I hope you didn’t miss Part 1 of this two-pack.

The first article addressed why and how digital insurance agencies grow faster and earn more. In the conclusion, I write about some of the tools mentioned in Rise of the Digital Insurance Agency, research from AgentForTheFuture.com.

Now, in this article, I go one-on-one with Avdhesh Saxena, who authored 2021’s fine book Friendly Agent: The Secrets Behind Building a Multi-Million Dollar Insurance Agency. Avdhesh’s book commits a chapter to covering “Tools for Success.”

You’ll want to read the book and spend some time with the FriendlyAgent blog, but before you do, read this information-packed interview Avdhesh was nice enough to do with me.

Q: You wrote in your book, you can start a digital agency as your sole business, or add one to your existing brick and mortar company. Can you explain or expand on what you mean by that?

Avdhesh: Basically, a digital agency is selling insurance and servicing it online. If you’re just starting off, then having a fully digital agency where you provide quotes, issue a policy, and service those things, that’s possible.

Or if you’re already running one or more brick and mortar agencies, you can enhance it by having a digital presence. And expand it as well.

Q: Let’s talk about the tools required. The agency management system is on everybody’s list, I suppose. What type of agency management system is ideal for a growing agency?

Avdhesh: A quick perspective: an agency management system is something which you use to manage your customers and policies. Insurance companies provide you information, once a policy is issued, like the policy download. You give out commissions, receive commissions, and all those things using this tool.

Then there are multiple tools based on complexity and how many lines of business you have. If you are a big agency that serves multiple lines of business, maybe you have a complex and more expensive agency management system. But in some cases where you’re operating, say, only one line of business, you may go with an agency management system, which serves only that, for example, life insurance, or health insurance.

Q: Agency management software is not the same as CRM. How would you differentiate an AMS from a CRM?

Avdhesh: AMS is generally used for servicing policies.

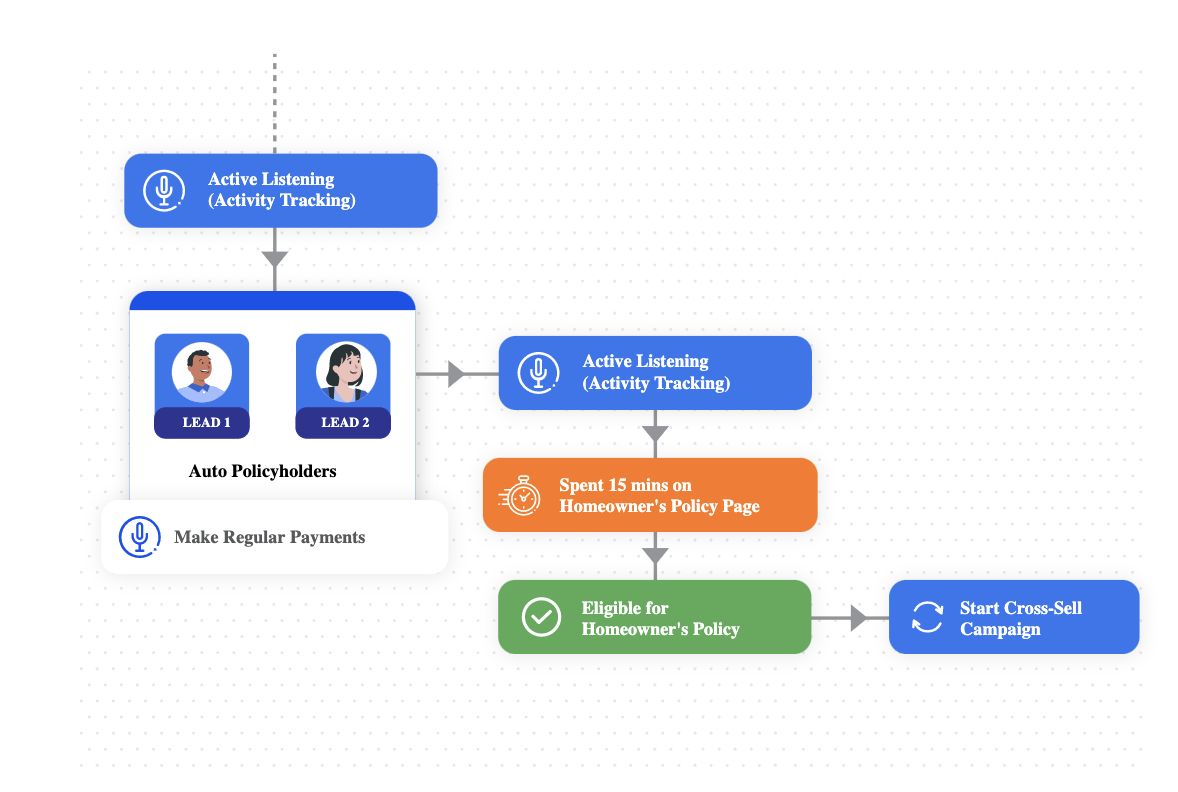

CRM is a tool where you get your leads, qualify them, and reach out. You have automations built and those kinds of things. To convert that lead to a customer, a lot of activities have to be done and the CRM caters to that initial part where you acquire a customer, and then stay in touch with them on a regular basis.

Q: In an interview in your book, Mark Vitali says few people understand how to leverage CRM effectively. He said he could have been five times more successful if he was able to better manage leads. Do you think that’s a problem all across the insurance agency business?

Avdhesh: Yeah. See, unfortunately, the insurance business has always been very people driven. People would just talk one-to-one, but now things have changed. So now electronically, you can restart thousands of folks, in one go, using technology.

Mark mentions that out of 100 customers, maybe 20% to 30% might convert in the first go. But for the rest, you need to follow up through emails and provide some value, and keep them engaged. He has seen that by having the CRM technology in place, he’s able to go from 20 to 30% to a 60% conversion rate.

Q: So, in today’s digital everything approach, an agent must exchange information with carriers. What kind of system gets that job done?

Avdhesh: That’s your agency management system. You generally use the AMS to interact with carriers.

Q: Everybody loves their phones. Should insurance agencies offer their clients mobile apps?

Avdhesh: Yes, you have to be mobile and serve your customers all the way from lead generation to customer service. The mobile app is something that customers are demanding in today’s world.

Q: Very few conversations about digital marketing, don’t include conversations about data analytics. What processes will you introduce or optimize with the use of analytics systems?

Avdhesh: Many people don’t take time to look into their data, to find out what trend is there and where they should be focusing. Obviously, if you have an AMS you’re collecting data. You should concentrate on certain metrics.

One is estimated revenue. Just to explain, when you issue a policy and you’re getting monthly payments; it’s called earned revenue. You estimate you will be getting this revenue for the next year. Once you have that data, you know how much you can invest to get more clients and things like that.

The second thing is you can break down your accounts by revenue. Say, how many policies are between, say, zero to $1,000, premium, and $1,000, to $5,000 premium? This will tell you what kind of agency you are running, and what you should be doing.

Another metric is average revenue per producer. How much revenue is each producer generating? What’s the reason behind it? Obviously, if some of them are not producing well, then you have to find someone new. The metrics indicate where you should concentrate—where to focus to grow your agency.

Q: What about identifying marketing channels that work best?

Avdhesh: Definitely. But not many people are doing that well—finding where the leads came from, and all. And that’s where your CRM also plays a big part, capturing data from all the different channels to analyze.

Q: Are you a proponent of using social media to connect with prospects and customers?

Avdhesh: Yes, definitely. Nowadays, everybody’s on social media and is getting their news through social media. So, you have to be there to interact with your customers. Agents who are doing it well are seeing success.

Q: Where should insurance sellers begin with social media?

Avdhesh: You need to identify what you focus on and who your target audiences are. If you have a lot of customers in a younger demographic, then you may have to look into Instagram. In my mind, Facebook is for everything. But if you have a more female population, you may look at Pinterest, which is 80% female. And if you’re selling commercial or business to business, then maybe LinkedIn is a better platform for you. You have to look at social media on a case-by-case basis.

Q: Being that you have a chatbot product, I guess it’s obvious you believe in the use of chatbots.

Avdhesh: All of us are chatting. It’s a main mode of communication nowadays. So if you’re running late, you will not call your home and tell them, you just send a text message. The top four messaging platforms are bigger than the top four social media platforms. So messaging is on the rise.

Successful insurance agents use it for lead generation. When people go to your website, many times, there’s only a contact us form and nothing else. Having a chatbot can help you help your customers 24 x 7. You can qualify leads using a chatbot.

And you can service your clients. Maybe on a Sunday night, somebody messaged that they need to make a change to their policy. The chatbot collects all the information and Monday morning somebody can execute the transaction. So it provides a good experience to customers.

Q: What about live chat?

Live chat is kind of part of the use case. If for some reason a chatbot is not able to answer, somebody should jump in and help the customer. Generally, live chat is a part of most of the chatbot features.

Q: You recommend delivering proposals with video. Tell us more about that.

Avdhesh: Sure, we have a challenge with insurance. It’s really complex. Many times you don’t know what you’re buying, what’s covered, what’s not covered, and things like that.

Most of the time agents want to talk to their customers over phone to explain the details, but it may be just as effective to create a quick video. Many successful agents are doing this and customers love it.

Q: We’ve talked about social and chat and every form of communication but email. Email is far from dead, right? Do you believe it’s important to have an email service provider for your agency?

Avdhesh: Definitely. Email will always be there. You can have automation sequences running for years. I’ve seen people who read my email for three years and then make a purchase. You can get special marketing automation software, but in most cases, it will be a part of your CRM.

Q: I want to make sure everyone understands what you mean by automation sequences. You mean something like, “Thank you for downloading XYZ. Here’s how we can help you next.” Or the sequence might be “Thank you for submitting a policy request or placing a call to our office.” Is that what you mean? Those type of emails are pre-loaded to be sent in a sequence?

Avdhesh: That’s right. The sequences can be based on where your customer is in their journey. If they are a new lead your email sequences will be to educate them about insurance. But if it is an existing customer, your email sequences may be targeted toward renewals or cross-selling other insurance products.

You need to keep all your customers’ details in the system and keep them engaged to make sure they continue with your agency for a long time.