The financial services domain is extremely competitive, and maximizing return on investment (ROI) is essential. Affiliate marketing in financial services is a reliable strategy for achieving this. In addition to increasing accessibility, this strategy more accurately targets potential clients, increasing conversion rates and income.

Financial services may reach new markets and demographic groups by utilizing the power and reach of strategic partners. This article examines how financial services use affiliate marketing to optimize return on investment.

Learn the Nuances of Affiliate Marketing in Financial Services

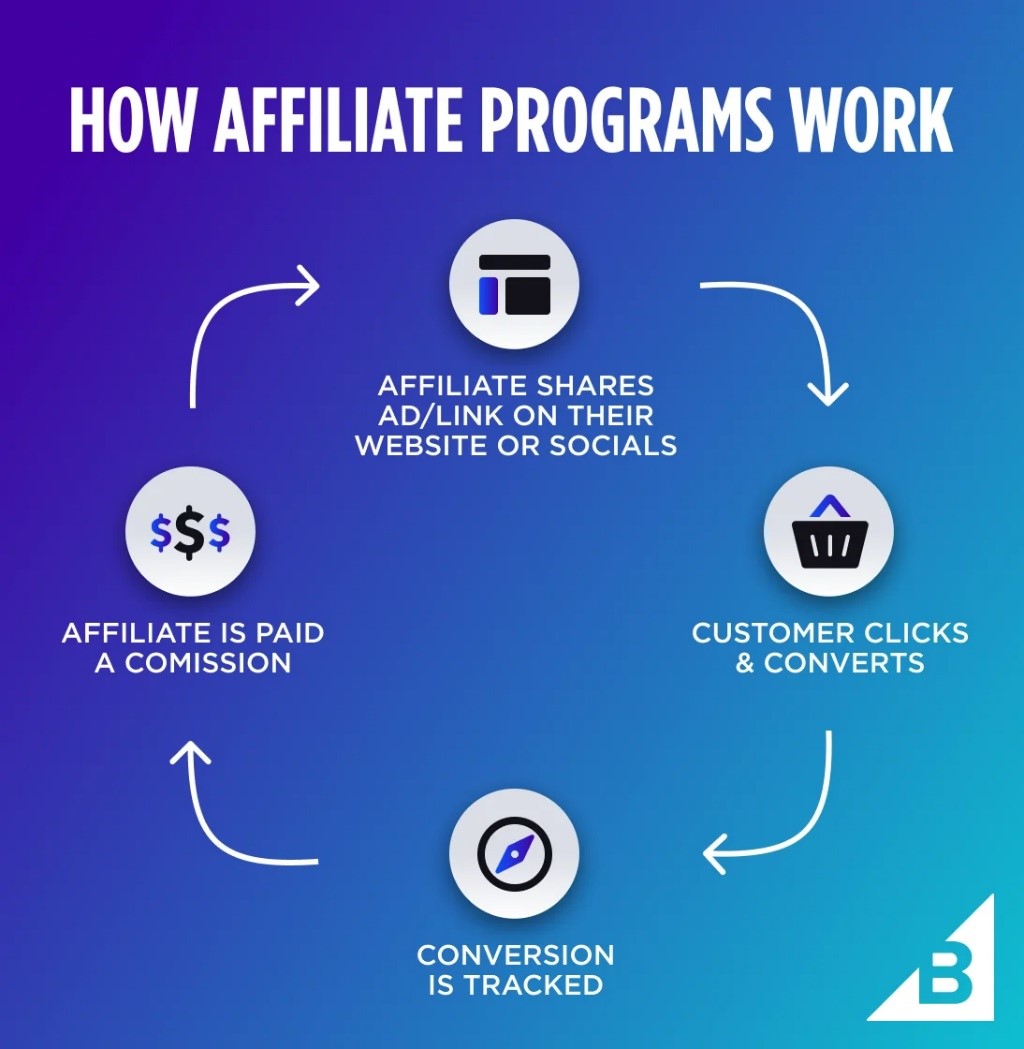

In affiliate marketing, you will collaborate with people or businesses (affiliates) who promote your financial services to their audience in return for an affiliate commission of any leads or sales.

Financial organizations save money using this performance-based strategy, which can only charge for outcomes. Affiliate marketing contacts new customers through multiple platforms, including electronic mail, blogs, and comparison websites.

Financial services may more successfully build client trust and establish their reputation by implementing these affiliates’ trust and influencing their audience. Additionally, this strategy makes marketing activities scalable. It enables institutions to quickly modify their affiliate arrangements in response to evolving possibilities and performance.

Key Strategies to Maximize ROI

Maximizing return on investment (ROI) through affiliate marketing in the competitive financial services domain requires careful planning and implementation. Here are some strategies that ensure success:

1. Select the correct partners

Selecting the appropriate affiliates is essential. Identify partners with a solid reputation and significant support within your target market. It might be competitor websites, financial bloggers, or influencers in the financial services industry. Ensure they know your items and can concisely and effectively explain their advantages.

For example, look at Mashreq Bank’s approach, a well-known financial company in the United Arab Emirates. Through collaborative efforts with major Middle Eastern financial bloggers and influencers, Mashreq Bank has expanded its customer base to include consumers interested in banking and financial services.

2. Offer competitive commission rates

Provide attractive commission structures that can help you reach top-notch affiliates. Financial firms can provide generous commissions as they frequently have greater client lifetime values. It motivates affiliates to give your services preference over competitors.

For example, by providing some of the highest commission rates in the area, Dubai-based Noor Bank has expanded its affiliate network. This action has increased their lead-generation efforts and pulled in top-tier affiliates.

3. Provide valuable resources and training

Provide your partner organizations with the resources and instruction they need. It might contain marketing brochures, compliance standards, and comprehensive product information.

Affiliates can benefit from regular training sessions to keep informed about innovative products and changes in requirements. Increase their efficiency by giving them access to a special affiliate site where they can track their success, locate tools, and get in touch with your support staff.

Moreover, providing affiliates with individualized support and feedback can assist them in improving their methods and better aligning with the brand goals. Reward and recognize top-performing affiliates that show a deep comprehension of your goods and regularly generate quality leads to encourage lifelong learning.

4. Make use of analytics

Use effective tracking and analytics tools to focus on your affiliates’ success. You can continually optimize your program by knowing which affiliates generate the highest-quality leads and the most conversions.

For example, Majid Al Futtaim, a multinational corporation located in Dubai with substantial holdings in financial services, uses sophisticated analytics to monitor affiliate performance.

Their data-driven strategy has helped them achieve comprehensive financial results, such as a 12% rise in EBITDA to AED 4.6 billion and a 17% increase in digital sales revenue to AED 2.6 billion (an approximate 20% boost in their business).

5. Design customized advertising campaigns

Create customized marketing campaigns with your affiliates relevant to their target market. Personalized content has a higher chance of attracting visitors and encouraging conversions.

For instance, Emirates NBD, a top bank in the United Arab Emirates, works closely with its affiliates to develop highly effective targeted campaigns consistent with objectives. The affiliates’ target audiences result from this combined effort.

Incorporate Leadsquared for Better Campaign Results

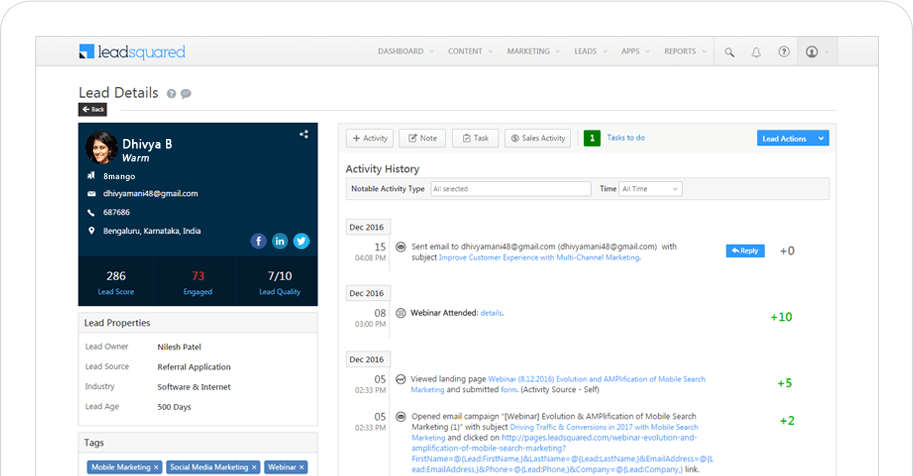

Are you looking for better results on your targeted campaigns? Utilizing resources like LeadSquared’s lead management and source monitoring may greatly improve these efforts.

With LeadSquared’s extensive lead tracking features, you can observe the exact source of your leads and how they engage with your campaigns. This data-driven methodology aids in strategy improvement and ROI enhancement.

Learn how to use LeadSquared for Lead Management and Source Tracking. Follow the below steps:

1. Source tracking: Using LeadSquared’s platform, you can easily track where your leads are coming from. It involves monitoring leads from various marketing sources, including direct traffic, email campaigns, and social media. Extensive reports enable an understanding of the most efficient paths.

2. Lead management: By automating lead capturing, distribution, and follow-up procedures, LeadSquared enables brands to send personalized messages that translate to higher conversion rates.

By incorporating such cutting-edge solutions, you can provide your affiliates with the information they need to improve their campaigns and ensure advertising is as focused and successful as possible.

Benefits of Affiliate Marketing in Financial Services

Affiliate marketing is an affordable way for financial institutions to increase their audience and generate leads. Financial institutions may use performance-based marketing strategies to reach new consumer groups, improve brand awareness, and increase return on investment using affiliate networks.

- Efficiency of cost: Due to its performance-based payment model, affiliate marketing ensures more efficient use of marketing funds.

- Extended range: Through affiliate marketing, you can reach those audiences that you cannot reach using traditional marketing and introduce them to your financial services.

- Enhanced trustworthiness: Affiliates give your goods credibility, particularly those in the financial services industry.

- Improved spotting: Affiliates possess in-depth knowledge of the audience choice to target campaigns more precisely.

Challenges and Solutions

Multiple challenges exist when elevating ROI in financial services via affiliate marketing. However, finding reliable solutions can resolve those issues on time.

1. Commitment to regulations

The financial industry is strictly monitored. Ensure that all affiliate marketing initiatives respect applicable rules and regulations. Affiliates can reduce risks by receiving compliance training. Keeping the lines of communication open with legal professionals can help navigate challenging regulatory environments.

2. Inspection of quality

It’s critical to keep leads and conversions at a high quality. Align your affiliate activities with your brand’s beliefs and goals by regularly reviewing them and offering feedback. More severe authorization procedures for content created by affiliates can help protect the company’s reputation.

3. The prevention of fraud

Affiliate fraud is the biggest problem. Thus, it is essential to place a fraud detection systems module and select affiliates with a solid reputation for sincerity. Cutting-edge affiliate fraud tracking software can also assist in the early identification and stoppage of fraud.

In 2024, there are multiple examples of successful fraud detection software as follows:

- FraudScore: This application uses advanced algorithms to identify and prevent various types of affiliate fraud. It offers thorough reports and immediate notifications to ensure the integrity of your affiliate network.

- Forensiq: Known for its strong fraud detection capabilities, Forensiq counts only real leads and conversions and uses behavioral analysis and machine learning to detect fraud.

- Voluum: This tracking software offers strong fraud protection tools. It analyzes traffic patterns and looks for irregularities to stop click fraud and other unfair activities.

You can protect your affiliate marketing efforts and ensure your investments generate maximum returns with the help of the above-mentioned advanced tools.

Integrating Artificial Intelligence (AI) and Machine Learning (ML) in Affiliate Marketing

The financial service sector of the UAE is expected to grow between $3.16 billion in 2024 to $5.71 billion by 2029.

Thus, in this changing financial services sector, AI and ML can completely transform advertising campaigns in affiliate marketing.

AI and ML help increase flexibility, concentration, and overall marketing strategy efficiency, and these innovations also benefit business success.

Using AI to enhanced targeting and personalization

AI and ML algorithms can analyze vast amounts of data to identify patterns and understand customers’ behavior and interests. This helps financial organizations to target their customer’s potential by understanding their preferences and maximizing the ROI.

For example, Emirates NBD can analyze every customer’s previous transaction data, browsing behavior, and digital platform usage patterns using ML algorithms. This advanced analysis will help affiliates deliver targeted campaigns to that client to leverage engagement and conversation rate.

Furthermore, AI can adapt and change the advertising content or pitches based on the customer’s interaction. Suppose a customer, during his browsing session, shows any interest in financial products or services, and AI will notify affiliates to advertise some related financial services through customized email or advertisement.

This ensures that the customer receives proper and relevant messages to increase the way of conversation and attract an audience. AI predictive analytics helps to predict customers’ future interests.

This AI capability enables affiliates to anticipate the financial service and product in their next campaign based on AI-driven analysis of customer interest.

Incorporating AI/ML into affiliate marketing strategies improves the effectiveness of the campaigns and helps to build customer relationships through customized experiences that can meet individual preferences.

Implementing different ideas using AI/ML

Multiple organizations, such as Mashreq Bank, Emirates NBD, and Dubai Islamic Bank, are using AI/ML in their business and success. Some use AI services like predictive analytics, AI tools for customized content, tools to score leads, etc. However, some ideas can be implemented to improve your business using the same technology with some different ideas.

- Develop a virtual reality system where customers will interact with a digital avatar of a bank branch. In this VR innovation, clients will see an AI-based avatar that helps them to learn about different financial products and services, investments, answer queries, help to complete transactions, etc. Affiliates can promote this innovative experience to give customers a unique and interactive way to manage finances.

- Design an AI-powered system where affiliates can access the dashboard to deliver customized product and service suggestions to their audience. When AI detects that a customer is regularly searching for investment opportunities, affiliate cloud promotes tailored investment products on the dashboard that align with the user’s interest.

- Implement AI-driven behavioral biometric fraud detection and prevention in affiliate marketing to analyze customer behavior interacting with digital platforms like gestures. AI can monitor the unique pattern to detect fraud, remind users about suspicious activity, and secure them from clicking suspicious links or ads. This improves security and builds trust between customers and affiliates.

Conclusion

Financial firms may increase their return on investment through affiliate marketing by implementing the reach and reputation of trustworthy partners. By choosing the best affiliates, giving competitive commissions, delivering thorough assistance, and implementing programs, financial institutions may see substantial development.

By offering financial services to target the population that traditional marketing might ignore, affiliates contribute to trust, and improved conversion rates can increase brand awareness and client loyalty.

While issues like regulatory compliance, quality control, and fraud prevention must be handled, these risks may be reduced with solid partnerships and ongoing program optimization, guaranteeing the financial services industry’s long-term expansion and higher return on investment.

In this regard, LeadSquared can help you with comprehensive solutions to boost your ROI in financial services through affiliate marketing. To get more information, book a demo today!