I can’t remember the last time I paid cash.

I order my groceries at bigbazaar, book an Uber to commute, pay for delivery online and use my card for the rare over the counter transactions. Technology has definitely changed the way I live. It has also changed the way I interact with brands. Instead of taking my concerns to a customer support agent, I resort to Social media to have a hearty vent.

And I am your average customer.

And because your average customer has changed with technology, his expectations from your brand has changed as well. Even from a financial business like yours. He wants things more personalized, he wants things on time, he wants things with lesser hassles and he wants a hundred un-identifiable things that will add up to a great customer experience for him!

And unless you deliver an unrivaled experience, you will find yourself losing customers to your competition.

So, how do you deliver such an experience? An experience that will make satisfied customers and happy users? You can turn to the same technology for help – in this case, the technology that we call the ‘new-age’ financial CRM software.

I am not talking about a static CRM that an average sales person uses; I am talking about a solution that empowers your teams to do much more than just keep track of the inquiries and customers. A solution that can help you tackle your day-to-day business needs, while helping you achieve better customer satisfaction; A solution that is called financial CRM.

Easier Information Processing

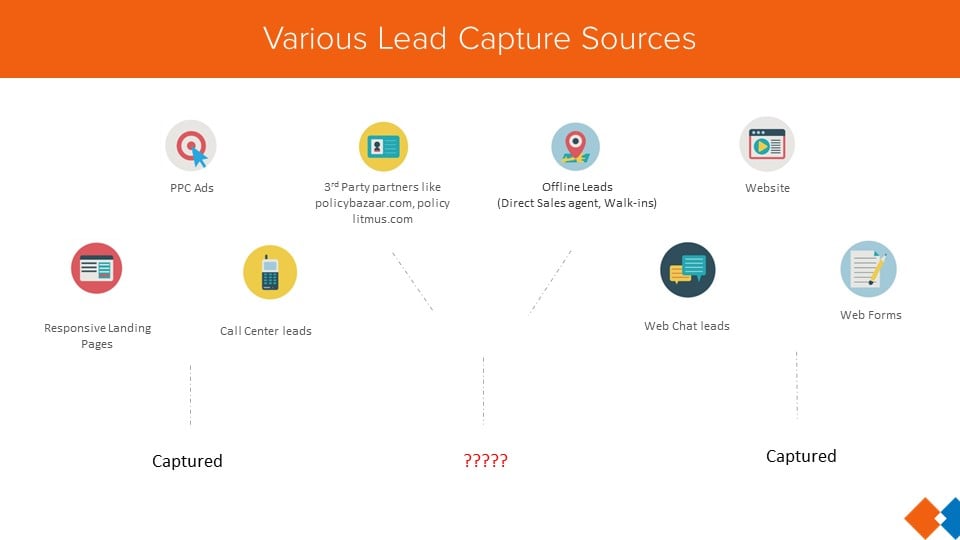

“I have 100% tabs on my leads, without a software” said no one ever – because, given the number of sources you get leads from, some leads often get lost! This brings us to the first problem –

Losing leads to a complicated or sometimes a non-existent process

Think of the various sources you gather leads from – your Direct Sales Agents (DSA), call centers, partners (like Moneydunia.com or dealsofloans.com) and the several ad campaigns (online and traditional) that you would be running. Typically, all these enquiries are recorded in various different systems, without a unified view.

Doing so generally results in a lot of leads slipping through the cracks – doesn’t it?

Unified lead capture is the answer

The obvious solution is to have a single platform onto which all your leads are automatically captured. It will enable you to follow up with every single lead, without losing any to procedural errors.

High response time

One aspect that generally takes a huge amount of time is assigning leads manually to every sales person. It involves looking through every single lead and then delegating it to a particular sales guy. The longer this takes, the less interested your lead becomes in you.

Resolve it with automatic lead assignment

What if you are able to automatically assign leads to various personnel? I am sure you have a set protocol in place – for eg. all personal loan inquiries to person A, all home loan inquiries to person B and so on. I do it based on region. So if a lead is from Delhi, then he is automatically assigned to Ankit from my sales team. This process is instantaneous and did I mention automatic? That means, there is no time lapse between lead capture and lead assignment! The minute a Delhi lead is captured – Ankit reaches out to them without my intervention. Faster response – so easier conversion!

Building relationships

Nobody invests in companies they do not trust. And trust can only be cultivated if the prospect perceives your sales guy as not just a sales guy. Despite knowing this, not all financial corporations are successful in establishing relationships. Why?

Lack of Lead Engagement

Here is a call I got from a bank recently:

Sales rep – “Sir, I am calling from ABC bank – would you be interested in home loans or personal loans?

Me – “No thank you”

Sales rep – “Ok Sir” *Cuts call*

And I never heard from them again!

Quite apart from the fact that he addressed me as “Sir” (yes, I have a deep voice, but really?!), he was selling to me right from the first second! I knew it was a sales rep – meaning that their objective is to make a sale and not my best interests. Why would I buy from them? Where was the trust factor?

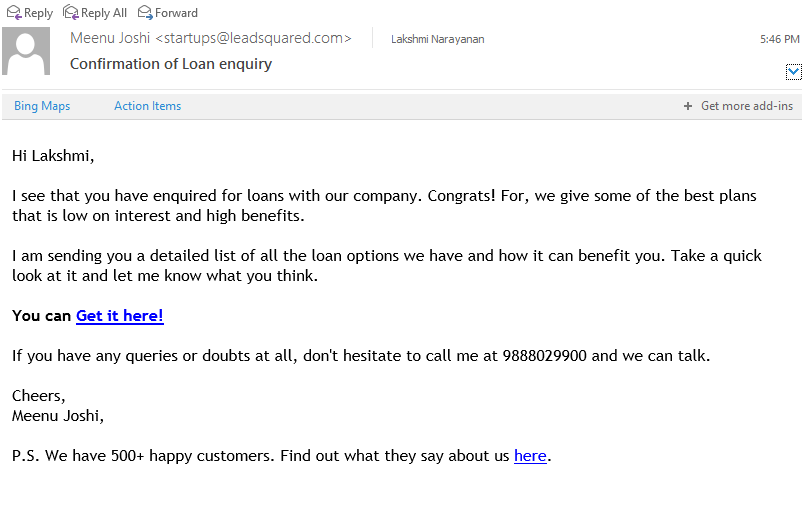

Think Autoresponders and email campaigns

Imagine this though. I sign up for a loan inquiry. I then get an email from the bank confirming the same. Then before a sales guy calls me, I also get a list of the type of loans I can apply for and a few testimonials from previous clients.

If, after the sales and the follow up calls I do not convert, I still get information about the various loan plans, how it will benefit me, perhaps how the budget affects the loan plans etc. and even a few offers.

Result? If I think of loans again, their business is definitely the first I will think of! Autoresponders triggered by lead action and frequent nurturing through emails can really make all the difference between a relationship built and lost.

No personalization

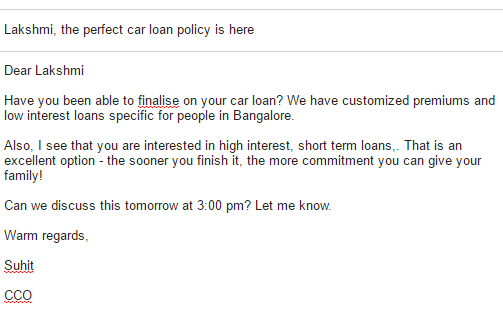

Right. So I keep getting a bunch of emails rather frequently. Suppose one reads like this:

Do you think I will be tempted to call that number? Don’t guess. The answer is no.

And what is the missing ingredient? It is personalization! They did not even get my name and had they really paid attention, they would know that I was interested in loans and not insurance!

So, Keep track of their interactions!

How can you make it more personalized though? Why, by knowing what exactly what the prospect communicates – by keeping tabs on their interaction with you. Consider this:

The second one is a clear winner! He mentions my name, signs off as a person and most of all – refers to knowing my activities online and even to the fact that I have a family! All clear signs of building or having built a relationship!

And it could not have happened without knowing my activities on the web and also my interactions with the sales person.

Simpler logistics

People want things fast! They want the approval yesterday. In fact, the finance industry is notorious for the time- consuming paper work and representatives who stand you up. Why?

Going back and forth for document approval

That is true! The document has to be first collected from your client (either manually or you ask him to submit it), then it is submitted for verification to another team after which you finally get back to the client about the outcome -which could be more information (a rather annoying outcome) or the news that the loan is sanctioned! Supposing the process takes about three days, it means that after three days of waiting your client is told that he might have to provide more documentation! So not the customer experience you are aiming for!

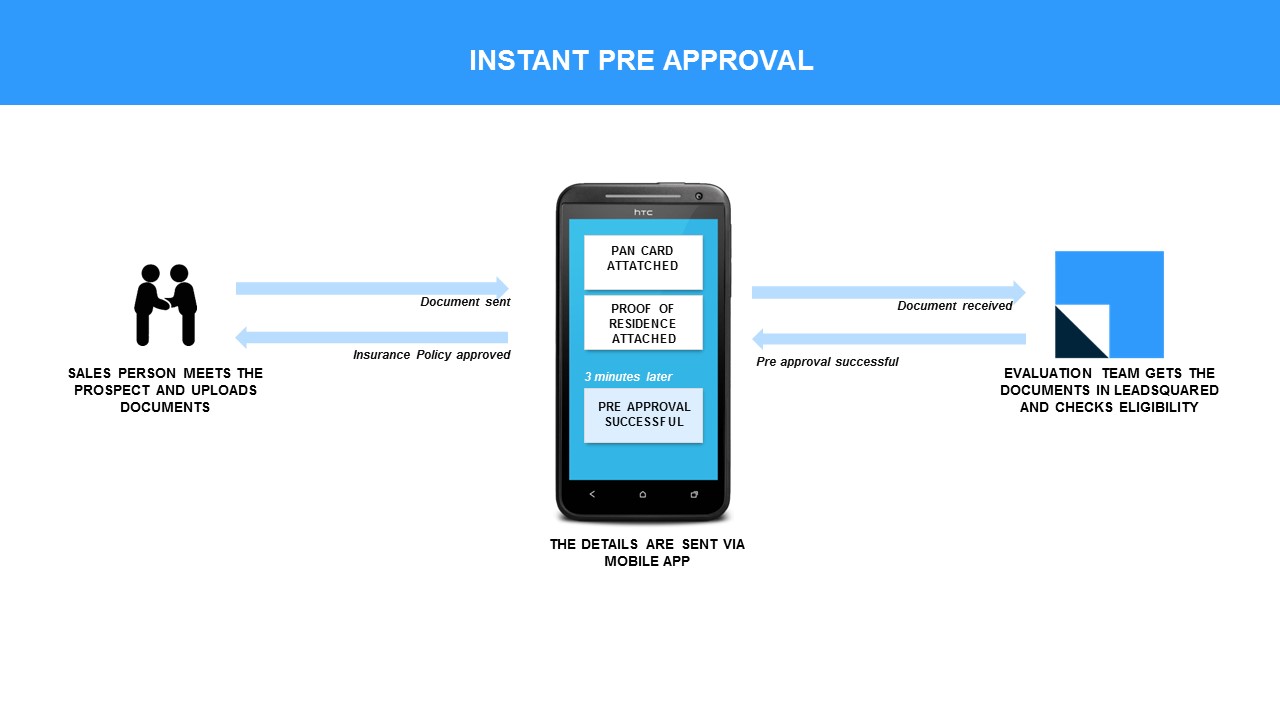

What if you could get instant approvals?

What if you could get the soft copy of the documents delivered to the verification authority the very same instant your sales rep gets it? Upload the documents given by the lead (scan and send through phone) to the appropriate authority who can then verify and send it back in a few minutes. The result? The frustrated wait period is completely removed – your customer satisfaction scores just shot up!

Haphazard monitoring of team

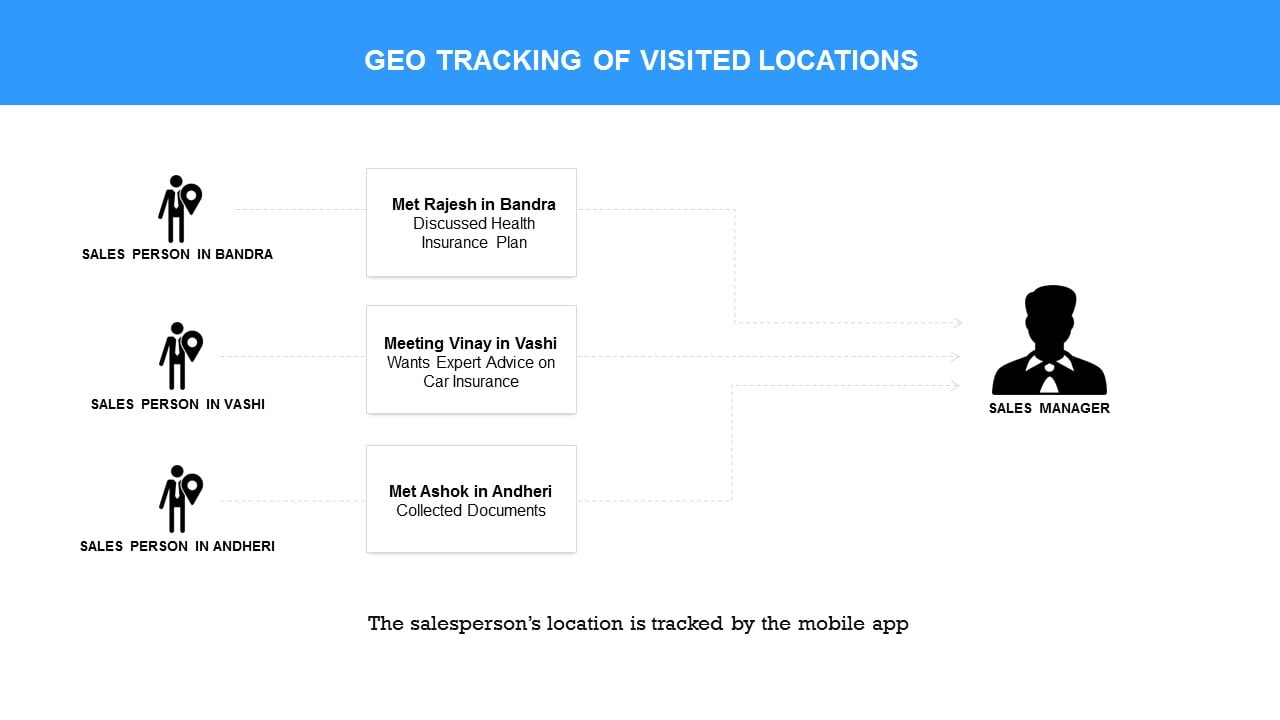

Let us come to the second problem – how to know where your sales rep is? Yes, we want to keep tabs on them – not just to know which clients they are meeting and when (and whether they indeed are meeting clients), but also to redirect them quickly in case of an emergency.

Get on board with geo-targeting

So, the answer to this is knowing where your sales person is at all times – with the geo targeting feature in the mobile app. You can immediately know how to re-allocate his client list (in case something comes up) and also know how many deals you can close that day!

In short, the right CRM software can bring in revolutionary changes to your business, while adopting a customer centric approach. The technology is here, and it is here to stay. Are you in?