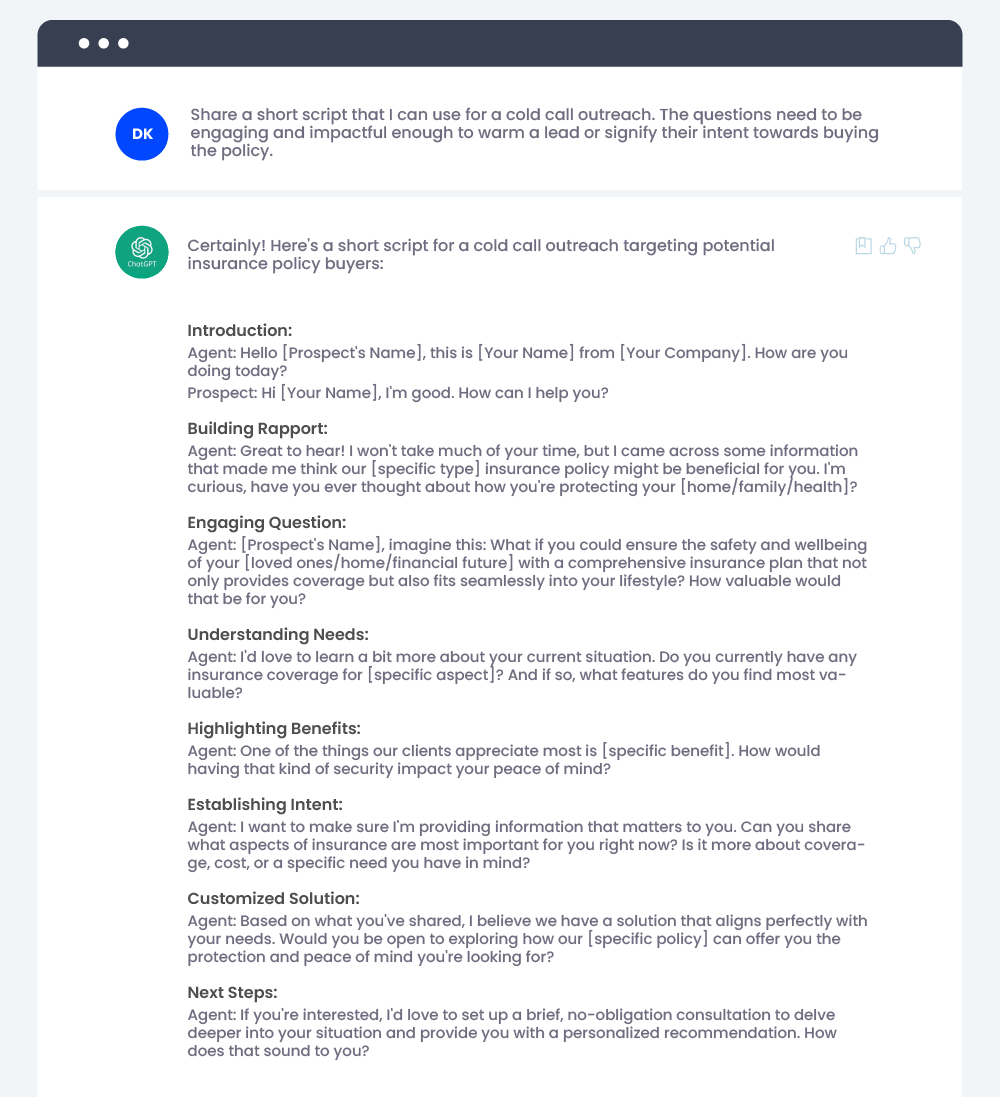

2. Cold calling

Once leads are generated, there needs to be movement on it to warm them up. This is when cold calling can help strike up a conversation. Here’s a ChatGPT prompt for insurance agents that you can use to generate a short script to guide you through the outreach.

Share a short script that I can use for a cold call outreach. The questions need to be engaging and impactful enough to warm a lead or signify their intent towards buying the policy.

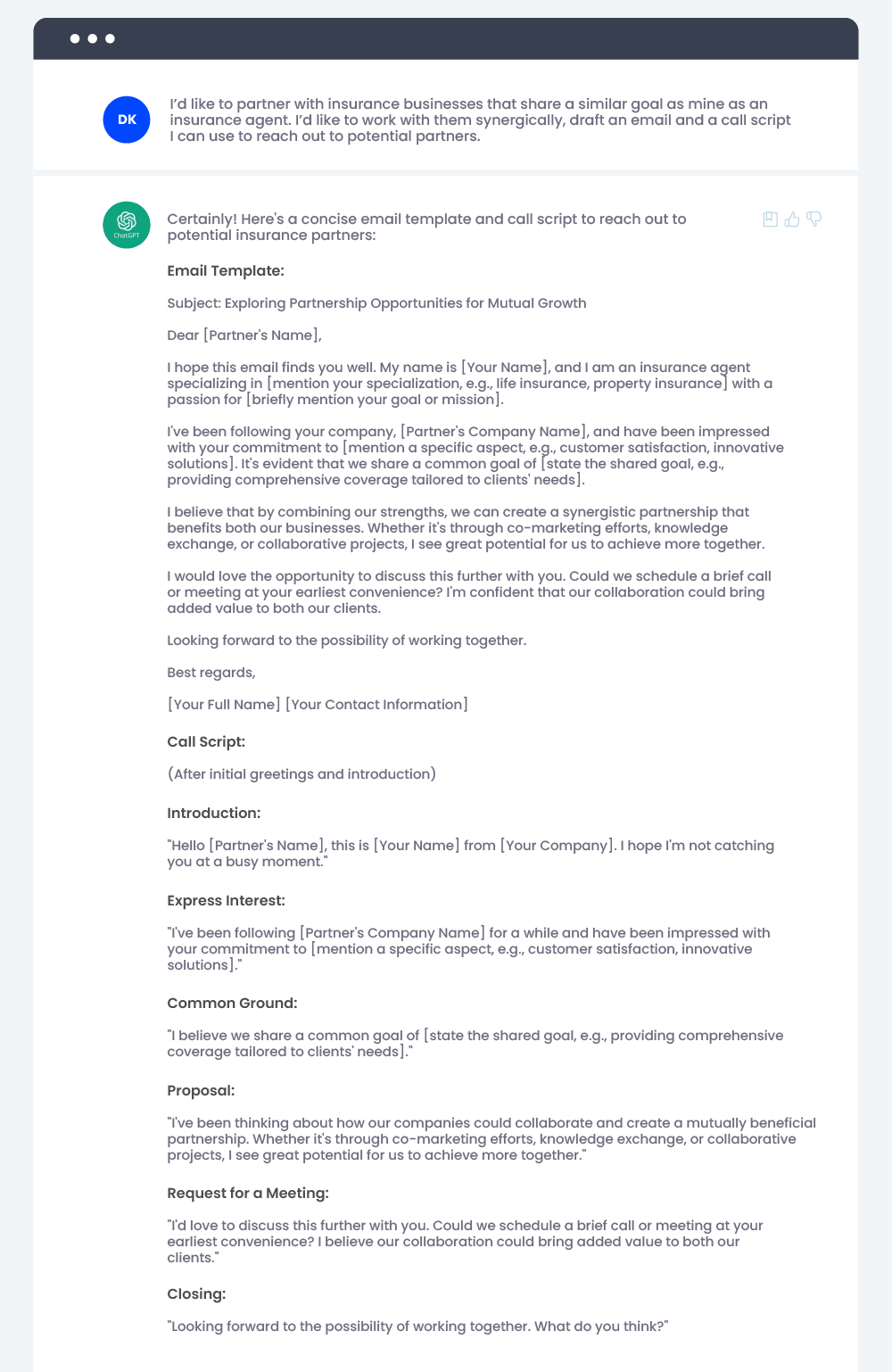

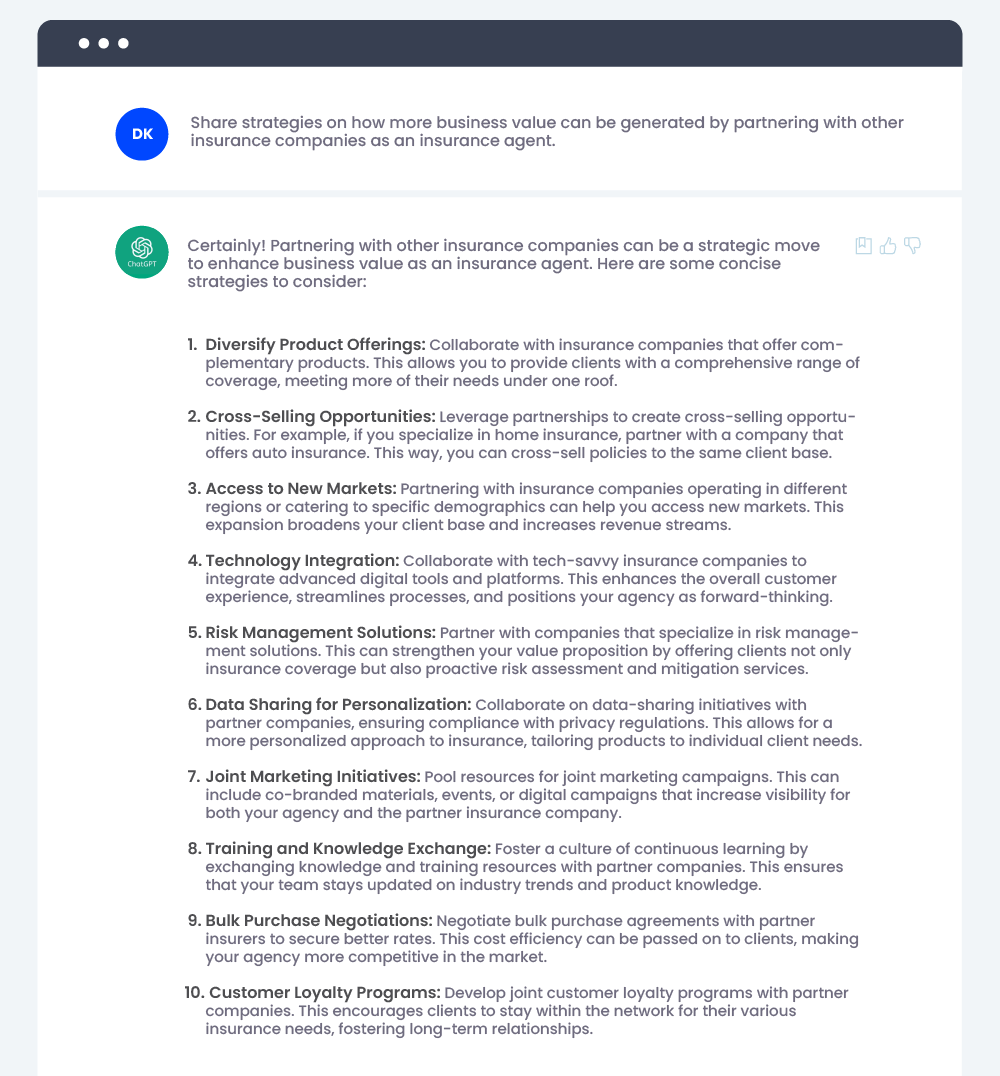

3. Building partnerships

We’re in a time where businesses really believe in co-opetition over competition. Make use of this ChatGPT prompt to grow relationships with other insurance partners synergically.

I’d like to partner with insurance businesses that share a similar goal as mine as an insurance agent. I’d like to work with them synergically, draft an email and a call script I can use to reach out to potential partners.

Share strategies on how more business value can be generated by partnering with other insurance companies as an insurance agent.

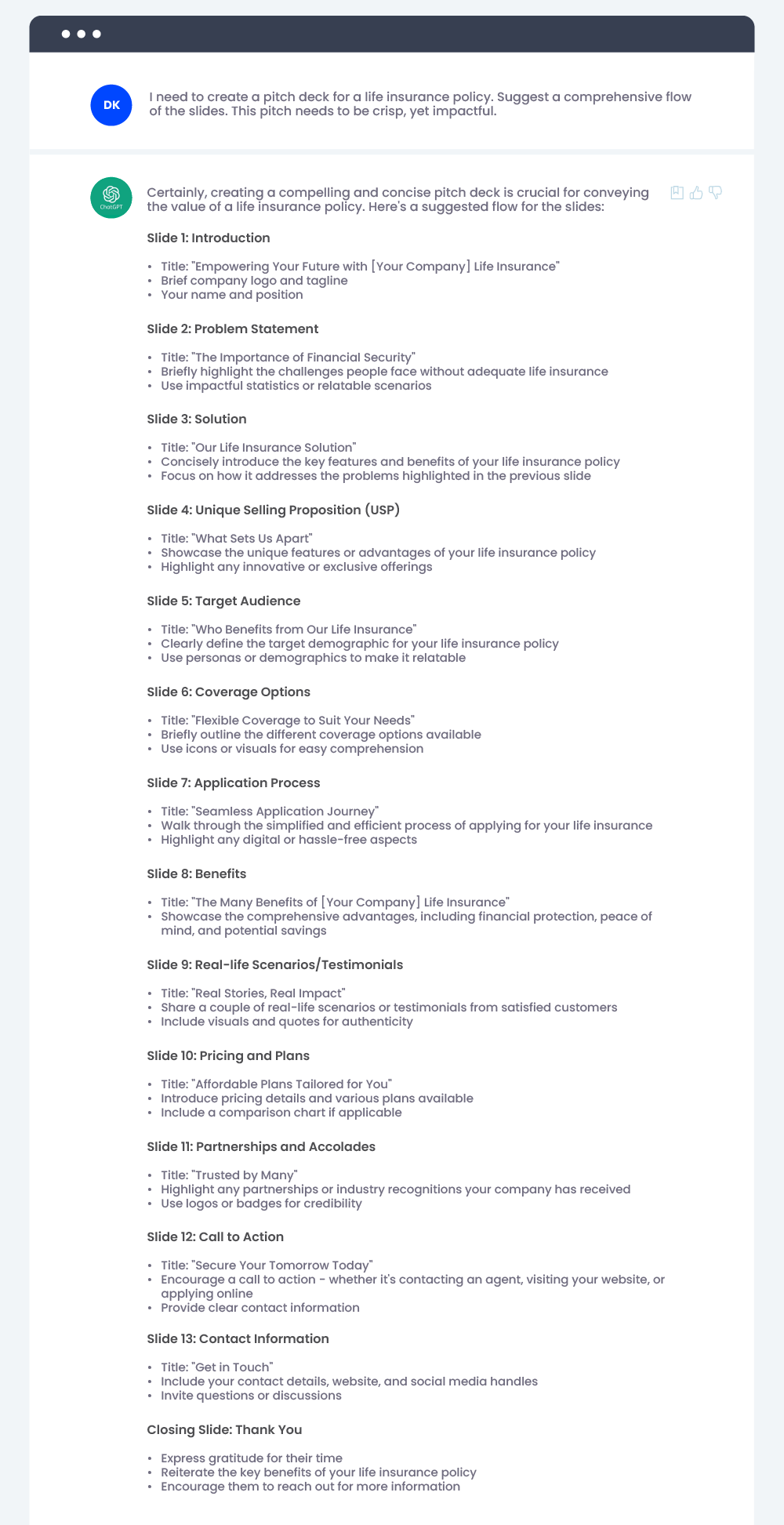

4. Crafting a sales pitch

Behind every done deal, there’s a perfect pitch. Creating a pitch from scratch can be a lot to do and think about. To make this a more simplified process, here’s a ChatGPT prompt for insurance agents to get started on building the pitch deck!

I need to create a pitch deck for a life insurance policy. Suggest a comprehensive flow of the slides. This pitch needs to be crisp, yet impactful.

5. Quotation and pricing

ChatGPT can also be used to structure quotations with premiums, coverage selections, deductibles, etc., in a more structured manner once this information is collected.

ChatGPT Prompts for Impactful Insurance Marketing

When the creativity tank runs out, ChatGPT has your back. Marketers today use ChatGPT for creative content generation, and brainstorming ideas. Here are a few popular ways insurance agents can leverage ChatGPT for marketing:

1. Developing insurance marketing strategies

To get started, define the insurance marketing channels that you want to tap into and develop strategies tailored to each channel. Besides this, also identify the kind of content you want to generate, the scope to repurpose content in other formats, and who your target customer segments are. This way, there’s enough clarity to detail out your ChatGPT prompt to get results close to what you’re expecting.

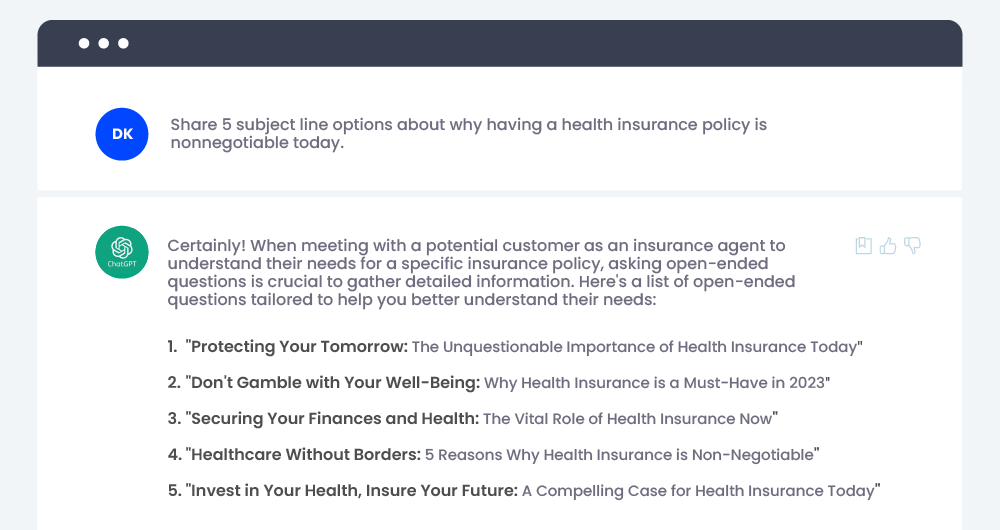

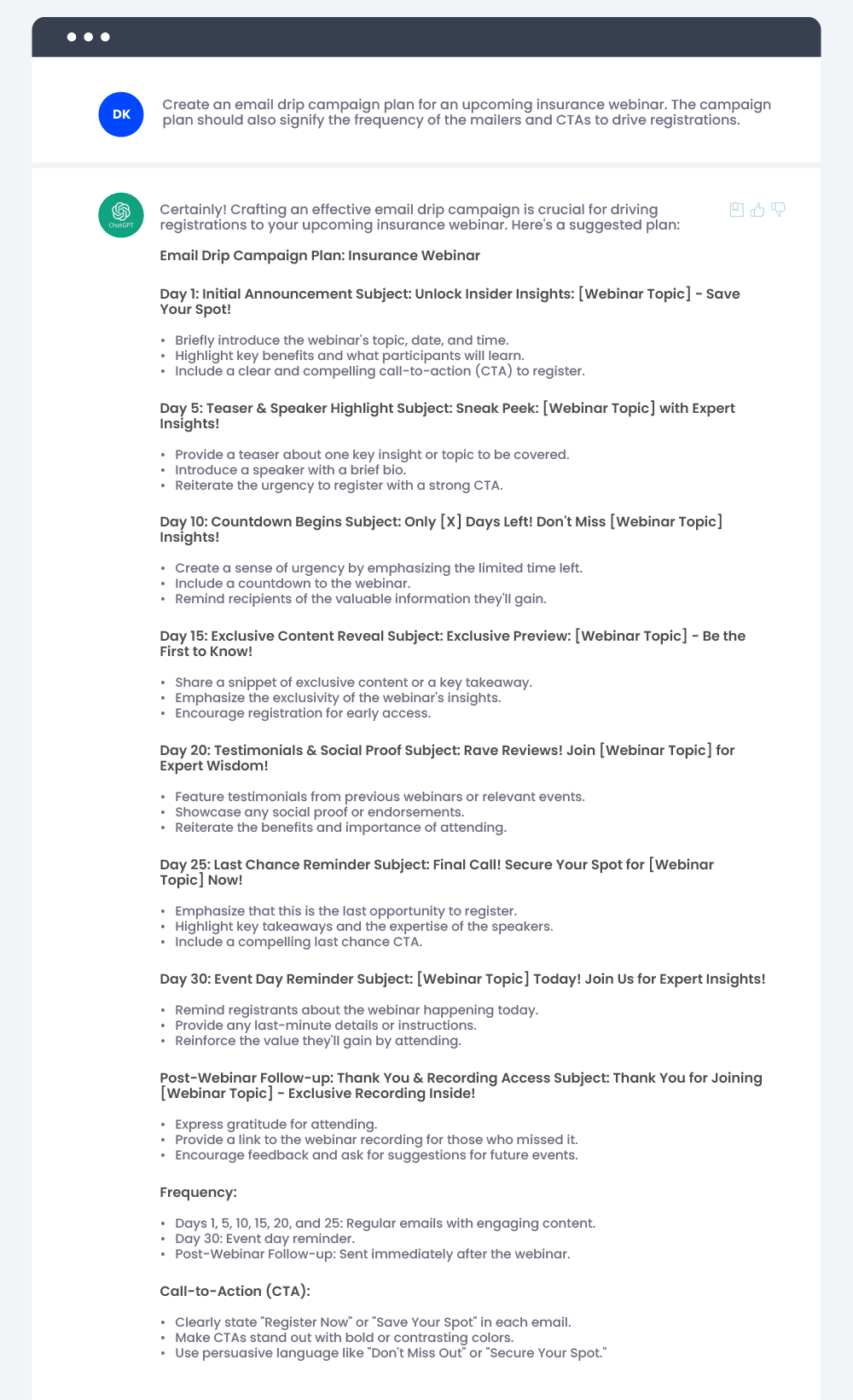

2. Outreach emails

Whether it’s coming up with compelling subject lines or creating contextual email campaigns, explore ChatGPT if you haven’t already. Check out these ChatGPT prompts that you can use for insurance marketing-

Share 5 subject line options about why having a health insurance policy is non-negotiable today.

Create an email drip campaign plan for an upcoming insurance webinar. The campaign plan should also signify the frequency of the mailers and CTAs to drive registrations.

3. Social media

Every social media channel calls for content that is of varied formats and tones. Which is why the strategy for each of these channels will differ accordingly. Here’s an example of a ChatGPT prompt for insurance agents to optimize LinkedIn.

My target demographic on LinkedIn includes personas like Insurance Distribution Officer, Insurance Underwriter, Certified Risk Manager, and other ranks in insurance companies. Prepare a monthly calendar with different posts such as polls/ testimonials/ short videos, etc.

4. Proofreading content

To save time and be sure of the copy you draft, leverage ChatGPT to run through your content. As an insurance agent you can use the following ChatGPT prompt to proofread your content:

Proofread the following content- [paste text that needs to be proofread]

ChatGPT Prompts to Up your Game as an Insurance Agent

In this section of the article, you can explore a few ways in which insurance agents can use ChatGPT for their own professional development.

1. Insurance exam preparation

ChatGPT can be a great tool to find out the kind of material to refer to for an insurance exam based on the region it’s being taken in. Here’s a simple prompt to get you started-

Help me with study tips and recommended resources to help me prepare for an insurance exam in [mention state].

2. Understanding industry concepts

The insurance industry is an ever evolving one. When in doubt about industry jargon or if you think a simple Google search isn’t going to cut it, head to ChatGPT!

It can help explain concepts with analogies and other examples.

Help me understand the concept of claims adjudication with analogies.

3. Common customer FAQs

Prepare for everyday customer interactions by understanding what their potential questions may be about the product you’re selling, and how they stand to benefit from it.

What are some common FAQs I should expect during customer interactions as a health insurance expert?

Other Insurance Operations that ChatGPT Can Help With

It’s no news that the insurance industry is rooted in dissecting data, predicting and mitigating risks while ensuring the best for policyholders.

ChatGPT can be integrated to an existing tech stack through APIs. Therefore, this allows it to analyze data and arrive at reliable decisions.

Here’s more of how it can help in critical operational processes:

1. Fraud detection

Close to 25% of claims come with a margin of deception. NLP tools like ChatGPT can help insurance agents make sense of reams of data. It can analyze and help draw patterns and inferences that can point toward anything that needs attention, like fraudulent behavior.

For instance, if there’s a claims request, the credibility of the same can be justified by checking the customer’s claims history to note if the grounds for the claims have been valid previously.

Here’s a sample prompt:

Help me analyze if the following mail thread reads suspicious or indicates fraudulent activity like phishing.

2. Risk assessments

The more accurate this is, the better it is for the insurer and customer. Risk assessments help customers get coverage at the right price while insurance agents can attend to customer inquiries and handle claims with better clarity. Risk assessments done by ChatGPT will only help make this process more dependable and accurate.

Take a look at the below prompt that can be used to analyze the involved risk for a customer when ChatGPT is integrated with a CRM:

I’d like to do a risk assessment of [customer’s name] for customizing their insurance coverage. Point out any unavoidable risks involved with this profile after studying details such as their financial portfolio, and health conditions.

3. KYC processes

This stage involves the detailed checking of financial data, transactional history, and any other personal information. ChatGPT can be resourceful in this context by automating the validation of customer profiles against authorization criteria and potential red flags as decided by the agent. This can save insurance agents a ton of time on KYC processes, especially when they deal with data in high volume.

Analyze profiles of customers onboarded since [add date] and flag any suspicious profiles that violate compliance measures with regard to their KYC details that have been recorded.

4. Ensuring Compliance

Compliance violations invite poor brand perception and financial loss. ChatGPT can help insurers keep a check on compliance by tracking deals and notifying cases that don’t meet compliance standards. This avoids any fines or potential penalties.

Analyze submitted invoices and flag any abnormal transactions that have taken place from [add date] to [add date].

5. Claims assistance and management

By automating the preliminary claims assessment, responding to client inquiries, and streamlining the paperwork procedure, ChatGPT can assist and optimize the claims process. Policyholders may find the process less frustrating and insurance companies may find it more efficient as a result.

I’m helping [customer name] to submit their claim. Based on their policy, create a list of documents that can help justify their claim for a smoother process.

Let’s Wind-Up!

In closing, it’s pretty evident that insurance agents have a lot of perks if they ever choose to make ChatGPT an ally. Insurance agents can streamline everyday activities, explore a chunk of activities that can be automated, personalize policy offerings, ensure 24×7 customer services with instant responses, and so much more!

So, in a time like today, ask yourself if you want to be an insurance agent who is an early adopter or a digital laggard?

Because there’s a sure shot of missing out on all the fun stuff if it’s the latter!

FAQs

ChatGPT is a powerful tool for insurance agents to automate processes such as KYC, underwriting, claims, automated reminders for policy renewals, customer engagement,marketing, sales and so much more. Besides their work, they can also use ChatGPT to learn new concepts, prepare for an insurance exam, and other such aspects.

ChatGPT for high ticket conversion sales involves generating content that is aligned to customer pain points, and how your business value is aligned to it. For instance, ChatGPT can help create compelling copy for a landing page with a powerful CTA or for a campaign you’re running for the HNIs you’re targeting with personalized offerings.

Insurance agents can use these best practices to create a prompt that fetches results that are close to what they’re expecting.

Be clear about the topic you need help with. Is it an email, a social media post, a cold calling script, etc.

Specify the target audience and their potential pain points.

Provide more information in the prompt on the tonality and style of the content you’re expecting.

Try assigning a role to ChatGPT, like a Distribution Officer, Underwriter, Marketing Executive, etc. This can lay the field to bring out content from their perspectives.

Lastly, make sure the prompt articulates a task and its purpose.