India is among the fastest-growing Fintech markets in the world.

There are 6,636 FinTech companies in India. The market size for the Indian FinTech sector is expected to reach $150 billion by 2025.

In terms of digital payments by volume (CAGR 50%) and value, India’s payment landscape has become the most advanced in the last ten years (CAGR 6%). At a CAGR of 20%, the value of Fintech transactions is expected to increase from US$ 66 billion in 2019 to US$ 138 billion in 2023.

Let’s see how these leading Indian fintech companies are transforming finance.

Top 10 Fintech companies in India

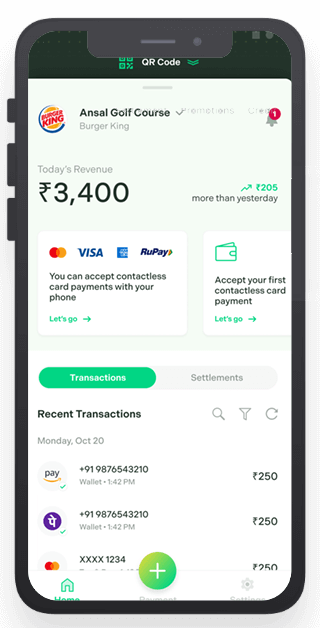

1. Paytm

Website: https://paytm.com/

Address: Skymark One, Shop No.1, Ground Floor, Tower-D, Plot No. H-10B, Sector 98, Noida, UP, India. PIN: 201301

Employees: 10,487

Funding Raised: $5B (raised $300M in 2016)

Investors: Sameer Brij Verma, Ravi Adusumalli, MediaTek, Alibaba

About Paytm:

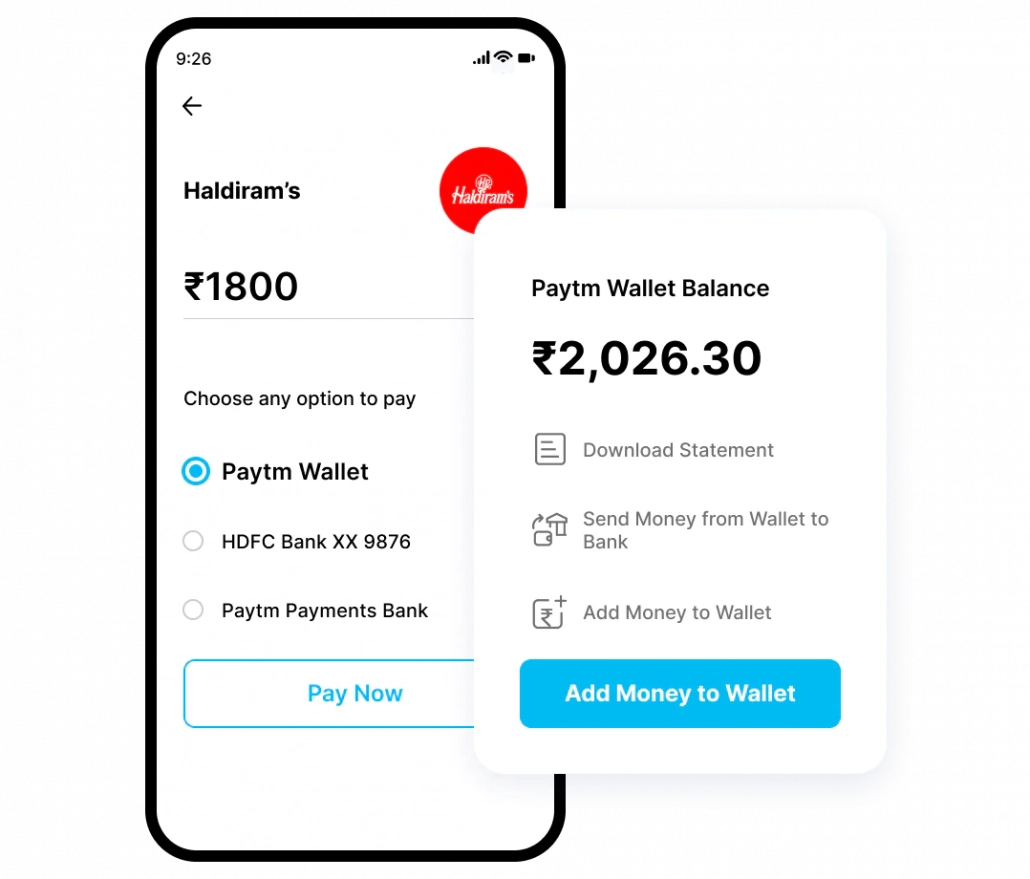

Paytm (short for “pay through mobile”) is one of the first and the most popular Indian mobile payments and financial services companies. It was founded in 2000 by Vijay Shekhar Sharma, the company’s current MD and CEO.

Paytm provides consumers and merchants with payment, banking, lending, and insurance services. With the Paytm QR Code, the company offers online transactions such as mobile recharges, utility bill payments, travel, movie, and event bookings, as well as in-store payments at grocery stores, restaurants, parking, tolls, pharmacies, and educational institutions. It also facilitates small business commerce and provides loan disbursement services.

Its parent company, One97 Communications Limited (OCL), was listed on Indian stock exchanges on November 18, 2021, following the largest initial public offering in India at the time.

USP: Paytm introduced digital payments in India through their e-wallets. Later, Paytm expanded to the Universal Payments Interface (UPI) functionality to process payments but still maintains its own payment transfer in parallel.

Customer testimonial:

“Works flawlessly most of the time. The user interface has come a long way from the initial days and it’s easy enough to navigate the app although it could be made simpler (please?). I use it almost everywhere for payments. Also, the privilege of sending credit from wallet to banks is insane. No other e-wallet company offers such an option.”

Priyanshu Raj (via: Google Play)

2. Lendingkart

Website: https://www.lendingkart.com

Address: 6th Floor, B Block, The First, The First Avenue Road, Behind Keshavbaug Party Plot, Vastrapur, Ahmedabad, Gujarat, India. PIN: 380 015

Employees: 930

Funding Raised: $215.4 m ($15 m raised a year ago)

Investors: Alteria Capital, Anicut Capital, Ashvin Chadha, Bertelsmann India Investments, Darrin Capital Management, FMO, Fullerton Financial Holdings, Fullerton Financials, India Quotient, Mayfield Capital, Mayfield Fund, Saama Capital, Shailesh Mehta, Sistema Asia Fund, State Bank of India, Yes Bank

About Lendingkart:

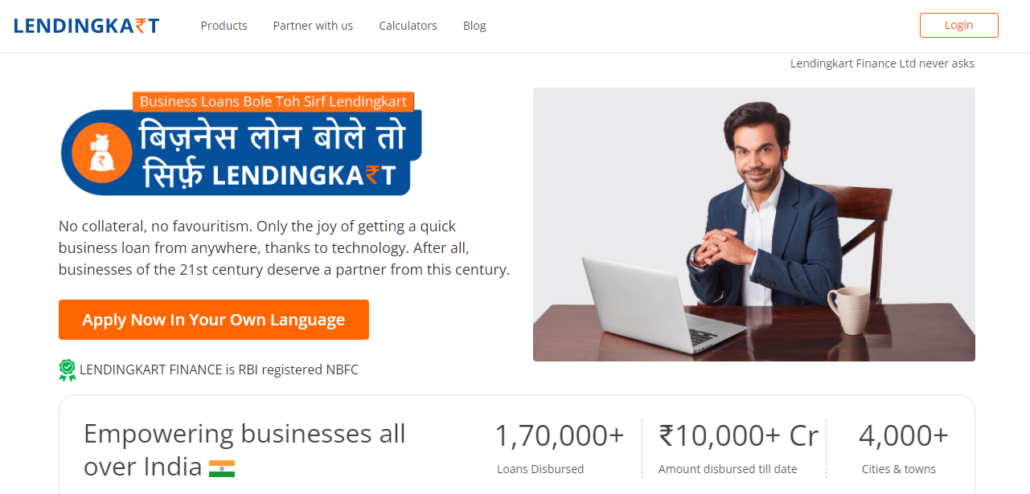

Lendingkart was founded in 2014 by ex-banker Harshvardhan Lunia and ex-ISRO scientist Mukul Sachan as a digital lending platform for SMEs.

The company uses big data analytics tools and machine learning algorithms to assess customer creditworthiness, identify risks, detect fraud, and disburse loans within 72 hours. Lendingkart’s in-house data science and data engineering team creates data models for the primary underwriting process.

The entire underwriting and loan approval process is based on ML training models. Lendingkart’s proprietary algorithms assess the applicant’s creditworthiness using over 7000 variables, collected from multiple sources and stored across databases, docs, apps, etc.

USP: Lendingkart was one of the first lending platforms that automated the underwriting with artificial intelligence and machine learning, allowing those without credit scores to qualify for loans.

3. MoneyTap

Website: https://www.moneytap.com

Address: Sigma Soft Tech Park, No.7, Whitefield Road, Bangalore, Karnataka, India. PIN: 560066

Employees: 151

Funding Raised: $82.4 m ($70.05 m raised 3 years ago)

Investors: Aquiline Technology Growth, MegaDelta, New Enterprise Associates, Prime Venture Partners, RTP Global, Sequoia Capital, Sequoia India

About MoneyTap:

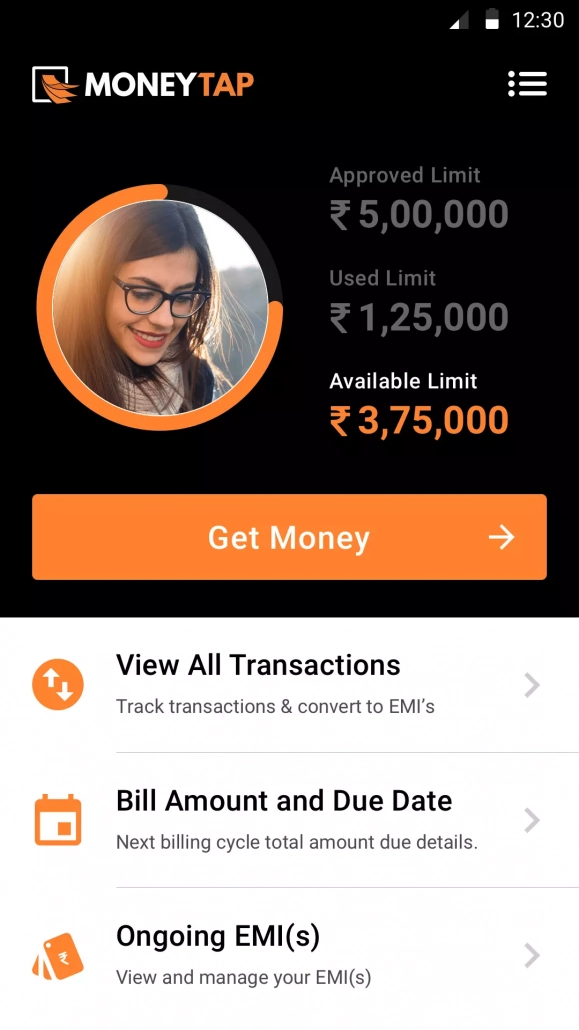

MoneyTap was founded in October 2015 by three serial entrepreneurs, Bala Parthasarathy, Kunal Verma, and Anuj Kacker. It provides instant personal loans of up to Rs 5 lakhs, with the entire KYC process taking place via its mobile app. In collaboration with banks, the startup aims to provide individuals with quick and flexible personal loans smoothly and efficiently.

MoneyTap is India’s first company to offer its customers instant lifetime credit of up to Rs. 5 lakhs. It provides instant loans in a completely paperless process and does not require a bank visit. Furthermore, interest is only charged on the amount borrowed. A loan obtained through their app is collateral-free and has loan terms ranging from two months to three years.

USP: MoneyTap makes it much easier for people without credit scores to get credit.

Customer testimonial:

“I used MoneyTap for the first time. Just love this app. I have successfully got 10k for 6 months. I love the long repayment. Better from all other apps. Recommended to everyone.”

Gurkirat Singh (via: Google Play)

4. Instamojo

Website: www.instamojo.com

Address: 302, 3rd Cross 9H Main Rd, HRBR Layout 1st Block, HRBR Layout, Kalyan Nagar, Bangalore, Karnataka, India. PIN: 560043

Employees: 152

Funding Raised: $14 m ($944 k raised two years ago)

Investors: 500 Startups, AnyPay, Bharathram Thothadri, Blume Ventures, Gunosy Capital, Kalaari Capital, Rajan Anandan, Rob de Heus, Shailesh Rao, Shinji Kimura, Times Internet

About Instamojo:

Instamojo is a full-stack transactional platform aimed at bringing small businesses online. The company is a pioneer in bringing payment links to India. It provides an easy-to-start and simple-to-integrate payment solution that enables businesses to collect payments online.

Aside from payments, they also offer a suite of services and products for sellers to set up an online store, gain insights into their store’s performance, and use that information to grow their businesses.

By offering meaningful connections, practical tools & services, and pertinent content, they assert that they are well on their way to becoming a “Growth Gateway” that will put every business in their ecosystem on a fast-track growth path. They currently have over 500,000 sellers on their platform.

USP: Instamojo is the first company to provide businesses with payment link services. Thus, allowing businesses to collect payments with more flexibility.

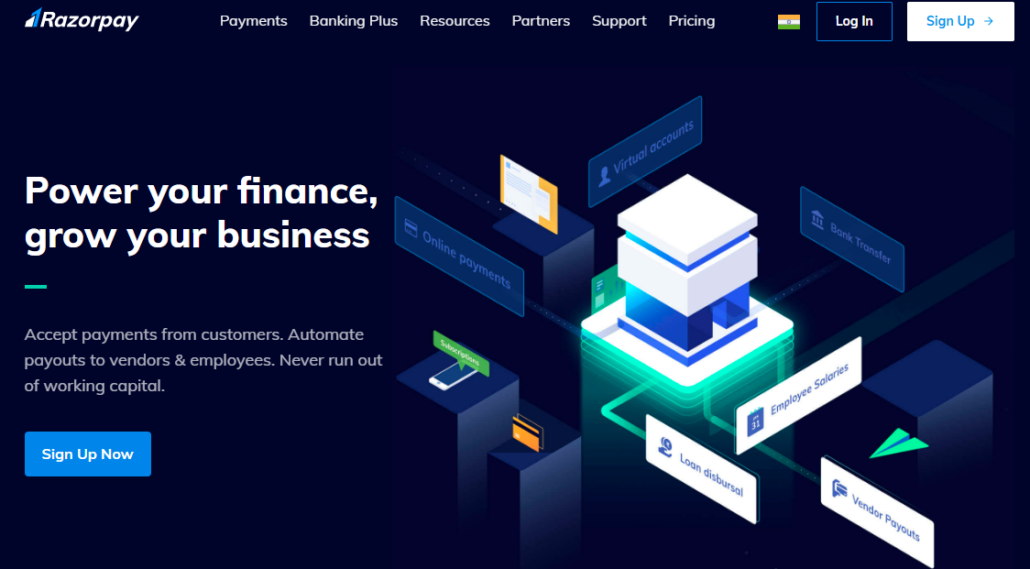

5. Razorpay

Website: https://razorpay.com/

Address: SJR Cyber Laskar, Hosur Road, Adugodi, Bengaluru – 560030, Karnataka, India

Employees: 2,219

Funding raised: $385 m ($160 m raised a year ago)

Investors: Abhay Singhal, Amit Gupta, Anand Swaminathan, Bill Gajda, GIC, GMO VenturePartners, Hiro Mashita, Jeff Ferguson, Jeff Huber, Justin Kan, Kunal Bahl, Kunal Shah, Matrix Partners, Matrix Partners India, Meyer Malka, Michael R. Sutcliff, Naveen Tewari, Punit Soni, Ram Shriram, Ribbit Capital, Rohit Bansal, Sandeep Tandon, Sequoia, Sequoia Capital, Sequoia Capital India, Soma Capital, Tiger Global, Tiger Global Management, Tikhon Bernstam, Y Combinator

About RazorPay:

Razorpay is an online Payment Solution platform in India that provides businesses with a quick, safe, simple, and cost-effective way to accept and disburse payments digitally.

It offers a variety of online payment methods, including credit and debit cards, net banking, UPI, and a slew of leading wallets in India, such as JioMoney, Mobikwik, Airtel Money, FreeCharge, Ola Money, and PayZapp. The platform provides a comprehensive dashboard for users to manage payments via web and mobile apps.

Razorpay Route, Razorpay Smart Collect, Razorpay Subscriptions, and Razorpay Invoices were all introduced in 2017. These products attempt to handle tasks such as cash flows, money disbursement, automating NEFT, bank wires, and scheduled payment collection.

USP: Razorpay offers complete payment solutions for businesses, from collecting payments to invoice generation. It is one of the largest payment gateway solutions in India and is presently on its way to starting its own NeoBank service for consumers.

6. Shiksha Finance

Website: https://shikshafinance.com/

Address: 497, Kattima Isana Mall, 3rd floor, Poonamallee High Road, Arumbakkam, Chennai – 600106, India

Employees: 128

Funding Raised: $33.9 m ($4.24 m raised three years ago)

Investors: Aspada, Michael & Susan Dell Foundation, Northern Arc, Triodos Investment Management, Zephyr Management

About Shiksha Finance:

Shiksha Finance provides loans to educational institutions (for asset creation, working capital, and infrastructure development) as well as students (for their school fees). Its two main products are Study Loans and Asset Finance.

To further lower the school dropout rate, it intends to open more branches in nearby towns and villages. It aims to finance education entrepreneurs who want to improve access to quality education for low- and middle-income communities.

Shiksha Finance’s COO, Jacob Abraham, stated that the company was developing a new psychometric-based business model to evaluate the financial standing of their no-income customers since they are unable to provide bank statements or CIBIL scores to obtain loans.

USP: Shiksha Finance provides services to a very specific and deprived community in the country. Their business model prioritizes the well-being of the community over generating revenue.

7. Pine Labs

Website: https://www.pinelabs.com/

Address: 2 Candor Techspace Plot No. B2, Industrial Area, Sector 62, Noida – 201309, India

Employees: 1,449

Funding: $911.2 m ($600 m raised a year ago)

Investors: Actis, Altimeter Capital, BlackRock, Fidelity Management & Research Company, Flipkart, Ishana, Lone Pine Capital, Madison India Capital, MasterCard, PayPal, Sequoia Capital, Temasek, Tree Line

About Pine Labs:

Founded in 1998, Pine Labs began by developing a solution for a large-scale, card-based payment and loyalty program in the retail petroleum industry. They have been reinventing its business model in response to the changing needs of its merchants since 2012. Following that, it pioneered the intelligent, cloud-based, unified point-of-sale (PoS) platform.

Pine Labs has reshaped the payments and fintech industries while also contributing to the development of a global digital economy. Today, the company is maniacally focused on developing a product and services platform that broadens access, accelerates commerce, and automates local market merchants.

Pine Labs has over a hundred thousand merchants in India and other Asian countries. In India alone, it powers over three hundred and fifty thousand PoS terminals.

USP: Pine Labs is one of the older startups in India that pioneered card-based payment. It is also one of the first companies to provide NFC-based payment solutions to merchants.

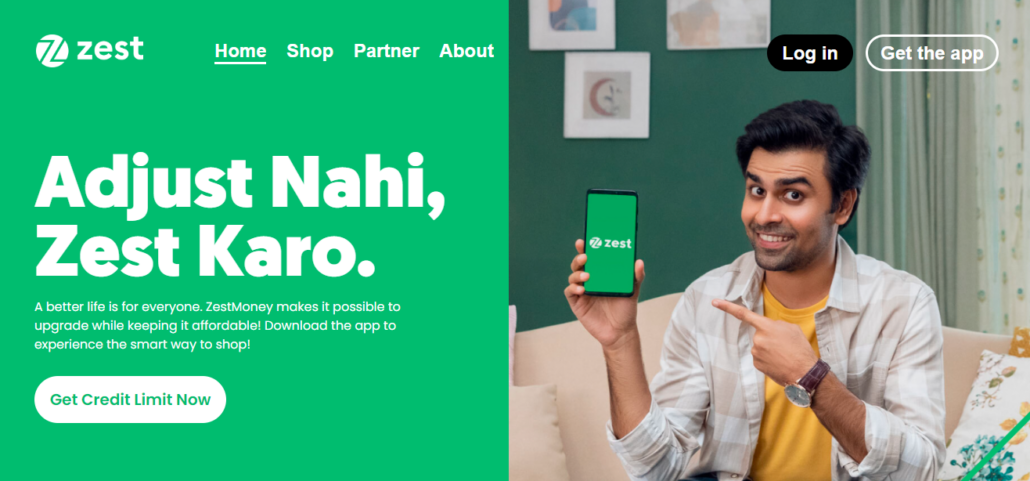

8. ZestMoney

Website: https://www.zestmoney.in/

Address: Site No. 19 & 20, Koramangala 1A Block, Bangalore, Karnataka, India. PIN: 560034

Employees: 303

Funding raised: $117.6 m ($50m raised about 10 months ago)

Investors: Alteria Capital, Coinbase, Goldman Sachs, Naspers, Naspers Fintech, Nelson Holzner, Omidyar Network, PayU, Primrose Hill Ventures, Quona Capital, Reinventure Group, Ribbit Capital, Xiaomi, Zip Co

About ZestMoney:

ZestMoney makes it simple to obtain loans by combining mobile technology, digital banking, and artificial intelligence. While many lending institutions are hesitant to lend money without a credit history, ZestMoney does not consider it to be a barrier to obtaining a loan.

ZestMoney creates a risk profile for each borrower using its AI-based machine learning decision engine. Those who do not have a sufficient credit history can provide further information, after which ZestMoney’s Decision Engine evaluates the borrower’s credibility and lends him money.

USP: ZestMoney enables AI-assisted underwriting and is one of the first companies in the country to do so. It provides clients with credit even when traditional banks will not.

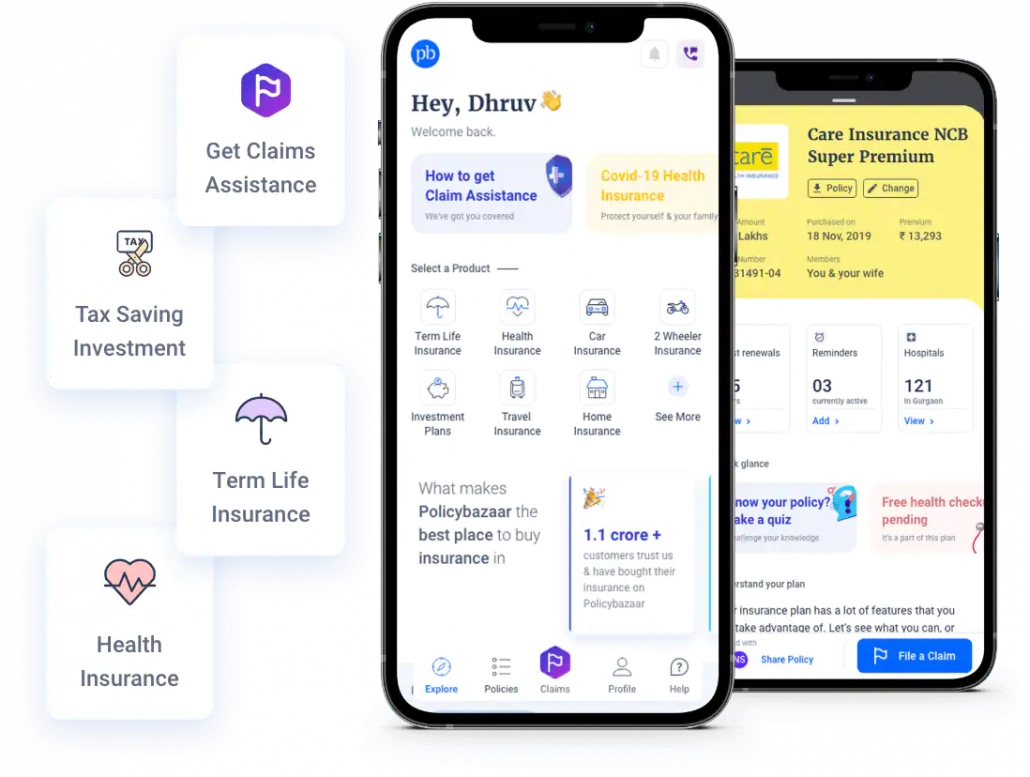

9. PolicyBazaar

Website: https://www.policybazaar.com/

Address: 123, Sector 44, Gurugram, India. PIN: 122003

Funding raised: $616.6 m ($75 m raised a year ago)

Investors: ABG Capital, Falcon Edge Capital, IDG Ventures India, Info Edge, Intel Capital, Inventus Capital Partners, PremjiInvest, Ribbit Capital, SoftBank Vision Fund, Steadview Capital, Temasek Holdings, Tencent Holdings, Tiger Global Management, True Northland, Wellington Management

About PolicyBazaar:

PolicyBazaar is India’s leading insurance product aggregator and marketplace. Founded in 2008, the company initially compared insurance policy prices and provided insurance-related information. The company experienced rapid growth and has since expanded across many horizons. Along with being an insurance marketplace, the company also helps with policy cancellation/renewal and claim settlement.

USP: PolicyBazaar makes it easier for small businesses and consumers to compare financial products and policies. Often consumers and businesses in the country would get stuck with one financial institution, which is likely to be a large traditional bank. PolicyBazaar democratizes the financial product landscape by letting consumers know about all their options.

10. InCred

Website: incred.com

Address: Level 3 & 7, The Capital, Plot No. C-70, G Block, Bandra Kurla Complex (East), G Block BKC, Bandra Kurla Complex, Bandra East, Mumbai, India. PIN: 400051

Employees: 875

Funding raised: $177.2 m ($2.1 m raised three years ago)

About InCred:

InCred is an NBFC that provides personal, education, home, and SME loan services. It intends to use technology to improve analytics and risk management capabilities. It is backed by the Dutch development finance institution FMO, the US-based asset manager Moore Capital, Elevar, and Alpha Capital.

USP: InCred offers personal loans for cases where a traditional bank will not, allowing consumers to get credit even without a credit score.

In Conclusion

The fintech industry experienced a significant revolution because of the rapid growth of the internet in the 1990s. Electronic payment systems, web-based business models, web-based shopping, portable banking, and bank digitization are just a few examples.

New Fintech businesses are bringing the level of advancement that was initially difficult to achieve. They are digging through several untapped areas outside traditional business sectors.

The Indian economy, which largely relies on finance, has benefited from the Fintech opportunity over the past few years. The variety of services offered with a range of options, such as digital wallets and digital payments, is the stepping stone for the advancement of the finance sector. The lending and insurance sectors also witnessed a significant impact of the fintech revolution.

LeadSquared provides sales, marketing, operations automation, and vendor onboarding solutions to leading fintech companies like InCred, PlicyBazaar, Oro, MI credit, and more. Book a quick demo to know the capabilities of the LeadSquared platform and how it can contribute to your growth.