2024 brings with it brand-new battles of fostering growth in the economic wreckage that 2022-23 left behind. The credit union industry continues to evolve and grow at a pace much slower than its financial counterparts. Besides, there has been an alarming lack of growth within the smaller sections of the industry.

To stay in the game and compete against rising FinTechs, it has become extremely to identify and implement new credit union membership growth strategies.

The reports released by CUNA Mutual for the fiscal year 2020 further supplement the need to do so. The report states that the total credit union loan balances rose only by 5.7%, which is far below the 7.2% long-run average. What’s worse is that this is not a representative percentage due to the large disparities between smaller and larger credit unions. Credit unions with assets greater than $1 billion reported an 8% increase in loan balances, up from the similar time-period one year earlier. However, credit unions with assets less than $20 million reported loan growth of -3.5%, below the 3.2% pace set one year earlier. Not just this, the report also states that they expect overall credit union loan growth to fall to 5.5% in 2022. Without the right credit union membership growth strategies in place, we may soon see these figures come to life.

So, you may be wondering, what are the credit union membership growth strategies one must adopt to overcome these challenges. The first step would be to understand the importance of ‘big data’ and its analysis.

1. Delving into data analytics

Credit unions are engaged in an increasingly competitive financial landscape, with fintechs popping up on every corner of the internet. In 2020 several credit unions merged with fintechs to survive the increasing demand for digitization. This in turn led to credit unions realizing the discrepancies that exist within the industry, when compared to other financial institutions. This is particularly visible in the lack of data analytics being implemented by the credit union sector.

Data analytics aids most industries in their pursuit to gain greater understanding of their target audience. This is achieved by sifting through large amounts of data and analyzing the information to arrive at a conclusion. Sadly, the data goes largely unused by the credit union industry. According to a study from 2018 by Best Innovation Group and OnApproach, 45 percent of credit unions did not have a strategy involving data analytics in place. The credit unions that did have a strategy stated that it would take them three to five years to implement.

A white paper by Information Builders highlights the connection between analytics and personalization. The paper explains how analytics solutions assist credit unions in personalizing their offerings based on individual members’ needs, behaviors, and preferences. This strategy can increase credit union membership growth, through data that summarizes the key performance indicators. However, as stated in an article by Credit Union Insights, it’s important to know that analytics won’t help without marketing automation. This helps utilize information gained about members through marketing campaigns to improve membership engagement strategies. All of this will in turn go hand in hand with the next growth strategy – strengthening existing cybersecurity measures.

2. Improving cybersecurity and increasing fraud detection

The pandemic brought with it unemployment, leaving several people with time on their hands, which unsurprisingly led to a significant rise in fraud reports as found by the FTC. They received over 1.3 million fraud reports in Q1-Q3 of 2020, resulting in total losses of over 1.5 billion dollars. Credit unions are heavily investing in ample cybersecurity measures to tackle these issues. What can be even more difficult to realize is that not all these attacks come from an anonymous hacker. As reported in an article by Sharpen, 50% of the attacks are malicious. But around 23% of the breaches were attributed to negligent employees, in the report by IBM and Ponemon Institute.

Thankfully, credit unions understand the importance of protecting their members from such dangers. PYMNTS’ Credit Union Tracker® collaborated with PSCU to prevent fraud attempts and saved over 277 million dollars in 2019. They stated that credit unions are on high alert for such security threats and are increasing their protection against cyberattacks. They went on to state that they have greatly invested their resources in data analytics to help protect their communities.

Credit union membership growth strategies can only be fostered when adequate measures that protect member identities are in place. Credit unions can greatly boost their cybersecurity measures through the use of eKYC verification systems. As they can reduce the time taken for verification and fight against fraud. These systems can also help the onboarding agents both on and off field, with the right eKYC.

3. Targeted products at points of inflection

Once you adopt different systems to incorporate data analytics, verification procedures and security measures, the next step would be to combine the information received from these systems to create personalized member journeys. A report by the NACUSO, details the importance of staying connected and relevant. Due to the increasingly competitive products available, the best way to ensure your growth is by keeping existing members aware of the new products.

Awareness in this sense indicates providing products that are highly relevant at a point of inflection. In a report by HubSpot, they found that 44% of consumers skip using search engines to look for products. Instead they directly enter their product needs on Amazon for speedy, relevant, and highly personalized results. This is because Amazon has successfully captured the market through detailed demographic segmentation and the use of machine learning.

The connection between personalization and cross selling

Similarly, credit unions must try to capture their existing member needs through personalized member journeys. This gives higher opportunities for cross-selling and upselling to members at an inflection point. Inflection points are generally when people are looking into moving into a new home, buying a new car, or are entering university. This means that they will be on the lookout for a financial institution to provide them with the right products and services. Even better if they can acquire all the products they need from one organization. This gives you the chance to acquire younger members and retain them for the future, according to an article by Forbes.

The best way to implement these personalized member journeys is to manage member transactions from one platform. This article goes in-depth on the steps to cross-sell credit union products in a successful manner. Credit union membership growth depends on understanding your members’ needs and meeting them. This can only be achieved by implementing strategies that give you information on what your members want even before they realize they need it.

4. Improving member retention

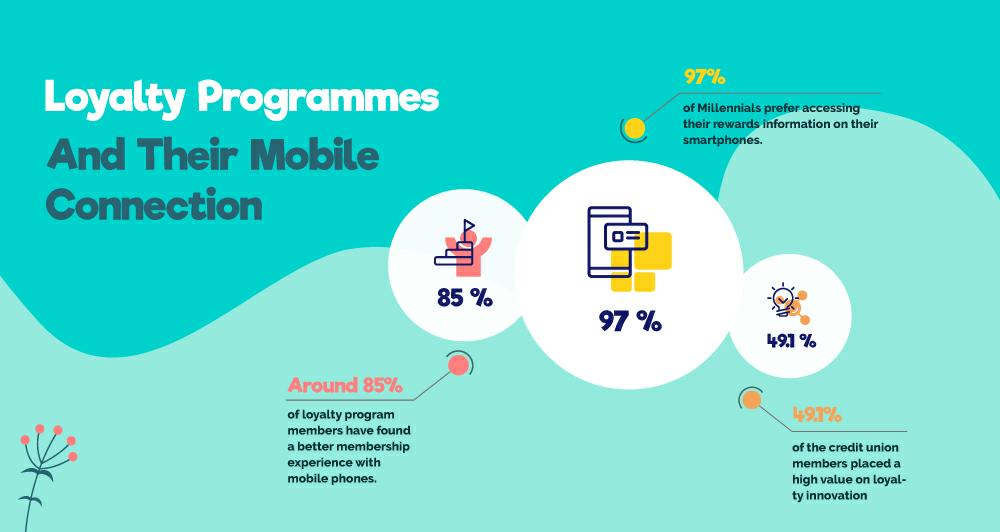

Once members are onboarded into the credit union systems, the right credit union membership growth strategies will increase retention. This can be achieved through 2 important channels which are- loyalty programs and mobile services. In a report by Pymnts they found that 49.1% of the credit union members placed a high value on loyalty innovation. This survey was sent to 2000 credit union members in total, making it representative of the general population.

The 10.8% of their respondents who weren’t interested in the loyalty programs were also likely to switch their financial institutions. This makes loyalty programs all the more important when it comes to surviving and thriving amidst growing competition. In a report by Flexcutech, loyalty programs are greatly desired by credit union members. With a growing number of members willing to pay a fee to access enhanced loyalty program benefits. This is also complemented by members looking to use mobile banking platforms for loyalty programs.

Why mobile is key to retaining loyalty program members

Around 85% of loyalty program members who have redeemed rewards with their mobile phones stated that they felt an improvement in experience. What is even more surprising is that 97% of millennials stated that they would actively engage with loyalty programs, if they could access rewards information on their smartphones. This further builds the argument for digitization, specifically geared towards improving mobile experiences.

In research done by Aberdeen Group and cited by SuperOffice, companies with the strongest omnichannel customer engagement strategies retain an average of 89% of their customers. As compared to 33% for companies with weak omnichannel strategies. Therefore, credit unions need to work on their omnichannel member engagement strategies, to do this they need to integrate efficient mobile apps. These apps need to be fast, simple and secure while offering customized rewards programs for their members.

5. Embracing automation for greater efficiency

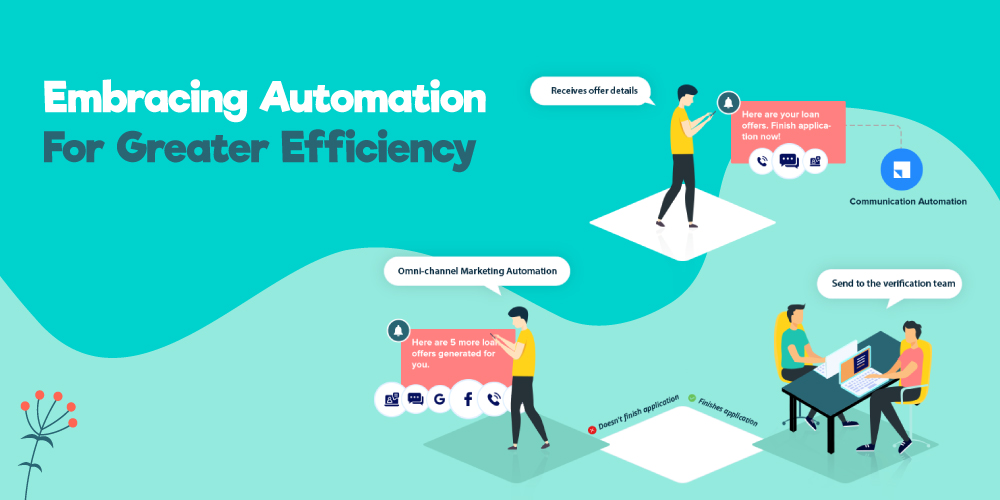

Finally, to execute the strategies involving data analytics and omnichannel customer engagement, credit unions need to automate their processes. Hyper-personalization would be impossible to achieve without a system in place that does it in an accurate and systematic manner. This might sound daunting, but the truth is that companies that offer in-built automation can be the perfect solution for your worries.

According to a recent consumer banking trends study, the deployment of chatbots will save the banking industry $7.3 billion in annual customer service costs by 2023. This means that heavily automated processes will be at the forefront of financial institution growth and development. Starting small-scale automated workflows for member acquisition and engagement strategically increases credit union membership growth. Automation and data analytics go hand in hand. Capturing data and applying it is crucial to compete with existing corporates that have these processes in place.

Ultimately credit union membership growth in 2024 will depend on integrating these strategies well. Thankfully, credit unions have an edge when compared to banks due to their community-based operations. As stated previously, members of credit unions are deeply interested in continuing their membership journeys – all if credit unions revamp and restructure to increase consumer satisfaction.

If you’re looking forward to increasing your membership growth, do check out the features of Leadsquared Credit Union CRM.