What is Bancassurance Model?

Bancassurance is the insurance distribution model where insurance carriers and banks join forces to sell insurance products to consumers.

The channel utilizes the respective strengths of insurance carriers and banks to not just distribute insurance policies in a whole new way, but to increase customer satisfaction and maximize their own profits and reduce costs.

eBook on Digital Sales and Operations in Insurance [Free Download]

The State of Insurance Industry

Currently, the insurance penetration in India stands at 3.7% of GDP, against the world average of 6.31% (Source: Business Today, 2019).

In comparison, some of the emerging economies in Asia such as such as Malaysia (4.77%), Thailand (5.42%) and China (4.77%) have a higher insurance penetration.

It’s clear that the opportunity is immense both globally and in India to get more people to buy insurance, both life, and non-life. India, especially being the 2nd most populous country in the world holds immense potential.

The Need for Bancassurance Model

The bancassurance distribution model for insurance grew to capitalize on this opportunity – to increase the distribution reach with the least possible resources (in terms of infrastructure, manpower and time). Banks with their vast reach in the financial services market were the perfect vehicle to aid the insurance carriers in this endeavor and thus rose the bancassurance channel.

In certain markets around the world, the growth rate for bancassurance is four times the growth of life insurance. (Source: Marketwatch, 2018). Now, with this opportunity, it’s obvious that the competition would be immense as well, and it is, with many insurers and banks launching new alliances all over the globe. So, innovations are needed in the Bancassurance model as well.

Innovations in Bancassurance Model

While mergers and acquisitions in the insurance and banking industry remain a classic move to gain an advantage, there are several new innovations that are helping some insurance carriers rise above the intense competition.

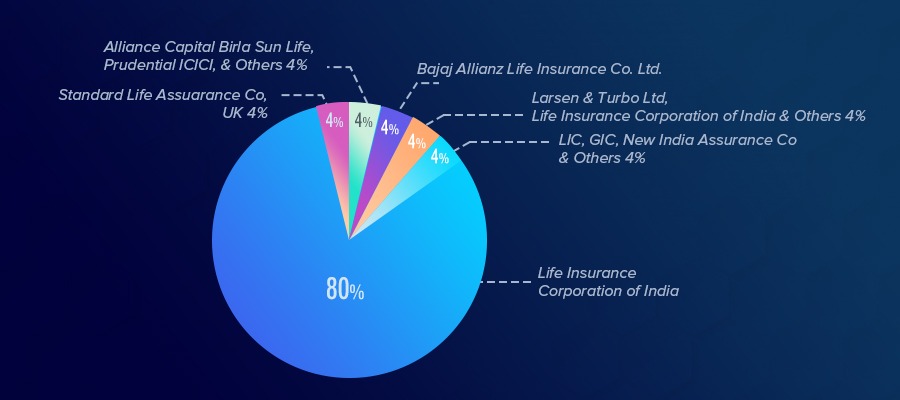

The graph below highlights the acquisition of shares of banks by insurance companies. (Source: Journal of Business & Financial Affairs)

Following are a few other technological advances in bancassurance (and in the insurance sector in general) that are being used by certain insurance carriers to increase their operational efficiencies.

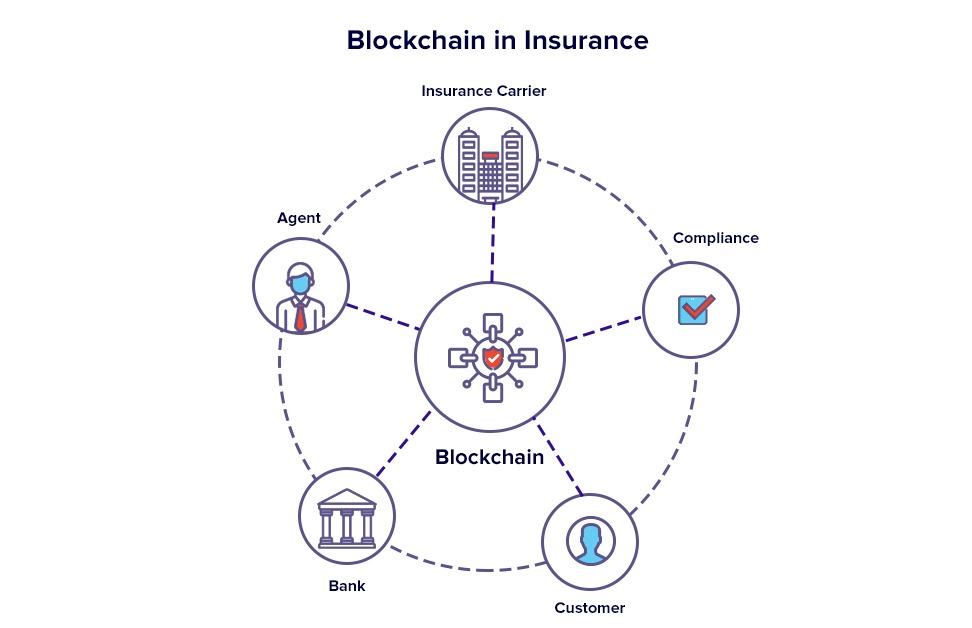

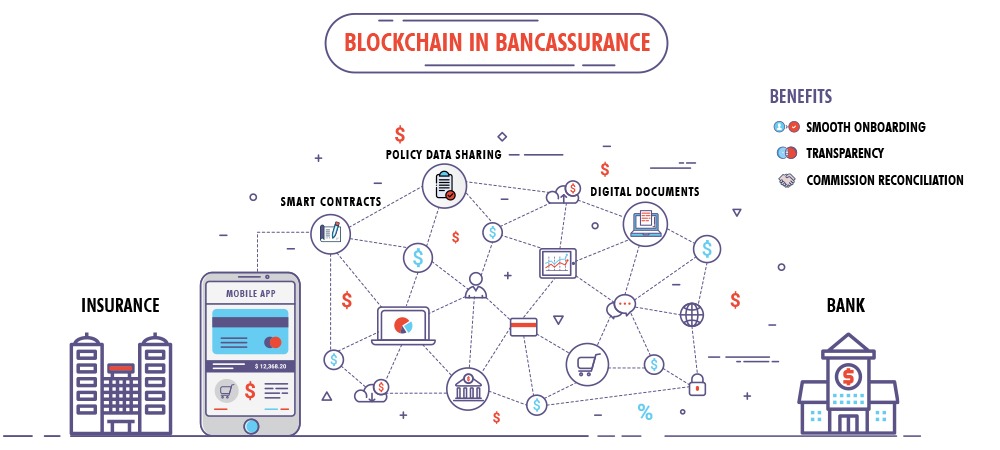

a) Blockchain

For speedy, transparent and secure authentication, underwriting and claims attribution.

AIA Hong Kong has led the way in this regard. They have launched a blockchain-enabled bancassurance platform allowing the life insurer and its bank distributors to share policy data and digital documents in real time, streamlining the onboarding process, improving transparency, and reconciling commissions automatically through smart contracts. (Source: Deloitte, 2019).

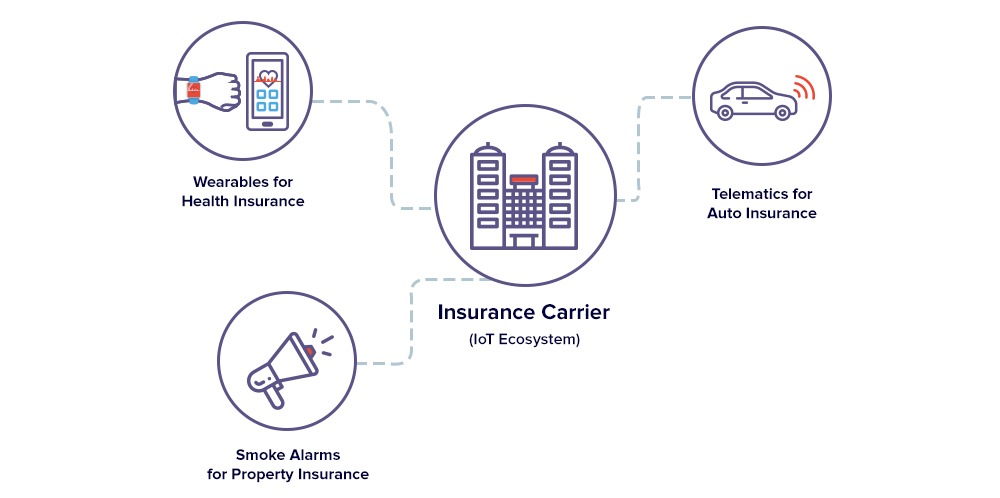

b) IoT

For underwriting and claim settlement using real-time data. Examples of the usage of IoT in insurance include wearables for health insurance, telematics for car insurance, connected smoke alarms for property insurance and many more.

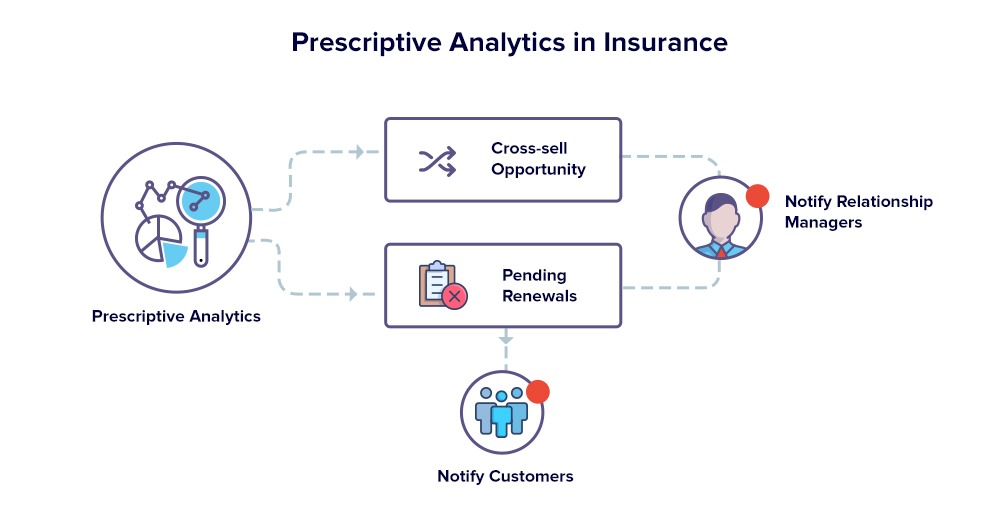

c) Data Analytics

Banks sit on mounds of data, including the demographic and financial details of clients, their transactional details, their complete portfolio, and credit repayment history and more. Bancassurance channels can utilize this data to predict customer needs and deliver customized products.

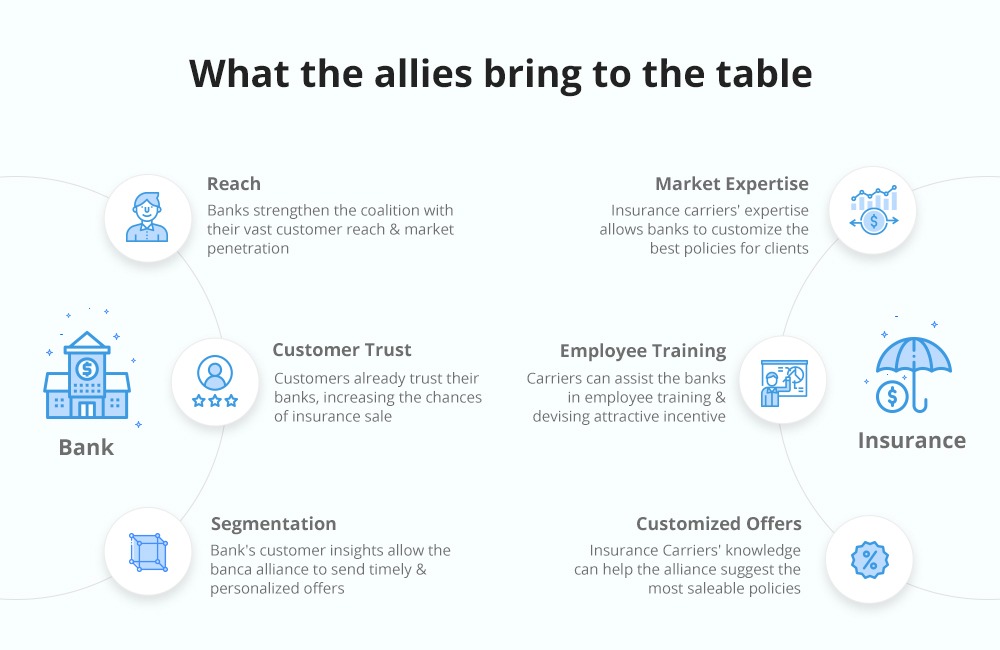

Tapping into the strengths of both the partners

Banks strengthen the coalition by acting as the insurance distributors with their vast reach, market penetration and established customer trust, while insurance carriers bring their vast, specialized knowledge of the insurance market to the table.

While banks benefit by enriching customer portfolio and making extra risk-free income over and above interest rates, carriers get access to a much wider audience than they could have reached solo.

How banks strengthen the bancassurance alliance

a) Reach

Banks already have a huge reach and market penetration because of their existing customer base. This serves as the key advantage that banks bring to the bancassurance coalition.

b) Customer Trust

Because of the reach and the long-standing relationship of customers with their banks, the chances of an insurance policy being sold via the bank’s influence is higher.

c) Customer Data and Segmentation

Banks have access to a huge amount of data on their customers, including their existing financial products, preferences and other demographic information. This data makes segmentation very easy for them, allowing the bancassurance alliance to market the insurance products in a highly personalized and relevant manner.

How insurers strengthen the bancassurance alliance

a) Market Expertise

Insurance carriers know the industry inside out and are well-versed in using all available data to make predictions and package the right insurance products for the customers.

b) Employee Training

One of the major challenges in accepting bancassurance alliance into the bank’s culture is the resistance of the employees. However, insurance carriers with their market expertise can step-in in not just training the bank employees on selling insurance but helping the banks devise an encouraging incentive structure.

c) Customized Offers

Insurance Carrier’s expertise, along with the bank’s access to customer segments, allows the alliance to package highly relevant insurance products and create customized offers for different segments of customers.

This was a brief gist of the bancassurance distribution model – why it came about, how it functions and the key innovations in the model. To really understand the advantages that bancassurance brings in insurance distribution, for customers, banks and the insurance carriers, check the advantages of the bancassurance model here.

Resources:

- https://www.marketwatch.com/press-release/bancassurance-global-industry-analysis-and-opportunities-challenges-and-forecast-to-2018-2023-2018-11-16