Company

GET IN TOUCH

(+1) 732-385-3546 (US)

080-47359453 (India Sales)

080-46801265 (India Support)

62-87750-350-446 (ID)

© 2025 LeadSquared

Empower your teams to track and follow-up with defaulters efficiently, predict debt recovery and enable faster collections

Right from borrower segmentation to debt recovery prediction and guided team actions

Get 360 degree view into your borrower profiles and manage defaulters accordingly

Distribute loan defaulters automatically to your teams in different regions and to the respective collections agents based on any criteria you want – loan type, location, default amount, agent availability, agent performance, and more. You can even limit the number of leads getting assigned to an agent with capping logic.

Bucket your defaulters based on every important criterion – date past due (DPD), credit repayment history, the amount due, repayment intent, and more. You can define your collections strategy accordingly – for instance, defaulters with payment due of less than 50k can be connected via automated payment reminder emails, while borrowers with a large amount of debt would need to be called immediately.

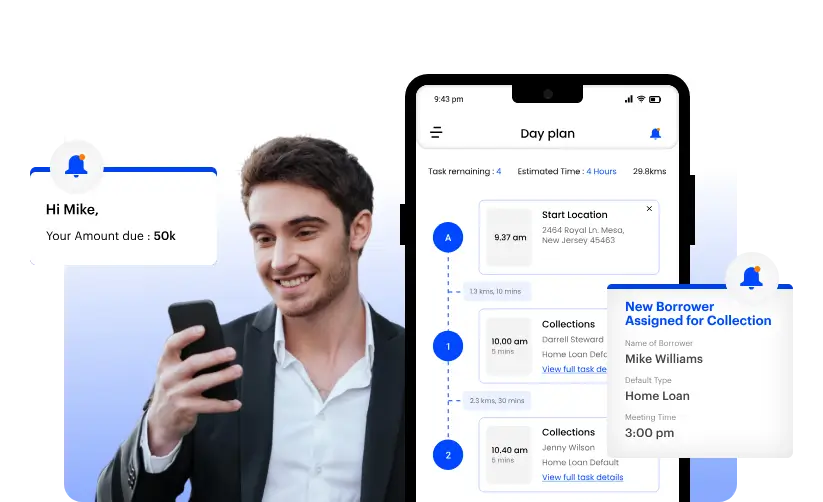

Enable all your collections and call center agents to stay on top of their work with automated notifications whenever a new borrower is assigned to them. You can do this via email, SMS or any other communication channel. LeadSquared plans the collection agents’ complete workday accordingly.

LeadSquared automatically plans your collections agents’ day completely, including collections meetings in order of priority, best routes to follow, goals for the day and more. Increase your team’s productivity by auto-identifying possible meetings in their proximity.

Segment your borrowers based on various factors – the kind of debt, DPD, amount due, repayment history, demographics, location, financial status, credit history and more. Use this information to always maintain relevant messaging across all communication channels.

Intelligent call distribution to review loan defaulters and follow-up for Collection

Empower field agents to plan their customer visits and collection follow-ups

Updates on fraud intentions and updates on legal actions

Connect your support teams for updates on technical issues

With advanced automation and guided actions

As a manager, you can track all field force activities and ensure productivity. Your collections agents too can track all their current pending tasks on their mobile app. With the day planner and ‘nearby leads’ feature, he can optimise his time on the field.

With advanced automation, guided actions and direct connect to fraud control teams

Borrower profiles, agent performance, collection funnels and more

“LeadSquared collections module helped us digitize our debt recovery process, building efficiencies and transparency. Also, tracking legal cases on the same module was a huge advantage.”

Make debt recovery easier, faster and more organized

How much does debt collection software cost?

The cost varies from vendors to vendors and the functionalities they provide. With many debt collection software in the market, it is important to gauge their ROI. With LeadSquared, lenders save costs by automating payment reminders and prioritizing cases effectively. Additionally, they can also optimize spends by up to 15%.

What is debt collection software used for?

A debt collection software is used to manage EMI collections and automate collection processes.

What software do collection agencies use?

Many collection agencies/ lending businesses like ORIX Leasing and Pepper Finance rely on LeadSquared Debt Collection CRM for their debt recovery process.

What is a debt collection software?

Many collection agencies/ lending businesses like ORIX Leasing and Pepper Finance rely on LeadSquared Debt Collection CRM for their debt recovery process.

What are the 3 key strategies when it comes to collections?

Lenders can improve debt collection by:

1. Using a debt collection CRM, lenders can segregate and prioritize borrowers that are likely to miss their payment deadline. Sending them automated reminders before the due dates can help increase collections.

2. By segregating cases based on their DPD (Days Past Due) count, lenders can deploy soft or hard collection mechanisms to improve collection efficiency.

3. Through different modes of payment, lenders can make it easy for borrowers to complete their payments.

What techniques are used to collect debt?

Payment reminders through emails, phone calls, field visits by collection agents, legal notices for outstanding dues, etc. are some common techniques for debt collection. Many steps can be automated through a debt collection software to improve collection efficiency.

What is the most effective collection technique?

One of the most effective collection techniques is to segregate cases, prioritize them based on DPD (days past due) and then use automated payment reminders across different channels – like email, SMS, WhatsApp, automated calls, and more. Additionally, when paired with soft collection or call collection through agents, this technique is most likely to improve collections.

How can debtors collection be improved?

Lenders can improve their debt collection by employing robust debt collection software and effective collection techniques. A debt collection software like LeadSquared can help automate EMI collections, manage cases end-to-end, automate payment reminders to borrowers, execute hard and soft collections, and provide detailed analytics.

Is there any MS Dynamics CRM alternative for debt collection?

Due to its simple UI and ease of use, a preferred alternative is the LeadSquared Debt Collection CRM for payment and collection of EMIs. As a collection software for small business owners and large enterprises, LeadSquared can maximize debt recovery through next-gen automation workflows.

(+1) 732-385-3546 (US)

080-47359453 (India Sales)

080-46801265 (India Support)

62-87750-350-446 (ID)