When a home buyer decides to purchase a new property, he doesn’t take this decision easily. The journey to buy a home is full of deliberations, indecisions, and a ton of research. When a home buyer needs a mortgage loan to finance his purchase, the process becomes even more lengthy.

Now, how do mortgage lenders fit into the picture?

The mortgage industry in the US is a whopping $11.05 trillion and projects selling 6.24 million homes in 2020. With the pandemic putting a damper on the mortgage industry, it has become even more important for lenders to quickly identify leads with high buying intent, nurture them, and disburse mortgages. And to do this, digital transformation using a good mortgage software has become the need of the hour.

Why Invest in a Mortgage Software?

Traditionally, mortgage lenders managed borrowers and disbursed loans using old school methods like paper filing, telephone operators (who lacked context, half of the time), and blind follow-ups. The unprecedented global pandemic has changed things drastically, probably for ever. The only way that mortgage businesses can sustain or keep up with this new normal is to embrace technology that can help ride out this wave.

A good mortgage software helps you to:

- Increase mortgage lead volume

- Reduce loan origination costs

- Support omnichannel lending

- Shorten loan processing time

- Automate loan pipeline management

In addition to this, a mortgage CRM solution should be easy to use and blend well with your existing process. This way, you can save time, which you can utilize to train your team. Moreover, your team would not be reluctant to use the software if it is easy to use and serves the purpose.

The following are the key benefits of mortgage software.

Mortgage Software Benefits

Automating Borrower Management

A mortgage lender’s journey is long and tiresome. Borrowers stay with the lender until the final mortgage settlement or foreclosing. In either case, the lender needs to keep tight control over the borrower pipeline. And the only way he can do this, without spending hours poring over a million papers, is with the help of a mortgage CRM.

Now let’s take a look at how a mortgage CRM helps you to manage your borrower’s lifecycle.

1. Loan Inquiry Capture

To build a borrower pipeline, you need to have an inflow of high-intent buyers who are looking for mortgages. With targeted marketing and by identifying your best lead sources, you can ensure that your mortgage lead generation efforts bear fruit. Here are some tried and tested ways with which you can capture leads.

- Partner with real estate agents

- Advertise on property listing sites

- Embrace paid marketing

- Attend real estate events

A good mortgage CRM software can help you collate all your borrower leads from various places and organize them within one place, so you can easily prioritize, reject, and follow-up on your prospective borrowers.

Also read: New exclusive ideas for mortgage lead generation

2. Digital Application Portal

When your marketing works well, your leads naturally land on your website. And, if you have a loan application form on your website, they must fill it out to become a borrower.

Wait, there is more to the benefits of mortgage software apart from tracking website visitors.

Once the prospect starts filling out the application form, you need to track their progress right from the point of application to loan disbursal.

You can also follow up on the status of their application. For example, if the borrower has filled out only half the form, you can then route the lead to your call-center team or agents, who can then follow-up with them, and push them to complete their application.

But, if they have completed their application, you can do credit and data checks before sending the application to your underwriting team.

Every step of the borrower’s lifecycle, including application status, credit checks, document collection, e-sign disclosures, and the loan application status, should be trackable from your mortgage CRM software.

3. Borrower profiling

Before processing the loan, or even before sending the application to an underwriter, mortgage lenders must verify the identity of the borrower. There was a total of 135,341 cases of identity theft reported by creditor and third-party debt collectors in the US in 2019.

To mitigate the risk of falling prey to such fraudsters yourselves, you must create an accurate borrower profile that is trackable. You must update the borrower’s profile information until the final settlement. Checking on their employment status, social security numbers, or have a reference who can back them up can help you rest assured that the borrower is who they say they are.

Not just that, you might be getting borrower details from several sources. It is necessary to collate all of this into one consolidated collection CRM, where you can access different borrower profiles with a single click at any point in time.

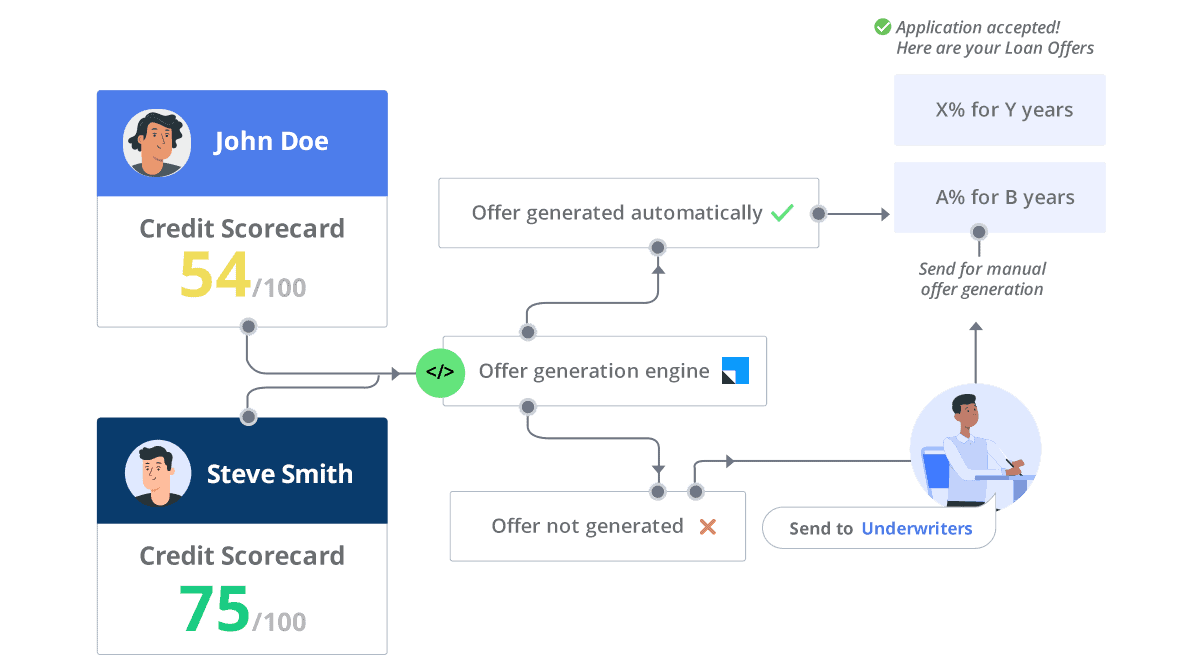

Risk assessment and mortgage underwriting

A mortgage loan is a very high-risk product. The threat of foreclosure or the borrower absconding to escape repayment is real. As of 2019, the mortgage delinquency rate in the US is 4.4%. Now, this is why mortgage lenders need to ensure that each lead is trustworthy and that their credit scores are up to the mark and that they have no history of deferred payments.

Here are some of the main factors that might pose a risk of recovering your mortgage loan:

- Rising interest rates

- Income shocks

- House price volatility

- Individual risks

Here, underwriters come into the picture. They calculate the risk by checking the applicant’s income status, credit history, bank account statements, residential information, W2 or I-9 forms, and other collateral. Most underwriters ensure that their underwriting processes follow the guidelines set by Fannie Mae and Freddie Mac, using automated underwriting processes. Finally, the underwriters decide the loan amount, the rate of interest, and repayment duration based on the borrower’s profile information.

Mortgage CRM integrated with LOS (Loan Origination System) can give an end-to-end solution to your mortgage lending process.

Loan lifecycle management

After loan disbursal, you’ll need to ensure timely repayment as well. Your mortgage CRM can help you track when the mortgage is due and how much of the principal is remaining. Integrate it with your loan origination system to get access to the borrower’s amortization schedule. You can then automatically schedule reminders to the borrower on the date their payment is due.

In the case of delinquency, you can trigger notifications that alert you to take action. All of this ensures that you don’t lose out on money and help you close the loan on time or foreclose if needed.

Conclusion

The US mortgage industry is seeing a small decline because of the COVID-19 crisis. Businesses are scrambling to ensure that they put in recovery management practices into place. But, people are still buying homes, and it is essential for mortgage lenders to identify opportunities and disburse loans quickly.

A mortgage software can be your best friend that helps you ride this wave and come out of the other side unscathed (well, mostly). It can help you embrace the digital transformation when you need it the most.

Here are some benefits of adopting a digital mortgage CRM software:

- Easy borrower profiling: borrowers can quickly complete their application, submit their documents, and schedule appointments for physical verification.

- Access to historical borrower information: in the case of a payment default or any other risk, a lender can quickly access all the information he needs on the borrower. It can include loan origination date, outstanding principal, any down payments made, and their annual percentage rate.

- Instant call center routing: when leads do not complete their loan application, or when a borrower has defaulted their payments, you can easily route these to your call center so that they can take quick remedial actions.

- Referral management: helps you get your borrowers to bring in referrals through co-marketing efforts. Give lenders better visibility into which borrower is bringing in more new applicants. It can help you make better marketing decisions.

- Productive field-force: helps you equip your field agents with a mobile CRM application. It will help them collect, verify, and upload documents on the go for faster underwriting.

If you are on the lookout for a solution that can lead your mortgage lending business into the new decade, you must try LeadSquared’s Mortgage CRM!

Mortgage Software FAQs

1. What is mortgage CRM?

A mortgage CRM is a tool that lenders use to manage their mortgage loan lifecycle right from loan disbursement to closure. It helps in digitizing the manual lending process and mitigate any potential risks in the process. Details.

2. What is a loan origination process?

Loan origination is the process where a borrower requests for a loan. The lender, in turn, verifies the applicant’s background, calculates risks, and disburses the loan to the borrower. In the case of mortgages, this is called the mortgage origination process.

3. What is a loan management system?

A loan management system is a digitally powered and secure platform which connects potential borrowers with the high quality and credible lenders so that they can get convenient access to credit.