The financial services industry has experienced a remarkable digital transformation in recent years, driven by rapidly evolving customer needs and expectations.

For the Middle East region in particular, the shift from traditional financial services companies to agile, tech-driven organizations has been nothing short of transformative.

With the overall UAE fintech market size expected to grow from USD 3.16 billion in 2024 to USD 5.71 billion by 2029 during the period 2024–2029, the region has emerged as a main hub for fintech innovations.

This post aims to explore some of the top financial services technology trends and understand how they are going to shape the overall industry. Dive in!

The Need for Digital Innovations in Financial Services

While digital transformation is necessary for almost every industry, it is particularly useful for the financial services industry, which gains higher efficiency in transactional as well as decision-making processes facilitated by intelligent use of data and deeper insights into customer behavior.

To navigate the space effectively and stay competitive, an increasing number of financial institutions in the Middle East region are starting to adopt the latest digital trends in financial services.

Overall, the UAE financial services market’s high digital adoption rate, coupled with various regulatory advancements, positions the region as a great place for testing and implementing new digital financial products.

Top 5 Emerging Digital Technology Trends in Financial Services

Here are some of the emerging digital technology trends in financial services to look out for:

1. Blockchain

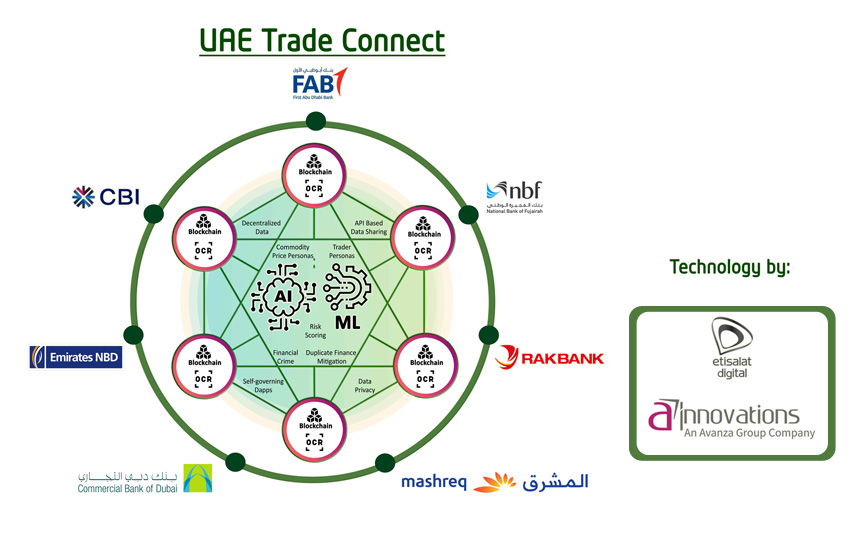

The emergence of blockchain technology is one of the most innovative financial services industry trends in recent times.

The term is primarily used in the context of cryptocurrency, where organizations use the technology to protect data, record transactions, sign contracts, and improve overall traceability.

The UAE Blockchain Strategy 2021 initiative by the UAE government, seeking to become the world’s first government to operate this technology, needs special mention.

A recent study also suggests that the adoption of blockchain in the Middle East financial services system helped to highlight an estimated 3.75 million fraudulent transactions annually. This increased transparency and security have positioned blockchain as a vital component for the future of financial services.

The technology is beneficial to the financial services industry because of its safety and dependability. The last couple of years have also seen blockchain and distributed ledger technology enter a phase of experimentation and adoption.

In the future, the technology is expected to have transformative impacts on aspects such as trade finance, cross-border payments, and decentralized finance (DeFi) with quick settlements and streamlined processes.

2. Generative AI

From intelligent virtual assistants and chatbots to seamless content creation and customer guidance, generative AI technology is all set to personalize financial services, fostering higher engagement and deeper user understanding.

According to a recent report, generative AI in banking and financial services is set to surpass other sectors, with the potential to boost productivity by almost 30%. In the UAE, the generative AI market is expected to grow at a whopping 46.47% annually, resulting in a market volume of US$2,036.00 million by 2030.

Another report also suggests that the most significant impact of generative AI in financial services is expected to be on revenue, sales and general productivity by efficiently navigating areas such as risk management, privacy of data, fraud, sales, and exceptional customer interaction.

However, what is important to achieve this kind of growth is designing and implementing a robust AI strategy that prioritizes the workforce.

3. Open Banking

An increasing number of banks and financial services companies in the UAE are adopting open banking initiatives.

Banking license regulators in the region are also more willing to offer banking and non-banking financial institution licenses to new players entering the segment.

KSA (Kingdom of Saudi Arabia)- based FinTech Geidea is one example of the first non-bank to receive a banking license. Likewise, several digital-only banks have recently entered the UAE. These include ADQ, Zand Bank, and Al Maryah Community Bank.

Another example of the rising popularity of open banks in the UAE is the Saudi Central Bank licensing several FinTechs to offer consumer microfinance, payment, and other financial services.

4. Embedded Financial Solutions

Embedded financial solutions mean integrating financial services into various non-financial platforms and applications. The coming years will witness a rapid surge in embedded finance solutions across sectors, including healthcare, e-commerce, and ride-sharing.

Moreover, technologies like banking-as-a-service (BaaS) and other embedded financial solutions will enhance user experiences, paving the way for new revenue streams for financial institutions and organizations.

5. Digital Lending

Another noteworthy development in the Middle East’s digital services market is the rise of digital financing. As the name implies, digital lending provides both individuals and businesses with rapid and easy access to loans and other financial products.

Using these digital platforms, financial services firms may quickly automate loan origination, expedite documentation procedures, and provide customized lending solutions.

This is an interesting trend that has the potential to extend financial inclusion by ensuring that lending and financing are more accessible to everyone. Financial services companies leveraging digital lending can also benefit by enhancing their competitiveness, improving customer experience, and expanding their loan portfolios.

In recent years, the Middle East region has also witnessed a rapid transition towards cashless payments, with contactless cards, mobile wallets, and QR code-based payments becoming increasingly prevalent.

Empower Your Financial Future with Cutting-Edge Technologies

The Middle East’s financial services sector has seen a significant transformation in recent years, embracing interesting digital trends and innovations that redefine how financial services are offered to customers.

The future will further see the latest digital technologies and innovations redefining the digital financial sector landscape, with strong government support and the influx of the latest technologies.

If you also wish to leverage technology to make the most of the financial services landscape, LeadSquared is an excellent tool for marketing automation and follow-up. With advanced analytics, seamless integration, and robust automation features, we can help financial institutions streamline their processes, enhance customer engagement, and drive growth.

Book a demo to learn more!