There are many kinds of mortgages in India but finding the right lead that requires a mortgage can be the most difficult part of the entire mortgage process. Mortgage leads are hard to come by mainly because not everyone will want to buy a property. Identifying who does and whether they are looking to get a loan is a challenge.

The economic outlook across the country is improving year on year, and so the number of people looking for mortgages is increasing. The question is, where can you find them?

Where to find the best mortgage leads

Now, there are various ways in which you can generate leads for your business. Let’s look at them one by one.

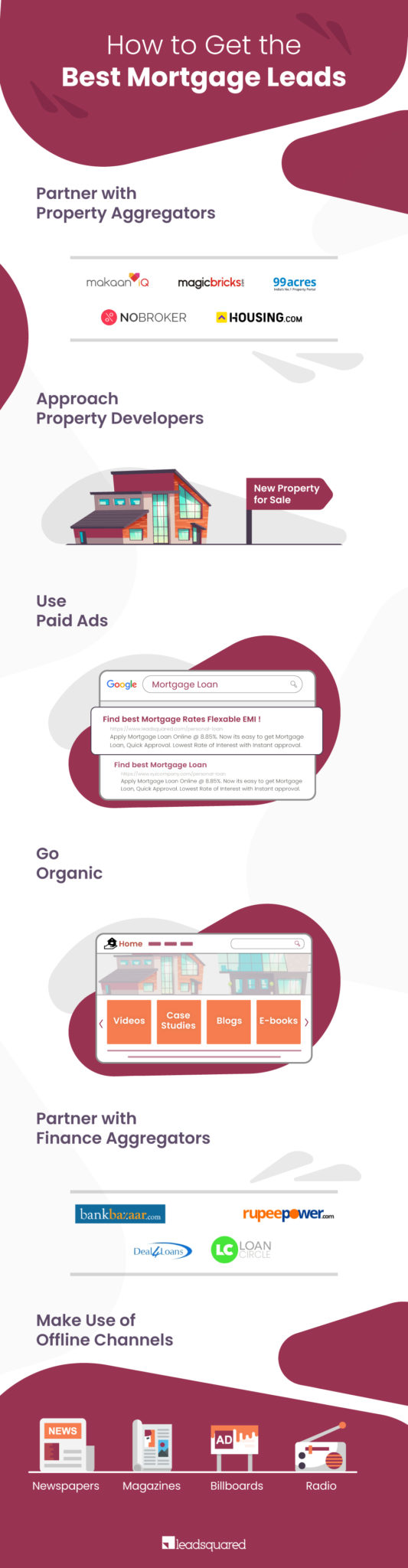

Partner with property aggregators

The best advice when selling any product is to go where the people are. Working backward from the destination, it becomes quite clear where the people are going to be.

The ultimate destination is for you to sell a mortgage product to a lead. Why do they need a mortgage? Because they are investing in real estate.

Where do people go to find real estate for sale? They visit real estate websites like magicbricks.com, makaan.com, housing.com, and 99acres.com. If you know you have an audience on these websites, the simplest tactic, to begin with, is to advertise on these very same sites.

Even if the sites don’t accept advertising from external companies, you may find that you are able to form a partnership with them – perhaps you can offer a special deal to the site visitors and become the “preferred” option for providing mortgages.

This works in real-world scenarios too, as well as just with websites. A physical real estate agent office may be inclined to work with you, as there will be benefits for them too – they could potentially sell more real estate if getting a mortgage was made simpler for their clients.

But it isn’t just agents that could benefit from your products.

Get leads from property developers

At any given time, there are numerous building projects ongoing around the country. The developers aren’t in this business for fun – they’re in it to sell their finished projects. As most people will be unable to purchase a new building outright, the need for a mortgage is apparent, and that’s where you step in.

In a similar way to working with real estate agents, you may find you are able to advertise on the website that belongs to the developers or alternatively become their preferred solution for providing mortgages to people wishing to purchase their creations.

With the right deal in place, you may not even be providing mortgages for these developments. If the developer is happy to hand out brochures and leaflets detailing your services in an effort to sell their new development, the leads may choose to use you to mortgage a piece of real estate that they have found elsewhere.

Make use of search engines

As with many other products and services, establishing your own web presence can bring leads directly to you.

Use Google (or even other search engines) to your advantage by putting together a PPC campaign. You can choose relevant keywords like “mortgages in [location]” and have your advert display every time someone searches for that phrase.

While Google may be the most used search engine, the second most used is YouTube. Millions of people search every day for thousands of different terms and keywords, so never underestimate the power of video marketing.

Creating and connecting people to mortgages

You can also build a website that details some of the products you have to sell. Use content marketing with articles about the mortgage process, the best deals, interest rates, and so on, to help people find your site via search engines.

You can even strike a deal with real estate agents or property search websites to advertise them on your site in exchange for them advertising you on their site.

Another option to explore is the use of social media including sites like Facebook and Twitter. This allows a two-way interaction with potential leads and can facilitate the building of trust, an important factor where finance is concerned. Posting the latest mortgage news and answering questions related to buying real estate can boost your profile and brings leads flocking to you – but make sure your branding is consistent across all platforms, with the same logo, color choices, and professionalism.

Find the people looking for loans and mortgages

Not everyone will use real estate agents (or their websites) but they may still have a need for a mortgage. These people will head directly to their bank or websites like Deal4Loans, RupeePower, and LoanCircle.

Advertising on these sites is a possibility, but the true purpose of these sites is to provide a comparison of different mortgages and loans to allow the site users to find the best deal possible.

By partnering with these sites, your mortgage products can appear in their listings, and if you offer a great deal then customers will be directed straight to you. Of course, the sites want to make a profit, and so part of the deal of becoming a partner may involve a fee or a commission for every referral you receive.

It can certainly be worthwhile as the number of people who use sites of this nature is high.

Finding mortgage leads offline

As previously mentioned, partnering with real-world business such as real estate agents and developers can help you to find leads, but a further option is to advertise in other real-world locations.

Billboards, newspapers, magazines, and even local stores will allow you to advertise to a range of different people. While printed media may have one sector of society, billboards will be noticed by many people passing by.

Even small stores will allow you to place a small advert in their window – why not give it a try and see if you catch the eye of a passer-by?

People will continue to live their day-to-day life even when they are looking for a mortgage, so getting your services in front of them as often as possible will only help you to discover more leads over time.

Looking to automate your lead capture so you don’t miss out on your mortgage leads? Then check out LeadSquared and book a demo now.