You know what they say about insurance companies and paperwork – you either live long enough to be able to buy an insurance policy, or you die, getting buried under its paperwork.

The insurance industry (including agencies) has been drenched in large amounts of documents for as long as one can imagine. They have been managing their business manually without any technological support. Product complexity, regulations, and extensive balance sheets have been keeping them away from digital transformation. There is additional pressure on agencies because they have to manage their book of business, agents, commissions, claims, and several insurance products.

Let us look at how an insurance agency management system can help streamline agency operations.

An insurance agency management system or AMS is a SaaS (Software as a Service) tool that can optimize the existing agency business processes and help run the operations effectively. It tracks details of the insurance policy, improves agent productivity, and provides instant access to client data. Not only this, but it also helps in managing claims for customers and handling commissions for the agents. It sets up automated workflows, making the agency operations fast and efficient.

More and more insurance agencies want an effective way of automating routine tasks and managing their book of business. They are also using tech-based software products to handle daily operations.

“Our agency principal, Jeff Arnold, has really done a top-notch job in making sure we have all the tools we need to sell and service our clients,” says Cheryl Forman of Rightsure Insurance Group – Tucson, Arizona, while talking to InsuranceJournal.

The agency management system allows storing a vast amount of data under a single umbrella. As a result, the agents do not have to use multiple applications to retrieve even a small amount of information. Instead, they get a simple-to-use customer-friendly product that streamlines all documents and client base without any technical support.

Mike Russ explains what is AMS or agency management software and why agencies need one in this video:

5 Reasons Why Life, Health, and P&C Insurance Agencies Need an AMS or Agency Management System

In a survey by Statista, 63.3 percent of young insurance agents say that the industry has been too slow to adopt new technology.

As an agency’s book of business grows, it becomes extremely difficult to manage agents, sales commissions, clients, and more importantly, make sense of client data. Agency management software can help increase agencies’ potential by utilizing the data and automating processes. It increases an agency’s ability to retain customers while acquiring new insurance business.

1. Build personalized journeys with customer journey builder

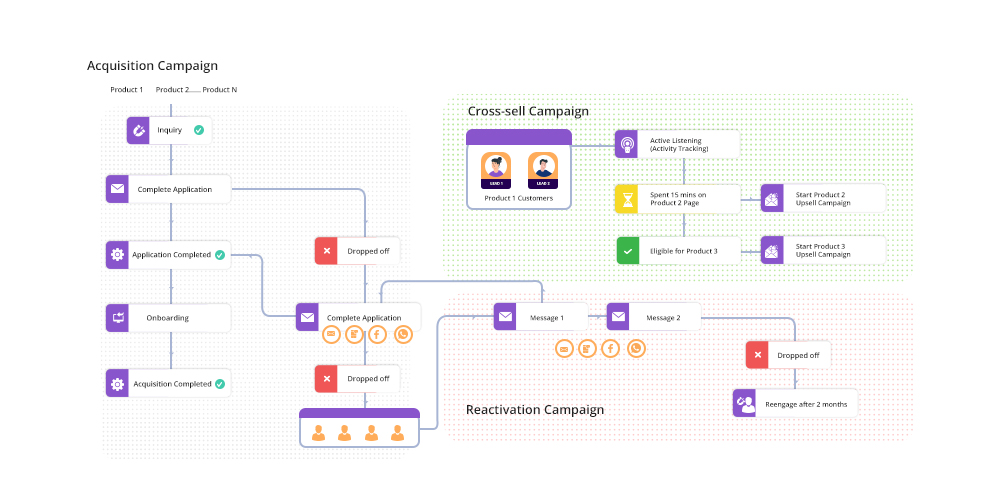

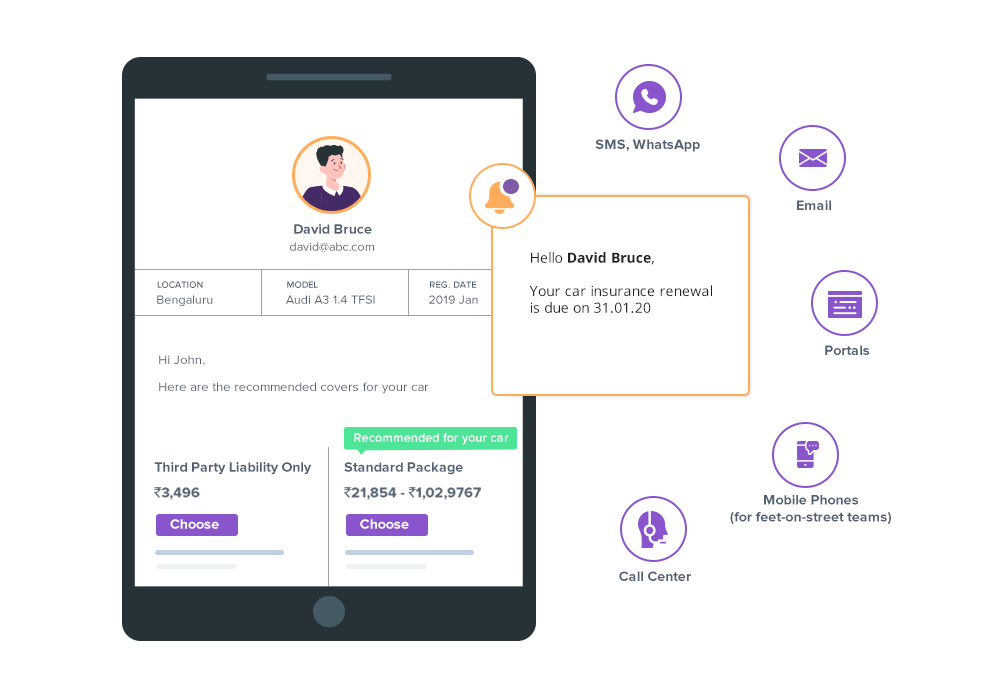

A customer journey tracks how customers interact with the organization and its resources or products. The insurance agency has to make sure that the customer journey is smooth and satisfying to reach their target audience. No matter what the campaign goal is – new customer acquisition, dormant lead reactivation, increasing upsell/cross-sell rates, increasing renewal ratios, app installs, app usage – a well-thought journey builder addresses all the issues.

A customer journey builder is one of the most important features of an agency management system. It allows insurance agents to sketch customer and prospect journeys visually, identify pain points and drop-off areas, and reduce lead leakage if any. A journey builder helps build an end-to-end customer journey across communication channels and enhances customer communications to increase goal completion rates.

The benefits of using a customer journey builder are:

- Builds optimal prospect and customer lifecycle journeys for all the insurance products

- Provides a multi-channel trackable journey for all customers

- Creates individual customer experiences for long-term brand loyalty

- Analyzes customer behavior and automates marketing campaigns accordingly.

2. Increase agent productivity using intelligent ales automation

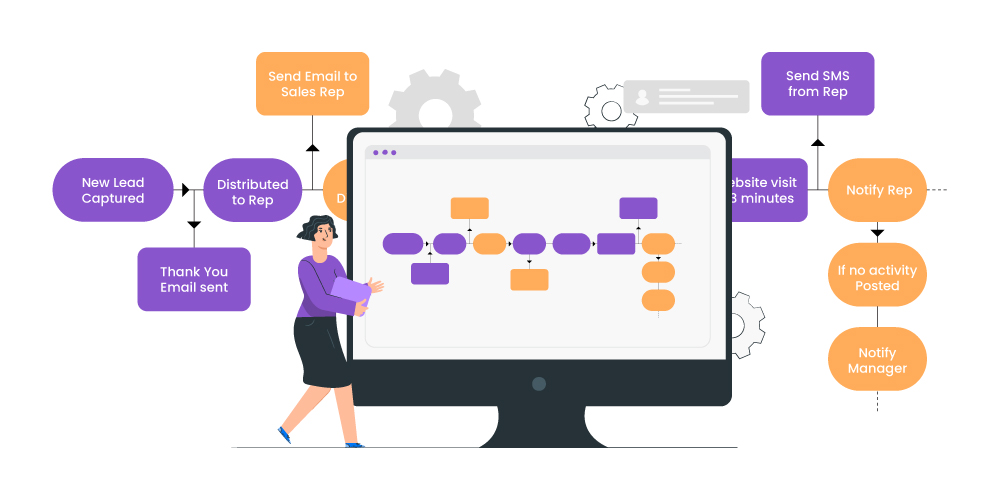

An insurance selling process consists of multiple repetitive tasks – from generating leads to storing and assigning them to the right agent. However, these tasks can be cumbersome and time-consuming.

Sales automation takes care of all of these routine time-consuming tasks and other additional tasks triggered by a certain event. By updating and utilizing existing data, it makes the sales process more efficient and impacts revenues directly. Similarly, the sales and marketing automation engines completely eliminate any chance of human error.directly. Similarly, the sales and marketing automation engines completely eliminate any chance of human error.

Automation can perform various tasks within an insurance agency such as:

- Assigning leads to agents automatically based on the insurance product, geography, source, and more

- Setting rules to alert agents as soon as something important happens automatically

- Assigning quality scores to leads based on lead activity

- Monitoring sales team using automatic reports based on performance and other attributes

3. Building a strong business process with accurate commission processing

Commission processing is a critical part of the insurance agency business process. Using spreadsheets or Excel for calculating sales incentives can lead to inaccurate results. Hence, it is essential to use an automated, data, and purpose-driven solution to increase agents’ morale and revenue potential. It helps the agents be up to date with their daily progress and promotes simple and error-free accounting practices.

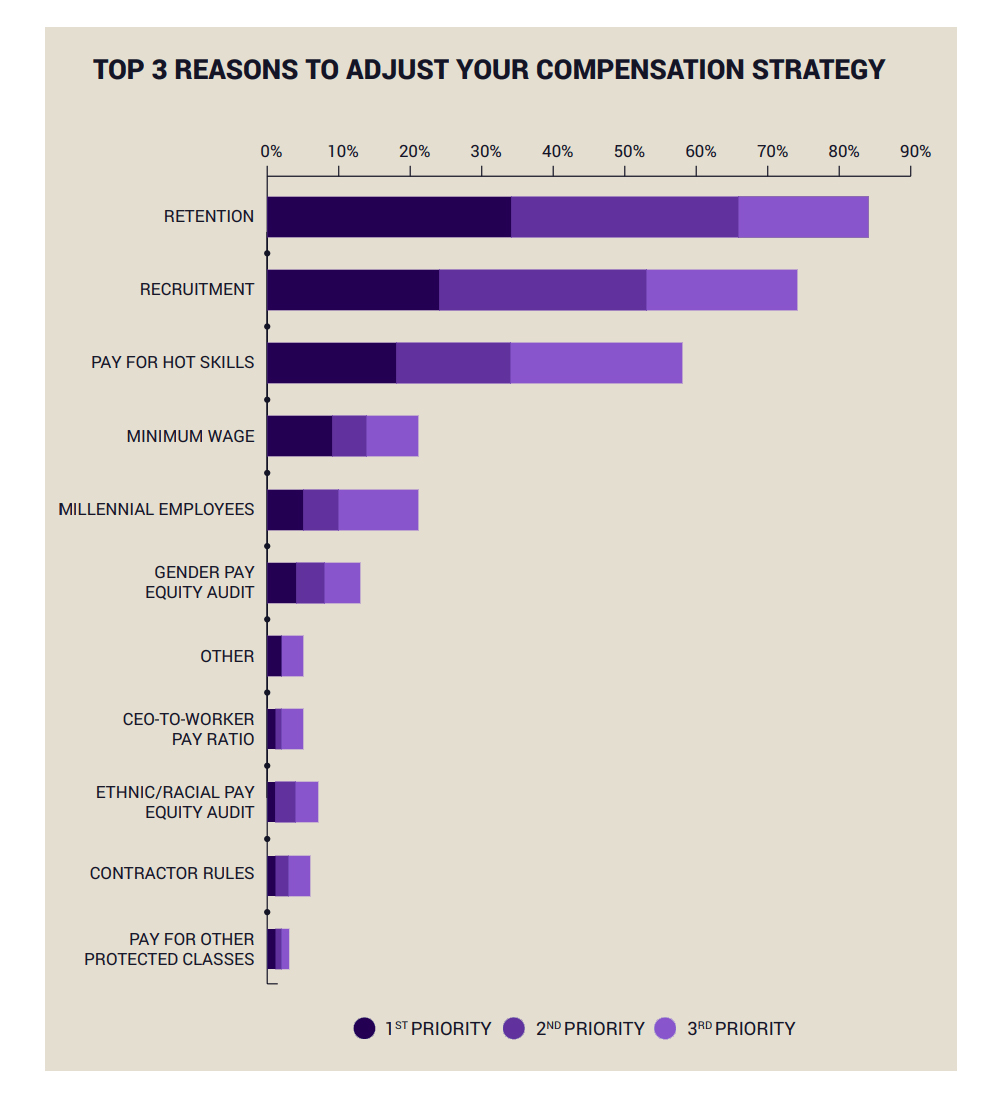

According to PayScale’s 2019 Compensation Best Practices Report, retention was identified as the number one reason for having a sound compensation strategy, followed by better hiring and paying for in-demand skills.

An automated commission processing can benefit an insurance agency in ways such as:

- Enables quota attainment and motivates agents to perform better

- Reduces time, effort, and overpayment costs

- Increases agent productivity and increases trust and morale within an organization

- Improves data integrity and streamlines the compensation administration process

4. Increase bottom-line sales with automated up-sell/cross-sell & renewal alerts

The concept of up-selling and cross-selling has been prevalent across industries for a long time now. From retail shops and restaurants to e-commerce and finance, every industry has been benefiting from this concept. But what if the up-sell and cross-sell alerts can be automated based on the customer’s purchase history? Sounds relieving, right?

Similarly, agencies might lose potential customers if agents forget to reach out to the customer at the time of renewal. It might result in a reduced customer retention rate and can affect the revenue potential. Hence, the sales reps must be reminded on time.

An agency management system can help by:

- Optimizing and automating up-sells and cross-sells by setting predetermined factors such as policy issue date, policy type, family details, etc. in the system

- Setting renewal task reminders for the agents to keep them up-to-date with their customers

- Automating marketing activities based on up-sell, cross-sell, or renewal

- Nurturing leads and onboarding customers based on automated alerts.

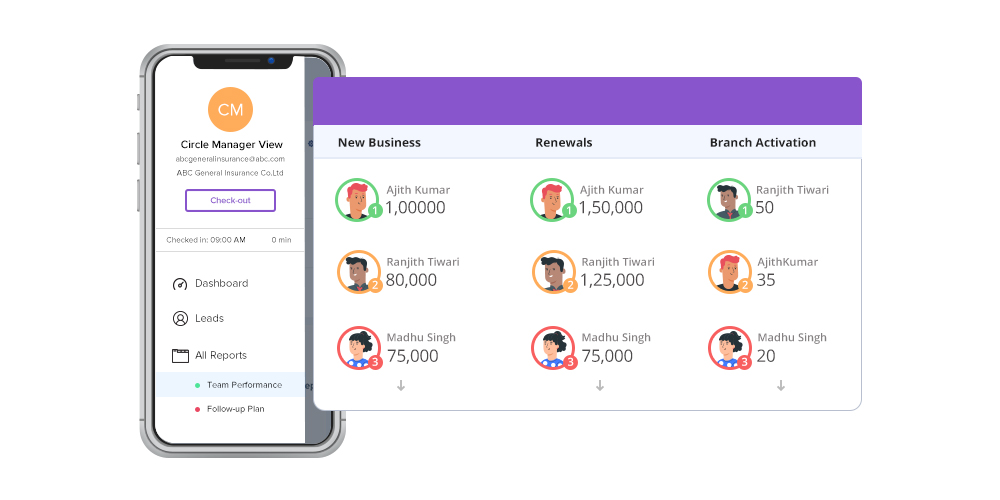

5. Manage all the leads with in-depth analytics & reporting:

Another process that is crucial but time-consuming for agencies is collecting data and analyzing reports. Measuring data such as lead generation, quarterly revenue, and sign-ups at the end of the sales cycle through effective lead management is a regular business practice. However, not many leaders track and analyze data in real time.he end of the sales cycle is a regular business practice. However, not many leaders track and analyze data in real-time.

Creating reports in real-time helps in predicting cash flows, removing bottlenecks, and enhancing sales productivity. Maintaining a sales funnel helps track the number of leads at each stage, forecast pipelines, and reach revenue goals on time. The automated reports help in:

- Keeping a tab on all on-field agents’ work hours, monthly sales, and commissions at all times.

- Recognizing any discrepancies, keeping track of company efficiency level, and reducing errors.

- Improving accuracy by providing real-time insights into total policies sold, renewals done, claims settled, and more.

How Insurance CRM Helps in Agency Management

As per the definition, agency management software is a digital tool that helps life, health, and property & casualty insurance agencies automate their day-to-day tasks and make operations more efficient. The new-age insurance CRM software is evolved as per the needs of the insurance agencies, and hence it is perfect for insurance agency management.

Here are the key features of Insurance CRM that make agency management more efficient:

- Lead and customer relationship management: It is a core functionality of CRM software, and no other software can handle client relationships better than CRM.

- Cloud-based AMS: Cloud hosting allows your agents to work smoothly even while working from home. Plus, cloud-based insurance CRM for agencies offers top-notch data security.

- Contact management: Insurance CRM ensures that the agency’s book of business is organized in a clean, efficient, and easy-to-understand manner.

- Workflow automation: By automating routine tasks, agencies can help their agents work smarter and achieve more in less time.

- Real-time analytics: With CRM, agencies can keep a pulse on business and address situations before they become problems.

- Automated reports: Managers and agents need not spend hours fetching data and building reports. The system automatically generates individual/team performance reports, reports on policies sold, etc.

- Marketing: Insurance CRM comes with an in-built drip marketing feature. It allows your sales agents to set up automated emails for nurturing leads, sending them offers, informing them of new products, and more. Automated email marketing saves a lot of their time and reduces the chances of missed communications.

- Opportunity management: The smart way to do business is to identify up-selling and cross-selling opportunities with existing customers. Insurance CRM helps you identify such opportunities by tracking the customer activities on your website, ads, social media, and partner websites.

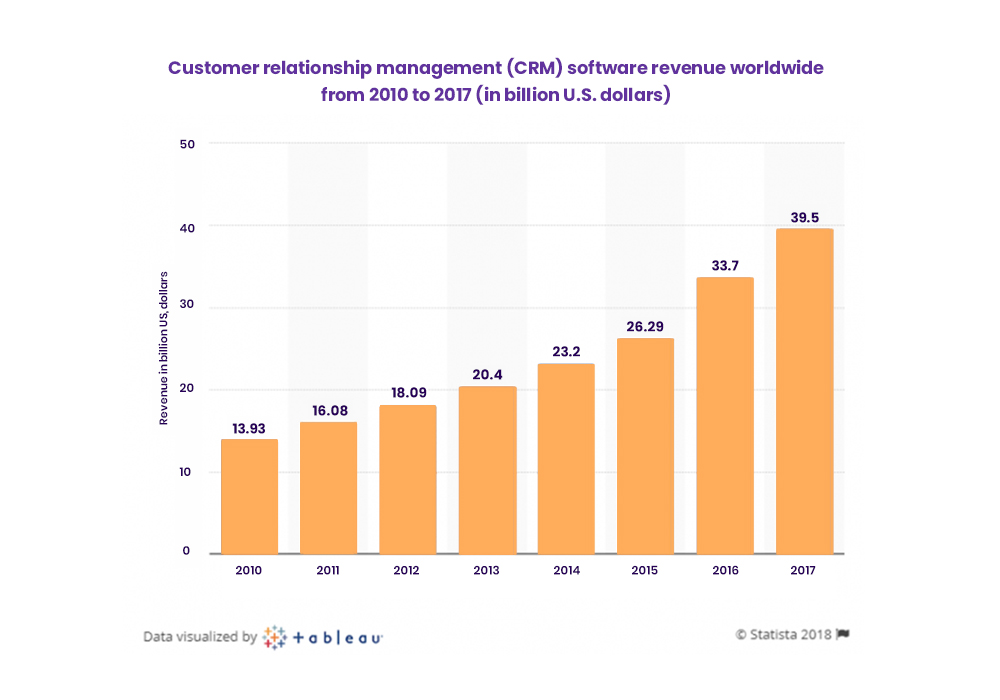

CRM software market:

As per Gartner, the year 2017 ended with worldwide CRM (customer relationship management) systems revenue amounting to $39.5 billion, which made CRM the largest software market, overtaking database management systems. In 2018, the segment continued to lead as the fastest-growing software.

Research by Statista shows an impressive increase in global CRM revenue from 2010 to 2017.

The growing adoption of CRM software solutions is indicative of how it empowers businesses to streamline their operations.

The next section delves deeper into the benefits of using CRM for insurance agency management.

Benefits of Insurance Agency Management System

Because of the pandemic, Northwestern Mutual, the United Nation’s largest seller of life insurance, saw a 15% jump in the number of life insurance policies it sold between April and September in 2020, versus the same time in 2019, according to a spokeswoman. Similarly, many insurers have reported an increase in their policy sales.

There is no denying the fact that agencies are the most popular insurance distribution channels. With the increased business coming in every day, insurance agencies find it difficult to manage their processes manually. And to mitigate the risks associated with handling a tremendous amount of work, most agencies are now looking at using an insurance agency management system.

Insurance agency management systems help organize policy, agent, and client management within an agency. These comprehensive software solutions not only deal with all back-office operations but also manage the customer journey.

The best insurance agency management software ensures the following benefits:

a) Operations management:

The insurance agency management software streamlines various operations within an organization without human intervention. It speeds up processes like policy issuance and claims management. It not only makes the exercise faster but also accurate.

“The most helpful thing in growing my book of business was the decision to be an expert in understanding the policies we help clients purchase,” says Brett Cutchin, Lipscomb & Pitts Insurance LLC – Memphis, Tennessee (source).

Automation helps in improving agency management by letting the machine do redundant, time-consuming tasks.

b) Improves sales:

The AMS improves sales by identifying cross-sell opportunities and helps grow the agencies’ books of business.

It also helps in policy management by mapping clients, agents, insurers, and everything involved in between.

Efficient sales are important for an agency’s growth, and with the help of agency software, insurance agencies can sell more policies and manage agents efficiently.

c) Marketing automation:

A non-obvious perk of the software is reducing the communication gap between the agent and his customer. With the email marketing feature of AMS, agencies can keep in touch with the leads, prospects, and clients and send the right kind of communication at the right time. Many evolved Agency Management Systems also support omnichannel communication. It further increases the capabilities of agents to communicate with prospects via their preferred channels.

Automated communication based on factors like renewal dates, cross-sell, and upsell signals helps avail more sales opportunities.

d) On-field sales:

On-field sales might have reduced due to the impact of COVID, but it is still prevalent in the insurance agency business. The agency management tool makes the field sales team more productive through online document collection and easy customer onboarding. In addition, agencies can calculate commissions or incentives for agents on the go.

e) Analytics:

A built-in analytics in the agency management system allows the agencies to leverage the data and forecast sales. Data-driven insights also help agencies take measures to improve the business. It helps visualize key customer metrics using Charts, KPIs, and more so that vital information is never missed.

It also keeps a tab on every individual agent and gathers data such as policies issued, renewals done, and claims settled.

Conclusion

In a nutshell, a good insurance agency management system is one of the most fundamental building blocks for a successful agency model. It not only takes care of customer relations and manages the book of business but also automates otherwise time-consuming and cumbersome tasks. An effective insurance agency management system saves money, retains customers, and adds to the company’s revenue. Hence, investing in the best insurance agency management system based on your requirements is very important.

“LeadSquared helps us manage our partnerships with carriers & agents, and our internal processes across the sales cycle. It is a key part of our digital ecosystem that will enable us to build great customer experiences and deliver value back to the business,” says Andrew Day, Global Chief Data Officer, Pepper Financial

“LeadSquared helps us manage our partnerships with carriers & agents, and our internal processes across the sales cycle. It is a key part of our digital ecosystem that will enable us to build great customer experiences and deliver value back to the business,” says Andrew Day, Global Chief Data Officer, Pepper Financial

Are you thinking about implementing an Insurance Agency Management System? Look no further! Check out LeadSquared to get efficient outcomes and enhance ROI.

FAQs

An insurance agency management system or AMS is a SaaS (Software as a Service) tool that can optimize the existing agency business process and run operations effectively. It tracks details of the insurance policy, improves agent productivity, and provides instant access to client data.

An agency management software can be used across all operations of an insurance agency. It can: 1. Support omnichannel communication with prospects and clients 2. Speed up policy issuance 3. Identify cross-sell and up-sell opportunities, helping in increased retention and customer wallet share 4. Provide in-depth analysis and reports across different agency metrics.

There are various benefits of using an agency management system. It helps in increasing agencies’ potential by automating different processes – like online quotes process, lead assignment, client communication automation, agent sales workflows, cross-sell opportunity identification, and reporting among others. It also increases an agency’s ability to retain customers while acquiring new business.

Read further: