There are rarely any simple answers to complicated banking queries. Even though there’s a vast amount of literature on it, there are few avenues where lucid answers are available. LeadSquared started a BFSI webinar series to help people tackle such problems. Our speakers tried their best to be as comprehensible as possible while not sacrificing technical nuances. Nilesh Patel himself was available to give some answers in accessible language. Check this page out to know the answers to frequently asked queries on BFSIs.

These questions were curated from our regularly held webinars which are free to attend and encompass a large variety of topics.

Banking related queries

Q. Given your experience what’s been the key pain-points that banks have?

Ans. This is a bit complicated question to answer, as in my experience different types banks face different kinds of problems. I think one challenge that all service providers including banks face is that of increasing customer acquisition. So, as banks are complicated organizations the key problems they face also vary widely. For instance, a corporate bank and a retail bank would face starkly different problems from each other. Fundamentally, although their problems manifest in different ways I think what’s important is to have a high quality retail liability franchise. It brings their cost of funds down. That’s certainly important for all of them. Making sure they lend to right people is also super critical. These two are, I think, fundamentally important things. One recent thing I’ve noticed in Indian financial industry is how profitable selling to existing customers has become. New customer acquisition costs a lot, so the fact that some NBFCs have managed to sell more than a few products to the existing customers has sparked an interest in the industry. It’s cost efficient and a bit easier to do. Given the unfortunate situation we’re in due to COVID-19, I think at this time, focusing on this area will be beneficial for some of these financial institutions. Of course, given the times, collections are going to take a huge hit. That will be the most important thing for them, if you ask anybody right now. That’s a long answer but I think that’s the situation we’re in.

Q. In this current COVID-19 situation how do you think we can reduce dependency on FOS (Feet On Street) teams?

Ans. So, I think the only alternative we have for communicating with customers right now is by connecting to them remotely via phone. A lot of things that you used to do for them like sending a fixed deposit etc, will have to be done by the customers themselves. I think that would require some encouragement from your side. To make sure that you retain the customers, your relationship managers might have to learn a few new skills. You know, like interacting via video calling and navigating customers through the use cases of different tools available to them. I know your net question is probably going to be, then what difference would remain between the virtual relationship manager and relationship manager? Well, to that I think the boundaries shouldn’t be that strictly set. Of course the high valued customers would prefer in person service, but I think virtual relationship managers can curb this problem to an extent.

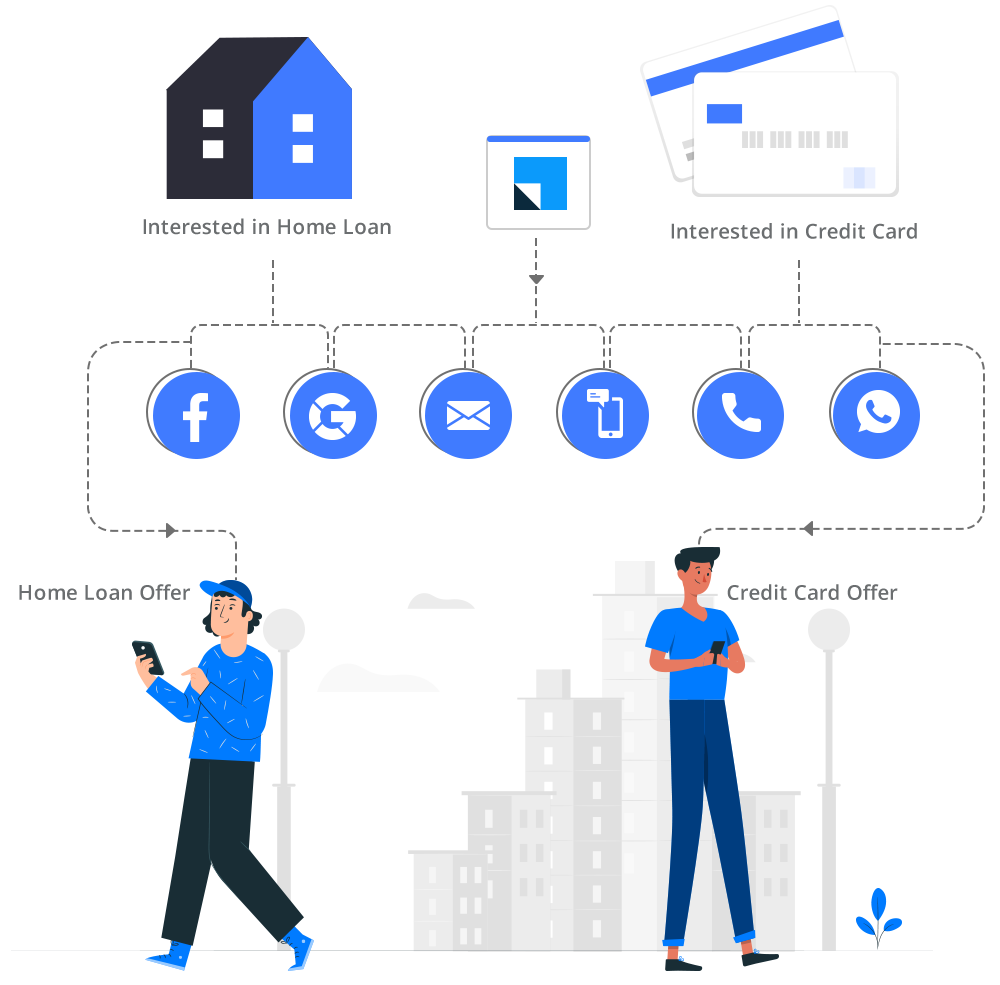

Q. Some customers visit and explore my site for features, case studies etc. and leave without giving any contact information. Is there a mechanism to reach out some of these people?

Ans. I do not know of the foolproof method of doing this. I think the only way is to retarget them through Google Adwords, Facebook, and Linkedin advertisements, etc. That way they can land on a different page and may give their contact info. I don’t think you’ll be able to contact them without them consenting to receive calls from you.

Q. Does LeadSquared support the integration of FOS application with other utilities such as account opening KYCs etc.?

Ans. Some of these things can be integrated using our platform, I think we have already done this for our customers. So, yes I would say that is possible. Please feel free to reach out to us to know more about the specifics.

Q. Does LeadSquared comply with relevant RBI mandates and regulations as these are essential in banking sector?

Ans. Unequivocally, yes. We already tend to large banks in India and several of our customers are large scale lending institutions and insurance companies. All the guidelines laid down by them and the RBI have already been taken into account. We have qualified for all the relevant security criteria that banking institutions have. So, my answer to that is yes.

Q. How can we digitize some operations that have been traditionally offline, for e.g. document collection etc.? Do you think AI NLP block chain can help?

Ans. Document collection can certainly be digitized. In fact, we already do digital document collection using Aadhar XML, video KYC etc. (Know more about how this is done from this free ebook). There are different degrees to which digitization can be done and should be done. For instance, getting few simple tasks done like checking for validity of Aadhar card or pan card is fairly easy using video e-KYC. Other times, there are documents like a lease agreement of 500 pages, I think that’s better to be given offline. Having said that, I think what we’ve seen is that a large portion of such activities can be automated.

Q. What should be the correct penetration for business generation ensuring customer centricity?

Ans. I think if you ask anyone they’d like to have 100% of it. So, I won’t know the exact right answer to that but if some of managers I have interacted with seem to think 40-50% is sufficient. That would mean you’re doing good.

Q. From a digital insurance perspective, does LeadSquared assist in online lead scoring for prioritizing prospect? If yes what metrics does LeadSquared define for tracking priority?

Ans. The answer to this varies from business to business. There is a scoring model we follow, but it is flexible enough to refine and accommodate demands of different businesses. I believe our experts can give a more detailed answer to these questions. (Here’s how you can reach out to them.) Off the top of my head I think you can contact Murali (murali@leadsquared.com) to guide you through the details of how we approach lead prioritization and scoring. (Access the insurance webinar to learn more about this from here.)

Q. Is it legal to ask people for Aadhar card or PAN card from home?

Ans. The Reserve Bank of India has come up with some guidelines related to this. If you’re interacting with them on video-KYC, I think asking for identification cards fall under the RBI guidelines. I am definitely sure about asking for PAN card during the process. For Aadhar card I am not sure. You need to store it in an encrypted format and then upload it. What we have come up with to solve this problem is, we temporarily store it and use OCR to verify its contents. The data is deleted the moment it is not required. So, for Aadhar card, you need to make sure the data is not stored in an unsafe way.

Q. Is mobile application supported in all devices?

Ans. Yes. Mobile application runs on virtually all devices, except maybe for a few of the lower versions of androids. It works in offline mode also, so you can access your profile, leads, opportunities, and customer reports without an active connection.

Insurance related Queries:

Q. Is lead scoring metric customizable for different products in LeadSquared?

Ans. Yes. LeadSquared is a blank slate when we give it to you. Quality scores are based on different attributes of a lead like name, age, e-mail address etc. Lead scores can be assigned according to the product type as per your convenience.

Q. What is the difference between lead score and lead rank?

Ans. Lead rank pertains to the prioritization of leads. Lead score is the cumulative score assigned on the basis of activities and engagements of the leads. It can be positive or negative based on lead’s actions. For instance, a lead unsubscribing from your e-mails may be assigned a negative score. Prioritization is based on how close the lead is from conversion and how beneficial would it be for the organization to pursue this customer.

Q. Does LeadSquared employ chatbots (Lead capture bots)?

Ans. We integrate with them. LeadSquared as a platform provides APIs. These APIs are used to integrate with chatbots. Chatbots individually collect prospect information and try to convert them to customer their own. Through leadsquared you can integrate with a chatbot and get all the transcripts of the chats.

Q. Is there any way to integrate cloud telephony and getting recorded conversations through LeadSquared?

Ans. Yes, there is definitely a way to do that using LeadSquared. We already do integrate with cloud telephony for multiple customers. Since we are also a cloud platform, this is very convenient for us to do. Ozonetel, Ameyo, Exotell are some the many service providers we integrate with. All the recorded conversations are available within LeadSquared.

Q. Are there any mobile applications or interface where an agent can take call from mobile itself and fill the disposition in app itself?

Ans. There are two ways to go about doing this. One is through the LeadSquared mobile application, it records the duration of the call, the time at which it was made etc. However, the call itself is not recorded since android security patches (and ios) often prevent the app from doing so. To overcome this, the best way we have found is to intergrate with telephony applications. It is pretty easy to do so using LeadSquared and takes only a few minutes to execute.

Are email masking and mobile number masking available in LeadSquared?

Ans. Yes. We do provide our customers with that feature. Additionally, we can customize this feature according to your business needs.

Q. Do we have a feature for incentive calculation for the team?

Ans. Incentive calculation is something we have in our roadmap. Currently, we don’t provide that but it is something we’re eager to try out.

Q&A related to LeadSquared features

Q. If any leads enter the CRM, will there be a pop-up notification in the mobile app?

Ans. It was previously a customizable feature. Then we observed situations that made this feature slightly annoying. For instance, there were scenarios where a customer was getting dozens of new leads. For every new lead there was a pop-up notification, that proved to be detrimental to customer experience. So, instead what we suggest to our customers now is to use our Smart views feature. Smart views are customizable windows that organize your leads according to your needs. Using this feature a user can automatically see which new leads are available at the click of a button. Having said that, yes we can definitely provide the pop-up notification feature for every new lead if you want that. We just think that smart views is a much more efficient option.

Q. Can we track the Field team and RMs location?

Ans. Yes, we can do that. The idea is to track the activities of the field and regional managers, so we have provisions in the LeadSquared application to do the same.