When you venture out into the strange and ever-changing jungle of financial services, there’s only two things that determine the fate of your business: speed and efficiency. Whether it is hunting prey in the wild, or chasing a lead with a notoriously short life cycle, tremendous speed and unerring efficiency are what can help you the most. In other words, there are just two simple rules for capturing your lead and converting them into a customer:

a) Are you quicker than your competition? Does your organization have instant access and ready responses for every lead checking you out?

b) Are the right people reaching out to every single lead? Would you be willing to lose a deal because a low performing sales rep is talking to a HNI with high intent to buy?

Of course, there are other things to consider like the product, rates, ease of onboarding, etc, but all things equal, if you get the first 2 things wrong, your valuable finance lead has already slipped away.

Here are tried and tested ways to make sure that you are not just quick but efficient as well in boosting your sales.

Lead Attribution

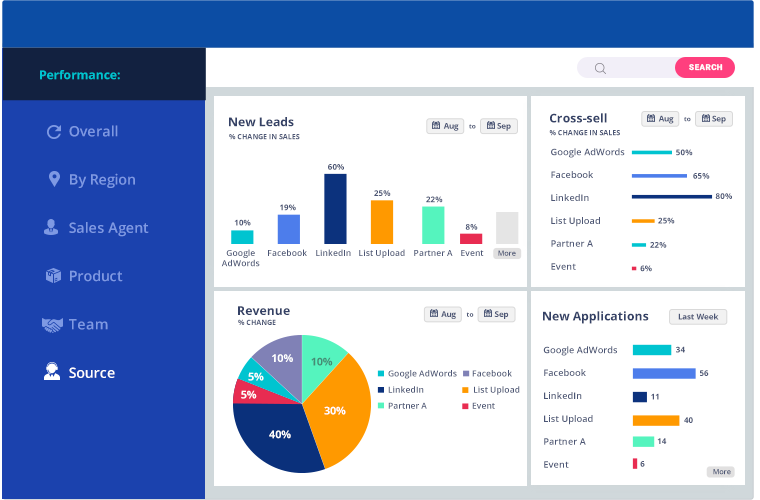

The first step in ensuring right conversations with the right leads, is the process of identifying “where your leads are coming from”. Being able to attribute every single finance lead to its source of origin is essential. This is not just true for financial services, but any marketing team that does not have its attribution nailed down is just shooting in the dark.

Understanding not only if it’s a PPC campaign or a Feet-On-Street (FOS) generated lead, but being able to attribute it to the type of campaign or location that it was generated from is imperative to understand the quality of the finance lead. For example, a first time user visits a bank’s website from Mumbai. The location of the user can be identified from her IP address. Using this information, the bank can leverage its efforts to show personalized messages in real-time based on the user’s location. To put it simply, ensure that every lead is tagged appropriately.

Lead Qualification & Prioritisation

The first step for getting ahead of the competition curve is identifying the most promising leads. Specifically, which ones to invest time on, and which ones to let go of. This necessary step is termed lead qualification. One way to effectively ascertain the quality of a prospect is analyzing where they have come from. A lead coming in from banking relations has a different level of need than that of an online lead. As a result, it has to be handled differently.

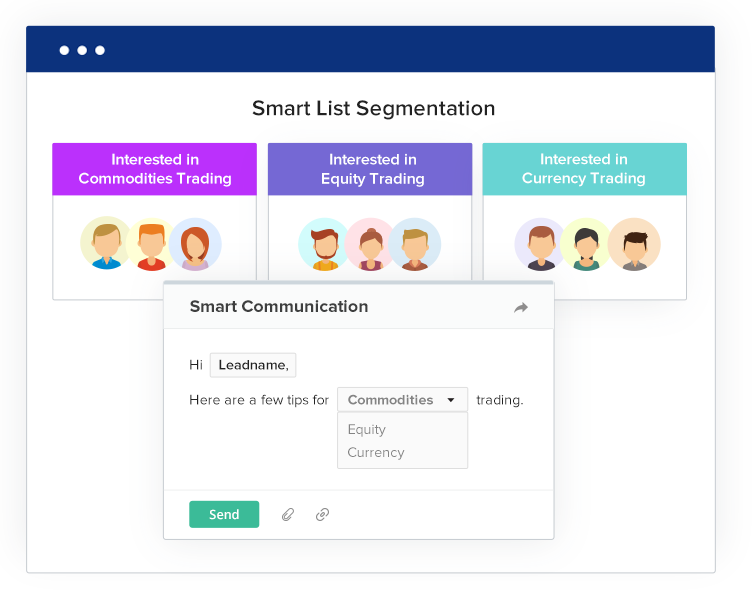

In other words, a message needs to be personalized to be effective. The conversations have to be right. With today’s technology, we can effortlessly determine different leads’ willingness (or lack thereof) to take the next necessary steps.

And the conversations we need to prioritize first.

Here’s how focusing on the core principle of personalization changed the financial marketing landscape in India.

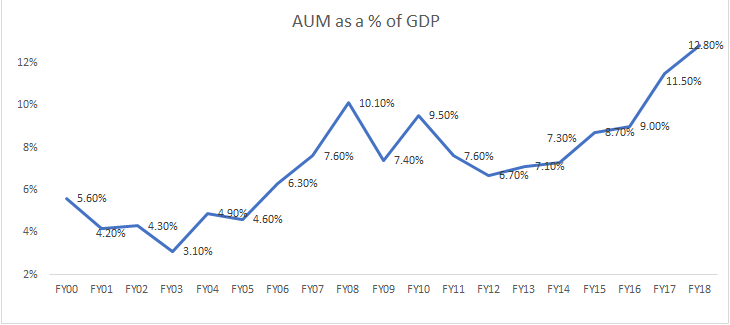

According to SEBI reports the penetration of mutual funds was pretty low in August of FY2013, but it has since seen an increase as of Jan 2020. Mutual fund AUM as a percentage of GDP rose from 6.8% in 2012 to 12.8% in 2018.

One reason cited for the increase in penetration of mutual funds in Indian markets are the awareness campaigns run by various firms on the efficacy of SIPs and mutual funds. The interesting thing about these advertising campaigns was how they were often set in the backdrop of normal Indian life. They were designed to appeal to average middle-class households.

In other words, these were targeted campaigns that proved to be enormously effective. Reportedly they brought in over 50 lakhs more investors for mutual funds, thereby proving that the strategy paid off handsomely. They found out which potential demographic could be affected by marketing using available data and focused on them and pursued them with an appropriate strategy. This principle can be applied right down to FOS leads.

FOS (Feet on Street) Leads – A lead coming in from your FOS who’s trying to push credit cards in a mall to an unwilling customer is much less likely to convert. But a lead from the same FOS at a tech park or a college with prospects who have a highly expendable income might be slightly better. Here again, we can dig deeper and capture details to try and segregate them according to their activities.

Prioritize and pre-screen leads

A problem that people often face is that there are way too many channels from where leads come in. Focusing on so many different things at once kills your ability to measure the effectiveness of any one of those channels. To avoid that it is essential to improve the quality of leads entering the funnel. There are a few ways you could improve the funnel quality of your sales process.:

a) Improving sales metrics: It’s hard enough as it is to get actually interested people on board. To have a system that uses faulty metrics just adds to the problem. It is essential that marketing and sales teams are on the same page for leads to be viable. For example, one metric that helps synergize the efforts of sales and marketing teams is Marketing Qualified Leads to Opportunity Ratio. This metric enables one to effectively track and demonstrate Marketing’s contribution to the pipeline.

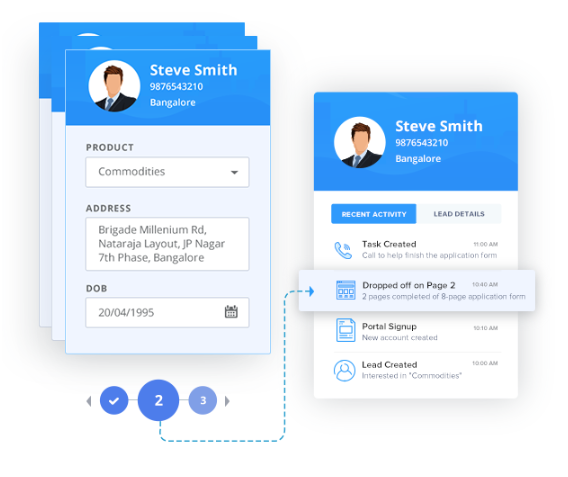

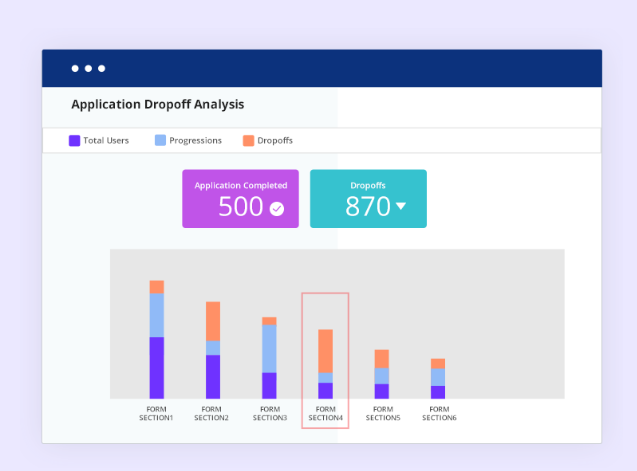

b) Incorporating better quality criteria: Leads abandoning the sign up on the last page for Demat account registration are more likely to be better prospects than leads leaving after filling the first one. When thousands of people log on at the same time, it’s simply impossible to classify people as required manually. Fortunately, with the help of available technology, we can differentiate efficaciously and instantly if we have adopted the right criteria.

c) Listening to data: Someone rightly said, “In God we trust, everyone else must show data”. Only data tells the truth about what’s working and what’s not. The progression of revenues with rapid advancement in data collection and analytics is not a coincidence. If there is anything that the digital revolution has taught us, it’s this: Algorithms combined with the right amount of data can figure out people’s needs better. Here’s how it can help us: 91% of genX and 97% of millennials use mobile banking and 61% of them would be unwilling to open a bank account without proper mobile banking capabilities. It’d be a good idea to use this fact when designing marketing campaigns for student loans.

Lead segmentation & distribution

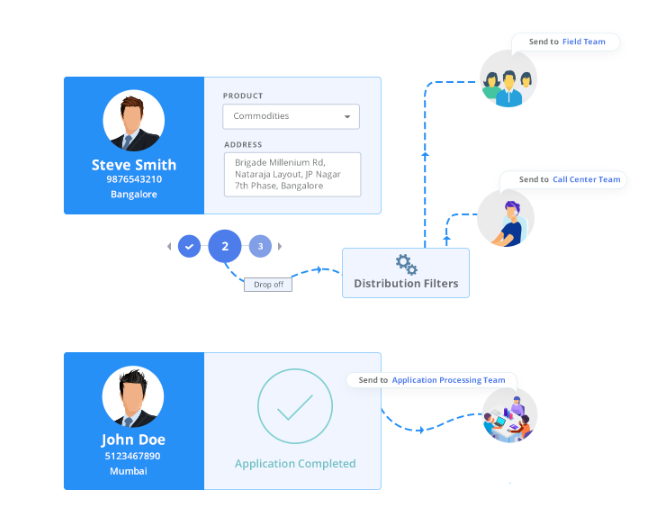

Not every conversation can be fruitful, especially not when the wrong person is involved. What is required is ensuring the leads are mapped to the right person at the right time. Here’s how you can do that:

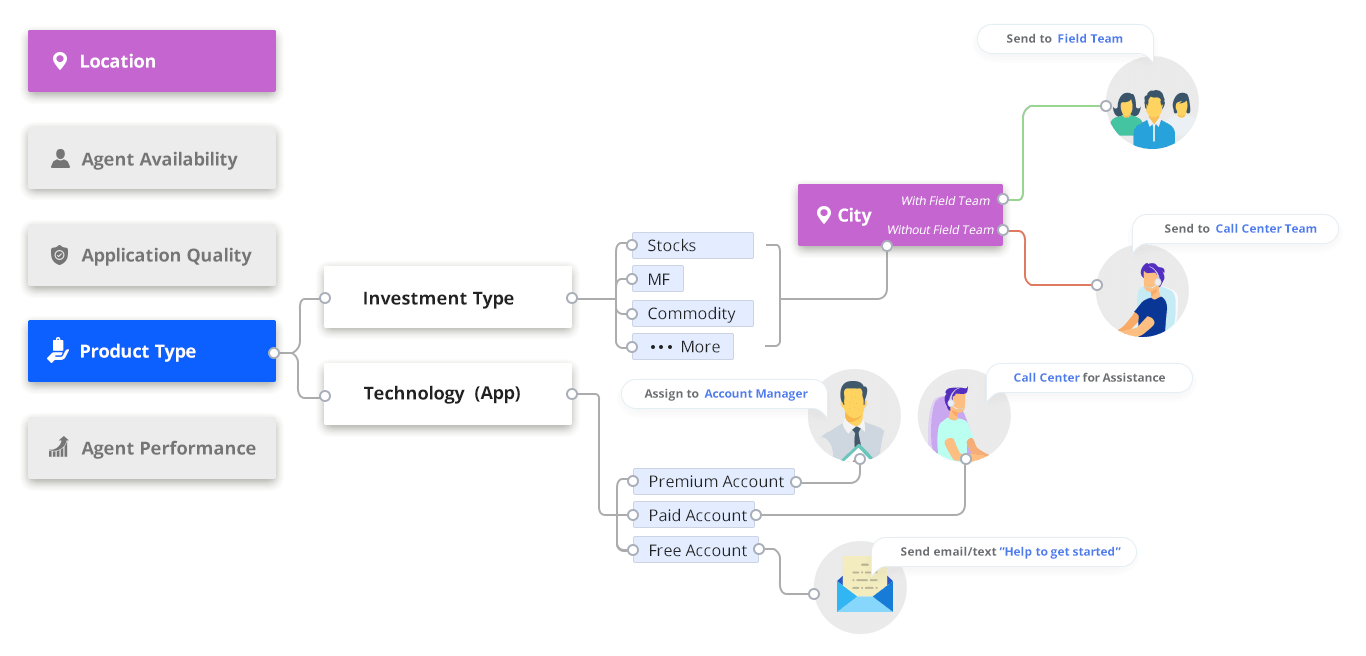

Segment and distribute the leads as soon as they come in according to some parameters like:

a) Sources: A lead is generated generally from four sources: a) Banking Relations b) FOS c) Online d) Referrals. These leads are all different from each other in several unique ways . Thereby making it essential to have a different approach to deal with each one. For instance, a guy looking to open a mutual fund account is to be handled extremely differently than a FOS prospect considering credit card membership.

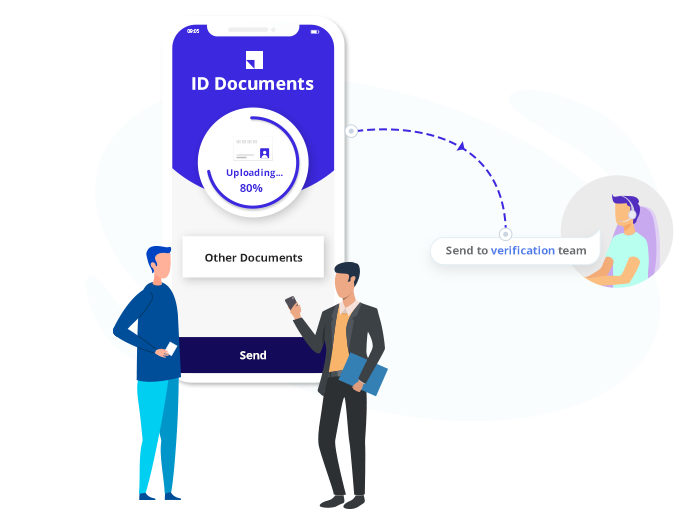

b) Location: Research has shown that many people seem to be unwilling to complete a lengthy task in one go. This is why we see the incredible abandonment rate of Demat account sign up pages. There is often a need to engage prospects that have come halfway through the sign-up process. It is of great help if the document verification part (which in most cases is the chief reason for abandonment rate) is handled vis-à-vis. For that, it is necessary to segment leads according to their Location. Undoubtedly, there is always a need to make sure that leads are assigned to FOS nearby the prospective.

c) Language: There are few things more personal to people than their own language. People like to be addressed in their own mother tongue. People segmented based on the language they are comfortable in and communicated in that language is always a win.

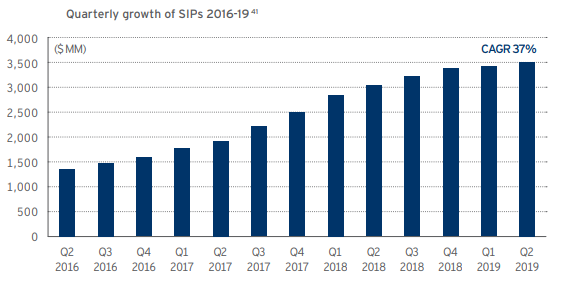

d) Users: Every call for a conversion of a prospect is a battle all in itself. And specific battles need specific strategies. There is a requirement to cater to the needs of different people differently. To assign the right people for a job is a challenge in itself. The task only becomes easier if leads are already segmented according to their specific demands and needs. This saves time and increases productivity. For instance, recently SIPs are once again seeing an upward trend. One reason for this being a renewed interest among younger investors in mutual funds. It’d be a good idea to inform these young users about existing plans regarding SIPs and mutual funds. It is always helpful if your existing users are segmented automatically so that you can engage with them with the right content.

e) Time of inquiry: The market never sleeps, sales executives have to. But, to satisfy competently the needs of different people, it is necessary to reach out to them as soon as possible.

We can only do this if we position ourselves as capable of knowing the time of inquiry of different people and having specific people reach out to them. The working hours of industrious insurance agents, call center employees, and sales agents are limited. Their productivity doesn’t have to be. Have them bring their A-game by reminding them of customers that may have called in late. At the same time effectively have them prioritized without much effort using predefined metrics.

f) Salespeople: To make and enforce a good and effective marketing strategy takes an extreme amount of synergized effort, dedicated people and money. When it finally pays off and outreach gets a good response, it could still potentially result in underwhelming conversions. This is why it is essential to have the right people to contact valuable leads.

This could get a bit tricky in situations where a good lead is assigned to an above-average but overworked employee. Or when someone’s current performance is degrading at a greater than average rate due to unfortunate circumstances. Once again we turn to technology, with which it is now possible to easily overcome such problems.

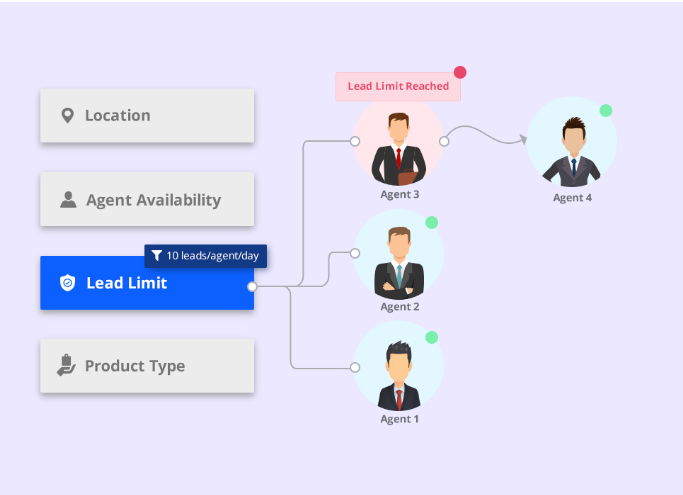

Lead Distribution logics

For instance, several firms now use CRMs that have an inbuilt capping logic and leave calendar that facilitates better distribution of leads. With capping logic, you can make sure a sales rep is not overworked by limiting the maximum number of leads they can be assigned. Take into account the availability and presence of sales reps by using a pre-configured leave calendar and shift timings.

For instance: You won’t give a high-value lead to a poor-performing salesperson.

Automation Benefits

One other added benefit from using segmentation is it aids in reviving leads via automation. The process allows us to attain higher specificity while targeting prospectives and ultimately helps in triggering the right automated responses. Automation has proved to be highly beneficial for firms such as Finance Buddha. For instance, with automated loan processing and improved customer experience, the inside sales conversions have improved by 25% reducing the time taken for loan processing. The customers are gaining from not having to wait long for approvals, which in some cases is almost instantaneous.

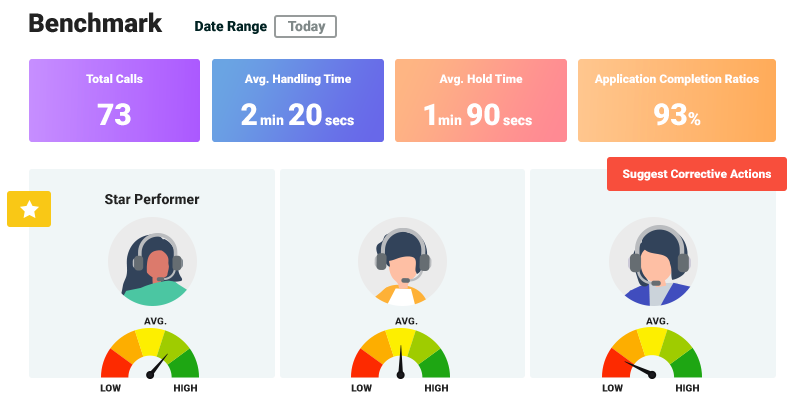

Reporting and Feedback

Of all the things that are almost universally viscerally hated, negative feedback would probably be near the top of the list.

It would also be among the top in the ‘most important things for improvement’ list.

Just as a viable lead turns cold in the wrong hands, a potentially great employee turns mediocre due to a lack of appropriate and necessary feedback. It is, therefore, a necessity to have a feedback mechanism installed in the process. It is absolutely critical that competent people handle viable leads. Regular reporting enables you to do that efficiently. Assessment of performance while the distribution of leads helps both the leads and firms.

Although it would be a mistake to limit the feedback process to sales representatives alone. We need to look further, which campaign strategies bombed? Which lead acquisition method has become outdated? In essence, are the changes happening in the finance sector outpacing our strategies? A great feedback mechanism helps answer all these questions and more.

![[Webinar] Digital v/s Non-Digital Strategies in Education: Finding the right balance 13 Digital v/s Non-Digital Strategies in Education: Finding the right balance](https://www.leadsquared.com/wp-content/uploads/2021/11/MicrosoftTeams-image-35-80x80.jpg)